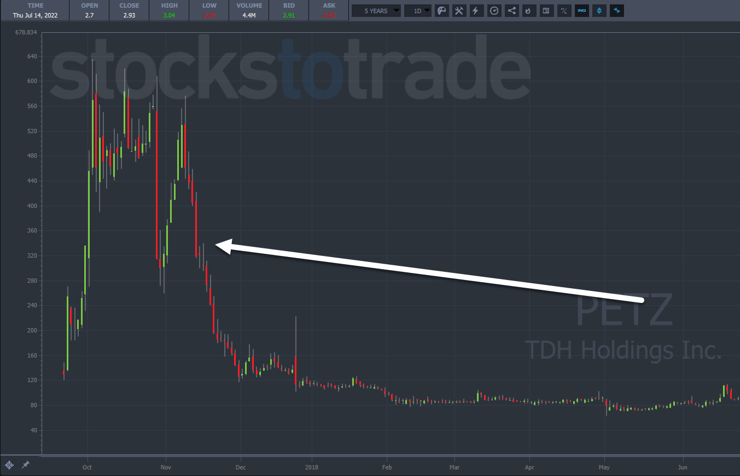

Take a look at the chart below and tell me what you see…

I earned my first $1 million trading this exact pattern.

In fact, this pattern is so powerful that within the last few weeks, four of my millionaire students made almost $1 million combined in one stock within a matter of days.

And if you know how to identify them they could potentially mean huge profits for you.

How do you spot these career-making trades?

Short Float %

Many traders look at the short float percentage as a way to gauge the potential for a short squeeze.

At its core, the short float percentage tells you the proportion of shares sold short to the total shares available to trade.

For example, if there are 10,000,000 shares to trade (float) and 1,000,000 of them are sold short, you have a 10% short float.

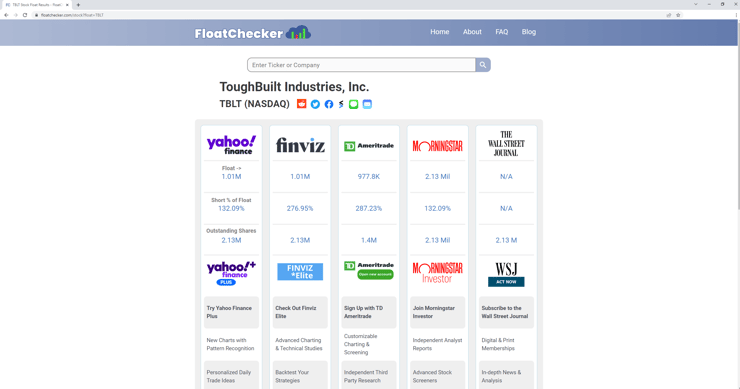

Floatchecker.com is a great resource to look up this information. The site lists the float, short percentage of float, and outstanding shares from several sources.

However, if you look at the information above for Tough Built Industries (NASDAQ: TBLT), you’ll immediately see a problem.

While most of the sites have similar outstanding shares, the other numbers vary wildly.

This is caused by definitional problems and calculations.

To start with, most sites should get the outstanding shares correct. That’s the number of shares that currently exist.

The float is the amount available to trade, excluding shares closely held by insiders and board members. It’s more indicative of what publicly trades.

Most places will have the same value for the float.

The short percentage of float gets tricky.

Short interest is reported roughly every two weeks. From there, sites may try to calculate the current short float based on transactions or other methods.

I find that it’s best to take the information with a grain of salt.

With TBLT, it’s safe to say that there are a ton of traders short the stock.

Larger cap companies will tend to have numbers closer to one another.

Now, you may be wondering how it’s possible for more shares to be shorted than are available for trading.

That comes down to leverage and borrowing. Brokers will allow for traders to sell shares without actually owning them, known as a ‘naked’ short sale.

Additionally, the time between the transaction and settlement date can also cause discrepancies.

The best way to think about it, if all the sites say the short interest percentage is high, it’s probably high.

Now, let me show you a different way to think about short interest.

Look For Massive Flops

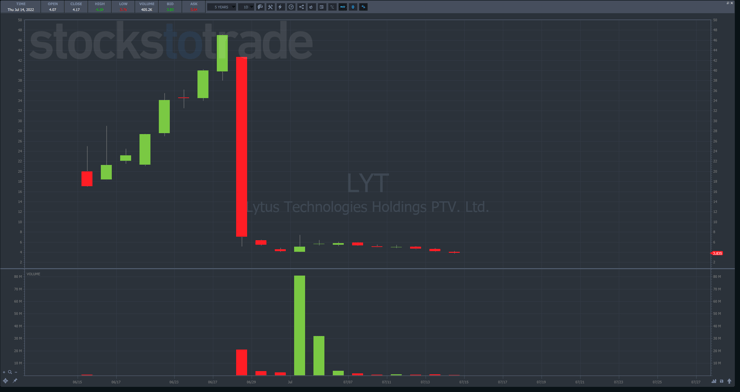

Take a look at the chart below for Lytus Technologies Holdings Ptv Ltd (NASDAQ: LYT).

This is the stock that helped Jack Kellogg, Tim Lento, Jack Schwartz, and Kyle Williams all harvest huge profits on the short side when it crashed.

But they weren’t the only ones.

Whenever a stock gets a huge selloff, quickly or over time, you start to see short sellers pile up.

Keep in mind, there’s a limit to this as short selling below $5.00 carries different margin requirements, and most folks simply won’t short stocks below $1.00.

Nonetheless, these former runners that crashed offer up some sweet bounces.

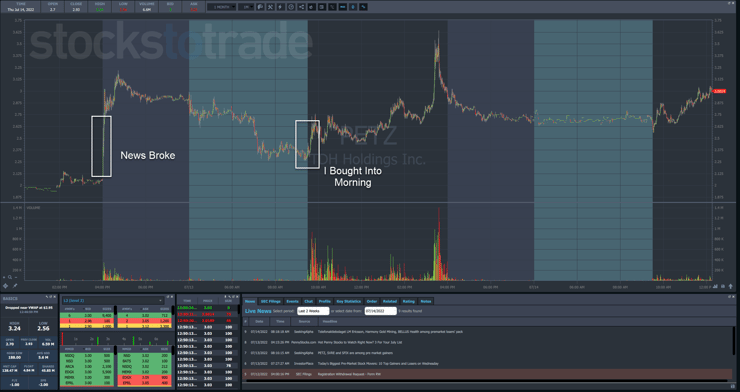

In fact, that’s exactly how I found my setup in TDH Holdings Inc. (NASDAQ: PETZ).

The stock was a former runner that recently saw interest as news hit after hours on Tuesday that the company was cancelling a share offering.

With the shorts getting squeezed in the after hours, I used the early morning strength the next day to enter my trade, actually cutting it off early before the real squeeze happened.

Even the pullback from the prior day’s after hours run created the potential for a short squeeze if buyers would step up to the plate.

More Breaking News

- Microsoft Stock Plummets Amid Legal Troubles and Investor Disappointment

- Coupang Faces Major Legal Challenges Amid Data Breach Fallout

- Eos Energy Stock Faces Turbulence As Chief Commercial Officer Sells Shares

- TransCode Therapeutics: Promising Data Boosts Future Outlook

While it got a decent pop in the morning, the real squeeze came on heavy volume at the end of the day.

Final Thoughts

Practice looking for setups like these where shorts build up. Then watch and see how, where, and when they get pushed out of their positions.

A great place to start is by identifying my #1 pattern.

–Tim

Leave a reply