Back when I was learning how to trade penny stocks, I didn’t have a penny stock screener.

I was in high school, learning how to build my account. I skipped classes to hang out in the high school library. The computers there had the fastest internet connection around.

Ah … the good old days, right?

Wrong! It was hard work. Multiple computers with multiple browsers open to search finance message boards and stock quotes … looking up regulatory filings, earnings reports, and press releases on slow computers with slow internet…

I don’t begrudge the time I spent learning. Since then I’ve made over $7.6 million in trading profits. I learned tons, and I loved every minute of it.

But I don’t want to go back to that kind of research. I’ll take a stock screener any day of the week.

Read on to learn about what penny stock screeners do and don’t do, and how a screener can help you in your trading. I’ll also give you the pros and cons of some of the most popular screeners.

Let’s get into it…

Table of Contents

- 1 What Is a Penny Stock Screener?

- 2 8 Top Stock Screeners (Penny Stock Screener)

- 2.1 Penny Stock Screener #1. StocksToTrade

- 2.2 Penny Stock Screener #2. Finviz Stock Screener

- 2.3 Penny Stock Screener #3. Yahoo Stock Screener

- 2.4 Penny Stock Screener #4. Fidelity Stock Screener

- 2.5 Penny Stock Screener #5. CNBC Stock Screener

- 2.6 Penny Stock Screener #6. Zacks Stock Screener

- 2.7 Penny Stock Screener #7. Thinkorswim Stock Screener

- 2.8 Penny Stock Screener #8. MarketWatch Stock Screener

- 3 How to Take Advantage of a Stock Screener

- 4 Key Features From a Stock Screener Software

- 5 Penny Stock Screener Bonus Tip: 3 Penny Stocks to Watch

- 6 The Bottom Line on Penny Stock Screeners

- 7 Frequently Asked Questions About Penny Stock Screeners

What Is a Penny Stock Screener?

A stock screener is a tool that lets traders filter stocks based on specific criteria. If you don’t have a stock screener, how do you know which stocks to watch?

With a penny stock screener, you can zero in on the stocks that fit your account size and trading strategy. You can search stocks based on price, percent gain, volume, market cap, sector, and more. The choices are almost endless.

Without a stock screener, you could spend hours researching the hard way … like I used to. No one wants to do that anymore, and you don’t have to.

Stock screeners make a day trader’s life much simpler. You still have to put in the time, but you can set screens to create your watchlist.

When Should You Use a Penny Stock Screener?

Check your penny stock screener every day. Especially when you’re building your daily watchlists. How else will you sift through the thousands of stocks out there?

Need guidance? Sign up for my no-cost weekly watchlist and I’ll send you a list of hot stocks I’m watching every week.

Don’t sign up for my watchlist for stock picks, though! Use the watchlist I provide to learn the process, then make your own. I’ll explain more later about how to screen stocks for your watchlist.

Benefits of Trading With a Stock Screener Software

Here’s where technology gets awesome. If you use a top-quality trading platform — like StocksToTrade — it’ll have built-in stock screening software.

Why should you use a stock screener? For one thing, it can save you time. Especially if you trade penny stocks. Finding information on these stocks can be difficult. A stock screener can help.

8 Top Stock Screeners (Penny Stock Screener)

More Breaking News

- Coeur Mining’s Acquisition of New Gold Approved by British Columbia Court

- Vizsla Silver Corp US Market Rift: Challenging Times Ahead

- SunOpta’s Acquisition Boosts Stock by 32% Amid Key Industry Moves

- Goodyear Faces Challenges with Earnings Miss Amid Industry Turbulence

Penny Stock Screener #1. StocksToTrade

My go-to stock screener for day trading is StocksToTrade. I use it every day. And with brokerage integration, you can do everything with it. (These are my favorite brokers.)

(Full disclosure: I helped develop StocksToTrade and I’m a major investor. That said, it’s my dream stock-scanning tool. It’s designed to help save time in finding the best stocks that fit my patterns and strategy.)

StocksToTrade has built-in scans — the ones I’ve been using for the past two decades. I helped design this software because I was tired of having to log in to several sites and tools to get the information I needed.

Why go through all that trouble when you can click a few buttons and run a quick scan? And why jump around from your stock screener to your brokerage account if you can place your order on the same platform?

You can scan for earnings winners, big percent gainers, big dollar gainers, news, and Twitter mentions … Did you know Twitter is an awesome place to find out what other traders are watching?

Traders like me tweet about trades and stocks a lot. Short sellers tweet about stocks they’re shorting, which helps me prepare for potential short squeezes.

Even better is StocksToTrades’ Breaking News Chat. Two market pros sift through the news and alert subscribers to potential catalysts. This tool is a game-changer. It makes it even easier to find all the news in one place.

Penny Stock Screener #2. Finviz Stock Screener

The finviz stock screener is decent … But the information is delayed unless you pay for a premium service.

Even with the free service, you can use the stock screener to sift through stocks based on fundamentals or technicals. Or you can search for stocks using descriptive criteria like exchange, market cap, and float.

Penny Stock Screener #3. Yahoo Stock Screener

The Yahoo stock screener is another decent, free tool. If you want to see how it works, head on over to the Yahoo Finance website. You’ll find the stock screener in the headings on the homepage.

You can create your own custom screener or use some of their built-ins, like Day Gainers. If you click that, you should see a list of big percent gainers from the last trading day (or the current day if the session is open). From here, you can filter your results by clicking ‘Edit.’

Now, look at the top stock on the list. There are columns for price, price change, percent change, volume (keep this in mind), three-month average volume, and so on.

Penny Stock Screener #4. Fidelity Stock Screener

The Fidelity stock screener is only available to Fidelity clients. It includes built-in scans, or you can create a custom scan.

You can search for stocks by sector, market cap, and other criteria. You can get guest access, but you’ll have to create an account.

Penny Stock Screener #5. CNBC Stock Screener

The CNBC stock screener also lets you use built-in scans or create your own.

You don’t have to create an account to use the stock screener. Want a stock screener for day trading? The finviz stock screener and the Yahoo stock screener have more options to help you narrow your search.

Penny Stock Screener #6. Zacks Stock Screener

The Zacks stock screener is also free. But it doesn’t have as many choices as the finviz and Yahoo stock screeners.

The Fidelity, CNBC, and Zacks stock screeners are more geared toward investors looking for companies with solid fundamentals. I think StocksToTrade is a better choice for penny stock traders. That’s what it’s designed for.

Penny Stock Screener #7. Thinkorswim Stock Screener

The thinkorswim stock screener used to be for TD Ameritrade clients — now it’s exclusively for Schwab traders. It offers built-in and customizable scans. It’s a solid platform for users to find and analyze charts according to their style.

Before StocksToTrade, I used thinkorswim to help scan for stocks. It has a decent setup, but I like the advanced features of StocksToTrade.

Penny Stock Screener #8. MarketWatch Stock Screener

MarketWatch offers a stock screener on its website. You can search for stocks based on price, volume, fundamentals, technicals, exchange, and industry.

MarketWatch focuses a bit more on overall market news, not penny stocks.

How to Take Advantage of a Stock Screener

Once you have access to a screener, you need to learn how to use it. There’s so much to search for … but only a few things really matter in any given market. I’ll focus on those below.

Analyzing Price Performance With a Penny Stock Screener

One basic thing I look for in a stock is price performance. I don’t want to trade something that’s not on the move. If I buy a stock and the price action doesn’t match my thesis, I get out.

When in doubt, get out.

I also look for big percent gains and big dollar gains. Big percent gains are pretty easy to sort with almost any stock screener.

I like penny stocks because they tend to make huge percent gains in very short periods. Why trade stocks where a $1 move is only 2% when you can trade one where a $1 price difference can mean a 20%, or even a 100%, gain?

In this niche, you see big percent gains when low-priced stocks skyrocket.

You’ll see big dollar gains more often with higher-priced stocks. (For our purposes, I’m still talking about stocks under $10 per share.)

Maybe a $3 stock reports good earnings, is in a hot sector, and announces a deal with a big company all at the same time. The stock could shoot up to $10 or $15. That’s a big percent gain and big dollar gain at the same time.

Using a Stock Screener to Analyze Volume and Volatility

Volume and volatility go hand in hand. High-volume stocks are more volatile — especially in penny stock land.

That’s why I use a penny stock screener that scans for volume and volatility.

Even though volume and volatility are standard scans, not all stock screeners are good for penny stocks! Some stock screeners include over-the-counter bulletin board (OTCBB) or pink sheet stocks, but don’t have all the information you need to trade.

A good penny stock screener will also scan for things like price action, news, and Twitter chatter. (The one on StocksToTrade does all that and more!)

Whichever screener you use, make sure it’s easy to get volume and volatility numbers.

Technical and Fundamental Indicators

In stock research, you’ll hear a lot about technical and fundamental analysis. Which should you focus on?

As a penny stock trader, I’m not as interested in company fundamentals. I’m more focused on technical analysis — especially to determine entry and exit points and to see patterns.

Still, I want to know the basics. What does the company do? Are there rumors of upcoming product releases? Have they signed a deal with a big investor?

Remember, most of these companies will fail — you want to play a stock when it moves. But it’s a good idea to know something about the company.

Since most of my focus is on technical indicators, I use a technical stock screener to find stocks that meet my criteria.

I use the stock screener to find stocks to watch. Before a trade, I get enough information to form a thesis about the stock. I use my Sykes Sliding Scale for every trade. You can learn how to use it in my “Trader Checklist Part Deux” DVD.

And I always cut losses quickly!

Locate Low Float Stocks

What are low float stocks? They’re stocks with a small number of unrestricted shares available to trade. Strong catalysts in low float stocks can create big price swings as buyers and sellers compete for control.

It’s supply and demand. Say some tiny software company announces a big deal with Apple. That news catalyst creates demand, which drives the stock higher because there aren’t many shares available.

So you need to have a low float stock screener. Ideally, you’ll have a screener that screens for everything in one go. Like StocksToTrade.

Key Features From a Stock Screener Software

I’ve tried almost every stock screener and trading platform out there. Here’s a list of key features to look for in your penny stock screener.

Winning Strategy Scan

There isn’t a one-size-fits-all trading strategy. You need to find the one that works for you. Then look for a stock screener that allows you to create a winning strategy scan with the setups you like.

Percentage Gainers Screener

This screen shows you the stocks that are on the move. Most stock screeners have this built in. Remember, big percent gainers are just one thing you want to screen for.

You’re looking for stocks that match all of your criteria. You may want to filter for high volume and a strong catalyst.

New Daily High List

All the best stock analysis websites show intraday trading ranges. That’s the price range from the day’s low to the day’s high.

I look for new daily highs when I’m searching for stocks with breakout potential. If there’s a powerful catalyst and enough volume, the stock can keep running once it breaks out.

Dynamic Charts With News Indicators

Your stock screener should have dynamic charts that let you change time frames. You also want the ability to add technical indicators and to relate the news to the price action.

Watchlist Filtered News

This is huge for a penny stock trader. You want a news streamer filtered to stocks on your watchlist. Then you can get alerts for news that may trigger price action.

Ten years ago, you had to subscribe to several different sites — often paid sites — for this level of research. StocksToTrade gives you all of it in one place.

Penny Stock Screener Bonus Tip: 3 Penny Stocks to Watch

I’ll give you a few stocks to keep an eye on. None of these is meant to be a long-term investment or even a day trade. I want you to watch and study them to learn the patterns.

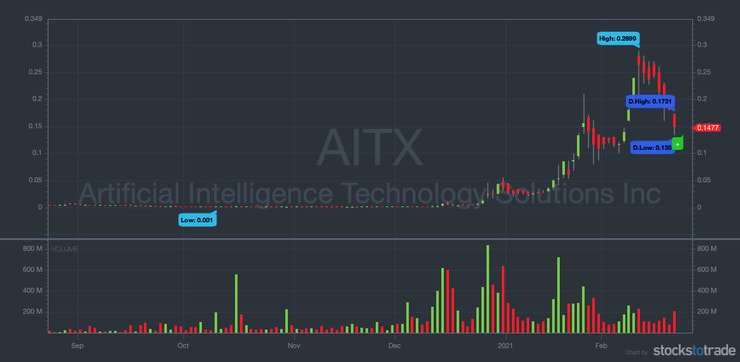

Artificial Intelligence Technology Solutions Inc. (OTCPK: AITX)

AITX delivers robotics and artificial intelligence-based hardware and software. I think artificial intelligence (AI) is an up-and-coming hot sector. And I’ve been watching this stock.

Check out the six-month chart…

AITX had some big spikes over the past few months. It’s faded a bit, but I wouldn’t be surprised to see it break out again. Keep an eye on this stock, and watch for my favorite patterns.

Never randomly buy and sell stocks. You need a plan.

Sundial Growers Inc. (NASDAQ: SNDL)

SNDL produces, distributes, and sells cannabis for medical and recreational use.

Take a look at the six-month chart…

SNDL had a huge spike with insane volume in mid-February. There’s been lots of chatter about cannabis being legalized. I don’t predict anything, but I like to be prepared.

Watch for a potential spike if there’s a big news catalyst.

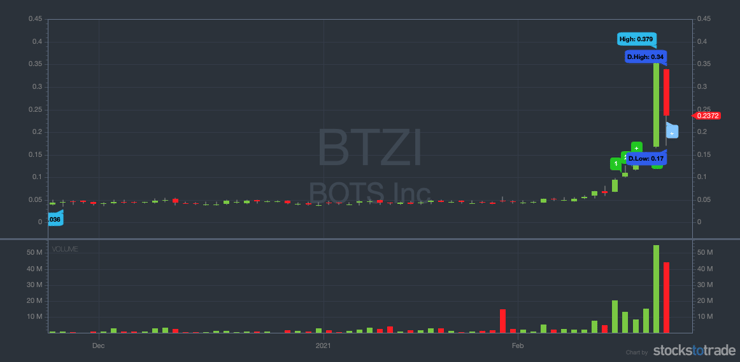

Bots Inc. (OTCPK: BTZI)

BTZI develops blockchain, cybersecurity, and robotics technology. It’s developing several projects focused on financial technologies, such as cryptocurrencies.

When bitcoin broke the $50,000 level, it brought tons of momentum sympathy plays like BTZI.

Here’s the three-month chart…

There’s been a price surge because of the hot crypto market. This year could be an even bigger year for the sector.

A word of caution: Penny stocks usually fall hard and fast. That’s why I take the meat of the move and get out. If a trade goes against you, don’t hold and hope. Just cut losses quickly!

The Bottom Line on Penny Stock Screeners

If you want to trade stocks, a stock screener is one of the most important tools you can have. It will help you find the stocks that match your specific criteria and trading strategy.

A good stock screener can save you hours of research. Hopefully, you now have a better idea of how to use one — and a clear understanding of why they’re not all created equal.

When you’re ready, get your hands on StocksToTrade. You can try it with a 14-day trial for just $7. Or get it with the Breaking News Chat add-on for $17. I think it’s the best stock screener available. In the meantime, keep studying.

Head over to Profit.ly and get one of my trading courses, or apply for my Trading Challenge. See you on the inside!

Do you use a stock screener to find trades? Share your thoughts in the comments!

Frequently Asked Questions About Penny Stock Screeners

I get a lot of questions about stock screeners. Let’s tackle some big ones.

Can I Use a Stock Screener to Trade Penny Stocks?

You don’t execute trades through a stock screener. You’ll still need a brokerage account. But you can integrate your broker with a platform like StocksToTrade.

Is It a Good Idea to Use a Stock Screener to Day Trade?

YES! A stock screener is a must-have for day trading. You need to know which stocks are moving. Don’t trade stocks with no volume or interest. Get yourself a stock screener, even if it’s a free one, to find trades that fit your strategy.

What Is Technical Stock Screening?

Technical stock screening is searching for stocks based on technical analysis or indicators. That could be a chart pattern that includes stocks making new 52-week highs, or those crossing a moving average. Big percent gains and gap-ups are also key technical indicators.

What Is the Best Penny Stock Screener?

To me, it’s hands-down StocksToTrade. It’s played a huge role in my trading success.* It specifically focuses on the penny stock market. I helped develop it for that purpose.

What Are the Best Free Stock Screeners?

Some of the top free stock screeners are finviz, Yahoo, and MarketWatch. They offer built-in scans that you can use to build a watchlist. But because they’re free, they might not have the latest information or the best functionality. If you’re serious about stock trading, consider paying for a stock screener.

Can You Become Rich by Trading Penny Stocks?

Yes. I’m living proof. Don’t get the wrong idea, though. It’s not easy to get rich trading penny stocks. It takes hours of studying and practice … Even then, there’s no guarantee. Remember, most traders lose. Never risk more than you’re willing to lose.

Leave a reply