Nothing makes me happier than watching my students succeed.

Mark Croock joined my trading challenge all the way back in 2010.

His hard work paid off when almost 8 years later, he hit the $1 million milestone.

So, I wasn’t too surprised when he smashed that record and earned $1.22 million in 2020!

Mark’s trading style is his own.

He trades a broader range of assets, from penny stocks to options.

So, believe me when I say he can teach you a thing or two.

That’s why one of his recent trades caught my attention.

Check out Mark’s Evolved Trader

As I stared at the chart, I realized that Mark discovered a new pattern that combined the lessons I taught with his unique perspective.

That’s why I wanted to review this trade because it works perfectly with my 7-step penny stock framework. And anyone can apply it to create a low-risk setup.

The 7-Step Framework

Stocks create recognizable, repeatable patterns that happen over and over.

Sometimes they last for days. Sometimes they happen in a matter of hours.

Yet, they all follow the same basic framework.

You’ve probably intuitively noticed this price action before.

A stock goes parabolic and then collapses shortly thereafter.

We’ve seen it in everything from biotech trash to BItcoin.

Mark knew it would happen in Liquidia Corporation (NASDAQ: LQDA), he just didn’t know when.

Like any good trader, he kept the stock on his watchlist to see what would happen.

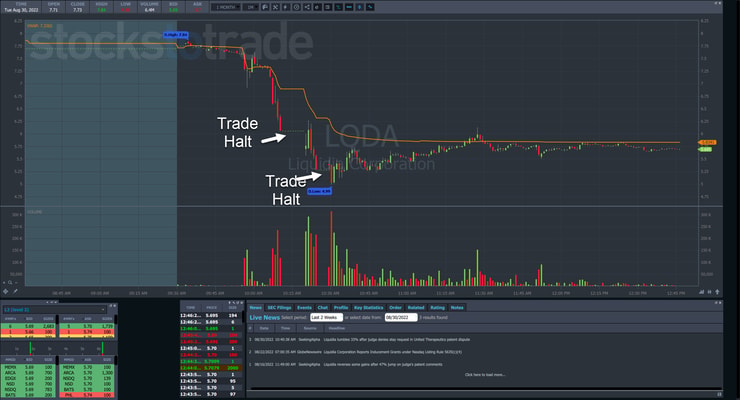

You’ll notice the stock didn’t collapse immediately after its run.

Shares actually traded sideways in a bullish formation.

Yet, on Tuesday, things changed.

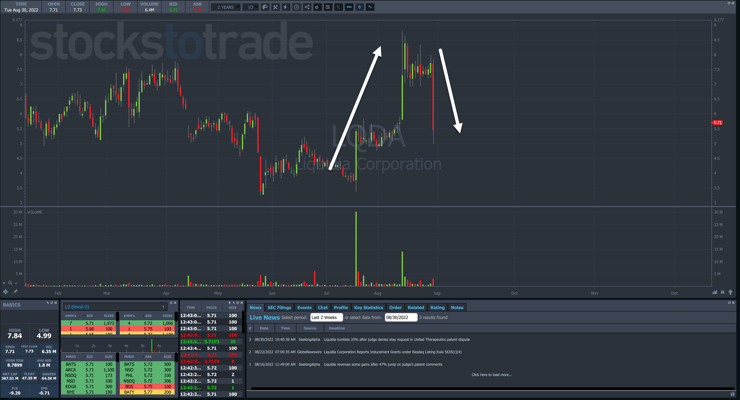

In the chart below, you’ll see how things started off quietly enough.

As the morning progressed, selling pressure increased, eventually leading to two limit down trading halts.

That kind of downward pressure creates a phenomenon known as capitulation.

Essentially, all the sellers are exhausted and a bottom is formed.

Knowing this, Mark was looking for a panic dip buy on the stock.

However, he didn’t want to jump in without some confidence the stock had found a low.

So, he waited for roughly 30 minutes and watched as the stock began to create a stair step of one bullish pattern after another.

You probably recognize this as a bullish consolidation.

It appears on charts of all varieties and timeframes.

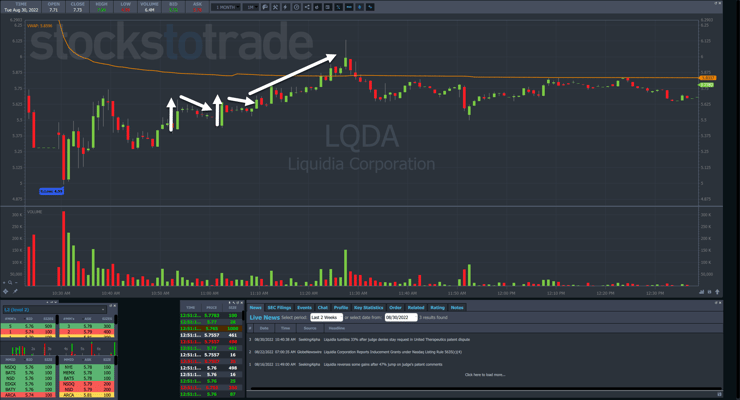

Using the first pullback pattern, Mark took his initial position around $5.50.

The cool part about these patterns is you can use the bottom of the large green candlesticks as your stop, usually on a candle close below the low.

That keeps your risk small while maximizing the upside potential.

In fact, Mark used the second pattern formed to add to his position.

Finally, he rode the bullish float until shares put in a reversal candle near his $6.00 target.

When I step into panic dip buys, I typically look for high-volume reversal candles or a wall of buyers on level 2 data.

Mark’s method took what I did and added his own flavor.

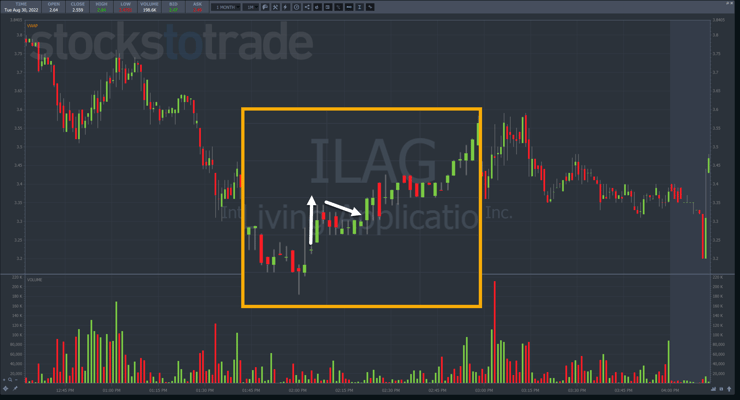

If we go back in time a few weeks, you’ll see the same pattern in the chart for Intelligent Living Application Group Inc. (NASDAQ: ILAG).

Shares soared out of the gate on August 15th. They made a high just shy of $4.40 before collapsing back down to $3.25.

That low didn’t have a lot of volume associated with it.

Yet, you could’ve used Mark’s pattern here to take a low-risk entry around $3.30 and play for a nice bounce into the close.

Final Thoughts

Most of my students have different ways of trading the market.

We learn from each other and grow as traders.

That’s why I encourage you to join my millionaire challenge and begin your unique journey.

–Tim

Leave a reply