What’s more important than hot stocks? Having the right mindset, strategy, and tools.

And when it comes to tools, your online broker can be a key asset … or your worst enemy.

Trust me. I’ve learned from experience.

Choosing an online broker for your investment strategy should take time. Evaluate your options, consider your trading strategy, and don’t be afraid to ask questions. In the financial industry, every tool you use should help make you feel comfortable and secure.

When you’re a day trader, the right penny stock broker can help you maximize every trade, both during and after market hours. Before you make a decision, you’ll want to look for several key indicators, which I’ll describe below.

You might also consider setting up accounts with my preferred traders. If you don’t have a frame of reference, then you won’t know whether you’re using the right online broker for you.

Let’s dig into the strategy between choosing an online broker for penny stock day trades.

Table of Contents

What Is a Penny Stock Online Broker?

A penny stock broker is an online broker who facilitates the trading of penny stocks — also called over-the-counter stocks, or OTC. Penny stocks are stocks that trade at $5 or less per share, so they’re not high-profile or high-revenue companies.

This doesn’t mean you can’t make money with pennystocking. I’m living proof. I turned an initial investment of just over $12,000 into profits of nearly $5 million, primarily through penny stock trading**.

Penny stock online brokers require you to make a minimum investment, which varies between them. Typically, though, the minimums prove much lower than if you planned to trade on the major stock exchanges — or if you wanted to trade on margin, which I never recommend.

Anyone who tells you that online brokers require minimums of $10,000 or $20,000 is lying. If you have $500 to invest, you’re likely good to go.

Investment and Trading Companies

The securities industry is highly diverse. Everyone has different strategies, goals, and areas of expertise.

As you might have gleaned from this site, I focus on small-cap companies. I want to trade quickly and take profits wherever I can.

An online broker can have specialties, too. For instance, some focus primarily on long-term investment strategies. Their clients hold investments for months, years, or even decades before selling and taking their profits. In the meantime, they often get dividends.

That’s not my bag. Instead, I day trade penny stocks and small-cap stocks. I’ve executed trades that lasted only minutes, though I occasionally hold stock overnight or for longer periods of time based on my research.

If you’re interested in day trading versus investing, you’ll want an online broker that specializes in day trading.

What Are Some Top Online Stock Brokers for Beginners?

You’ll want to work with an online stock broker that can help you learn your way around the process. For beginners, some are better than others.

Joining my Trading Challenge can help you get your feet wet and learn faster, but I still recommend several companies that have proven their worth for newbies in day trading.

Here are four of my top recommendations. Check them out for yourself to determine the best solution for your specific needs.

StocksToTrade

Before I talk about traditional online brokers, I want to share the benefits of getting on board with StocksToTrade. It’s an incredible platform that teaches you how to trade stocks in a low-stress, high-data environment.

It’s not an online broker — at least, not yet — but it allows you to try paper trading, filter copious amounts of market data, isolate the stocks that might make big movements in the near future, and more.

Many new stock traders get overwhelmed because they have to get their information from numerous sources. It’s confusing and frustrating … and it eats up a ton of your time.

StocksToTrade combines all those utilities — from live webinars at market open and close to paper trading and stocks to watch. The filters are highly adaptable, so you can adjust your usage of the platform to your particular trading strategy.

More Breaking News

- Globalstar Inc. Takes Off: What’s Driving the Stock’s Upward Momentum?

- Sintx Technologies’ Strategic Maneuvers: Are These the Key to Sustained Growth?

- Is SoundHound AI Riding a Growth Wave? A Dive into its Recent Performance

TD Ameritrade

I’ve used TD Ameritrade and know lots of people who use it consistently. It’s one of the most well-known online brokers in the world, which gives it some immediate credibility.

TD Ameritrade isn’t great for shorting, but it’s a decent broker. I know many people who have one E-Trade account and one TD Ameritrade account, which means they get the best of both worlds. You can short sell using E-Trade and use TD Ameritrade primarily for buying.

There aren’t any subscription or platform fees with TD Ameritrade, which is one great selling point. There’s also no minimum cash deposit to create an account.

E-Trade

Both TD Ameritrade and E-Trade have commission fees of $6.95 per trade (at the time of this writing). They’re also similar in terms of content and interface, though I prefer E-Trade. In fact, I almost always have an E-Trade account open for trading smaller amounts of money.

Interactive Brokers

You might be interested in Interactive Brokers if you want to trade on margin (again, which I don’t recommend) or if you want to work with a company that has tons of assets. The company requires a $10,000 minimum deposit to start trading, and you must keep a balance of $2,000 in your trading account.

How to Select a Penny Stock Broker

Back in the day, individual traders like you and me were faced with very few broker options. Most stockbrokers were full-service brokers. You had to call them every time you wanted to make a trade and pay a hefty premium for their time.

Fortunately, the landscape looks much different now …

You have lots of online brokers from which to choose, and most allow you to make trades without picking up a phone. That’s a good thing, especially when it comes to commissions.

What Do You Need to Look At?

If you’re interested in working with a penny stock broker, there are several considerations that deserve your attention. What works for me might not work for you, so I’ll cover each category in full to help you make an informed decision based on your trading strategy.

Trading Costs

Not once have I ever cared about the commissions that E-Trade or Interactive Brokers have charged me. If I focus on the right trades, the commissions are negligible.

You just have to be choosier with your trades.

I know that you think that you have to trade every single day, but you don’t. If there’s not a great supernova, or if there’s not a huge volatile stock, or if there’s not a stock that you can make 20, 30, or 50 percent on, don’t trade.

The commissions can actually be a good thing to help you avoid over-trading!

This is no different than the pattern day trading (PDT) rule, which many people hate, Even I hated it at first. When I first got started teaching, I was like, “Come on, let everybody trade.” Now I see how many newbies over-trade. The PDT rule helps you scale back.

Still, you don’t want to use an online broker that will charge you more than the competition. This is especially true when it comes to hidden fees.

Find out exactly how much your online trading broker will charge and for what.

Trading Tools

The top online broker platforms provide handy tools to help you make smart trades. For instance, E-Trade offers fantastic information for people who are new to trading. There’s also an extensive knowledge base, information on investing trends, market news, and more.

Of course, if you’re a StocksToTrade member, you don’t need all of those extras. You get them in one place, and you can use your online broker exclusively to execute trades.

Investment Products

You also want to consider the trading products in which you’re interested. Obviously, if you want to trade penny stocks, you need a broker that allows you to do so. You might also be interested in commodities, ETFs, FOREX, and other investment opportunities.

Legitimate online brokers tell you exactly what types of investment products they offer. E-Trade, for instance, allows you to invest in options, futures, mutual funds, bonds, and more. The same goes for TD Ameritrade.

Mobile Trading

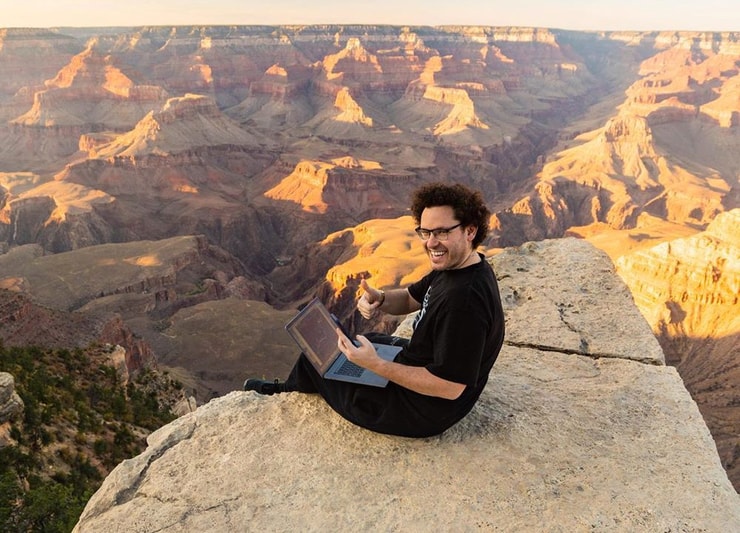

I don’t know about you, but I don’t like being stuck behind a computer all day. While I enjoy the laptop lifestyle, sometimes I want to carry around something smaller. That’s why online brokers that offer mobile trading can be awesome.

You can usually download an app that mimics the online dashboard. Execute trades while you’re on the go, and don’t worry about having to make a phone call when you suddenly realize your investment has taken a turn for the worse.

Mobile trading offers other benefits, too, such as receiving mobile alerts about your account. You don’t have to keep checking constantly if you know your device will let you know when your account needs your attention.

Customer Service

Diversity matters when it comes to customer service. I don’t like dialing 800 numbers and waiting for someone to answer the call. Instead, I want to be able to shoot off an email, engage in live chat, or text my online broker about a problem.

Look for brokers that offer multiple lines of communication. The best ones also have knowledge bases or help centers where you can find the answers to frequently asked questions. I usually consult those before reaching out to a company because I don’t want to waste their time or mine.

Stock Analysis

Some companies charge for stock analysis and other services via their platforms, while others do not. If you’re a StockToTrade member, you don’t need to worry about this point. However, if you want access to stock analysis tools through your online broker, check on that before you sign up for an account.

This also matters less when you’re primarily trading penny stocks, because most online brokers don’t offer detailed information about the companies behind them. Their analysts focus more on blue-chip and large-cap stocks instead.

Regulation

There are two types of regulations: Those set forth by governing bodies and those your online broker creates. You need to be aware of both of them.

Without a doubt, you need an online broker that follows FINRA guidelines to the letter. The company should be willing to enforce securities regulations consistently and to monitor accounts for any infractions.

Most online brokers have systems in place to keep traders honest. For instance, they issue violations when a cash-account trader doesn’t have sufficient liquidity to cover a trade or otherwise takes a position that violates government or broker rules.

If you receive a violation, you might have your account limited, cancelled, or restricted. Make sure you’re aware of the rules and regulations before you begin to trade.

Banking Services

I know a lot of investors who prefer to bank with their brokers. They can easily shift cash between different accounts — and with penny stocks, minutes can matter when you see a potentially lucrative trade opportunity.

Account Security

From two-stage authentication and data encryption to fraud protection and firewalls, you want to know that the money you invest with an online broker will remain safe. Checking online reviews and inquiring about specific security setups not only puts your mind at ease, but can also help you trade with greater confidence.

Order Execution

Speed of execution matters, too — especially with pennystocking. You need to be able to act immediately if you decide to buy or short a stock. These days, most reputable online brokers have execution guarantees.

For instance, E-Trade currently has a two-second guarantee as long as the trade meets specific criteria. It doesn’t apply to penny stocks trading for less than $1, but most other scenarios should be covered.

International Trading

Some online brokers permit international trading, while others don’t. For instance, Interactive Brokers allows you to trade internationally on the stock market, American Depositary Receipts, ETFs, and mutual funds, while while E-Trade doesn’t permit international stock market trading.

Key Tips for Choosing an Online Broker

When you’re choosing an online broker, there are two key tips I want you to keep in mind. They’re total deal-breakers, in my opinion — so take them seriously.

Know the Broker and Its Terms and Conditions

Online brokers change their terms and conditions all the time. They also change fee structures, rules, and other aspects of online trading. If you’re not diligent about research, you could get burned.

Don’t Let Anyone Trade for You

You’ll never learn how to trade penny stocks if you let someone else make your decisions or execute your trades. Practice makes almost perfect. Focus on expanding your education on the stock market and making your own decisions.

The Bottom Line

Choosing an online broker is a personal process. You’ll figure out what you want out of a broker as you trade with different companies and compare their interfaces.

You might choose one over another because of the ease of execution or because you read lots of favorable online reviews. However, there’s no substitute for experience.

I’ve tried more than 100 different trading software programs and online brokerage tools over the years. StocksToTrade is the most comprehensive when it comes to education, whether you’re checking out potential stock picks, engaging in paper trading, or researching companies.

E-Trade, TD Ameritrade, and Interactive Brokers all offer several advantages for those who want to trade penny stocks. I recommend checking out each of them in depth before making your decision.

I also recommend joining my Trading Challenge. It’s one of the top ways to get a quick education in the stock market and to follow some of the leaders in this industry. I’m always sharing my trades, producing new webinars, and providing advice and feedback.

You never know … you might be my next success story.

Leave a reply