Secondary offerings can have dire consequences for your trading account.

You never know when shady penny stock companies will dump shares into the market. If you hold these stocks overnight, you’re exposed to that risk. But some stock offerings are worse than others…

It depends on the details. You have to look at the big picture…

In this post, I’ll go over some of the types of secondary offerings and strategies for trading them. And I’ll show you some recent examples of how stocks reacted to secondary offerings.

Table of Contents

- 1 What’s a Secondary Offering?

- 2 Primary vs. Secondary Offering: What’s the Difference?

- 3 Understand How Secondary Offerings Work

- 4 Secondary Offering vs. Follow-on Offering

- 5 How to Trade Secondary Offerings: 3 Trading Tips

- 6 Advantages and Risks of Secondary Offerings

- 7 Secondary Offering Calendar (2021)

- 8 Frequently Asked Questions About Secondary Offerings

- 9 Secondary Offerings: The Bottom Line

What’s a Secondary Offering?

2025 Millionaire Media, LLCWhen a company creates new shares and sells them to the public or to private investors, it’s a secondary offering. When current shareholders offer shares they own, that’s also a secondary offering. Secondary offerings are done after a company’s initial public offering (IPO).

A stock offering can have a huge impact on a stock’s price.

A stock’s reaction to an offering depends on the specifics … like the price and size, demand, and the company’s plans for the cash.

There’s a big difference between a toxic financing announcement and a secondary offering near the current market price…

Or between a stock offering that will line insiders’ pockets and one that will generate cash for an acquisition or to buy assets. More on that later…

When it comes to penny stocks, I always expect the worst, so I’m never disappointed.

New to penny stocks? I’ve made over $1.1 million in 2020 and $720,000+ so far in 2021 trading this niche*. Start your penny stock education with my free guide now!

(*Please note: My results are far from typical. Individual results will vary. Most traders lose money. I have the benefit of years of hard work, dedication, and experience. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Primary vs. Secondary Offering: What’s the Difference?

A primary offering consists of the initial shares a company offers in its IPO. It includes shares held by insiders and those offered to the public as part of the float.

A secondary offering is an offering that takes place after the company goes public. It can be an offering to institutional investors or the public.

Companies use primary and secondary stock offerings to generate capital.

Understand How Secondary Offerings Work

2025 Millionaire Media, LLCBefore a company can sell more shares to the public, it must disclose the offering details to the Securities and Exchange Commission (SEC).

And like I said, some are worse than others. So let’s look at some factors that go into a stock’s reaction to an offering announcement…

Types of Secondary Offerings

There are two main types of secondary offerings…

Non-Dilutive Secondary Offerings

A non-dilutive secondary offering is when insiders sell shares. Their shares were part of the shares outstanding when the company went public. They’re used in a company’s market cap calculation.

The sale of these shares doesn’t dilute the value of other shares or the company’s earnings per share (EPS).

But insider selling could still be bad news…

Why would insiders sell? Is there bad news pending? Or do they just want to cash out? If they don’t believe in the company enough to hold their positions, why should you?

Another negative is that the company doesn’t get any money from the sale. All the proceeds go to the selling shareholders.

Dilutive Secondary Offerings

Dilutive secondary offerings are those in which the company creates new shares. Here are a few ways a company can dilute…

- Public stock offering: The company creates shares for sale at a predetermined price. Then an investment bank handles the sale of the shares into the open market. The company has to register the shares with the SEC before they can be sold.

- Private placement: The company creates shares to sell to accredited investors like hedge funds, banks, trusts, and high-net-worth individuals. The company doesn’t have to register the shares, because it’s selling them to sophisticated investors.

- Toxic financing: The company creates shares to sell to institutional investors at a deep discount. The investors can sell the shares into the market for a profit. This puts a ton of selling pressure on the stock and burns anyone who bought at a higher price.

In general, stock offerings are bad news for shareholders. But even though a private placement is dilutive, the market may interpret it as good news … The fact that a high-net-worth individual is willing to take a risk on a penny stock could be a good sign.

Offering Price and Size

The two most important things to know about an offering are the size and the price.

Too many traders see a headline about an offering and short the stock. But if you’re willing to do a bit of reading, you can get a potential edge…

Because if a company is only offering a small number of shares near the current market price, the stock may not react at all.

But a toxic financing deal at a deep discount can send a stock plunging below the offering price.

The stock’s reaction will also depend on whether there’s a recent news catalyst, whether it’s trading high volume with demand, and whether the stock is already up a lot.

Let’s look at an example…

More Breaking News

- Jayud’s New Cargo Service Takes Off

- BLNE Stock Surges: Time for Action?

- SurgePays’ Surprising Surge: What’s Next?

Real-Life Examples of Secondary Offerings

Here are two examples of stock offerings from 2020 and 2021.

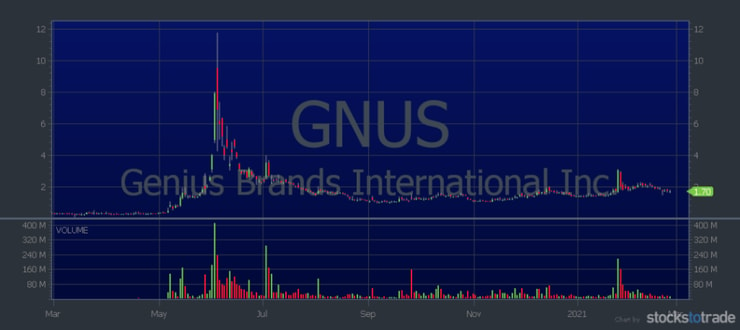

Genius Brands International Inc. (NASDAQ: GNUS)

Children’s entertainment company GNUS was a big runner in May 2020. The stock’s run-up is a great example of a supernova — one of my favorite chart patterns.

You can see it jumped from under $1 to $11.73 within a few weeks.

The company announced an offering on May 7, when the stock was just starting to get attention. The offering, which was made to long-standing investors, was for eight million shares at 35 cents each.

The company said it would spend the funds on its newly announced Kartoon Channel, which would launch the following month.

The stock traded between 68 cents and $1 that day. The following day it reached a low of 50 cents. Then it went supernova.

GNUS announced more than one stock offering in May. But the volume and demand were enough to keep pushing it higher. Until June 4…

The company announced insiders were selling over 60 million shares into the market. Some insiders liquidated their entire holdings. Remember, the company doesn’t get any of the money from the sale of these shares.

The stock tanked from almost $12 per share to less than $5 in about an hour.

Know the Framework

The GNUS daily chart fits my pennystocking framework pattern almost perfectly. Get my “Pennystocking Framework” DVD to learn all about it. Or get it as a bonus when you take my 30-Day Bootcamp.

My Bootcamp gives you a month’s worth of lessons with daily assignments and homework. I created it with my former Trading Challenge student Matt Monaco. He’s now a millionaire trader and one of my Challenge chat room moderators.*

You can complete the assignments at your own pace and repeat them as many times as you like. Plus, you get “The Complete Penny Stock Course” book written by my student Jamil. You get all three for under $100.

(*These results are not typical. Individual results will vary. Most traders lose money. Traders like Matt and me have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence, and never risk more than you can afford to lose. I’ve also hired Matt Monaco to help in my education business.)

SOS Ltd. (NYSE: SOS)

SOS is a tech company that entered the crypto mining business in early 2021. The stock rose along with the whole sector as bitcoin soared to all-time highs.

On February 18, the company announced an offering of 8.6 million American depositary shares (ADS) and warrants for an additional 4.3 million ADSs at $10 each. The stock was trading between $10.50 and $12.50 the day the news was released.

As you can see from the daily chart, the stock slowly returned to its pre-runup levels.

Secondary Offering vs. Follow-on Offering

A follow-on offering is another term for a secondary offering. It can also be called an offering of common shares, stock offering, public offering, or private placement.

All the terms mean a company is creating more shares and diluting the value of existing shares.

How to Trade Secondary Offerings: 3 Trading Tips

2025 Millionaire Media, LLCHere are a few tips if you want to trade stocks based on offering news.

#1: Avoid Them

My #1 tip for trading stock offerings is to avoid them. When a company announces an offering, it’s dead to me.

The more supply there is, the more volume and demand you need to push the price higher.

And if you’re in a position when an offering is announced — get out. Take your profit or loss and move on. It’s not worth holding through an offering to ‘see what happens.’

Especially when it comes to sketchy penny stocks. You can always get back in later if you see a pattern or price action that fits your strategy.

If you’re an experienced trader, here are a couple of ways you can trade news of a stock offering … But I’m warning you now, they’re risky…

#2: Short Sell

I don’t recommend short selling for new traders. So if you’re new, skip ahead now.

Shorting is a risky strategy with high fees, and it exposes you to the potential for huge losses. I don’t think it’s worth the risk for new traders.

But if you’re an experienced trader with a solid trading and risk management strategy, it might work for you.

Just don’t be one of those short sellers who blindly shorts any stock with offering news.

Do your due diligence. Read the filings. Find out the size and price of the offering. Stick to a pattern and strategy. And have a clear risk level.

If you want to learn more about how to read SEC filings, get my “Read SEC Filings” DVD. I created it with my first millionaire student, Micheal Goode.*

#3: Dip Buy the Panic

The idea behind this strategy is to dip buy a stock that’s a recent runner in a hot sector, with a catalyst, hype, and volume.

After the panic selling and short pressure, you can try to buy the dip. You want to take advantage of shorts buying to cover and dip buyers who missed the initial run-up coming in.

Look back at the GNUS chart from June 4. You can see that after the panic there was a bounce from about $5 to $8. Usually, the bigger the panic, the better the bounce. But it’s not an exact science.

Trying to guess the bottom of a panic can be tricky. Especially with listed stocks that are choppy. And stocks don’t always bounce. So you must be meticulous about cutting losses quickly.

Advantages and Risks of Secondary Offerings

As far as I’m concerned, there are no advantages to stock offerings. But there are risks. The main one being that you can lose a lot of money.

Offerings are usually announced after hours or in premarket. If your broker doesn’t allow after-hours trading, you’re at a big disadvantage.

But every once in a while, a company will announce an offering in the middle of the day. I’ve even been caught buying right as an offering was announced. The only thing I could do was cut losses quickly. That’s why it’s rule #1.

Trading junk penny stocks is risky. My trading rules help protect my account. And they help prevent a small mistake from turning into a huge disaster.

Secondary Offering Calendar (2021)

You can find secondary offering calendars online, like the one on Nasdaq’s website. A calendar will show the dates of upcoming offerings, including size and price.

Using a secondary offering calendar can help you in your stock research. If you want to know if a company’s reported float is accurate, you can check the calendar for recent offerings.

The calendar can also tell you when there might be excess supply — which would mean it could take more volume and demand to move the stock price higher.

If you want to know about stock offerings as they happen, you have to keep up with breaking news. And my favorite way to do that is to use the StocksToTrade Breaking News Chat.

The Breaking News Chat guys get the most important penny stock news out FAST! It’s been a game-changer for my trading.

I use StocksToTrade every day. For me, it has the best tools because I helped design and develop it specifically for trading penny stocks. (I’m also an investor.) It has awesome charts, built-in scans, social media feeds, and so much more to help you do your research.

You can get a StockToTrade 14-day trial for only $7, or get it with the Breaking News Chat for only $17!

Frequently Asked Questions About Secondary Offerings

2025 Millionaire Media, LLCWhy Do Companies Do Secondary Offerings?

The main reason is to generate capital. But a secondary offering can include insider selling — which doesn’t generate income for the company.

How Do You Buy a Secondary Stock Offering?

If a secondary offering is public, the shares are sold into the market. They become part of the freely traded float. There’s no way to know whether you’re buying original shares or shares that were part of the secondary offering.

Is a Secondary Offering Good or Bad?

Generally, a secondary offering is bad. But some are worse than others. The price, size, and details will all affect how a stock reacts to the news.

Secondary Offerings: The Bottom Line

2025 Millionaire Media, LLCIn the penny stock world, secondary offerings are bad news. Sure, the company will try to put a positive spin on what they’ll do with the money raised, but it’s usually a bunch of BS.

Most of the time the company insiders are lining their pockets. And when the stock price drops, they’ll do a reverse split to get it up, then dilute again.

It’s the penny stock cycle.

That’s why I don’t hold penny stocks. I trade quick price action — get in and get out. It’s how I limit my risk.

I teach my patterns and strategies in my Trading Challenge.

I start my account every year with $12,000. That’s so I can show students how to grow a small account over time by taking advantage of volatile penny stocks. My top students and I never believe the hype. We trade patterns and price action, then we move on.

If you want to know how we do it, apply for my Trading Challenge. I don’t accept everyone. I only want the most dedicated students. Think you’ve got what it takes? Apply today.

Have you been caught in a secondary offering? What did you do? Let me know in the comments … I love to hear from you!

Leave a reply