If you’re an aspiring day trader, you need to learn how to spot support and resistance levels.

For both shorts and longs, support and resistance are day trading basics. Knowing how to determine them is fundamental to the trading patterns I use.

What’s so special about these levels? Traders can learn to use support and resistance levels to evaluate stocks based on past performance.

If you can’t identify an area of support, how do you decide on a risk level? And if you don’t pay attention to resistance, how do you know when to sell a stock that’s going up? It’s important to learn these things.

I say this all the time … Education should be a TOP priority for any trader. Studying hard and taking it one day at a time is the way to become self-sufficient in these crazy markets.

Table of Contents

What Are Support and Resistance?

This trading concept has been around for ages — long before I got started. Support and resistance are among the most important indicators to include in any trading plan … and you MUST learn to identify them.

If you’re not familiar with the terms, here’s a quick primer…

Think of support and resistance levels as areas where a stock needs time to decide its next move.

A support level is a price a stock tends to stay above. For example, say a stock’s falling. It finds new buyers once the selling pressure slows. When the buyers gain the upper hand, the bottom of the pullback is a support level.

A resistance level is basically the opposite. It’s a historically high level for a stock … a price that the stock had trouble breaking through in the past.

Why is this important? Regardless of trading style, traders can use support and resistance to help determine appropriate risk levels. Some penny stock patterns, like breakouts, revolve around watching for a stock to break support or resistance.

If you’re new to trading penny stocks, check out my FREE penny stock guide!

How to Determine Support

Being able to spot support levels can be helpful. But it’s not exactly easy.

You can’t buy just any bounce and hope the stock will find support there. The most reliable support levels are the unique ones. Be on the lookout for increased volume. More buyers can indicate more strength.

The S&P 500, aka the SPY, gave us a good example in March 2020. After the overall market had a big pullback, the index bounced back to around the $220 level. Notice the sharp increase in volume during this time.

If the stock market drops to that area again in the future, $220 could potentially act as support. If it breaks through the support level, traders will probably see it as weakness and sell, driving the price even lower.

It’s important to track support levels in multiple time frames. A stock’s history can show you some truly valuable information.

You can also look for an area where a price has defended multiple times. That’s what traders call a double or triple bottom. When a stock fails to break under a price several times, that can indicate it’s hit a strong support level.

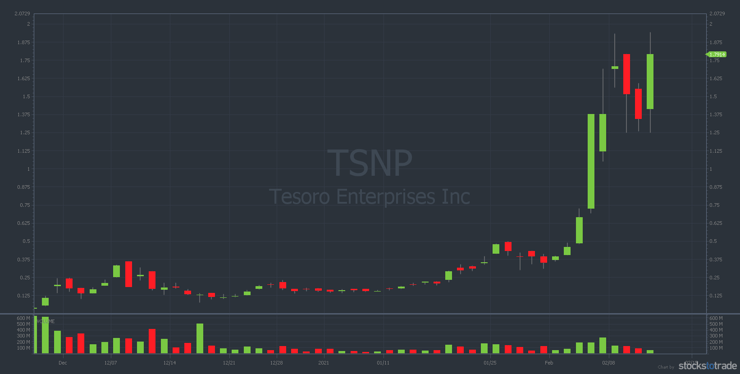

For example, look at Tesoro Enterprises Inc. (OTCPK: TSNP).

This stock was on fire in early 2021, running from under a penny to almost $2 in a matter of months.

Over the three days from February 9–11, TSNP formed a triple bottom at $1.25. Could that be in preparation for its next leg up?

Buying at Support Levels

Traders use support levels whether they’re going long or short. When going long, they try to buy in near a support level. Remember — always cut losses quickly if a stock loses support.

Traders buy in at support levels because they expect to see enough strength for the stock to bounce. It’s part of trading psychology.

Even after it’s clear a stock has found support, less-experienced traders might chase it even higher. This action can lead to big price bounces.

One of my favorite trading patterns is the panic dip buy — it involves buying into a support level as it’s forming. I try to get in as close to the bottom as possible … I don’t chase the stock if it’s already bounced a lot.

Here’s a chart of Enzolytics Inc. (OTCPK: ENZC).

You can see two major support levels where the price action turned from selling to buying. The stock panic-dropped to just under 7 cents, then bounced to a little over 8 cents.

Then it broke the previous support before dropping again. It went to 5.5 cents and bounced back up to almost 8 cents. Note the increased volume in both these areas. I’ve seen this pattern again and again. And as we see here, sometimes even twice in one day.

With every trading pattern, you MUST keep a tight risk level. Never go into a trade unprepared. Plan out every part of the trade ahead of time, and stick to it no matter what.

More Breaking News

- Price Predictions Fueled by Company Moves In Market Dynamics

- Skyward Surge: Momentus Inc. Soars and Faces Market Dynamics

- Prosperity of Tokyo’s Finance Hub: UOKA Shines

- SoFi Technologies Stock Surges: Q4 Wins Spark Analyst Upgrades

How to Identify Resistance

In a way, resistance is the opposite of support. But you need to know the ins and outs. Here’s an example…

Say a stock that’s running for several days finally reaches a parabolic stage with massive volume. Traders chase it at these high prices, hoping for an easy trade. But a parabolic move isn’t a good long opportunity — it’s bound to become overextended.

The stock pulls back, and the traders who chased it are stuck holding at high prices. Often, these traders will hold until they can break even or take a smaller loss.

The price range where the chasers are stuck could act as a future resistance level. This is a theme in the markets. Take notes and learn to be on the right side of the action.

Selling Near Resistance

In these wild times, it’s easy to forget what a regular market feels like. We’re seeing multi-day runners tear through resistance levels.

But when the market isn’t completely on fire, selling near resistance is the goal for many day traders. Because of the chasers, these levels can stop a stock from going higher.

Remember this strategy. We might stop seeing such crazy volatility, and resistance levels might again become a big hurdle for stocks. That’s something every trader has to consider.

It takes discipline to navigate a changing market. Get my “Volatility Survival Guide” now for no cost and start prepping!

Why I Buy Breakouts

Another trading pattern I have in my arsenal is a breakout. A stock breaks out when it passes a resistance level. Once that happens, there’s typically way less selling pressure. So the stock has room to make gains.

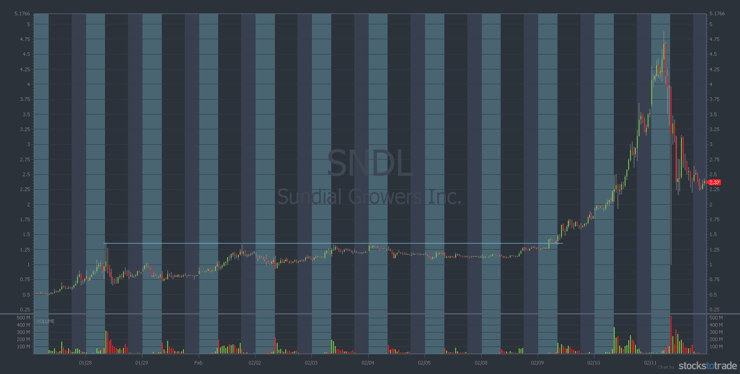

Here’s a recent example of a big breakout over massive resistance with Sundial Growers Inc. (NASDAQ: SNDL)…

On the morning of January 28, SNDL traded over 300 million shares in under a few hours. It topped out at $1.35, then pulled back over 50% to 66 cents.

At that point, it appeared the chasers were trapped. A lot of people were stuck holding the stock near those morning highs. For the next seven days, SNDL retested the $1.35 area several times and couldn’t break through. There was too much selling.

Finally, on the morning of February 9, it broke through the resistance level. This breakout led to the stock hitting almost $5 on February 11. It’s a great example of the potential behind this pattern.

You need experience and dedication to learn these patterns. If you’re ready, check out my 30-Day Bootcamp! It takes you from basics to patterns and beyond in just 30 days. Get it today!

Apply to My Trading Challenge

If you’re a dedicated student of the markets, check out my Trading Challenge. I started the Challenge so I could teach traders how I trade penny stocks. Including how to recognize patterns based on support and resistance.

If you think you’ve got what it takes, apply to join the Challenge. But I don’t accept everyone — only the hardest workers make the cut.

If you’re accepted, you’ll be a part of our Challenge chat room. It’s an opportunity to network with other hard-working traders. There’s so much you can learn!

You’ll also have instant access to TONS of learning material — video lessons, webinars, and more. Plus, I post all my trades, including my losses, on Profit.ly so you can study and learn from them.

I’ve been trading for 20 years and teaching for over 10. I’ve now had several six- and seven-figure students who became self-sufficient by using just a handful of trading patterns.*

If you have the dedication, the Challenge can help you develop an eye for patterns. Apply today and start your journey!

(*These results are not typical. Individual results will vary. Most traders lose money. These traders and I have the benefit of many years of hard work, experience, and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

The Bottom Line on Support and Resistance

Successful traders know how to recognize support and resistance levels. Those who fail to respect the fundamentals aren’t just using an incomplete trading plan … they’re also showing their arrogance.

Some of these concepts have been around longer than we have. They’re time-tested … so learn to ride the wave instead of going against it.

And remember, the markets constantly change. Right now, the abundance of runners is awesome! It can almost make support and resistance seem irrelevant. But that couldn’t be further from the truth.

If the market starts to slow, don’t get stuck chasing. Study the trading basics, like support and resistance, as much as possible.

Learn aggressively and trade wisely. You’ve got what it takes to become a self-sufficient trader.

How do you use support and resistance in your trading? Let me know in the comments!

Leave a reply