Imagine you made $1 Million…all before your 30th birthday…

What’s the first thing you would do?

Treat yourself to dinner?

Buy a new car?

Bryce Touhey…called his mom.

2 great moments from when @TraderBryce crossed $1 million in trading profits on Monday, 5 years into his journey & 1 week before his 25th birthday! Get inspired, retweet & bookmark this & promise to study hard enough to become my next millionaire https://t.co/occ8wKmT5U student! pic.twitter.com/Rt5BNzzRLe

— Timothy Sykes (@timothysykes) February 1, 2023

What I love about Bryce is that he doesn’t take anything for granted.

In fact, his first post on Twitter gave readers a look at the biggest lessons he learned along the way.

$1,000,000 Milestone: ✅

A bit late on this post, been taking the past few days to trade and rest. But this is my personal official post for crossing the $1M mark – truly a dream come true.

Below will be a thread of some of my biggest lessons for anyone who has the same dreams pic.twitter.com/Xx4bhz6ieA

— Bryce Tuohey (@TraderBryce) February 1, 2023

I want to take this a step further and dig into the why behind his 5 lessons.

This will help you understand how to incorporate them into your strategy and make you a more effective trader.

Table of Contents

#1 The Journey is Long

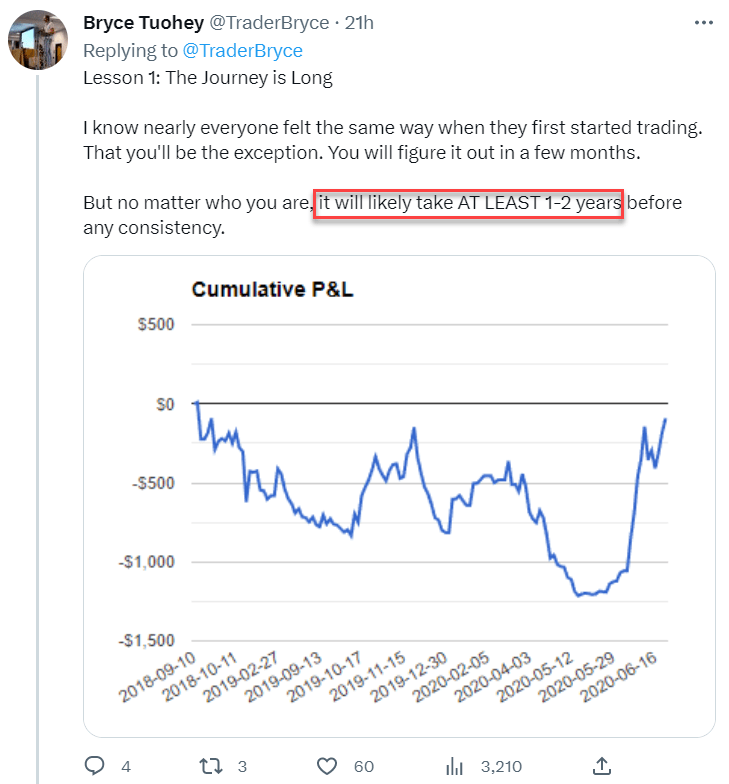

I have to start this one with a screenshot of Bryce’s tweet:

I highlighted the key phrase that says it all.

Traders want to know how long it takes to become profitable.

It’s different for everyone, with the key being how much quality time you spend studying and learning.

If you’re like Jack Kellogg and eat, sleep, and breathe trading, you can quickly become profitable.

But that’s more the exception than the rule.

Most folks work full time, and have families or other obligations that limit their hours.

That doesn’t mean you can’t become a profitable trader in short order.

Many of my Millionaire Challenge students like Paul Delgado split their time.

If you want to be successful, then you need three things:

- Patience

- Dedication

- A proper education

Don’t expect things to happen overnight.

Just look at how long it took Bryce before he even turned a profit.

Give yourself the space to work hard and study.

#2 Journaling

Can you remember every trade you took in the last week?

Not just the win and loss counts but the exact day, price, risk, exit, profit, etc?

What about over the last six months?

Unless you’ve got MENSA style memory, you can’t and shouldn’t try to recall every trade you make.

Instead, keep a journal.

No other tool will help you improve faster.

It’s like having your own personal roadmap to success. And you don’t need anything fancy. A simple excel spreadsheet will do just fine.

You want to keep enough information so you can identify patterns and trends, spotting weak areas and strengths.

More Breaking News

- Alibaba’s Intime Department Store Sale: A Strategic Move or Loss?

- Growth or Bubble? Analyzing the Current Surge in TeraWulf

- Growth or Bubble? Unpacking the Fast Rise of AppLovin’s Stock

That’s how you learn what to avoid and when to lean into a trade.

# 3 Risk Management

I say it a lot, but lose small and fast.

The way I trade if the stock doesn’t do what I want quickly, I cut it loose.

Far too many traders hang on to losing positions, hoping it will turn around.

It’s a fatal trap that captures folks over and over.

Just as important, you want to size your positions correctly.

Know when to reduce your share count and when it’s reasonable to put a little extra on the table.

Bryce put together a great YouTube video that covers these topics and many more.

Use it as a barometer for your own risk management. See if you are correctly controlling your trades.

# 4 Trading Friends

Bryce isn’t wrong when he says, “trading is lonely.”

It’s one of the reasons I created the Millionaire Challenge.

I wanted a place for traders to not only learn the right skills, but have a chance to collaborate with others.

When I started, there weren’t discord servers or Twitter feeds.

AOL was all we had and those chat rooms were awful.

Other traders can help you craft ideas, keep you on your game, and help you work through problems.

# 4 Mentorship

The road to riches is long enough.

Why not shorten the learning curve?

I’m not bragging when I say I can teach you how to become a successful trader.

In fact, I want you to be skeptical.

My proof will mean so much more that way.

Bryce makes my 32nd millionaire student.

I’ve taught folks for more than two decades and helped people achieve things they never thought possible.

Sure, I nor penny stock trading is right for everyone.

But what I teach works.

All my trades are posted here on Profitly to see whether you’re a member or not.

You can read the stories of many of my students here.

Do your research.

Read testimonials. I’m sure they won’t all be flattering.

But you’ll quickly realize that what I teach is the real deal.

I can help folks become successful traders.

It all starts with my Millionaire Challenge.

–-Tim

Leave a reply