It’s official: this is one of the craziest markets I’ve seen in years. And I’ve made trading webinars every week to help my students with understanding penny stock trading.

Now more than ever, preparing for these insane markets is so important. Why?

Imagine you’re a basketball player going into your first game — but you’ve never practiced. What do you think will happen?

You’ll probably get schooled and miss every shot you take. Soon enough, you’ll give up hope because you don’t think you’re good enough. But the truth is that you just didn’t prepare.

Trading is no different. Penny stock companies and the market couldn’t care less if you succeed. Your preparation and studying is the only thing that will determine your success as a trader.

This is why I make trading webinars every week. I want to make sure my students have all the resources necessary to prepare for crazy markets like this. Given the current market madness, there’s no better time to start preparing.

Who knows how long this market will last. Given all the craziness in the world, it could be another year — or it could end tomorrow. Regardless, there will always be another insane market. Here’s how to get into the right mindset for preparing.

Table of Contents

- 1 Understand the Difference Between Opportunity and Preparation

- 2 Understanding Penny Stock Trading and Why Preparation Is SO Important

- 3 Trading Webinars: Examples of Market Madness

- 4 Trading Webinars: Lessons From $GENE

- 5 Understanding Penny Stock Trading: Cut Losses Quickly

- 6 The Key to Understanding Penny Stock Trading: Learn to Watch

- 7 The Wrap on Market Madness and Trading Webinars

Understand the Difference Between Opportunity and Preparation

I see so many traders confuse these concepts … Preparation and opportunity are two completely different things.

Generally, in hot markets like this, opportunity is abundant. I haven’t seen this much opportunity in years. But…

That doesn’t mean every trader’s prepared for it. At the end of the day, most traders lose. No matter how hot the market is, opportunity is only there for traders who are truly prepared for it.

Like I said, I make trading webinars to recap key lessons in the market. And right now especially, there are tons of lessons.

Seeing 200%–300% runners in a single day is almost normal right now. That doesn’t mean you can just put money into a stock and expect to make 200%–300%.

I’d never recommend any trader shoot for those kinds of gains. Go for those singles — they add up. This volatility won’t last. Focus on finding consistency and learning to adapt. I’d rather create a self-sufficient trader who can trade in any market rather than a trader who can only nail hot markets.

Still, these hot markets are where prepared students truly shine. Several of my top students, like Jack Kellogg, Matthew Monaco, and Kyle Williams, have shown me how much they’ve prepared over the past few years.

Because of this market, they’re having the best trading year of their careers so far. That’s because they all studied for years. They learned from previous hot sectors and markets.

Students like Matt, Jack, and Kyle know how to take advantage of the opportunity in this market because they prepared with my trading webinars, DVDs. They also practice are dedicated to continuing to learn. I strive to teach all my students to have this kind of discipline.

Understanding Penny Stock Trading and Why Preparation Is SO Important

Preparation creates self-sufficient traders. You won’t become a self-sufficient trader by blindly following alerts.

Take it from my newest millionaire student, Roland Wolf.* He studied insane hours every day to prepare. He didn’t whine that a trading webinar was old. He took it all in so that he could learn to navigate the markets himself.

This is why trading success can’t happen overnight. And why your trading education never really ends.

It won’t happen in a single hot market. It takes years of learning from previous hot markets, studying video lessons, DVDs, webinars, and real practice in the market.

That’s what’s so great about preparation — there are so many ways to do it. You can study all of my 6,000+ video lessons three times over like my top student Mark Croock. But you still have to dig in and get real-world practice.

A less stressful way to start is by paper trading. It’s a way to practice the patterns you study without risking real money.

I’m a huge fan of paper trading — and StocksToTrade has a realistic paper trading feature.

Take it from my student Jack Kellogg. He studied for months and thought he was ready. But he’d never placed an actual trade. He learned the hard way that you need to apply the lessons I teach in real time.

But he was still far ahead of those who didn’t watch my DVDs, video lessons, and trading webinars. He was able to apply all the rules and lessons I teach pretty quickly when he actually began trading.

How Preparation Created My Newest Millionaire Student

I mentioned Roland Wolf earlier, my latest millionaire Challenge student. In four years, he turned $4,000 into $1 million in trading profits.*

Take that in. It took him four years — and that’s still pretty fast.

His success didn’t happen overnight, and I need you to understand that.

So many traders get into day trading because they think it’s a way to get rich quick. If you’re looking for that, you’re in the wrong place.

Seriously … Roland studied 17 hours per day for his first six months of trading. That included watching my trading webinars, videos, DVDs, and more.

He’s seen a lot of hot markets — like crypto, weed stocks, and now the pandemic market. As he continues to study, he’s better prepared for the next hot market … and the next … and the next.

There never comes a time when you’re fully prepared. Even I continue to learn something new all the time.

As a trader, it’s your job to continue to learn, refine, and adapt.

Roland’s done just that over the past four years. I’m so proud to call him my newest millionaire Challenge student.

*These results are not typical. Individual results will vary. Most traders lose money. My top students have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.

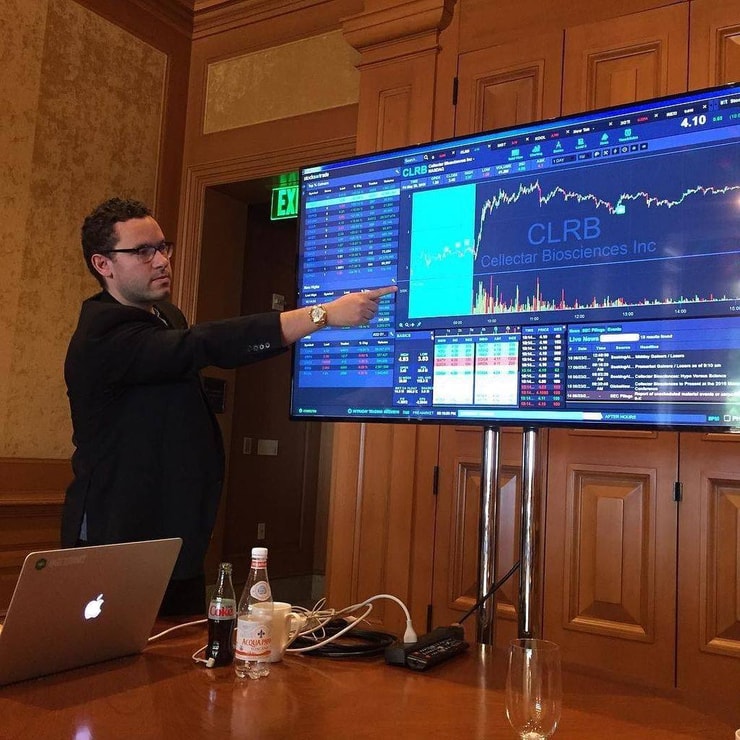

Trading Webinars: Examples of Market Madness

Like I said, even I’m forced to constantly learn from the market.

Some of my go-to patterns work differently than they have in the past … That’s OK. I covered this in one of my recent trading webinars, available to Trading Challenge students.

For example, the first green day pattern in OTC stocks still works, but it’s different now. You used to be able to buy them toward the end of the day and swing into the following day for a likely gap up.

That still happens sometimes. But the first green day patterns I’ve seen tend to work better the first day of the move than they used to.

It’s another example of how markets change — and why you have to adapt constantly.

Let’s look at some plays from this market madness that my students and I traded.

WISeKey International Holding AG (NASDAQ: WKEY)

Not gonna lie … I normally wouldn’t have traded this. Check out the volume bars at the bottom of the chart.

This play was far less liquid than I would have liked.

But the StocksToTrade Breaking News Chat alerted me of great news on this ticker, so I was willing to give it a shot. My goal was to make about 50–75 cents per share on this … I ended up making $4 per share.*

I made over $5,000 on it*. Another example of this market madness.

I’m so grateful to have the StocksToTrade Breaking News feature to help me find these plays. I’ll continue to take advantage of this market insanity on trades like WKEY.

More Breaking News

- Can ParaZero Technologies Maintain Its Momentum With Strong Q1 Performance?

- Qorvo’s Recent Moves Spark Speculation: Is This a Buy Signal?

- Bank OZK’s Earnings Surge: Is It Time to Dive in?

Spo Global Inc (OTCPK: SPOM)

Here’s another example of market madness and the StocksToTrade Breaking News Chat helping me spot opportunity. SPOM was a recent OTC supernova I’ve played before.

Remember that when a stock spikes on insane volume, it can run again. Keep an eye on these stocks — especially if they have good news and a lot of volume like SPOM.

The right news catalyst can lead to 20%+ price increases in a matter of minutes. I want to take advantage of that when I can.

I entered this trade around 14 cents per share and exited at 17 cents for a $1,054 win.* The stock kept running after I got out. Remember…

I’m not aiming for home-run trades. Traders who only swing for home runs will be majorly disappointed when the market slows down and they strike out every time.

I’ll continue to take advantage of the plays as long as I can. I see more opportunities for multiple singles throughout the day because of this insane market. And singles add up.

I talk about this in my trading webinars every week for my Challenge students. I want them to learn how to take advantage of these massive movers while making it clear this is not a normal market.

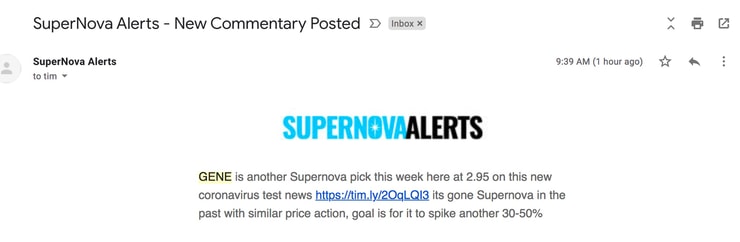

Trading Webinars: Lessons From $GENE

Genetic Technologies LTD (NASDAQ: GENE) was one of the craziest single-day runners of this insane market. I made sure to cover it in this video lesson.

In fact, I sent out a Supernova Alert for this ticker at $2.95 per share. Check it out…

I think it’s funny … my haters tried saying I was trying to pump the stock. But I actually underestimated how much this stock could run.

I thought the ticker might run 30%–50%. That would have been ‘normal’ price action in my opinion.

Instead, this happened…

After opening at $2.77, it hit a high of $10.30 per share.

This is a prime example of the market madness we’re seeing right now. I went over all the top lessons from GENE in my video lesson.

But in case you missed it, I’ll go over a few crucial points.

Understanding Penny Stock Trading: Cut Losses Quickly

I cover this a lot in trading webinars and pretty much anywhere else I can. It’s rule #1. With GENE, you might be thinking, “How could someone lose on a trade like this? It went straight up!”

Long-biased traders got blessed with an anomaly … because of aggressive short sellers.

I’ve seen it so often. Newbie short sellers keep adding to their positions. They reason that eventually, the stock comes down.

But it’s a matter of timing.

The vast majority of the time, these types of plays end up failing. But there was just too much volume and too many people shorting it.

Every time it went higher, shorts were forced to cover, leading to even more buying pressure.

For all of you short sellers reading this… cut losses quickly. Of course, I want you to cut losses quickly no matter your strategy. But with GENE, too many short sellers didn’t cut losses soon enough, leading to this insane move.

The Key to Understanding Penny Stock Trading: Learn to Watch

You don’t need to trade every supernova. I’ll be blunt: I didn’t even want to touch GENE. It wasn’t my type of setup. And I was OK with missing out.

That doesn’t mean you can’t learn from it. Even watching the price action — a clear short squeeze — can prepare you for next time.

GENE wasn’t a one-off either. It doesn’t happen every day, but this isn’t the only insane move we’ve seen in this hot market.

Learn to be OK with watching stocks to understand the patterns on these insane runners. Study my trading webinars and video lessons, like this one.

I will never promise you that you’ll make money. I lose on some trades. Every trader does. But I can promise you that by studying the past, you can be better prepared for the future.

The Wrap on Market Madness and Trading Webinars

I could talk about this insane market for days. There’s seriously so much opportunity. It’s every trader’s dream…

But it means nothing if you’re not prepared. My top students were rarely able to take advantage of the first hot market they witnessed…

But they learned from it.

If you’re in the same shoes, that’s OK. This is a great time to learn to trade.

Start with understanding this insane market volatility by checking out my no-cost “Volatility Survival Guide.” It’ll help you stay safe during this market and prepare for the next one.

Who knows … maybe this madness will continue. I really don’t have an answer as to how long this market will last. But I can tell you that you should do everything you can to learn from it.

It takes hard work and dedication. Don’t expect to sit in front of a screen for an hour a day and get it. Roland put in 17 hour days for six straight months. Even now he studies five to six hours a day.

Does that sound like the kind of dedication you’re willing to put in? Consider applying to my Trading Challenge.

What’s the biggest lesson you’ve learned during this market madness? Tell me if you have a favorite trading webinar. Tell me in the comments below!

Timothy Sykes teaches skills others have used to make money. Most who receive free or paid content will make little or no money. Any results displayed are exceptional and are not typical and will vary from person to person. Making money trading stocks takes time, dedication, and hard work. There are inherent risks involved with investing in the stock market, including the loss of your investment. Do not invest money you cannot afford to lose. We do not guarantee any outcome regarding your earnings or income as the factors that impact such results are numerous and uncontrollable. You understand and agree you will consider the important risk factors in deciding to purchase any of our products or services. Past performance in the market is not indicative of future results.

Leave a reply