Market crashes can create once-in-a-lifetime opportunities.

Stocks become incredibly cheap, with some trading at prices they haven’t seen in over 20 years.

But traders need to be careful they don’t fall into what I call the ‘Trading Value Trap Fallacy.’

While fundamental investors get sucked in by a stock with a cheap price-to-earnings (P/E) ratio, traders get sucked in by huge price drops.

They see a stock down 50% and think it can’t possibly go any lower.

So, they scoop up shares…except there’s one problem…

Where do you put the stop?

Unless you have a clear methodology, as I do with my panic dip buys, you’ll end up picking some random spot, and that’s not a recipe for success.

Instead, let me show you how to avoid the trading value trap and identify the BEST spots to make your stand.

This will help you make tighter trades on penny stocks and can even be applied to market swings.

Context Matters

All hell breaks loose when the S&P 500 drops 5% in one day.

I’d barely notice if a Supernova penny stock pulls back 5%.

Pullbacks are relative.

I screen for stocks moving +30% intraday for my trades.

That way, I can aim for 5%-10% gains and not be out of line.

However, I also look at how long the move takes.

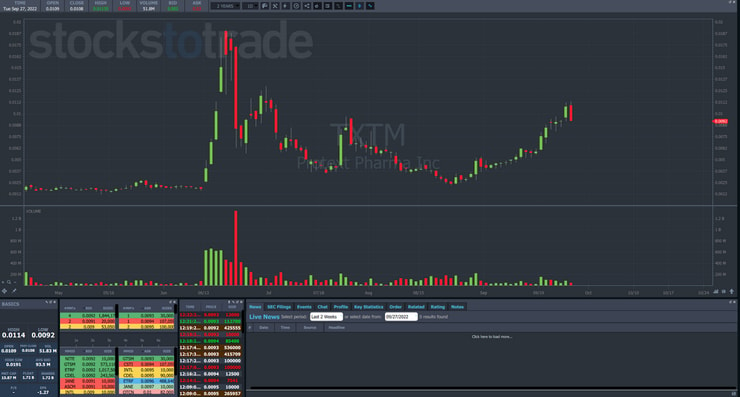

Take a look at Protext Pharma Inc. (OTC: TXTM).

This pattern fits perfectly into my 7-step penny stock framework.

When price flies into the stratosphere, it gains +855% in a week.

The pullbacks on the topping red candles drop as much as 36% intraday.

The 3rd red candle which broke the longs fell more than 50% at its worst…

And that wasn’t even the bottom.

The stock didn’t catch a bounce until two days later.

Supernova patterns work on the speed and magnitude of price changes.

These aren’t likely to happen to the S&P 500 on a day to day basis.

But that doesn’t mean they can’t on a larger scale.

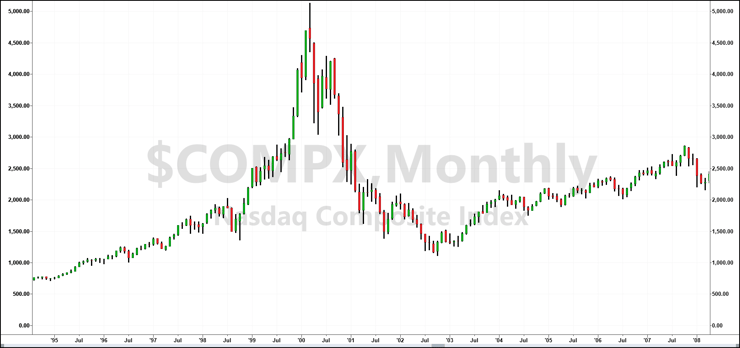

When the dotcom bubble exploded, the Nasdaq Composite Index looked exactly like every other Supernova.

The only difference was it didn’t fade into oblivion.

However, it saw a 40% correction before it caught a significant bounce. And that was still well before it found its low.

Markets may take longer, but they make the same patterns we find in penny stocks.

What Makes a Good Support

There are dozens of ways to find support and resistance levels.

The easiest are to look for previous highs, lows, gaps, or areas of consolidation.

It doesn’t need to get more complicated than that.

I identify these spots before a stock starts to collapse.

However, I don’t just jump in once the price gets to my level.

The key is to watch price action.

I want to see sellers give up and buyers take over.

This looks the same whether you use a 1-minute chart on a penny stock or a monthly chart on the S&P 500.

The only difference is the relative movement.

Here’s an example.

Global Tech Industries Group Inc. (OTC: GTII) is a former Supernova that caught a bid several days ago.

Shares more than doubled in a day before pulling back almost 40%.

In the 1-minute chart below, I identified two possible support levels based on the prior day’s price action.

I want to zoom in on the boxed-in area where volume picked up.

The first support level didn’t work as shares cut through.

But when price got to that support level, volume jumped, culminating with a reversal candle on the highest volume since the open.

All things being equal, this is a legitimate spot to take a long trade.

This is what I mean when I talk about price action. It’s looking for confirmation from the volume and price movement.

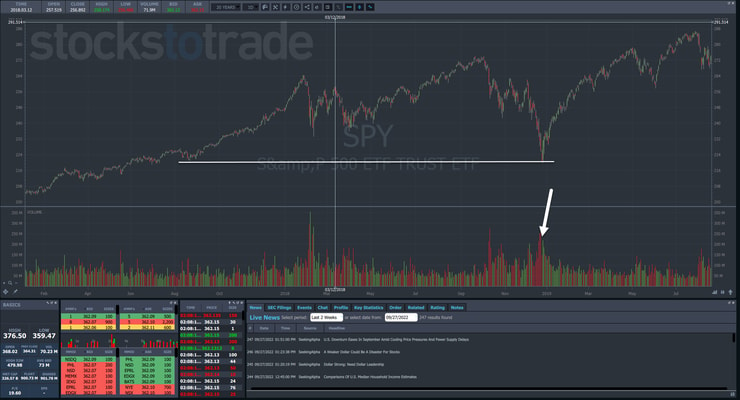

You can see the same concept in action on the S&P 500 ETF (NYSE: SPY) in 2019.

Shares plunged into a support level, saw heavy volume, and then flipped around.

There are two important differences to keep in mind.

First, I can scour the market for penny stocks that fit my pattern, but there is only one S&P 500 index. So, you can’t pick and choose there.

Second, the price action isn’t always so obvious with larger cap stocks and indexes.

The reversals are more subtle and aren’t as likely to see massive spikes in volume that you might find in an OTC.

Nonetheless, the same principles apply.

But you can make life easier on yourself.

Learn my #1 pattern that repeats again and again, no matter what the market does.

Let others worry about their 401K.

Click here and check out my Supernova pattern.

–Tim

Leave a reply