Stock Market Recap: Key Takeaways

- Sneak peek: My trades from last week and 2022 so far, plus what’s going on in the markets…

- A slow market provides different opportunities — discover how to maximize them.

- Why I laugh out loud when Wall Street traders look down on my process and profits…

There haven’t been as many trades recently, but that’s fine. It makes it easier to avoid overtrading. Even so, I’m already up roughly $35K in 2022. And while I’m not looking to take trades, I will when they come to me.

In this video…

- How to get rich with a 50% win rate. (Most new traders don’t know this…)

- The truth about trading the most volatile stocks in the market.

- Why you should cherish a slower market. (And how to benefit from the gift of time.)

- The real reason most traders aren’t ready when a great play stares them in the face.

- What Tim Grittani did on June 30, 2020. (Most people can’t believe it until they see it.)

- The trades and setups working in this market. Hint: the rules never change.

- Review of my recent INDO trades: The good, the bad, and rule #1.

- How to avoid FOMO on missed executions. (This lesson alone could save you thousands.)

- Why a stock trending up on unconfirmed rumors is more exciting than a ‘penny up, penny down’ former runner.

- When a double-top is NOT a bad sign. (Counterintuitive, but true…)

- How penny stock companies jump from one hot trend to another. You can’t believe the company, but you MUST respect its spikeability.

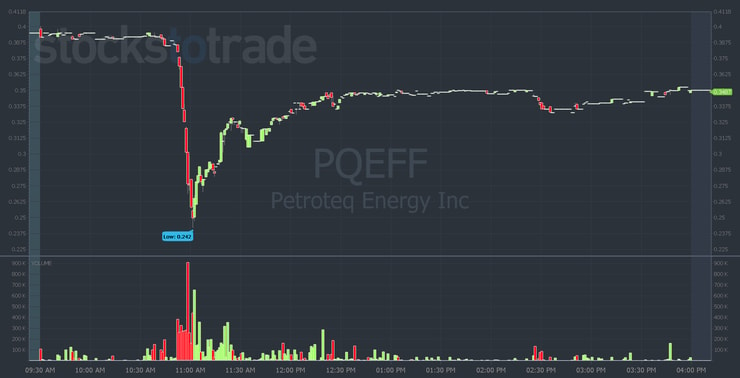

- PLUS: Why I can’t stop looking at this chart…

Tips From a Week of Trading Penny Stocks & More: Video Recap

Get all these lessons and more in the recap video below…

Remember, you don’t have to make BS predictions. You’re not a CNBC talking head trying to raise money to collect a 1% management fee.

Think bigger. MUCH bigger…

I’ve dedicated my life to being the mentor to trading students that I never had. There’s no magic formula, but my 20+ years of experience can help you speed up the learning curve.

One pattern I’ve traded for 20 years gives me the opportunity to make money by taking advantage of a Nobel-prize-winning economic anomaly. I’m broadcasting live TONIGHT to explain exactly how I do it…

Join Me Tonight, February 9 at 8 PM Eastern for

**The Overnight Profits Summit**

See you there!

And if you enjoyed this video recap, comment below…

Want more recap video lessons like this? Comment below. I love to hear from all my readers!

Leave a reply