Just a quick blog post for you today, because I know a lot of you are freaking out about the overall markets being down.

I’m here to tell you not to worry.

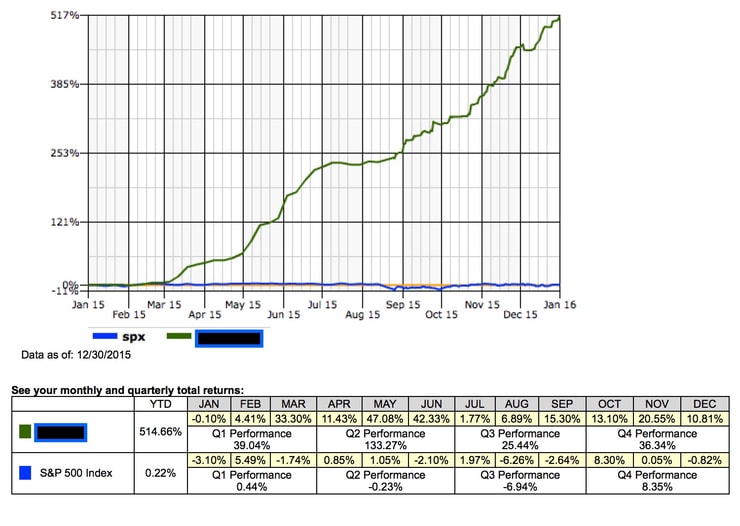

It is possible to trade penny stocks, even when the market is crashing. A lot of people rip on penny stocks, but look I’m up nearly 10% on my small account HERE while the overall US markets are down nearly 10% in just the first 2 weeks of 2016!

Facebook is down big, Google is down big and Microsoft is down right now, heck even Warren Buffett is down nearly 20% in just a few weeks. Just because these big companies are down doesn’t mean everyone is down. You just have to know where to look.

It is possible to trade penny stocks, long AND short, as long as there’s volatility, of which there’s plenty these days.

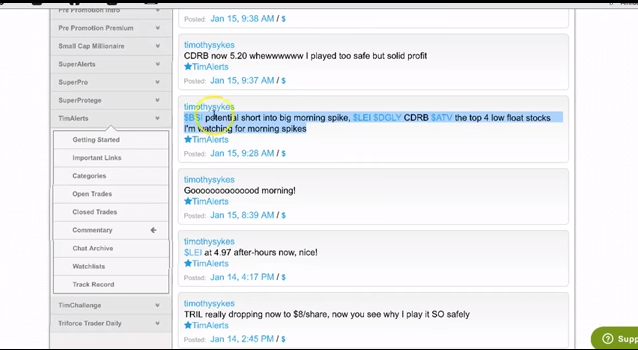

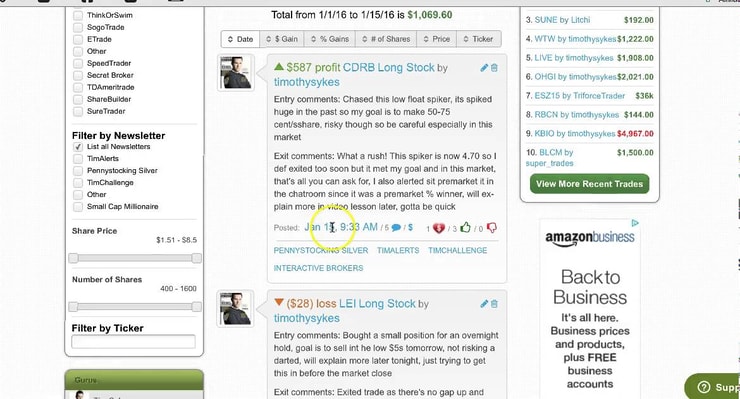

On Friday, I picked the single biggest winner of the market – CDRB was up nearly 100% on the day. Every day for the past two weeks, I’ve been close to picking the winners – but on Friday, I finally figured it out and nailed it and my students and I made nearly six figures…long AND short, just trading in and out of the stock’s awesome volatility.

You can see more of my CDRB trade in the video above, but how did I find it? Basically, it was on my watchlist a few months ago when it went from $12.00 to $40.00. I always remember old supernovas. Remember that: when a stock can triple or quadruple, it can start flying once it starts moving again. Here, I wanted my initial execution at $3.80, I got it around $4.00 and it went all the way up to $5.70. I was out in the $4.40s, which meant I captured $.30-.40 per share (or, one third of the potential profits).

How did I know CDRB was going to spike? Well, first of all, you never really know how much a stock is going to spike. You can try to guess, but that’s why stock trading is an art, not a science. I actually should have held CDRB longer, and I would have made more. But I knew I was chasing it, and that makes me a little more hesitant, because I don’t’ know when the spike is going to end. My goal was to make $.50-.75 per share, but it was more important for me to be careful.

That said, this was a big win for my small account – and it’s one I needed. I don’t like to add money to my accounts. I know some traders do, but with the challenge I’m doing this year of trading with a small account, it just doesn’t make sense. Why should I get to add money, when I know most of my students can’t? To me, it really takes away from the whole spirit of the thing if I can take advantage of the fact that I’ve already made my millions by boosting my account.

Now, though, I’ve got some breathing room in my small account. I like it when my back’s up against the wall. With this challenge, I’m trading as if I only have $12k to my name. I’m not trading from a millionaire mindset. I’m trading from where you are. I’m up $1,000, which means I’m up 8% when the markets are down. And it’s great to outperform the index, but I’m not getting too excited. I think about what $1,000 could buy me in the real world, and it’s not that much. That’s ok, though. That just leaves me feeling hungry to do better.

My big win with CDRB aside, I haven’t traded perfectly over the past few weeks. I’ve had to cut losses. With LEI, for example, I held overnight, hoping that there’d be a morning spike, but instead, it was actually fading premarket. That’s ok, though. Because of it, I cut losses with LEI and got into CDRB, which actually had a delayed morning spike that I was able to profit on.

Working with the PDT rule

When I’m trading normally, I’m so far removed from having to worry about the PDT rule. But if you’re trading with under $25,000 in your portfolio – like I am with my small account – I want you to walk away with an important lesson. You’ve got to lock in profits or losses same day or overnight, not to waste trades. Remember, you’re limited to just 3 day trades in a 5-day period. That means you’ve got to get creative about when you buy, hold, sell or short.

For instance, you don’t want to use your day trades on stocks like BLRX, which was a failed morning spiker. You need volatile stocks. If you can’t find them, remember that you can always open positions near the market close and hold overnight – those trades don’t count as day trades.

With CDRB, I knew I wasn’t going to hold overnight. I should have held longer, but it’s okay. There’s no real reason that you shouldn’t bank. The good news is that I went in with a plan. Because I knew this was going to be a day trade – I knew it was a low float stock – I was able determine how and when to utilize best utilize my day trades.

Of course, making that decision means having a good idea of whether or not a stock is going to spike. And I sound like a broken record, but one of the best ways to find this out is to spend time in the chat room. I’m in there every day giving commentary, and you should be using it – especially at market open. Anybody could have seen the plays I’ve described here. You just have to be there.

More Breaking News

- The Stunning Surge of QUBT: Can This Quantum Leap Sustained?

- KULR Technology Group’s Bold Move: Investing Big in Bitcoin

- Can RAPT Therapeutics Defy Today’s Market Trends? An In-depth Look

Your final chance to save

If you’re serious about making the kinds of plays my students and have made that let us profit even when the markets are down, you’ve got to show up. You’ve got to be there. And that means taking advantage of opportunities when they’re right in front of you.

Today is the final opportunity for you to save 30-50% on my holiday sales. The deals will end tonight. That’s final. We’ve been as accommodating as we can be. I hate it when people come to me and want to invest in their future, but they’ve missed the opportunity. But I’ve been as generous as I can be. My TIMalerts are as low as they’re ever going to be. I’m giving you a great deal because I have more millionaire students than ever, and because so many people are interested in learning from me when my accounts are up and the market is so bad. But this year, I’m investing in quality students over quantity. If you want to lock in prices, do it now.

(Just a note – because I know I’m going to get emails about this – we’re not raising prices on existing subscribers; just on new subscribers. If you’re already in, you won’t see your fees go up.)

Here’s exactly how much you’ll save… My old TIMalerts pricing was $49.95/month or $497/year. The new 2016 pricing will be $74.95/month and $697/year. It’s currently on sale for $312/year – but only through today. This is the last time prices will ever be this low.

If you need more support, know that, while the old PennyStocking Silver pricing was $99.95/month or $797/year, the new pricing will be $149.95/month or $1,297/year. It’s on sale for just $557/year, but that sale ends today. This really is your last chance to make 2016 you turn your tiny account into something that makes a measurable difference in your life.

Because, here’s the thing about having a small account – you build it one trade at a time. Some of your trades will be scratches, and some will be wins. But the thing is, the small gains and small losses don’t matter. It’s the big gains that push you forward, big time.

I take a lot of shit for being wrong here or there, and if I lose a little or I gain a little. Some people tell me that I’m scalping against my subscribers, but what you have to remember is that I don’t give a shit about making $50 or $100. What you guys don’t understand is that I do this all for teaching. Trading with $12,000 helps you understand that more. In fact, when I make $50 or $100 on a trade, I’m actually losing money, because of what it costs me to send out text alerts to my subscribers. But it doesn’t matter to me. I’m not in this to make pocket change.

Being on the right track is huge. Remember that half of the US population has less than $10,000 in their savings accounts. Are you one of them? If so, make this the year you stand up for yourself and reclaim your financial future.

I think I can change the world by teaching you how to trade. Small trades like the kind I’m doing here add up. It is possible to improve and make profits over time.

It all adds up, but you have to remember that almost everybody I teach starts small. Some of my best students have started out with just $1,000 to their names. Don’t ever feel bad about being on the right track – the most important thing is that you’re there.

It’s not too late to make a New Year’s resolution about your financial future. But you’ve got to do what it takes to follow through. Did you know that 80% of people who have a gym membership don’t go? If you want to be fit, you’ve got to put in the time. If you want to be financially fit, you’ve got to study – and you’ve got to take action.

This is your gym.

I’m your trainer.

Leave a reply