Hey Trader. Tim Here.

Just a few more weeks until I teach IN PERSON!

I can’t tell you how much I’ve missed connecting with traders in person. It’s literally my lifeblood.

But before you arrive, there’s one thing you must understand.

I’m not a perfect trader. Far from it.

Despite earning millions as a trader, the stock market continues to humble me.

Like a couple of days ago when I traded Sysorex Inc (OTCQB: SYSX).

This tiny trade reminded me of the importance of patience, a lesson you don’t always have to learn the hard way.

Many of you probably think you have this in the bag. Trust me. I did as well.

That’s why I want to show you how Evil Tim popped up in the SYSX trade and what I should have done differently.

Examples like these help all of us recognize and manage our itchy trigger fingers.

Before We Begin

Above all else, I want you to walk away with this…

DO NOT FORCE YOUR TRADES!

Trading is meant to be deliberate and methodical.

Learn to recognize and manage your emotions.

SYSX – The Setup

SYSX was a fairly simple setup.

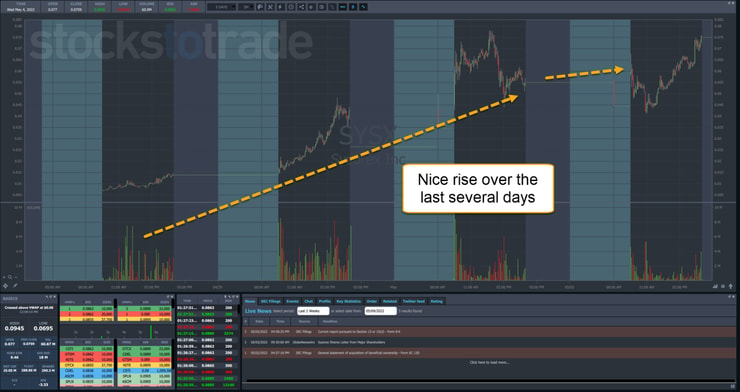

As the chart below illustrates, shares rose in heavy volume in the days prior to my trade.

In the premarket, there wasn’t any price action, nor had there been in the days prior.

However, SYSX was on my watchlist which includes other names I want to keep an eye on.

Once the market opened, shares dipped in a quick panic move.

That was when I attempted to jump into the trade … and where I made my mistake.

Our StocksToTrade Guru Tim Bohen talks extensively about his ‘9:45 rule.’

It’s simple really. You allow a stock to open and give it 15 minutes to make the violent moves before entering a trade.

Frankly that’s what I should have done.

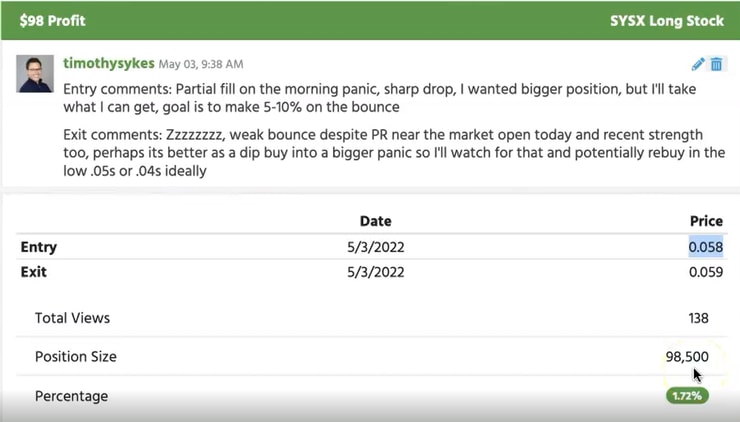

Luckily, after a minute or two, I realized that I bought on the high side of that panic dip and didn’t get the bounce I wanted.

So I sold for a very small profit.

While this was a win and I don’t necessarily swing for the fences, I do try to get 5%-10%, not 1%-2%.

But let’s face it. I’ve been in Bali building 22 schools for the past several weeks, I haven’t slept much, and I’m lucky that I walked away with a profit here.

Looking back, as I wrote in the comments, I should have looked at the low $0.05s or $0.04s.

And wouldn’t you know it, that’s where it found support.

Going back to the chart, I want to zoom out to the day before.

In this chart, I drew horizontal lines on the swing points where the stock ran into support or resistance.

Those levels worked splendidly the next day when I was trading.

Here’s how I could have worked them better.

As you read above, I should have considered a rebuy at lower levels.

Those lower levels coincide with those support prices I drew on the chart.

Frankly, if you want to be conservative, using the prior day’s low is a good risk-reward spot to trade a bounce.

You know there are a lot of stop orders below that point.

And you can see how the heavy volume held up the stock around 11 a.m. right at that price.

From there, you can trade the consolidation against that low, looking for a swing higher.

Now let’s say you got in early at around $0.053 or so.

If you took half a position there, you could take a similar-sized position at the lower level to bring down your average entry price.

From there, you can scale out of the trade if it rises or stop out should it fall.

More Breaking News

- Is Rhythm Pharmaceuticals Stock Set for Long-Term Growth or a Temporary High?

- Is Snow Lake Resources Ltd. Positioned for a Rebound with Fresh Exploration Funds?

- ChargePoint’s Q3 Surprise: Is This the Beginning of a Strong Comeback?

Again, using that low with heavy volume is a much better choice because it keeps my losses small compared to my potential reward.

Applying This to Your Trading

Everyone has a different style.

Even if we trade the same patterns, you probably execute your trades slightly differently.

Explore what works best for you.

You don’t always have to follow my exact trades. In fact, I encourage you not to.

My trades create a framework for you to build.

Think of it as the foundation for your home. I lay the concrete, you build your palace.

One great way to build that foundation is our upcoming LIVE in-person event.

If you want to cut your learning curve, this is a great way.

Make sure you sign up now — seats are limited.

—Tim

Leave a reply