It’s been over 20 years since I got into trading stocks. Over that time there have been bull markets, bear markets, and bubbles. There’s been a financial crash and panic in the streets.

The crazy thing is, the same penny stock patterns keep playing out. And the rules that helped protect me 10 years ago still help me trade conservatively today.

Hot markets come and go, and you’ll always have to adapt. But there are key rules that don’t change no matter the market. Keep reading for the five key rules I learned from 20 years in this niche.

But first…

Table of Contents

Karmagawa Proudly Announces…

72nd Karmagawa-Sponsored School Opens

I’m so proud to announce the opening of our 72nd school/library worldwide. It’s also our 22nd school working with Bali Children’s Project. Our goal is to build 1,000. We have a long way to go, but one school at a time we’ll get there.

View this post on Instagram

How crazy are the before and after photos?

I’m also proud of our work with Partners Relief & Development in Yemen…

500 Families Fed in Yemen

I'm proud to announce my charity @karmagawa just fed 500 families for the next month and also gave 3,000 blankets to 1,000+ families in Yemen to help them in their time of need during what's being called the largest humanitarian crisis in the world! #HelpYemen #YemenCantWait pic.twitter.com/KJKvKfIR3u

— Timothy Sykes (@timothysykes) January 6, 2021

This is the largest humanitarian crisis in the world right now. If you’re in a position to help financially, please do so. If not, share that tweet. Let’s spread the word and make the world a better place.

Let’s talk trading stocks…

Trading Mentor: Trading Penny Stocks Requires Discipline

Trading stocks isn’t rocket science. But it does take discipline. It’s a slippery slope when you start breaking rules.

One of the big problems in this niche is promoters luring newbies into thinking it’s easy. Then they get stubborn and ignore the process. There’s no shortcut to becoming self-sufficient and profitable. It takes time and dedication.

And it takes discipline. Which means you have to set rules and then FOLLOW them. It’s not enough to have or know rules. If you don’t follow them, the market will make you pay. It can only lead to disaster.

With that in mind, I want to use this week’s trade review to set up the five key rules I’ve learned from 20 years of trading stocks…

Trade Review

The riot in the nation’s capital last week was horrific. My heart goes out to the families of those who lost their lives.

When civil unrest breaks out, certain stocks tend to spike. Last week was no different. When it kicked off, I was giving a Trading Challenge webinar. During the webinar, StocksToTrade Breaking News alerted the protest outside the Capitol building.

Then the Breaking News guys sent this alert:

“CAPITOL POLICE SAY THAT INDIVIDUALS HAVE BREACHED THE CAPITOL BUILDING AND ARE IN THE ROTUNDA AREA.”

I actually stopped the webinar for 10 minutes to watch the news and see what was happening. Once I saw the videos and pictures coming out of Washington, I understood how serious it was. It made me think civil unrest plays would spike.

Before I review the trade, I want one thing to be crystal clear…

More Breaking News

- Guardant Health: Unraveling the Surprisingly Flourishing Revenue Trajectory

- From Lows to New Highs: Is U.S. Energy Corp. Stock Ready to Shine?

- Seagate’s Stock Skyrockets, But Is It Justified?

Civil Unrest Plays Bring Conflicted Feelings

I’m not rooting for civil unrest or for these stocks to spike. It’s better for our nation, and for people’s safety, that this kind of thing never happens.

That said, part of my job is to help my students understand catalysts. So when I saw the protest turn to a full-on riot, I checked to see which stocks were on the move.

Lamperd Less Lethal Inc. (OTCPK: LLLI)

Lamperd Less Lethal manufactures specialized riot gear. It focuses on products and training to help police reduce the likelihood of injury. That applies to both rioters and law officers alike.

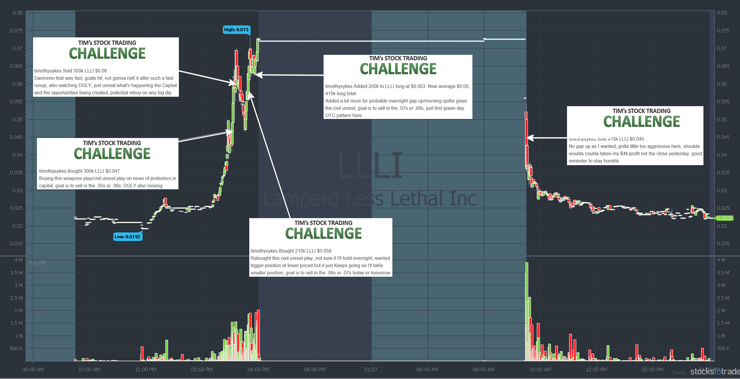

Here’s the LLLI chart showing my alerts from January 6–7 (click the chart to see an expanded view in a new browser tab):

As you can see, I actually chased a little as it was spiking very fast. When it hit my goals on the first trade, I sold for a solid $4,175 win.* That trade capped off a $21,550 profit day.* And it also made me a little too confident.

(*These results are not typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

Looking at the chart, you can see where the stock pulled back. That gave me the opportunity to trade it again. But I took a slightly smaller position than the first trade. When LLLI held near its highs, I added into the close.

My thinking was that in the past, when riots like this start, they often spread. And when they spread, it can take a few days for things to calm down. And that’s where I got greedy and broke one of the five rules below. Thankfully, it wasn’t rule #1…

5 Key Rules From 20 Years of Trading Stocks

20+ years in this niche have taught me a few key rules: 1.) always cut losses quickly 2.) expect the worst out of every company/trader 3.) take singles not home runs 4.) ride the hype but never believe it 5.) study & become self-sufficient, NEVER follow alerts/rely on anyone else

— Timothy Sykes (@timothysykes) January 5, 2021

My second LLLI trade ended up being roughly a $10K swing overnight. I was up around $4K going into the close. I shoulda, coulda, woulda, followed rule #3 below when it hit my goals. I didn’t and lost $6,391.

Let’s use that one big loss to drive home the rules. AND to show you how breaking the rules can really mess with your head.

Stock Trading Rule #1: Cut Losses Quickly

If you’ve been reading the blog or following me for any time you know that rule #1 is to cut losses quickly. This trade is a perfect example of why that’s so important. I was dead wrong about this stock gapping/spiking at the open. Instead, it gapped down and then tanked. Why? Because the civil unrest was over.

But I didn’t hold and hope for a bounce. I didn’t think, “Oh, this will run again because more riots could come.” I got out fast. And it’s a good thing because the stock dropped all the way to the $0.02s.

Stock Trading Rule #2: Expect the Worst

This is such an important rule. It can really mess with your head if you trust a company, a promoter, or another trader’s alerts. (See rule #5 below.)

Penny stocks aren’t long-term investments. They’re trading vehicles. And there’s a big difference between trading and investing. The chance of a penny stock company becoming a legitimate long-term investment is very low.

(New to penny stocks? Start with this FREE penny stock guide.)

Also, promoters who say, “This one is going to the moon,” are full of BS. The same goes for so-called trading teachers who say it’s gonna be easy. It’s not.

So always expect the worst. On my LLLI trade, as soon as I saw it was gapping down, I got out. I didn’t try to predict, I reacted. That’s it.

The one rule I really broke on this trade was…

Stock Trading Rule #3: Take Singles, Not Home Runs

To be honest, I got greedy. I was aggressive and confident because it was a breakout. But at the same time, if you were watching my Trading Challenge webinar you heard me say, “Don’t break out. Don’t break out…” Why? Because if it broke out, it would hit my goal….

And if it hit my goal, which was the $0.07s or $0.08s, then I’d have to sell. It did. Unfortunately, I didn’t.

This trade is a really powerful example — everything lined up well. I couldn’t predict the riots and protests would be put down so quickly. And had they carried on, it would’ve likely been one of my biggest wins in a while.

This was a classic OTC first green day, former runner, big percent gainer, with big volume and a catalyst. So based on my experience, I put myself in the right position.

But when it hit my goal, instead of taking the single, I swung for a home run. In hindsight, I should’ve sold some to reduce my position size. That would’ve locked-in some profits and reduced my risk.

Stock Trading Rule #4: Ride the Hype But Never Believe It

It’s human nature to love stories. They shape our lives from a very early age. But hyped-up BS is dangerous when it comes to trading stocks.

Don't get too caught up in the long hype/cheerleading of any asset, sector or play, we traders need those fanatics to whip up enough of a frenzy to create far more predictable short-term volatility to capitalize on, but it's definitely entertaining to listen to their hyperbole!

— Timothy Sykes (@timothysykes) January 8, 2021

So don’t believe the so-called due diligence and the stories about “world-changing tech.” I’m not saying there aren’t outliers. Some companies do have world-changing tech. But most don’t.

When it comes down to it, most penny stock companies don’t survive. Or they constantly dilute shareholders through stock promotion and toxic financings.

Breaking this rule leads to bag holding. It creates the hold and hope mentality. It’s OK to ride the hype train … just get off at the nearest station.

Stock Trading Rule #5: Never Follow Alerts or Rely on Someone Else

I’m just training wheels…

My goal as a teacher is to help students become self-sufficient. You can’t do that by following alerts. It doesn’t matter if the alerts are mine or anyone else’s. You MUST focus on the process.

Sadly, a lot of so-called teachers actually encourage students to follow their alerts. Some on social media run ‘free’ chat rooms and say: “buy now.” Then they sell into their followers.

You have a choice in trading, you can study patterns & learn from market history or you could be a lazy/gullible newbie/lemming & listen to half-assed/laughable joke "DD" by penny stock promoters who are paid to pump stocks for insiders & you'll get decimated in time, YOU CHOOSE!

— Timothy Sykes (@timothysykes) January 5, 2021

So say this out loud and repeat it three times: “I will NEVER follow alerts. Alerts are ONLY to help me learn the process.” Then put it on a post-it note next to your trading setup. Repeat it every day.

Millionaire Mentor Market Wrap

You can choose to wait for solid setups and opportunities. And you can follow rules meticulously. Or you can choose to ignore rules and take random trades. But your choices have consequences. Would you rather become self-sufficient, or be one of the vast majority of traders who lose?

I’m not saying you won’t make mistakes or take losses. My LLLI trade is a pretty clear example of making a mistake and breaking a rule. But had I not applied rule #1 it would have been a lot worse.

Again, trading stocks isn’t rocket science. But it’s not all unicorns and rainbows, either. Stay humble or the market will humble you. That’s a wrap.

Trading Challenge

Are you ready to immerse yourself? The Trading Challenge is the most comprehensive trading education I offer. It’s not easy. To become self-sufficient you’ll have to study. Maybe more than you’ve ever studied in your life.

Are you willing to put in the effort? Can you follow rules and focus on the process? Do you have patience and a strong work ethic? If so, apply for the Trading Challenge today.

What do you think of my 5 key rules for trading stocks? Comment below, I love to hear from all my readers!

Leave a reply