You’ve probably heard the phrase, “don’t put all your eggs in one basket,” right?

It’s a phrase that’s rooted in risk management, which makes it perfect for the stock market.

That’s because stocks, being as volatile as they are, tend to move with their sector. Meaning that if you have 10 stocks, and they’re all technology stocks, you’re doing nothing to hedge that risk. They’re all in the same sector, and are subject to swings in market conditions.

Just like you shouldn’t put all your eggs in one basket, nor should you put all your stocks in one sector — the key is to diversify your portfolio.

Here’s what a portfolio is, and how to build a well-balanced one that can help you diversify your risk profile and potentially reduce your vulnerability.

Table of Contents

- 1 What is a Stock Portfolio?

- 2 Online Stock Portfolio Example

- 3 Key Tips For a Successful Portfolio

- 4 The Bottom Line

What is a Stock Portfolio?

Quite simply, a stock portfolio is a collection of stocks held by institutions or individuals. The stocks held within your portfolio are referred to as positions.

A portfolio can have any number of positions in it. You could have 10 stocks, spread across sectors. Or the portfolio could contain other asset types, such as mutual funds and ETFs.

Who Needs a Stock Market Portfolio?

If you’re interested in investing and trading stocks, then you’ll need to have a stock market portfolio.

And don’t worry, you don’t have to do anything to create your portfolio. The stocks you trade through your broker make up your stock portfolio.

If you buy a stock, it’s added to your portfolio. When you close out of the stock, it’s gone from your portfolio and now considered a “closed position.”

Importance of Building a Balanced Portfolio

A balanced portfolio is also known as diversification, because you’re diversifying your investments.

Diversification is very important because you don’t want the bulk of your investment tied into one stock or sector!

Can you imagine if a fund manager only had one stock in his portfolio? He’d be fired for being so careless with money, and he’d likely underperform the S&P 500, which is considered the benchmark.

How To Balance a Stock Portfolio

To keep a balanced portfolio, you’ll need to place your investments across a variety of stocks and sectors.

If you’re day trading, this requires focus and active daily management of your portfolio.

Your goal is to get in and out of stocks to reduce your exposure to volatile stocks. If a stock isn’t moving your way, then you need to quickly get out of the position.

A balanced portfolio isn’t a “set and forget it” strategy. As a trader and investor, you MUST look at what the market is doing every day. That’s why you often need to “rebalance” your stock portfolio.

This means that you’re reducing exposure to stocks and sectors that are underperforming, and increasing exposure to stocks that are outperforming the broader market.

Got it? Good. Now let’s take a look at the different kinds of stocks you can have in your stock portfolio.

More Breaking News

- Riot Platforms Inc. Stock: A Rollercoaster with Cryptocurrency’s Wild Swings

- Quantum Buzz: D-Wave’s Extraordinary Leap in Fiscal Bookings – Is it the Start of a Transformational Era?

- Archer Aviation’s Unexpected Surge: What’s Fueling the Takeoff?

What Are The Best Stocks To Have in Your Portfolio?

If you’re looking to buy stocks and have a relatively passive management strategy, look for large-cap stocks with high floats (typically at least 5 billion shares).

This means that you’re buying shares of big companies that don’t have volatile prices — which means you won’t have to check the stock price movement every day.

As a bonus, most of these companies have healthy cash flow, which they return to shareholders in the form of dividends. So you can earn money in two ways with these stocks: dividends and share price growth.

If you’re an active trader, you might look at hundreds of stocks every day. You find stocks via StocksToTrade, my Watchlist, and scanning through news feeds for potential catalysts.

For active traders, stocks aren’t held for more than a few days. Some traders execute 100 or more trades per day! The best stocks for these traders change on a minute-by-minute and hour-by-hour basis.

However, some of these traders still maintain “long-term holds” in which they buy a stock and plan to hold it for years.

Volatile and Low Priced Stocks

Many low-priced stocks, AKA penny stocks, are cheaper than $5/share. They’re very volatile and subject to wild swings in price.

That volatility is great — if you can profit from it. It’s bad in other cases if you’re not an experienced trader and aren’t skilled in risk management. (I can teach you these skills, by the way).

These stocks aren’t good for long-term holds, because the underlying companies are junk (but you can potentially use that to your advantage).

The companies don’t have much cash on hand, have drastically declining sales, and some don’t even have any revenue.

When companies don’t have a lot of cash, they’ll raise money via the market. That dilutes everyone’s shares and drops the share price.

It’s for this reason that penny stock traders only hold their shares for the day. Some brave ones may hold them overnight for a swing trade.

Add to Your Investments on a Regular Basis

If you’re holding your stocks over the long term, you’ll need to review them a few times a year.

That’s your “check in time” to see what the price has done, and search for new opportunities.

If you’ve gained a large amount on an investment, you may want to start “trimming” that position and using the proceeds from that investment into a new stock.

For example, if you’re up 50% on a trade, you may want to sell about 35% of your position. Take those profits and put them in a new position.

Don’t get greedy and never assume that the stock price will always go up! As we know, this is never the case. Any number of things can send a stock moving down, and stock prices often go down much faster than they went up.

When you add an investment, make sure you aren’t adding to something you’re already heavily weighted toward. For instance, if you have 10 stock investments, and 7 of them are in the health care sector, do you really want to add another health care stock?

Probably not. So look for some other sectors that you think will perform well in the future, and then find stocks or ETFs to add.

Think of ETFs as being a group of stocks all placed into one fund. And you can buy that fund which has that group of stocks. These ETFs are less volatile, which can make them great for beginner traders that can become scared off by rapid (and sometimes extreme) price movements. I cover more on ETFs and stock sectors in this post.

Know When to Get Out

A lot of new traders lose money because they don’t cut their losses quickly. To avoid losing big money on a trade, new traders must learn the importance of knowing when to get out of a trade.

When you buy a stock, you’re actually making two trades. This is because you’re buying and determining where you’ll sell.

The takeaway here is that before you get into the trade, know where you’re getting out if the stock price moves against you.

This is all about pre-determining your risk and knowing your risk/reward ratio. Here’s an example:

Let’s say you’re looking at a stock that’s priced at $42/share. It has support at $40/share. You’re long biased, so you believe the stock will jump to $45/share, where the resistance is.

When you enter this trade, your risk/reward ratio is 2:3. You’re risking $2/share to make $3/share. You’ll set your stop loss at $40 and start scaling out when the price reaches $45.

Some traders keep much tighter stops. (Meaning their stop loss will be less than 1% under their entry).

It all depends on your risk tolerance and what each trade setup is. As a general rule of thumb, never lose more than 5% on a trade. Keep your losses small and manage your winning trades appropriately.

Don’t let a winning trade turn into a losing one! If you’re up a few percent, you can set a trailing stop to protect your gain. This means that if the stock starts moving against you, the trailing stop will start selling at your specified point.

Keep a Watchful Eye on Commissions

As a trader, the biggest cost you’ll have are commissions. Most brokers charge about $5 per trade. If you’re making 10 trades per day, that’s $50 in costs per day. That adds up to $1,000 per month in commissions.

Don’t be blind to your commission costs! It will add up quickly if you’re not paying attention. Check about once per week to see the commissions that have gone to your broker.

To learn more about brokers, commissions, etc., check out this video I made…

TIMalerts

My TIMalerts help you save time and headaches by alerting you to penny stock trades that are ready to make huge moves. You receive my alerts via text, email, and push notifications.

With TIMalerts, you also get my daily watchlist to give you a head start on the trading day. You’ll see the great technical setups and get your chance to get in on a stock before it jumps.

Online Stock Portfolio Example

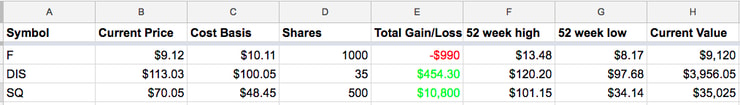

Your stock portfolio will have the following information:

- Company name and symbol

- Current price of the stocks you own

- How many shares you own

- Your cost basis

- Total gain/loss

- Total value

- 52-week high/low

- How much cash you have

Here’s an example of a stock portfolio (in spreadsheet format):

You can see stocks owned, current price, at what price they were bought, number of shares purchased, returns, the highs and lows of the year, and the current value of the investment.

How To Manage Stock Portfolio in Excel

The Excel program has a lot of great features to help you manage your investments.

As you can see in the screenshot above, you can use Excel to track your entry, the amount of shares you bought, your gain and loss, the current investment total, the high and low prices of the year, and anything else you’d find pertinent.

You can also use the graphing feature to plot your investments and see your entries and exits on trades.

The pie charts are useful for seeing where most of your capital is allocated (and I hope it’s balanced) across sectors. I recommend using bar charts to see how much of your cash is being invested, and how much is “on the sidelines,” not tied to any investment.

Other Stock Portfolio Management Tools

In addition to Excel, there are also some portfolio management tools you can use. Here are three of them:

The first is Personal Capital. With this tool, you connect your external financial accounts to Personal Capital. Once everything is connected, Personal Capital will track all your investments and how they’re performing against some of the benchmarks. They also have mobile apps so you can track in on the go.

The second is Morningstar. Similar to Personal Capital, Morningstar allows you to track your fees and performance. The drawback is that you cannot link to your bank and other investment accounts. You’ll have to manually enter the information yourself. But hey, maybe it’s better not to have an outside company have access to your bank account.

Finally we have SigFig, which has a free portfolio tracker. Like Personal Capital, you’ll connect SigFig to your broker and get all your investment data imported. In addition to stocks, you’ll also be able to track your 401(k) and IRAs. You’ll get weekly email summaries of your portfolio performance and news on your investments. Sigfig also analyzes your stock portfolio for hidden fees and overexposure to certain stock and industries. That makes it a good fit if you’re having trouble maintaining a balanced portfolio.

Key Tips For a Successful Portfolio

When setting up your stock portfolio and managing it correctly, it’s important to keep these tips in mind:

Never Trade Too Big

When you start trading, keep your position sizes low! This is because you’re still learning the ropes of trading and need to find a trading system that works for you.

When you first start out, don’t risk too much of your account on one trade — keep it under 2% of your total account value. If you have $20,000 in your account, your first trade should be worth about $400 or less. When you start trading a lot, you can refine your strategies and potentially increase your odds of succeeding in each trade.

Once you start having a consistent win rate (at least 60%) on trades, if you’re ready, you can increase your position sizes. But keep them balanced with your other stocks.

You don’t want to have 85% of your total account value in one stock. That’s a recipe for disaster.

The key takeaway here: Maintain relatively equal position sizes in your stocks.

Avoid Leverage

I don’t like leverage trading. With leverage, your broker gives you money to use for trading.

This sounds great, doesn’t it? After all, who doesn’t love free money?

But this can often lead to big mistakes for new traders.

For example, their broker gives them $20,000, and the new trader puts all that capital into a stock. Then the stock drops 20%, the trader doesn’t cut their losses until it’s too late, and now they owe their broker money — a lot of it.

Suddenly their joy of being able to take on bigger positions turns into dread, especially if you don’t have the money to pay your broker back for the money they gave you.

Remember when I talked about having a balanced portfolio? Reduce risk by holding multiple positions. Keep your position sizes small by only investing with cash, not margin.

Keep Learning

Great traders never stop learning. They’re constantly looking to refine their strategies to gain their edge in the market.

Traders are reading books, watching YouTube tutorials, and learning from other traders.

Every trader has a weakness … whether its holding onto losers too long, getting too emotional when trading, running an unbalanced portfolio, not timing entries or exits properly … the list goes on.

That’s why it’s so important to study and keep learning. A super-engaging way to keep learning is with my Trading Challenge.

Trading Challenge

I created the Trading Challenge to provide a valuable resource for traders. With my Challenge, you’ll get access to my webinars, videos, writings, and chatroom. It’s great for those enthusiastic traders who are willing to put the time into studying and improving their craft. You get a lot of great resources, all in one place.

I don’t make the trades for you. The people telling you what to buy are scammers! That’s not what I do.

If all I did were tell you what to buy, you’d never learn how to trade on your own. You’d always be relying on me, which isn’t the path to self-sufficiency. I want to create great traders that don’t need a scammy guru telling them what to buy.

The Bottom Line

How should you maintain your portfolio? Keep it balanced.

Stocks and the sectors they’re in are volatile and can decline quickly. Like, a 10% drop in a few minutes, quick.

If you have too much money in one stock or a particular sector, you’ll tip the scales and could end up losing a significant amount of your investment — and believe me, it’s not fun.

A good way to help protect yourself against this is to have a balanced stock portfolio, with an equal amount of cash in stocks and sectors. That way you can take full advantage of seasonal stocks and the price movements in sectors.

How do you balance your stock portfolio? Let me know in the comments!

Leave a reply