We’re in a bear market. Take a look at this chart of the S&P 500 ETF TRUST ETF (NYSE: SPY). It’s been on a decline since January…

Finding quality plays has been tougher. For example, I only made three trades last week.

But when it comes to my niche — day trading penny stocks — I don’t need to trade all the time. I only trade when I see a perfect setup.

That’s how I’ve been able to stay profitable for over 20 years in the markets.

The truth is, I’m not even that great of a trader. Some of my students do better than me. Like Tim Grittani. He’s managed to profit over $13.5 million in his trading career.

You can learn something from a trader with that incredible record. Here’s how he crushes it in bull and bear markets…

The New Scanner

For the last year, Tim’s been working on algorithmic trading.

He got so good at regular day trading, now he’s building computers to do it for him.

But last week in a live video webinar, he admitted to some difficulties with the process of building an algo. (Here’s a sneak peek of the webinar. )

Apparently, it’s pretty tough to quantify his strategy.

So in the meantime, he’s still doing some trading and teaching. One pattern Grittani likes to play is the overnight gap-up.

Here’s a video I made on the strategy…

Basically, a stock runs for the day and closes at least 10% above the open. Then the price gaps up the next morning.

Back in 2020 and the beginning of 2021, gap-up plays were a regular occurrence. Now that the markets are slower, there are fewer.

But professional day traders don’t just twiddle their thumbs waiting for the next hot market. We look for volatility.

Here’s where we can learn from Grittani (again). He created a stock scanner that assesses the probability of overnight gap-ups.

Read on for the criteria, and I’ll also show you how to plug this scan into the StocksToTrade platform…

How to Build the Scanner

For this part, you need some trading and scanning software. There are a lot of options out there, and some are better than others.

For example, the StocksToTrade platform allows me to quickly scan for the hottest stocks while trading. So I don’t miss anything…

Here’s where you can start your two-week trial.

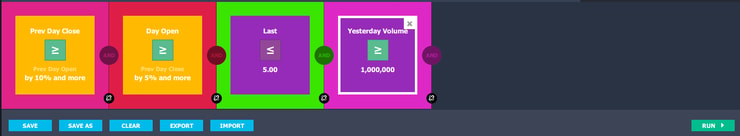

Tim Grittani’s newest scanner has four main factors…

- Prev. close > Prev. open: This finds stocks that have spiked at least 10%

- Open > Prev. close: This finds stocks that gapped up overnight at least 5%

- Price ≤ $5: Search for penny stocks, which are more volatile than higher-priced stocks

- Yesterday’s volume > 1 million: High trading volume ensures liquidity

I would also add a fifth crucial factor — whether the stock has a history of running. Stocks that have spiked can spike again. I look at the chart to find this.

Here’s what the scanner should look like in StocksToTrade…

More Breaking News

- Microbot Medical Eyes Expansion with Key Milestones in 2026

- TRX Gold Shines with Strong Q1 Earnings and Raised Price Targets

- BigBear.ai Partners with Maqta Technologies, Enhancing AI Solutions in Port Operations

- Valterra Platinum Strengthens Position with Impressive Earnings Surge

How to Use This Scanner

In the stock market, history repeats itself. That’s why I said former runners can run again.

Here’s the best way to use market scans: build watchlists.

This scan helped Grittani find recent spikers like Houston American Energy Corporation (AMEX: HUSA)…

… and Mexco Energy Corporation (AMEX: MXC) …

But just because he found a bunch of stocks that gapped up doesn’t mean they’ll continue to run.

You have to trade safely.

So he adds the best-looking plays to a watchlist and waits for a pattern to set up.

There are tons of different stock patterns out there. But Grittani and the rest of my millionaire students trade this 7-step framework the most.

It’s the same as when I discovered it two decades ago. And I’ve been teaching it to other traders ever since.

Follow in the footsteps of over two dozen millionaires…

Apply for my in-depth day trading course today.

If my team thinks you’re ready, I’ll see you in chat!

How do you use scans to find hot stocks? Do you search for any of the same criteria as Grittani? Leave a comment to show me you understand these lessons!

Leave a reply