This is one of the biggest opportunities for small-account traders right now:

The short squeeze.

These stocks can spike +100%, even +1000%. And in this 2024 market, we’re seeing new short squeezes every week. Partially because the stock market is so hot! Let me explain …

Three out of four stocks follow the market. When the market is hot, there are more stocks that spike. The bullish momentum works against short sellers from the very beginning.

Take a look at the S&P 500 ETF Trust (NYSE: SPY) this year. On the chart below every candle represents one trading day:

That momentum trickles down to our small-cap niche. That’s where we find cheap stocks that can spike +1000%.

Notice how the SPY spiked 12% this year. That’s because the SPY is trading above $500. It’s more difficult to spike by a big percentage.

Comparatively, a lower-priced stock can spike higher because the original price is so cheap. Take a look at Cazoo Group Ltd. (NYSE: CZOO) below, share prices were trading under $3. And prices hit $20 intraday yesterday.

Every candle represents 10-minutes:

Small-account traders can bank off of those big percent gains!

Here’s how …

The Short Squeeze

In case anyone is still confused:

A short squeeze happens when there are too many short sellers in a stock. Any bullish momentum from the stock can cause some short sellers to panic and buy-to-cover to exit the position. That bullish momentum creates a domino effect of short sellers blowing up.

How high the squeeze goes, nobody knows. Short sellers can keep trying to guess the top and can keep blowing up. For that reason, theoretically, these stocks could run to infinite highs.

But the stock will crash eventually. There’s a lot of money on the table for a short amount of time.

So we have to be careful while trading these plays.

The CZOO spike is unsustainable.

I already traded it for a profit. And I’m looking for another trade opportunity. But I’m NOT holding shares of this stock.

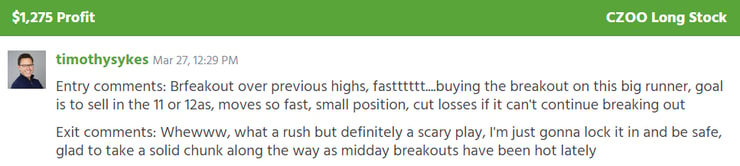

My trade notes are below, I had a starting stake of $16,365:

The stock spiked 120% the day that I traded it. I took a 7% profit.

That’s how to play these stocks. We take the meat of the move. I try to trade the most predictable part of the run, then I get out and I move to the next play. It’s not about making $1 million on one trade. I’m trying to maintain consistent profits for the rest of my life.

I love that trading is my job.

The Process To Profit On Short Squeezes

We need to identify strong price action on a stock that’s running without any news.

That’s right … On paper, CZOO is running for no reason.

That’s what attracts degenerate short sellers. They see a stock that’s spiking but has no business spiking. They stubbornly pile in, and then they get squeezed.

Now, remember: The spike will end eventually. So we want to confirm the bullish price action before we plan a trade. In the case of CZOO, I traded it on the sixth day of the move. The short squeeze had plenty of time to wind up and build momentum before I snagged a cool $1,275.

The patterns that I use to trade these runners are the same.

The patterns repeat because human beings are predictable during times of high stress. And short squeezes can be incredibly stressful if you’re on the wrong side.

Here’s the catch …

Every squeeze looks a little different. Like a snowflake.

If they all looked the same, this process would be easy as pie and everyone would be a millionaire.

It takes experience and practice to get used to. But there is a science to this. These are real profit opportunities. In my career I’ve pulled $7.6 million in profits from the market using these strategies. I also have over 30 millionaire students who use the exact same process.

We outline these plays in daily webinars for all of my upcoming students to see.

The market is closed this weekend. And that means it’s the perfect time to prepare! Watch the videos that I linked above in this blog post.

And if you have any questions, my students and I are available all weekend:

Tune in to the weekend chat and hit us up.

Cheers.

Leave a reply