In the stock market, there are lots of ways for companies to manipulate their stock prices — including a reverse split.

Manipulation isn’t always a bad thing. Sometimes, a company has legitimate reasons for changing its stock price. But that’s not necessarily the case when it comes to reverse stock splits in the penny stock world.

Luckily, I don’t care if a company manipulates its stock. In fact, I make most of my money off of their manipulative efforts.*

Reverse splits aren’t always bad — it depends on the company and why it’s doing a split. But it’s smart to know what a reverse split is and why most penny stocks do them.

So let’s dig into reverse stock splits and what they are. Plus we’ll cover some examples and whether they’re good or bad.

Table of Contents

What Is a Reverse Split — Definition

By definition, a reverse split is when a company decreases its number of available shares while increasing the price of its stock.

A company can’t magically increase its stock price — that’s why it resorts to a reverse stock split. So it has to “get rid” of shares to bump up its price. Honestly, it’s simple mathematics.

It sounds more complex than it really is. The company isn’t technically getting rid of shares — it’s just combining pre-existing ones. More on that in a bit.

What Does a Reverse Stock Split Mean for an Investor?

Remember, investors and traders have totally different approaches to the markets.

Investors hold onto stock positions for an extended period of time, generally for a slow and consistent gain. Traders, on the other hand, are in and out of stock positions relatively quickly, for potentially quicker gains.

I have nothing against investors, but investing in the scammy penny stock companies that I trade is a complete gamble. I’d rather play the patterns that I’ve recognized and learned over the past 20+ years.

I say this because most of the time, reverse stock splits mainly apply to penny stocks. A big company with a share price of $100 per share won’t normally do a split — the price of its stock is probably already fine.

Technically, a reverse stock split means nothing for an investor — note the key word “technically.”

I’ll talk about whether a reverse stock split is good or bad for shareholders of a company in a minute, but I want to make something else clear first…

Reverse stock splits basically mean nothing for an investor because the position value in the company doesn’t change. It just means owning fewer shares at a higher price.

Just because a reverse split basically means nothing for an investor doesn’t mean it’s a good thing…

In fact, it’s normally pretty bad news.

That may sound confusing, so I’ll break it down. I’ve seen toxic companies doing reverse splits for over 20 years now. It doesn’t normally end well.

Why?

You have to look at the reason behind the split. A big, reputable company with a stock price of $100 per share is probably financially stable.

But a penny stock with a price of 50 cents per share probably isn’t as financially stable. In fact, the company might need to raise money through public offerings. But public offerings for penny stocks are usually toxic and almost always end horribly.

Large investors don’t want to invest in a company with a low share price with tons of tradable shares — it makes it harder for their investment to ever make money.

So a company may do a reverse split to seem more appealing to potential investors. It lowers the share count and increases the price, making public offerings much easier. Public offerings dilute the company’s stock and make the company worth less over time.

Reverse stock splits can be a way for a scammy company to hide just how toxic it is, usually making it a bad sign for the average shareholder.

How Does a Reverse Stock Split Work?

Let’s look at a super-basic example…

Say Company A has one share that is worth $100. Since its share price is $100 and it only has one share, the company is worth $100. A company’s value is based on its stock price and share count. That’s known as market capitalization, which you can read more about here.

On the other hand, Company B has 10 shares that are each worth $10. This company is also worth $100.

Both companies are worth the same amount of money, but their share prices are different.

If Company B wants to increase its share price, it could do a reverse stock split. But this doesn’t increase the company’s value.

It just means the company’s share price is higher. So if Company B wants its share price to be $100 per share, it would merge the 10 existing shares into one single share that’s now worth $100.

Of course, a company can’t just do a split … It has to run it by its investors who have to approve the split.

New to penny stocks? Access my FREE penny stock guide here.

Market Impact of Reverse Stock Splits

I’m gonna say it again…

A reverse stock split does not affect the company’s valuation. There’s no technical market impact of a reverse stock split in terms of the company’s value.

But that doesn’t mean it doesn’t affect shareholders in the long run…

The market impact of a reverse stock split is that it lowers the tradable share count of the company by combining multiple stock shares into one. This can allow a company that does a reverse split to do some pretty sketchy stuff.

It goes back to the idea that companies that do reverse splits then have more ability to engage in toxic financing — which can be extremely scary for shareholders.

Again, that’s only if the company decides to engage in toxic financing like at-the-market offerings.

Just because a company does a reverse stock split doesn’t necessarily mean it will engage in toxic financing. But from what I’ve seen in the past 20+ years … a lot of them do.

But unless the company engages in toxic financing, there isn’t a real market impact of a reverse stock split.

Why Companies Do Reverse Splits

Reverse splits are more than a means for companies to increase their stock prices and try to appeal to investors … It’s sometimes a way for companies to stay listed on a bigger exchange.

This is another reason why reverse splits can be bad news for shareholders. But really — if a company is doing a split to stay listed — it had clear problems before the split.

Here’s an example … One requirement to stay listed on Nasdaq is that the company’s stock price has to be above $1. The following is taken from a letter from the SEC to Accentia Biopharmaceuticals, Inc. (NASDAQ: ABPI) regarding its stock price back in 2008:

“Marketplace Rule 4310(c)(8)(E) states that, ‘Nasdaq may, in its discretion, require an issuer to maintain a bid price of at least $1.00 per share for a period in excess of ten consecutive business days, but generally no more than 20 consecutive business days, before determining that the issuer has demonstrated an ability to maintain long-term compliance…’”

This is part of the warning the SEC issued ABPI about getting its stock price over $1 per share. If ABPI didn’t comply, it would be delisted from Nasdaq … it was eventually delisted.

When companies receive letters like this, they almost always do a reverse split to meet the requirement.

See why reverse splits are normally bad news for long-term investors? It can indicate the long-term failure of a company to consistently meet a major exchange’s listing requirements — not good.

Reverse Split Calculator

Now that you know a little bit about reverse stock splits and what they mean, I want to help you understand how to calculate the share price of a recent reverse split.

It’s actually pretty simple. When a company announces it’ll do a reverse split, it also has to announce what that split number will be.

Here’s another theoretical example. The same concept applies to a real stock that does this kind of split … and we’ll cover some real examples later.

Let’s say Company A announces a 1:10 reverse split…

This means that for every 10 stock shares a shareholder owned before the split, they’ll now own one.

Now, suppose Company A had a share price of 50 cents before the split. To find out the stock price after the split, just multiply the share price by 10. In this case, a 1:10 reverse split would mean Company A would then trade for $5 per share.

Most stock prices won’t be this simple — the price obviously won’t always be a round number. Also, every split is different. Some companies only do a 1:2 reverse split, while others might do 1:30 or even 1:50.

Whatever the case, just take the last number of the ratio and multiply it by the share price to find the company’s post-split price per share.

Reverse Stock Split Examples

Let’s get into some real examples.

A lot of penny stocks do reverse splits at some point … not every penny stock, but a lot.

Pro Tip: Know how to find out about reverse splits.

Reverse stock splits can influence stock prices after the split.

Again, the split doesn’t change the company’s value — but it can highlight some underlying motive for the company. So how can you find news about reverse splits … or any news relevant to stocks?

Use a screener like StocksToTrade. Its new Breaking News feature alerts traders to the hottest news — like reverse stock splits. This tool is helping me trade the best opportunities in this insane market. Check it out:

Full disclosure: I helped develop and design StocksToTrade, which is why I think it’s so great for trading penny stocks.

Want to better understand penny stocks and how they move? Read “The Complete Penny Stock Course” by my student Jamil. He’s organized all my lessons about this niche into one incredible resource. Don’t have it? Get your copy now.

Now, let’s check out a few examples of reverse splits.

More Breaking News

- Datadog Battles Price Target Reductions Amid Growth Hopes

- Credo Technology Unveils AI Innovation and Announces 3M Partnership

- Supreme Court Greenlights New Gold’s Game-Changing Acquisition by Coeur Mining

- Red Cat Holdings Poised for Growth as Drone Orders Surge

XpresSpa Group, Inc (NASDAQ: XPSA)

This is a reverse split on a stock I traded before the split. It was running slightly before I traded it, but the day I traded it, the ticker had solid news.

I made $1,605 on this ticker on a dip off of its highs.* You can check out my trade on Profit.ly.

The reverse split on this stock took place on June 11, 2020 — long after I had taken my trade on it.

Notice how on the chart, the stock price jumped way up, but on low volume … That’s because it split. Normally, a gap like that would be followed by a ton of volume coming in, but not on a stock split like this.

I don’t know why XSPA decided to do a reverse stock split, and I won’t waste my time researching it right now. If the stock drops solid news and becomes in play, that’s what I really care about.

Sonnet BioTherapeutics Holdings, Inc. (NASDAQ: SONN)

This reverse stock split happened on April 2, 2020. It was actually a 1:26 split — 26 shares of the stock before the split turned into one share after the split. That’s a pretty big jump.

Notice how a few days after the split, the stock got a ton of volume and had a massive run up to around $16. This is pretty common with reverse stock splits — but it doesn’t mean it’ll happen every time.

Remember, a lot of scammy companies use reverse stock splits as a way to partake in toxic financing. That usually means it’ll pump its stock price to raise money. That’s normally clear by the candle on the daily chart.

In the case of SONN, it hit a high of over $16 on the day it dropped news, before falling back under $10. It wouldn’t be unheard of if SONN dumped a lot of its shares on that run.

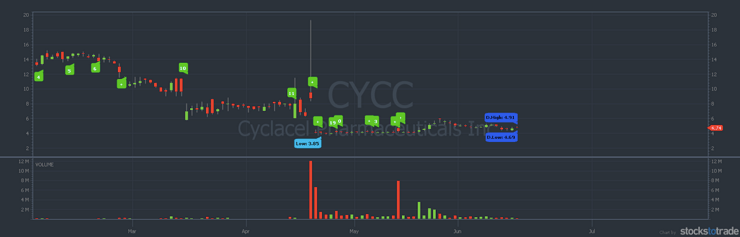

Cyclacel Pharmaceuticals, Inc. (NASDAQ: CYCC)

Notice a similar pattern here? This stock split on April 15, 2020 — just a few days before its massive run to about $19 per share. But…

Just like SONN, CYCC appears to have engaged in some toxic financing. Look at the candle on the day of its run. The large wick shows how high it got before falling back to new lows on the day.

More than likely, CYCC had shares it wanted to unload, so it released a fluffy press release to build some hype … That’s one more reason why you can’t believe the hype.

It’s OK to trade these moves — don’t get me wrong. But a lot of these companies release news to pump up their stock prices short term. That’s why I get in and out of these trades fast.

Find out what stocks I’m watching every week. Sign up for my weekly watchlist — it’s completely free of charge.

Frequently Asked Questions About Reverse Splits

Still have questions about reverse stock splits? That’s OK. They can be confusing to newer traders.

Let’s tackle some common questions I get about reverse splits…

Is It Possible to Make Money on a Reverse Stock Split?

You can’t make any money by being in the stock before it splits. Remember, the only change is that the stock price increases because the number of shares proportionately decreases.

Reverse splits normally have a deeper reason. If a company does a split to try to pump up its stock price, you may have reason to put that stock on your watchlist. Just make sure you wait for a pattern to present itself before trading it.

Is a Reverse Stock Split Legal?

Reverse stock splits are completely legal … but that doesn’t mean they’re always ethical. There’s a reason most big companies don’t do reverse splits — these companies are in solid financial standing.

But a lot of penny stocks aren’t usually in the same position. They may do reverse splits to raise money or meet compliance guidelines.

That can mean the company isn’t doing well financially, so it resorts to manipulating its stock price to make money.

That’s not always the case. But I’ve seen a lot of companies over the past 20+ years of my trading resort to splits to raise money. And that can hurt the average retail investor.

Do You Lose Money in a Reverse Split?

If you own shares, you won’t lose money in a split. All the split means is that your share count will decrease and the price of your new and lesser stock will increase proportionately.

But you can potentially lose money if the company engages in toxic financing. A reverse stock split can be a bad indication for long-term potential, but that’s not always the case.

If a company you’re invested in does a reverse stock split, it’s smart to do some digging and see what’s really happening.

What Is a 1 for 25 Reverse Stock Split?

Sometimes, this is the format you’ll see for a split announcement. Earlier, I had an example of a 1:10 split. In this case, a 1 for 25 split would look like 1:25.

Conclusion

Hopefully, by now, you’ve learned far more about reverse splits.

They can sound confusing, but they’re really not. It just means that the company doing the split is increasing its stock price by decreasing the number of shares.

If you see this happening, do some research if you want to find out why. There’s normally an underlying reason for the split … like the company is at risk of being delisted or in serious financial trouble.

There can be trading opportunities with reverse splits, but you’ve gotta be prepared. That’s exactly what I teach in my Trading Challenge. I use my 20+ years of experience in the markets to teach dedicated students how to think for themselves in the markets.

It’s not easy … but you get to trade alongside me and my top students every day. If you’re ready to really commit, apply to my Trading Challenge. Now, if you’re looking for hot stock picks, don’t waste your time or mine. But if you’re ready to really learn this niche — and potentially change your life — apply today.

What do you think about reverse splits? Leave a comment and let me know.

Leave a reply