Happy Thursday! Today is your last day of trading before the long weekend.

Reminder: On Friday, April 15, the U.S. stock markets are closed. It’s also the perfect time to reveal my big surprise. Stay tuned for more on that soon…

But first, when the market closes, top traders don’t stop working. I have 20+ millionaire students now, and they all found consistent success by making sacrifices and studying for countless hours.

But don’t worry — we took the long way so you don’t have to. Every time one of my students passes a big milestone, that means more content and strategies for traders like you to study. Learn from these students!

When I first started teaching over a decade ago, it was more difficult for newbies to follow along. I didn’t have as much content as I do now.

But since 2020 and 2021, more and more of my students are finding profits.

And I think it’s in large part because of the amazing community we’ve all built together. Traders who find success often stick around and pay it forward. They share the benefit of their knowledge with others.

So today I’m sharing my top students’ most helpful study tips.

Hint: You should pick at least one to do tomorrow.

And make sure you read to the end for my birthday surprise tomorrow. (No they’re not shutting the market down for my birthday — it’s just a coincidence).

Let’s get into it.

Table of Contents

Meet Just 3 of My Millionaire Students

Yep, you read correctly. I have 20+ millionaire students.

No, I won’t share tips from all of them today. But I will share tips from these top traders…

- Tim Grittani: To date, he’s profited more than $13.5 million in the past decade. He even took time off to spend with his family.

- Mariana Hincapie: My youngest millionaire student and the first woman in my Trading Challenge to make over $1 million.

- And last but not least, Matthew Monaco: I call him the Boy Wonder. He joined my Challenge in college and passed $1 million in profits not long after graduating.

They’ve all blazed unique trails to get where they are. Here’s their advice for up-and-coming traders…

Tim Grittani’s Tip for Day Traders

I want you to know two things about Grittani: He blew up his first account and spent nine months losing.

So don’t feel bad if you’re losing money while learning this process. All my millionaire students have been there. It’s part of the process.

Grittani didn’t let his failure rattle him. He started diligently tracking his trades until he found a strategy that worked for him.

Read about Grittani’s journey from insurance agent to millionaire trader here.

If you don’t have a trading journal, start one this holiday weekend. I keep a trading journal too! This video goes more in-depth on that…

How are you supposed to figure out what works if you don’t track everything? Use a notebook or spreadsheet and, at minimum, enter…

- Ticker

- Entry and exit price

- Catalyst

- Chart pattern

- Volume

And add anything else you want to track — time of day, your thesis, or your mindset.

Actually, my best advice would be to open an account with Profit.ly. I helped design this site so traders like me and my students can record trades.

Join us and become a fully-transparent trader today!

Mari’s Trading Advice

Pay attention: Shop around for your ideal pattern.

I interviewed Mari after she passed the $1 million milestone. We sat down in Italy and I asked her to share some tips for newbies.

I’ll share the video below, but I want to focus on one aspect in particular — trading patterns!

There are tons of different patterns out there.

Mari and I like panic dip buys the most, but other traders might argue that a simple ABCD pattern is best for new traders.

Everyone’s different, and that means everyone will feel comfortable with different strategies.

None of my millionaire students trade the same. For example, Tim Lento passed $1 million in profits in 2021 by mainly short selling.

Shorting stocks can be a profitable strategy, but I don’t do it much anymore. It’s too risky for me. And I don’t encourage new traders to short sell.

Lento spent time figuring out a strategy that works for him. And that’s what I want you to do.

Look around for different chart patterns. Go test them in the market. Find which ones are working right now and which ones work for you.

Here are 13 options to get you started.

More Breaking News

- BigBear.ai’s Journey in the Stock Market: Rising Trends and Challenges

- Top Bitcoin Stocks to Watch Under “Crypto Emperor Trump”

Words of Trading Wisdom From the Boy Wonder Matt Monaco

Matt’s one of the most versatile traders I know.

He profited over $1 million in the last two years trading penny stocks. And he’s found success trading altcoins and NFTs.

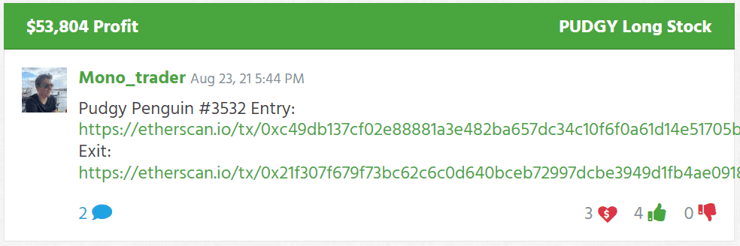

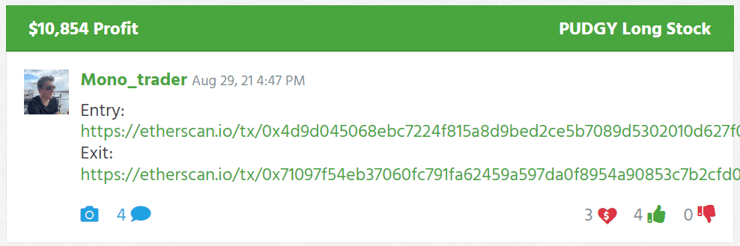

Look at these two Pudgy Penguin trades…

I didn’t see the NFT potential before, but I’m definitely looking into NFTs now…

Anyway, Matt’s most valuable advice for new traders is to rewatch live trading webinars.

Over my years as a teacher, I’ve held countless webinars while the market’s open. My students get to watch my screen and see trades in real time.

I don’t show my trades so that people can copy me. That’s not what this is about.

Matt can attest that watching a professional trade in real-time helps students learn the process more quickly.

I’m always inviting students to new webinars. But why not look through all the videos I already have archived.

My Big Birthday Surprise

Tomorrow may be my birthday — but I’m making it about you!

I can’t reveal all the details right now. My publisher doesn’t want me to give away these gifts tomorrow … but I’m doing it anyway.

It’s my birthday so I’ll do what I want. And with any hope, tomorrow will be the first day of your incredible trading journey.

Keep an eye on your inbox tomorrow. This is gonna get crazy.

What are some of your favorite study techniques? Which one will you put into practice tomorrow? Come on! Commit to your education, and comment below!

Leave a reply