Hard truth: Most traders fail.

I know this not just from my own journey to over $7.5 million in trading profits.

But from mentoring over 30 of my students towards their own 7-figure goals.

There are obstacles and misconceptions that derail many aspiring traders, and a lot of the “advice” out there doesn’t help.

In fact, some of it can send you down the wrong path entirely.

So, what does it really take to make it in this game?

Here are the 5 shocking truths that you won’t hear on social media.

Table of Contents

- 1 #1: Intelligence Has Nothing To Do With It

- 2 #2 You Don’t Have To Trade All Day

- 3 #3: You Don’t Have To Master The Entire Market

- 4 #4 Risk Management Is More Important Than The Strategy You Trade

- 5 #5. You Don’t Need A Lot Of Money To Get Started

- 6 Ready to Unlock the Real Secrets to 7-Figure Trading? 🤯

#1: Intelligence Has Nothing To Do With It

You don’t need an MBA or a math genius to be a successful trader.

You don’t even need a high IQ or go to college for this stuff.

Why?

Because the stock market isn’t always rational. It has a lot more to do with recognizing patterns and managing emotions.

You do however need to study and work hard.

One of my top students, Jack Kellogg, who has amassed 8-figures in career trading profits is a former valet, who never went to college.

What’s more important than a formal education?

Putting in the reps…

Putting in your reps is essential if you want to be the small percentage of traders who actually make money.

10:55pm study check, who’s still up studying, reviewing your @StocksToTrade scans or are making your watchlist to be better prepared for the #stockmarket tomorrow?! How bad do you want success and how hard will you study & push yourself when your competition is already asleep?

— Timothy Sykes (@timothysykes) September 21, 2023

#2 You Don’t Have To Trade All Day

I’ve discovered that there are only a few good times to trade. Generally the first and last hour of the trading day.

Of course, there’s been more opportunities lately with all these short squeeze plays. But the first and last hour are still the best times for me.

Whenever I find myself in front of my screen all day, I will get the urge to trade.

And while that might sound like a good thing…it’s not.

Why?

Because there aren’t always good trading opportunities.

And when there’s not…you end up overtrading subpar setups and lose money.

I encourage my students to step away from the screen, get outside, and enjoy your life.

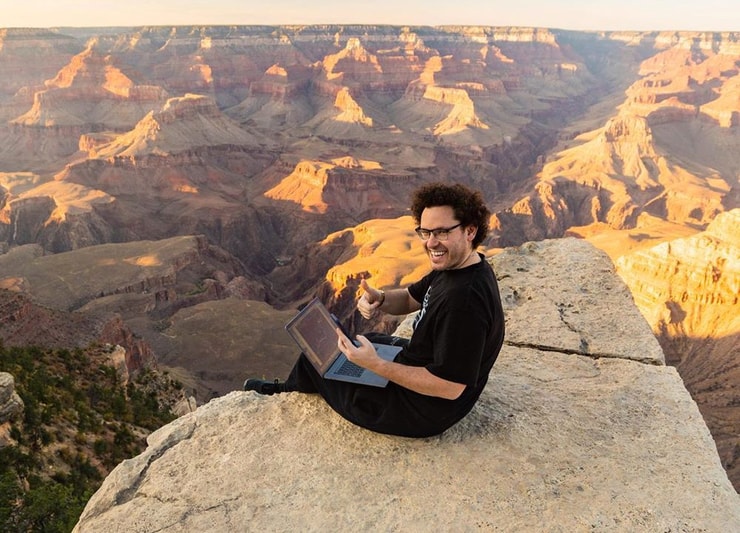

Truly Grateful to be able to Travel and share with others!🥰

Now onto some Night Time Study and Trading!🤯 #laptoplifestyle @timothysykes @profitly @StocksToTrade pic.twitter.com/PUFWs7vY3n

— Aaron Mizell (@AaronMizellam) September 20, 2023

More Breaking News

- SEALSQ Corp’s Quantum Leap: Is the Recent Stock Surge a Prelude to Bigger Gains?

- Nikola Stock: Ready to Rise or Risky Investment?

- Can ChargePoint’s Bold Moves Electrify the Market and Ignite New Growth?

#3: You Don’t Have To Master The Entire Market

I have made an entire career from trading penny stocks.

And while that might sound boring, I can tell you my life isn’t boring.

Just arrived at our new spot & it comes with this badasssss private pool so I’m hyped!!! Whatcha think, would you swim here? Should I film a video on some cool new @StocksToTrade features while I do some laps just to show his great the #laptoplifestyle is & how the race SUCKS! pic.twitter.com/DcwLKe8n8U

— Timothy Sykes (@timothysykes) September 17, 2023

You don’t have to know everything about the stock market or know how to trade every strategy or setup.

I don’t touch options.

I don’t trade crypto.

I don’t invest.

And I rarely trade anything other than penny stocks.

I’m not saying you should trade penny stocks like me.

But master one setup at a time.

My favorite setup right now is dip buying these crazy short squeeze stocks. In a few months it might be something else.

But if you can get good at one or two things, you can have a great career in my opinion.

#4 Risk Management Is More Important Than The Strategy You Trade

Short sellers are typically always right.

If you short an overextended crappy stock…it will eventually go down.

However, that’s not good enough.

If you can’t endure the squeeze, then you’re likely going to lose money.

That’s why risk management is more important than any strategy you trade.

I usually get in and out of trades quickly for a profit.

On the flip side, I cut my losses quickly.

So even though I’m not exiting my winners close or near the top…I’m still excelling because I don’t let my losers get big.

Again, if you want to make it, think risk management first.

#5. You Don’t Need A Lot Of Money To Get Started

You don’t need a lot of money to get started trading.

In fact, the smaller the better.

Why?

Because you’re going to suck your first year.

httpv://www.youtube.com/watch?v=shorts/uBwykA0gaH4

Why lose a lot of money in the beginning when you don’t have to.

Learn with small amounts of money, develop your skills, and scale up naturally.

I started with a few thousand dollars, and many of my now millionaire students did as well.

Success in this game can’t be bought…it must be earned.

Ready to Unlock the Real Secrets to 7-Figure Trading? 🤯

I’ve spent years in the trenches, trading my way to over $7.5 million in profits, and more importantly, mentoring more than 30 students to their own 7-figure success.

If you think you’ve heard it all, think again.

You’ve read the “5 Shocking Truths About Making 7-Figures in Trading.”

Now it’s time to go deeper and discover the real-world strategies that have propelled me and my students to financial freedom.

These are game-changing insights you won’t find scrolling through social media.

🚀 We’re hosting live training sessions every day this week.

🚀 Multiple slots available each day to fit your schedule.

🚀 This is your front-row seat to actionable, proven strategies.

🚀 No filler, no fluff—just raw, unfiltered trading wisdom.

Want to know why intelligence has nothing to do with success in trading? Want to avoid the pitfalls of overtrading and poor risk management?

Ready to break away from the crowd and join the elite circle of successful traders?

Your Path to Trading Excellence is Here. No Excuses!

Leave a reply