Ready to adapt to the markets? Here are two solid trading patterns you need to learn.

I love the volatility we’re seeing in the market lately. There are lessons just about everywhere…

We’ve recently seen tons of runners. And we’ll likely only see more as 2019 comes to a close.

To help you prepare for the year’s end, I’ll show you two ways I made 10% on my positions last week using two different trading patterns.

Table of Contents

Why You Need to Learn to Take Singles

I tell my students all the time to take singles … and more singles…

… and more singles. Forget swinging for home runs. That’s a losing mindset and can cause you to trade too much and stay in losing trades for way too long. The home-run mindset doesn’t work.

My top students don’t enter trades with a home-run mentality. None of them made a successful trading career on one trade. As I explained in a recent blog post, it takes thousands of singles to become a six- or seven-figure student.

(Pro-tip: read the full post: Trading Challenge Success Stories: Lessons From My Top Students)

My top students only average between $500–$2,000 per trade. But they find a process that they can repeat. They learn to take singles and find consistency over time. They find trading patterns that work for them.

Etch this into your brain…

The Home Run Mindset Isn’t Sustainable

Even if you get lucky and make a huge profit on one trade, you probably don’t have the skills to keep the profits. I’ve seen countless traders make one or two large trades, then watch them lose it all. Why? They lack a proper trading education and don’t enter trades to take a single.

If you look at my trades, you’ll notice two things immediately. I cut losses quickly, and I take singles. My gains aren’t huge, but I always make sure my losses are smaller than my gains. More newbie traders need to learn proper risk management. But too many of them listen to sketchy short-sellers who have zero risk management.

Every day last week, I got 60–70 emails from people who lost half or all of their money short selling. OTC without any problems. They’re pretty good about borrowing shares for Short selling is extremely risky … so let me educate you on an alternative. Learn solid trading patterns.

Last week I took two excellent singles on Proteostasis Therapeutics, Inc. (NASDAQ: PTI) and DarioHealth Corp. (NASDAQ: DRIO). Both these trades were longs, and I used proper risk management on both.

Let’s break these trades down…

Two Solid Trading Patterns to Learn Now

Remember as you study these two trading patterns that part of being a successful trader is…

… adapting to the current market landscape. The more you study what’s working now, the better prepared you’ll be in the future.

Trading Pattern #1: Dip Buy

I usually don’t trade premarket, but DRIO published an excellent press release early in the morning on December 3. The news that Walmart would start carrying its products was a great catalyst. After seeing the high volume premarket, I decided DRIO was worth the risk.

DRIO spiked from the $5s to the $11s in the first few minutes after the news release. When I’m looking for a dip buy, I’m not interested in the first spike. I don’t want to chase and end up with a huge loss. So I waited for the stock to pull back off its highs and started to form my trading plan.

The DRIO press release discussed its cool technology, but so far, it hasn’t really taken off. I thought the Walmart deal could help with some publicity. Any time a penny stock mentions a large, reputable company in a press release, I pay attention.

That said, DRIO has a terrible long-term chart. But — as I’ve said a lot lately — a lot of these bad long-term charts and fundamentally flawed companies make for the best spikers.

DRIO and Over-Aggressive Short-Sellers

Right now, we have so many moronic, newbie, idiotic, unprepared short-sellers. I say that so you can understand the landscape right now. There are a lot of short-sellers.

And a lot of them think, “options. For trading purposes, especially Short selling penny stocks just makes so much sense!”

They point to the nasty long-term chart, terrible fundamentals, and that most of these companies probably need an offering.

DRIO did have warrants … that was a small concern. But I was confident that the over-aggressive short-sellers would give this a nice bounce if not a full-on short squeeze.

In case you ever wonder how many shorts are in stock, there’s no specific data. The data on websites is old and inaccurate.

But you can usually tell by looking at social media. That’s a great reason to use the social media tool on StockstoTrade. It’s kinda like how you know someone’s a vegan — they just tell you, even if you don’t ask. How do you know if someone’s a short-seller? They tell you. They tell anyone and everyone who’ll listen.

So … when a fundamentally flawed company with warrants starts spiking big, ALL the little noble short sellers get riled up. They feel the urge to correct this injustice by shorting and tweeting about it.

Don’t get me wrong — you can make money shorting. But again, the risk/reward of shorting is terrible right now … because there are too many short-sellers.

In terms of DRIO, you have shorts in the $8s, $9s, and $10s getting squeezed a little. But then it comes down, and they start covering their losing position into the dips…

This is where I come in.

Why I LOVE Dip Buying

I positioned myself for the bounce because theoretically, DRIO could’ve retested the $11s. I didn’t know if it would break it. But I started buying roughly $2 a share off the premarket highs. I waited for support to develop and give me a good risk/reward opportunity.

I bought DRIO in the $9s, and I thought this could go back to the $10s or $11s.

Sure enough, this got to the $10s. I sold it because level two showed a brick wall in the $10.20s, and it bounced more than my 10% goal.

Then, within two minutes, it dropped back to low $9s. After that, I decided to avoid DRIO. Its wild movements were scary, and I wanted to protect my gains.

Shorts got bailed out here — the squeeze on DRIO was short-lived, and it faded to the $7s by the end of the morning session. BUT — what if it hadn’t stopped in the $11s?

DRIO could’ve easily squeezed anywhere from $13–$15. If it went full-on supernova, it could’ve hit $20. That’s why shorting is so dangerous.

But my trade was smart, safe, and profitable. I was ready to cut my loss quickly if it failed, but I got a nice bounce and a $738 profit.** I’ll take this single every day. See my verified trade here.

More Breaking News

- American Airlines Takes a Nosedive: What Now?

- TGL’s Phenomenal Rise: A Game-Changer?

- Major Stock Surge: ELAB’s Astonishing Leap

Trading Pattern #2: Multiday Breakout

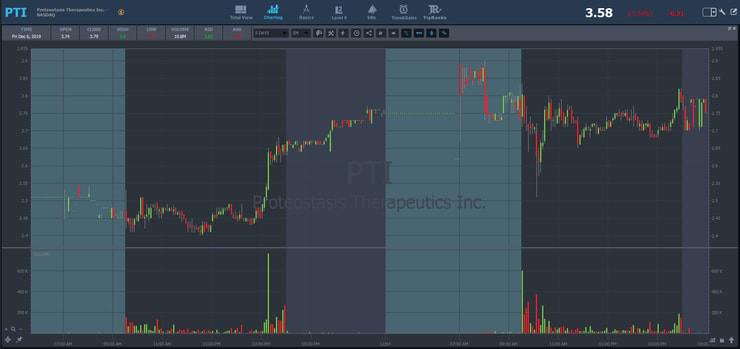

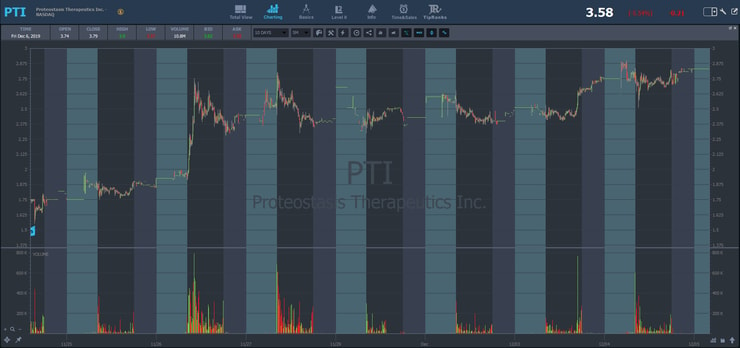

PTI spiked early last week and held its gains for multiple days. I had PTI on my watchlist every day and alerted my entry to both the TimAlerts and Trading Challenge chat rooms.

Because of my alert, I want to mention one thing with short-sellers…

If you look at PTI the day I traded it (December 4), there was a weird print premarket that made some of my students think the stock was dumping. The print came from a short-seller who was down on their position. They were trying to paint the tape.

What do I mean by painting the tape? Some short-seller was trapped.

By painting the tape, the short-seller tried to make it seem like there was some panic. A lot of newbies got confused when they saw PTI dump to $2.62. They thought they needed to get out. But in reality, only 100 shares traded premarket. That’s not something I worry about in a trade.

It’s not what price a stock hits, it’s how the stock hits the price.

Yes, it’s crucial to look at the price — but you also need to look at the bid, the ask, and the overall trend. I like to zoom out and look at the daily charts to see the overall trend.

Look for the Overall Trend

One of the best ways to see the overall trend is to look at what my top student Dom Mastromatteo (MichaelGScott on Profit.ly) calls the ‘intradaily.’

Dom coined the term at the 2019 Trader & Investor Summit (get the full DVD here). It describes a 5- to 10-day chart with 5-minute candles. The intradaily helps show all the critical support and resistance levels and the overall trend.

Back to PTI…

When I was in the trade, it hadn’t even broken out yet. I was only risking $200 or $300. By the time the breakout level approached, I was up about $1,000. That’s a solid risk/reward.

I had this stock on my watchlist for so many days, so I understood how it traded. And that gave me confidence in the move. I was able to build into my position before the breakout because all the key support levels were holding.

Still — I was prepared to cut my losses quickly.

I planned on risking $200 or $300, but if the stock started to act differently than I expected, I’d cut my losses quickly. PTI could’ve easily failed at the breakout. I didn’t know what was going to happen. Ultimately, it ripped to the high $3s, where I would’ve made around $2,000. The upside on this trade was much larger than the downside.

I’m willing to be patient when a stock behaves as I expect. But the moment it stops is when I cut my loss. It protects my account and doesn’t let any single trade wipe out my previous gains.

Lessons From My Two Singles

With both DRIO and PTI, my goal was to take a single. I wasn’t trying to make a huge home-run trade that would double my small account. That’s not how trading works.

Penny stocks are full of opportunities to make 10%. And I teach my students to trade smart and trade safe, using solid trading patterns in my Trading Challenge.

In two days, I made 10% on two simple trades. I wasn’t looking for a 50%–100% winner. I waited for one of my patterns to develop and was always ready to cut my losses quickly.

Sometimes you may get out too soon, but cutting losses quickly will always protect you from significant losses. Remember, trading is a marathon, not a sprint.

Stick to your process and let the trades come to you.

There are so many opportunities in this volatile market. Don’t be stubborn and dumb on any trade. There’ll be another one — until then, protect your account.

Protect. Protect. Protect.

I can’t say it enough. Smart traders learn solid trading patterns, how to protect their accounts, and how to take singles along the way.

Recent Tweets, Comments, and Trades From Students

From the Trading Challenge Chat Room

DRIO — December 3:

8:46 AM juniet: $drio might go higher more and more be careful shorts

9:13 AM maguila057: small scalp $DRIO in at 9.20 out 9.85

9:18 AM KarolaCrawford: $DRIO in 9.66 out at 10

9:23 AM LKScientist: $140 profit on $DRIO.. 200 shares IN at 9.6 and out at 10.3. Took my small gain.

9:27 AM olli400: Bought 100 $DRIO 9.80 anticipating a spike at the open to make $1.00-$2.00 a share

PTI — December 4:

7:14 AM firstgreenday: $PTI breaking out to new highs P/M

9:14 AM markcroock: $PTI could run 3.50 would be next target if it holds

9:08 AM markcroock: accumulating dips on $PTI

9:55 AM WinstonSmith: $pti in at 2.65 out at 2.8 for 1k shares woo hoo

11:57 AM Johncarlos_510: nice 800 shares of $PTI 2.81-3.31

12:02 PM trevorhondros: YES!! In at 3.07, half out at 3.25, rest out at 3.3!!! Whoop whoop, Small small position, small profit but I’m proud. Thanks $pti

More Comments from the TimAlerts Chat Room

PTI — December 3:

7:55 PM TradeHunter710: got a small position $PTI looking to selling premarket gap up

10:07 PM wallride5194: I say that, and I’m holding a small position of $PTI

PTI — December 4:

9:29 AM Jaykian720: $SSI watching @ $5ish, $PTI potential weak open entry @ 2.70

9:33 AM Jaykian720: $PTI bought 1k @ 2.75 w/risk @ 2.70 — watching for a squeeze to $3

10:02 AM ibanez1002: out of $PTI @2.80, held from 2.68, it didnt seem solid at the open

PTI — December 5:

11:49 AM cmhdrums: Bought 5k $PTI

11:57 AM cmhdrums: Sold $PTI 500 profit

2:44 PM nrddct: I’m guessing alot of stubborn shorts in $PTI

And One Awesome Student’s Tweet

another day green @timothysykes @profitly thanks to $DRIO small gains adding up is it tomorrow yet? pic.twitter.com/LkU7J9Ylmo

— yanna (@yannatrader) December 3, 2019

[**Please note these results are not typical. These traders have exceptional knowledge and skills that they’ve developed with time and dedication. Most traders lose money. Trading is risky. Do your due diligence and never risk more than you can afford.]

What do YOU think? Comment below!

Leave a reply