Repeat after me: small gains add up.

People seem to have this ‘all or nothing’ attitude about trading. They see success stories like my student Roland Wolf who just passed $1 million in trading profits.* And they want in.

So too many put their life savings into a brokerage account. Then they follow some so-called guru and sink wads of cash into random trades.

The ‘go big or go home’ mentality is a terrible approach to trading. It’s a fast way to join the ranks of the many traders who fail.

And when people fail at penny stocks, they start to hate them. They talk about how penny stocks are a scam on social media.

Then the media picks up the story and starts talking about the dangers of penny stocks. The universal hatred of penny stocks continues to grow…

Thing is, penny stocks aren’t the problem. The money mindset and wanting to get rich quick is the problem.

If new traders scale back their expectations and focus on gaining knowledge instead of wealth, there might be more success stories.

Sound counterintuitive? Welcome to trading. A lot about penny stocks doesn’t seem to make any sense at first.

But when you adjust your mindset, you’ll see it’s not that complicated. It’s about developing a strategy and letting small gains add up over time.

(*Please note: My trading results, along with the results of my top students are far from typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work, dedication, and experience. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Table of Contents

Traders Who Fail Have This in Common

Most traders who fail think that their sob story is totally unique. But it’s usually pretty predictable.

They don’t take the time to learn how the penny stock niche works or that small gains add up.

I’ve made over $5.5 million trading penny stocks.* I created my Trading Challenge to help my students learn how to trade penny stocks based on what I’ve learned in my 20+ years of experience in the stock market.

Too few newbie traders recognize that education is the smartest investment you can make in your trading future. Self-sufficient, knowledgeable traders make better decisions!

My Trading Challenge is no joke. Students have to apply, and I don’t accept just anyone. I only want serious students who are willing to put in the work.

But even if you’re not ready to take that step, there’s no excuse for not learning how penny stocks work. I have tons of no-cost resources, too. So you have…

No Excuses for Not Studying

If every new trader watched every video in my “30 Trading Videos in 30 Days” playlist on YouTube…

… signed up for my FREE weekly watchlist…

… read my autobiography “An American Hedge Fund”…

… and took the time to watch my videos and learn go-to patterns like this…

They might have better results.

But so many new traders are too lazy to study or learn the rules. They just want hot stock picks. So they blindly follow alerts from so-called trading gurus.

They don’t understand the idea of consistency. And they don’t appreciate that they have to put in hard work and time to develop a strategy that works for them. They don’t understand how to rate every trade using a system like the Sykes Sliding Scale.

Check out this video one of my students tweeted:

My thoughts on trading and Tim Sykes! @timothysykes @StocksToTrade @goodetrades @kroyrunner89 Thanks! pic.twitter.com/KJoR9RfPlu

— Simon 🎈 (@SimonFUTURE2) July 16, 2020

He’s up over $11K since June, which is incredible.*

I’m not telling you this so that you start to expect those results. Yes, it’s the hottest market we’ve had in years. But he admits it wasn’t effortless. This level of trading requires studying, and he’s real about it.

I want to show you what’s possible in this niche. Of course, you gotta work HARD for it and understand…

Small Gains Add Up

In July, I made a little over $115K.* It’s my worst recent month, but it’s still more than some people make in a year.

I owe a lot of props to my trading platform StocksToTrade. It helps me narrow down long lists of tickers to manageable watchlists. And its new Breaking News Chat is a game-changer … I would have missed so many of my trades without these tools.

And my monthly profits aren’t the result of one amazing trade. If you look at my trades — which I post publicly on Profit.ly — you’ll see my profits are a bunch of small gains over time. You’ll see my losses, too.

On July 28, for instance, I had two small losses … –$90 on Exela Technologies Inc (NASDAQ: XELA) and –$296 on Optec International Inc (OTCPK: OPTI.)

But I also had two small wins … $350 on Heat Biologics Inc (NASDAQ: HTBX), and $648 on Vystar Corp. Common Stock (OTCQB: VYST).*

My best trading day ever? Nope. But you don’t have to be a math whiz to figure out the most important part…

My wins were bigger than my losses.

Start Small, Scale Up Over Time

My top student Tim Grittani started with a $1,500 account. For his first nine months, he made nothing.

Now, nine years later, he’s made over $13 million.*

How? By starting small and scaling up over time.

Grittani also tracked his trades in a trading journal to find which strategies were working for him. Then he focused on honing his methods from there. At first, his profits were small. But as he found consistency, he started to scale up his position sizes.

So the same strategies that once made him $20 on trades now make him as much as $20K on a single trade* … sometimes more. It’s all because he focuses on consistency.

Best of all, Trading Challenge students can learn directly from Grittani. He often gives webinars to break down his trading experiences, like his recent crazy $272K profit day.*

More Breaking News

- CleanSpark’s Strategic Growth and Operational Success: Why Analysts Are Bullish

- Surprising Decline of Quantum Computing Stocks: Investigating the Market Ripples

- Can ParaZero Technologies Maintain Its Momentum With Strong Q1 Performance?

You Can Learn, Too

Right now, we’re seeing some crazy runners in the market.

Look at Peloton Interactive, Inc. (NASDAQ: PTON). Just months ago, this stock was treading water. Now that everyone’s at home and can’t go to the gym, it’s exploded. From the $17s to the high $60s … since March.

But that’s not the only reason there are so many opportunities right now. There are TONS of new traders. Due to pandemic-related job losses, many people are getting into trading. There are few barriers to getting started as a trader.

As a recent Wall Street Journal article reported, E-Trade added 260,500 new retail accounts in March. Robinhood had three million new accounts in the first quarter of the year.

All these new traders create even more market volatility.

Side note: need help understanding the current market craziness? Get up to speed with my no-cost “The Volatility Survival Guide.” It’s necessary viewing for anyone who wants to trade in the current market.

How Small Gains Add Up — Why Preparation Matters

My top students have been in the game for a few years. They’ve witnessed market volatility before, like with weed stocks…

They took the time to learn the market, understand volatility, and prepare.

Recently, the New York Post profiled some of my top students and me … They did a great job of showing how we trade and how our results are the result of studying and preparation. Our small wins add up to those awesome results.

Check out my student Jack Kellogg…

He’s made over $750K* … A lot of that was in the past 90 days. Kyle Williams is up over $400K* with killer gains in the past 90 days.

They’re not the only ones. For example, Matthew Monaco made $93K* in June and just passed $250K overall.*

Finding consistency as a trader isn’t something that happens overnight. Success is the result of MANY small wins adding up over time.

Contrary what these gunslinger wannabe short sellers & penny stock promoters hype up, you do NOT have to go for home runs & risk losing big in the process. If you want to be aggressive, sure, there's that path, but I'll tell you straight up it almost always ends in disaster/tears

— Timothy Sykes (@timothysykes) July 22, 2020

Beware Fake Gurus

There are opportunists everywhere. New traders must be very careful about where they get their information.

For instance, stock promoters are quick to tell you, “Don’t sell … these stocks are going to the MOON!”

Look at Spartan Energy (NYSE: SPAQ). What happened since it was hyped? Check out the chart…

From the $20s to the low $10s. Don’t hold and hope.

If you wanna be in this game for the long haul, you have to learn how to take profits and sell into strength.

I don't mind when gunslingers make fun of my tiny profits as I've been doing this 20+ years & I'm 100% real, the gunslingers can't show their real names or ALL trades for a reason, that's the difference between the 90% of traders who lose big & those of us who win big in the end!

— Timothy Sykes (@timothysykes) July 22, 2020

Don’t Force Trades

How do small gains add up? You gotta be humble and take what the market gives you.

Here’s another cautionary tale. A lot of people get into shorting because they think it’s like the movie “The Big Short.” They think they’ll become bazillionaires fast. Yeah, that’s not the case.

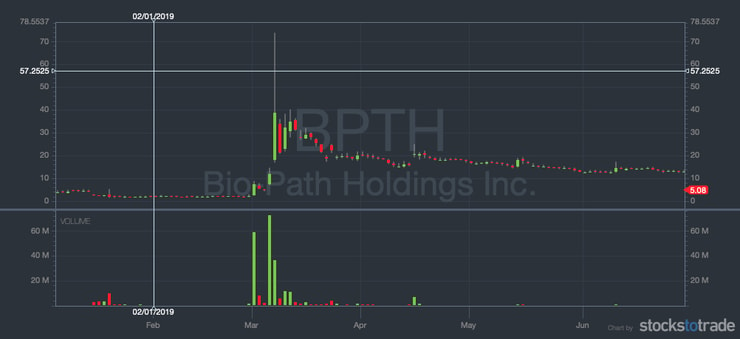

I remember Bio-Path Holdings Inc. (NASDAQ: BPTH). It’s a crap stock that doesn’t do much, trading for about $5 per share.

But once upon a time, it went from the $2s to the 70s. I know a ton of shorts who got beyond smoked. Here’s the chart:

Shorts got in at $7 or $8 and kept adding at $15, $20. Then it went to $70. That can destroy an account. People don’t talk about that enough.

It’s what can happen when you short in the age of short-squeeze insanity. The risks are huge and newbies usually end up losing big.

Take the Profits and Run

I admit it: I take profits too soon.

For example, on Axim Biotechnologies Inc (OTCQB: AXIM), I made $932.* I sold around 82 cents and it went up to about 88 cents. I could have made about $500 more.

On Nextech Ar Solutions Corp. (OTCQB: NEXCF), I made $1,589.* I sold it about 60 cents per share too soon. I could have made another $2K.* It wasn’t even a day trade. t was a first green day OTC that I held overnight — one of my favorite patterns…

On those two trades, I made about $2,500.* But even though I left some on the table, it shows how small gains add up.

Keep Your Wins Bigger Than Your Losses

Keep your losses small and your wins bigger. Duh, right?

It’s an easy enough concept, but traders get emotional. That makes them forget my #1 rule:

Cut losses quickly.

Don’t make the mistake of falling in love with these penny stocks. Most are crap companies that will fail. This video has tips for how to know when it’s time to get out of a trade — take notes!

Small Gains Add Up With Slow, Steady Progress

I’d probably get more students if I said, “Hey, follow my trades, and you’ll make $1 million.”

But I won’t do that. It doesn’t work. The stock market moves too fast. It’s too easy to miss moves.

Instead, I teach my students to be self-sufficient and to create strategies they can maintain and adapt over time. It takes hard work. You must take your education seriously.

If you’re ready to work and passionate about trading, my Trading Challenge can help you fast-forward your market learning curve.

You get access to nearly 1,000 trading webinars, including about 70 from Grittani … So you can learn strategies and trading techniques from other traders.

I love seeing students like papajohn, who has an epic profit chart. When you look at his individual trades, it’s a great example of how small gains add up. He’s finding consistency. And he’s in my Trading Challenge chat room every day, being a part of the community, and working toward his goals.

Ready to Get Real?

Remember: it’s a marathon, not a sprint.

Finding consistency in trading requires the right mindset, hard work, studying, determination, and dedication.

How dedicated are you?

My way is a lot more meticulous, cowardly, intricate, whatever adjective you want to describe the process of small gains, along with small losses, adding up to millions of dollars over time with your gains being bigger than your losses & very little risk of blowing up, you choose

— Timothy Sykes (@timothysykes) July 22, 2020

I need you to understand that you must study and focus on the process. Focus on building your knowledge account first.

Stay safe! Have huge goals, but be willing to work toward them over time. As boring as it might be, slow but steady wins the race.

Do you get what I’m saying here? Leave a comment and say, “Small gains add up!”

Leave a reply