Stock Market Crashes: Key Takeaways

- Many market bubbles have turned into widespread crashes — study the past!

- Are we in a stock market bubble? Learn the signs now.

- Penny stock supernovas are like mini stock market bubbles — check out these charts…

Here’s how you can prep for a market crash with me — and claim a free gift!

I’m getting a lot of questions like — are we in a stock market bubble? Will the stock market crash? And will a crash cause the next Great Depression?

I don’t play guessing games. But I can prepare.

Learn what creates market bubbles and crashes what they mean for you NOW!

Table of Contents

- 1 What Does a Bubble Mean in the Stock Market?

- 2 When Was the Last Stock Market Crash?

- 3 What Causes a Stock Market Crash or Correction?

- 4 What Are the Consequences of a Stock Market Bubble?

- 5 Stock Market Bubble 2022: Will the Stock Market Crash?

- 6 Learn From Stock Market Bubbles and Crashes in History

- 7 Frequently Asked Questions About Stock Market Bubbles

- 8 What Goes Up When the Stock Market Crashes?

- 9 What Happens When a Stock Price Goes to Zero?

- 10 When Will the Next Stock Market Bubble Burst?

- 11 Bottom Line: Can You Benefit From a Market Crash?

What Does a Bubble Mean in the Stock Market?

The market’s driven by supply and demand. Demand for assets drives prices higher, and more supply means lower prices.

When overexuberant and speculative buyers create a massive wave of demand, prices can soar.

That creates a stock market bubble.

In a bubble, investors don’t buy stocks based on income, earnings, or growth — they buy on speculation that future prices will increase.

And it often means traders or investors overpay for assets.

When Was the Last Stock Market Crash?

The most recent market crash was in March 2020. COVID-19 shut down many parts of the world. Uncertainty spooked investors, creating a mass sell-off.

But the markets quickly recovered. Many new traders and investors saw the crash as an opportunity to enter the market at discount prices…

And many people were at home due to lockdowns with plenty of time on their hands, plus extra cash thanks to government-issued stimulus checks.

Combine that with new trading apps like Robinhood and multiple major brokerages going commission-free, and you have a lot of new buyers.

Free trading apps make trading and investing like a game. And people can do it right on their smartphones

Some brokers even offer fractional shares — which allows even more buyers into the market with less money. In 2020, the wave of new buyers led to all the major indexes hitting new all-time highs. The volume and volatility were great for prepared traders.

But the markets can’t go up forever…

What Causes a Stock Market Crash or Correction?

Once buyers bid prices up high enough, fewer buyers are willing to pay those prices.

Without buyers, assets crash.

And once investors start to take profits, declining prices can trigger margin calls and forced selling. Sometimes a black swan event can cause a market crash — like the one that caused the 2020 crash.

There’s a psychological reason for market bubbles and crashes. Never underestimate the power of…

Herd Mentality

A stock market bubble is like a penny stock supernova. Buyers believe the hype. They follow ‘guru’ trades and tips on buying stocks instead of trading patterns and using a rule-based strategy.

Continued market highs can give traders a sense of euphoria and FOMO. So they keep buying, believing there’s no better time than now to buy.

Herd mentality can also create crashes. Once prices decline, mass panic can set in and sellers start chasing lows to get out.

Don’t know about penny stock supernovas? Get my “Penny Stocking Framework Part Deux” DVD.

What Are the Consequences of a Stock Market Bubble?

Stock market bubbles eventually pop — and they can have devastating consequences…

Steep Drop in Prices and Major Losses

A stock market crash leaves many investors with losses. Sadly, it’s usually the least-educated investors who buy at the top that end up with the biggest losses.

Most people who bought late won’t sell when the market starts to correct. They wait until the market tanks further. That only adds more fuel to the sell-off.

It’s why I prefer to trade instead of invest. I never recommend anyone hold and hope. My rule #1 is to cut losses quickly. If you follow trading rules, it can help protect you from huge losses.

I trade safely and expect the worst from every stock and every company.

Learn more about trading with my FREE penny stock guide here.

More Breaking News

- Top Bitcoin Stocks to Watch Under “Crypto Emperor Trump”

- BigBear.ai’s Journey in the Stock Market: Rising Trends and Challenges

Market Crashes Can Cause a Recession or Depression

The biggest stock market crashes in history led to a recession or depression.

It happens when the poor monetary policy that started the bubble dries up. Or when people lose their life savings, which can lead to them losing their homes or other assets.

Market crashes can affect more than just stock prices.

The losses can ripple through the economy and affect consumer confidence and jobs. Sometimes a full economic recovery can take years or even decades.

Stock Market Bubble 2022: Will the Stock Market Crash?

There’s a lot of talk about a market crash right now. There are so many overextended markets — housing, oil, the stock market.

Cryptocurrencies had a massive run too, followed by a big crash.

Does that mean the stock market will crash in 2022?

I don’t play guessing games. But I’ve seen overextended markets, hype, and exuberance before. And stock market bubble indicators from the past can give you an idea of the future.

Here are some examples…

Stock Market Bubble Indicators

One stock market bubble indicator is an increase in initial public offerings (IPOs). Companies want to take advantage of the market highs and exposure to investors at inflated prices.

Some of these companies may even be scams and not live up to the hype they play up to enter the market.

High speculation can be another indicator. Investors enter the market speculating that economic or technological changes can increase a stock’s value in the future. Speculators think they’re getting in early…

It’s reminiscent of a penny stock pump. Penny stock ‘investors’ think they’re buying the next Microsoft or Pfizer.

Look at these examples of penny stock supernovas. They’re like a stock market bubble on a smaller scale.

HUMBL, Inc. (OTCPK: HMBL)

HMBL rode a huge wave of hype in 2020 and 2021. Before it changed its ticker to HMBL, it traded under the ticker TNSP. It went supernova more than once. I made over $130,000 in profits on my TSNP trades. See my HMBL trades here.

Here’s what a bubble and crash look like:

Notice what happens when the hype and exuberance fade? The stock goes back where it started, volume fades, and nobody cares.

OTCs aren’t the only stocks that can go full supernova. Listed stocks can run on hype too. Check out this huge spiker…

Digital World Acquisition Corp. (DWAC)

DWAC was a massive supernova. It’s a SPAC linked to former President Donald Trump. And once news spread that he was bringing a social media company public through a merger, the stock soared.

The next day more buyers came in and pushed it even higher. In two days the stock went from roughly $13 to $175. Investors thought they were buying the next Twitter.

But once all the buyers were in, they wanted to take profits. And short sellers started pressuring it.

This is what mass hysteria looks like. Check out this chart:

If a stock’s up 10–20 times in a short time, it’s likely a bubble. It’s great to take advantage of these moves on the way up. But don’t hold and hope when a trade goes against you.

If you’re missing out on supernovas like these, apply to join my Trading Challenge today. My students and I take advantage of moves like this on the way up and the way down.

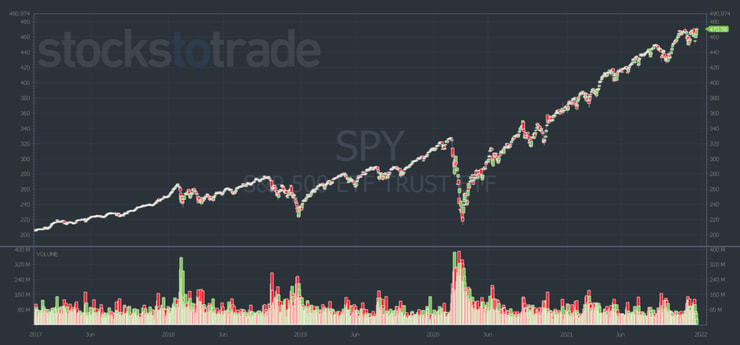

Now compare those charts to the SPDR S&P 500 ETF Trust (SPY) five-year chart. Since March 2020, it’s climbed higher and faster than prior years:

Are We in a Stock Market Bubble?

When you’re in a stock market bubble, the whole country gets involved. It’s mass hysteria.

Charles Mackay touches on market hysteria in his book “Extraordinary Popular Delusions and the Madness of Crowds.” (As an Amazon Associate, we earn from qualifying purchases.)

So are we in a market bubble now?

I’ve seen a lot of market bubble indicators over the last two years. Have we reached mass hysteria? I don’t know. Stocks can always go higher than you think.

But I’m looking for any signs of topping — failed breakouts, support levels breaking, and lower highs.

If you haven’t seen market bubbles or penny stock supernovas, you haven’t studied. There are plenty of past examples you can learn from…

Learn From Stock Market Bubbles and Crashes in History

History doesn’t repeat exactly, but it does rhyme. And there are plenty of big stock market bubbles from history you can study…

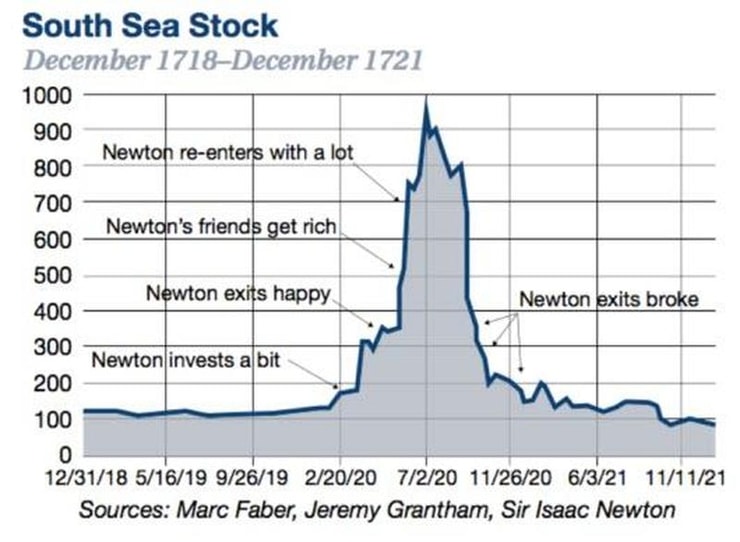

During the South Sea stock bubble, people used to crash their horse carts in front of the guy in charge of the stock. Then they’d fake injuries to try to get some stock out of him.

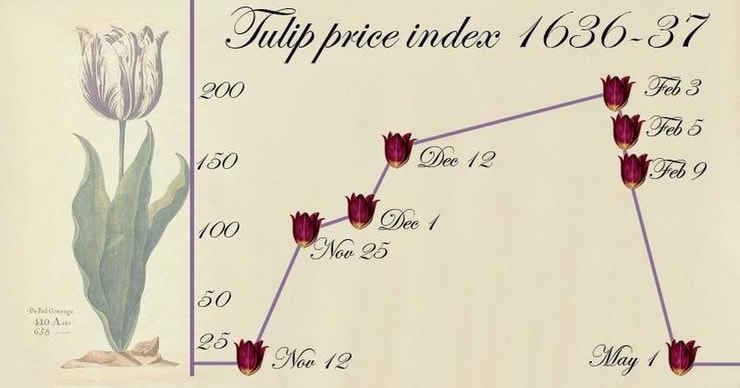

In the big tulip bulb bubble in the 1600s, tulip bulb prices were bid up by speculation and hype. Some became worth as much as a large home. But after three years they were only worth the value of the flower.

This is why education, discipline, and patience matter when you trade. You need to resist chasing stocks and hype. Think you missed an opportunity? Use that to learn and study so you can catch the next one.

Frequently Asked Questions About Stock Market Bubbles

Let’s go over some frequently asked questions about stock market bubbles and how to trade them…

What Goes Up When the Stock Market Crashes?

When the markets go down, investors usually look for somewhere “safe” to put their capital, like gold and U.S. Treasury bonds. Stocks of companies that make consumer staples can even go up as markets crash. People still need essentials to live, even during a crash.

What Happens When a Stock Price Goes to Zero?

Usually, before a stock reaches zero, it’s delisted from major exchanges and trades on the OTC markets. It might find interested investors there. But when a stock price goes to zero it’s worthless and there’s little chance of the company surviving.

When Will the Next Stock Market Bubble Burst?

Nobody can predict the future. I prefer to react to the market. We don’t know when it will end, but we do know the markets can’t go straight up forever. Study the past and be ready to react when the time is right.

Bottom Line: Can You Benefit From a Market Crash?

The markets constantly change. There are bear markets, bull markets, corrections, and market bubbles. You have to adapt to learn to trade through it all.

I don’t invest and hold long term. But I still watch the major markets, because three out of four stocks follow the market. Preparation is key so you can be ready to take advantage of any trading opportunity.

It might mean you have to switch up your strategies. I’m considering short selling if the market crashes in 2022. I opened a new account to prepare. Get bonuses when you open an account here.

For the ultimate trading education — apply for my Trading Challenge. It doesn’t matter if the market’s making new highs or crashing. We find the best penny stocks to trade and take advantage of repeating patterns.

Will we see the market crash in 2022? Let me know what you think in a comment below!

Leave a reply