This market has me absolutely pumped because we’re starting to see some BIG MOVES!

It’s more than just the nearly $1 million in combined profits my students made on the same stock in a matter of days…

I’m seeing a lot more opportunities open up with penny stocks running like they stole something.

One of my best trades last week has to have been Emergent Health Corp. (OTC: EMGE).

Leading up to July, I focused primarily on morning panic dip buys.

But with some of these stocks burning rubber, I decided it was time to adapt.

Normally, I don’t like to buy into strength.

However, EMGE was one of those news-driven moves with massive potential to run hard.

Here’s how I took designed my setup to manage risk while maximizing gains.

Use Price Action Entries

The best way to get into a runaway trade is during a quick pullback.

This doesn’t always happen, but there is usually at least a handful of ticks that will come in, even by a small amount, that offers a better price than bidding at the highs.

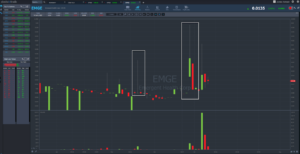

Take a look at the one-minute chart for EMGE.

I highlighted several spots where price backtracked, albeit for a minute at a time.

Even within those one-minute candlesticks, the stock can and will retrace some of its movements.

Manage Risk

Now, I got into the trade a bit after that second red candlestick.

My expectation was that either the stock would trade sideways and I’d get out around breakeven, or we’d get followthrough.

Considering the news had just hit, I felt confident we’d see a pop.

However, the worst case scenario here was it dropped back down to where it opened.

My entry was at $0.014. The open was about $0.009-$0.010.

That gave me downside risk of $0.004-$0.005.

But how could I know what the upside potential was?

Take a look at the daily chart of EMGE.

I boxed out two instances where shares jumped on heavy volume.

The high in the first one was just above $0.022 with the second getting to nearly $0.04.

It’s reasonable for me to assume that shares could run to at least $0.02, giving me a profit of $0.06.

That might not seem like much, but it’s 50% larger than my potential losses.

And that’s being conservative on my stop and profit target.

In reality, I’d likely get out of the trade well before max loss.

With any trade I take, I always want to maximize my possible gains and minimize losses.

That’s why I’m quick to cut positions I don’t feel are working.

The initial run in EMGE let me ride the stock pretty much to the dead highs. I managed to exit near the highs, locking in $5800 in profits.

Now, this sale was a large chunk of my position, but not all of it.

In fact, just past noon, I added to the position at $0.017 after the stock had pulled back.

Unfortunately, the sellers were in control as shares slid lower.

So, rather than ride it down much further, I exited the following day at $0.015.

In retrospect, I should have sold everything at $0.029. However, sometimes these runners can go a lot further than you might believe.

Plus, I thought there might be a possibility of a follow-up spike the following day.

More Breaking News

- Templeton Trust’s Stock Surge: What’s Behind the Recent Momentum?

- VCIG’s Latest Moves: A Boom or Bubble in the Making?

- Growth or Mirage? Unpacking the Latest Surge in SoundHound AI’s Stock

Nonetheless, I walked away with profits from this trade and moved onto the next.

The Bottom Line

Whether you trade off a support level or buy into strength, you need a well-defined plan of attack,

Trading should be mechanical enough to where you could define your actions by ‘If’ statements such as…

If shares trade sideways for more than five minutes, I will exit this trade… or… If the stock drops below $0.01 I will stop out.

That way, you can select setups that meet your criteria and offer the best opportunities for profit.

One of my favorite patterns to work with is the Supernova.

This pattern is great for both new and experienced traders because it offers so many avenues to design trades that match your style.

Click here to see what I mean.

—Tim

Leave a reply