With all this crazy volatility in the market…

… you’d think you need a setup like the one below just to compete…

However, nothing could be further from the truth.

In fact, I’ve had some of my best trading days on a laptop with sketchy Wi-Fi…

I’ve even had some monster days trading hungover and sleep-deprived.

Why am I sharing this with you?

Because I hear too many traders make excuses about this current market. And how it’s so hard to make money.

It’s not the market … It’s you.

Sure. it’s not as easy as it was last year. However, that hasn’t stopped me from being profitable.

And if you’re not like Roland Wolf or some of my other profitable students…

Then you’re probably doing this ONE THING WRONG.

Table of Contents

The Proof Is in the Profits

2025 Millionaire Media, LLCWe’re going to run through some of my most recent trades so that I can illustrate my point to you.

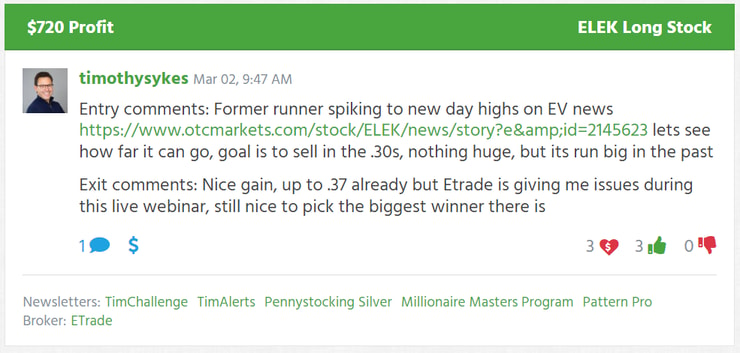

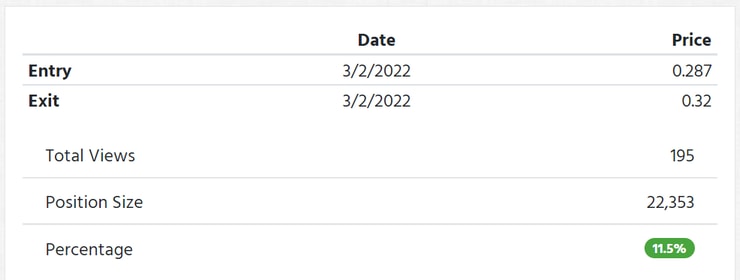

First up is a $720 profit on…

Elektros Inc. (OTCPK: ELEK)

Full disclosure: I wasn’t operating at 100% capacity for this trade.

So I didn’t play it perfectly, but that’s OK. Remember that 90% of traders lose. Any profits at all put me in the top 10%.

Actually, one of my students played it better than I did. Check out my video lesson where I give props to Suzy…

She had a better plan and execution. I’m so proud to see my students doing well.

I was really sleep-deprived while making this trade. And a lot of people might think, “Tim, why would you trade while low on sleep? What if you mess up?”

Well, for me, trading on low sleep actually improves my performance. I know that sounds pretty counterintuitive.

Let me show you my trade and then I’ll explain…

I saw this former runner start spiking in the morning on recent EV news. Here’s the headline…

I got in safely on a dip and then sold into strength as it broke out again. I think you’ll agree that I could have done better. But again, I wasn’t entirely awake. And as you can see in my trade notes, I was having broker issues…

Here’s a chart of the morning run…

I’ve got another example too. And this time I started with a loss…

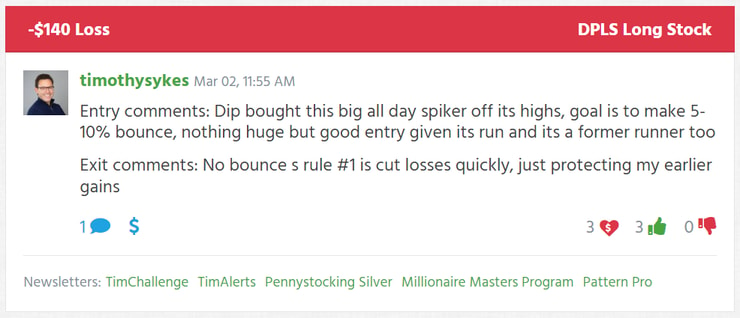

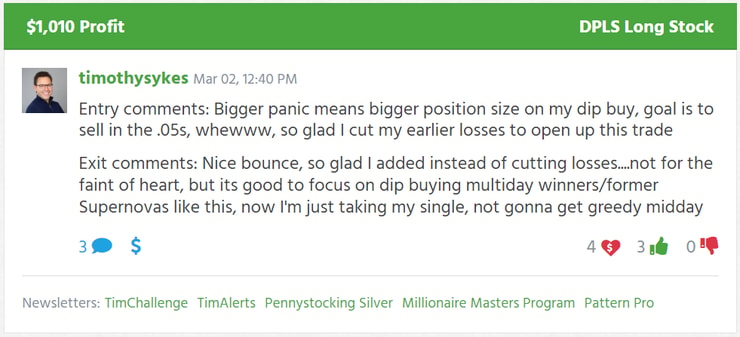

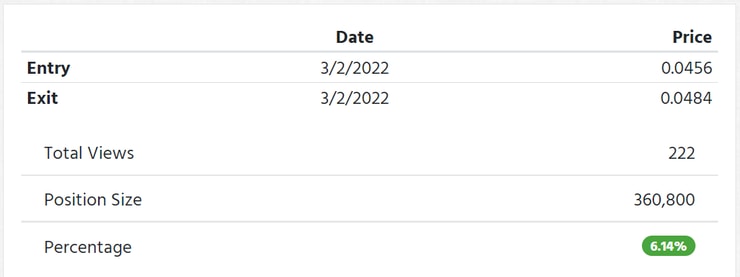

Dark Pulse Inc (OTCPK: DPLS)

One thing that separates me from the rest of this sketchy niche … I share all my trades on Profit.ly. Including my losses.

I’m not afraid to show my failures because I’m not in it for the money anymore. I trade to teach my students the process. And all my profits go to charity anyway.

Help save the reefs and buy some apparel!

Again, the main reason I show my trades is so my students can learn from them. They get to study the what, when, where, why, and how of each trade.

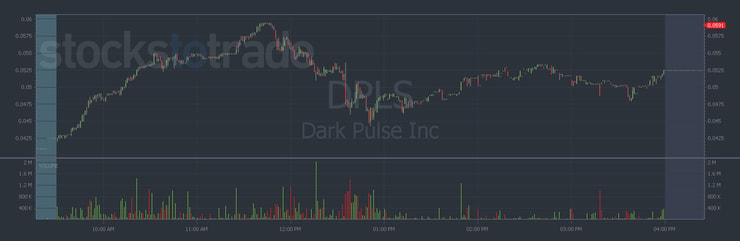

This stock is another former runner that’s been grinding higher for a few days. But instead of trading the breakout, I was trading a panic dip buy pattern.

When stocks fall off a cliff, sometimes they bounce after hitting a bottom. My goal is to buy at the bottom and sell into the bounce.

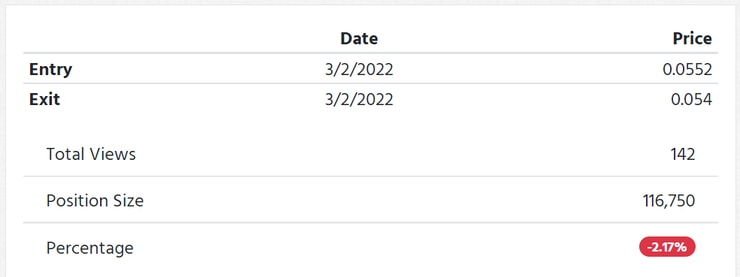

My first attempt didn’t go so well…

But I recognized the weakness and cut it for a small loss. Which was a great move, because it kept falling after I sold. And that opened the opportunity to rebuy…

Here’s a chart of the panic and resulting bounce…

There’s a lesson you need to learn and it’s hidden in these trades. Can you see it?

Why You’re Losing

2025 Millionaire Media, LLCStop caring so much.

So many newbies start trading penny stocks to make millions of dollars. Don’t get me wrong — I’ve helped more than two dozen students do that exact thing … But it takes time.

You can’t profit more than the market will let you. Does that make sense?

I trade better when I’m sleep-deprived, using bad Wi-Fi, having broker problems, and so on because it forces me to focus on only the best plays. There’s no time to screw around.

And I don’t pocket any of my profits. That helps me remove myself enough to trade smart.

My student Suzy did better than me on the same trade because she took time to study my framework and waited for the best time to strike.

She traded like a sniper.

My trading framework is the key to less stressful profits.

I’m not saying it makes trading easy. It’s still a pain in the butt. That’s why all my new students have to apply to study with me. I don’t have time to waste on lazy gamblers.

Think you have what it takes?

It’s a tough journey. But the most rewarding ones always are.

Comment below that you promise to focus on the best plays ONLY! No more screwing around. What’s your trading plan and how are you going to stick to it?

Leave a reply