People thought I’d lost my mind when I called for a crash last November. No one wanted to believe the epic run would end.

Seven months later, here we are hundreds of points lower.

The talking heads on CNBC tell you to hold onto crashing stocks.

Don’t get blinded by their fancy suits. They’re most likely fancy promoters pumping up their positions.

Of course, a market sell-off is bad for stocks and the economy. So being right on the crash, is not something I am happy about.

But when I see parabolic moves creating bubbles, I have to call them out, regardless of who’s behind them.

The good news is that I’m starting to see a lot of signs we’re nearing a bottom in the short term.

And that’s opening up HUGE opportunities for traders.

Rather than catch a falling knife, I want to show you how to play market bounces in a way that minimizes risk and maximizes potential gains.

Believe it or not, I’m starting to eyeball big names like Cathie Woods’ Ark Innovation ETF (ARCX: ARKK) and Berkshire Hathaway Inc. Class B (NYSE: BRK.B).

But I don’t want to step in without taking these three precautions.

Table of Contents

Look For Volume to Confirm Reversals

One of my favorite setups right now is the morning panic dip buy.

Essentially, I wait for a stock to drop and then watch the price action to see when promoters and other traders are jumping in to keep shares afloat.

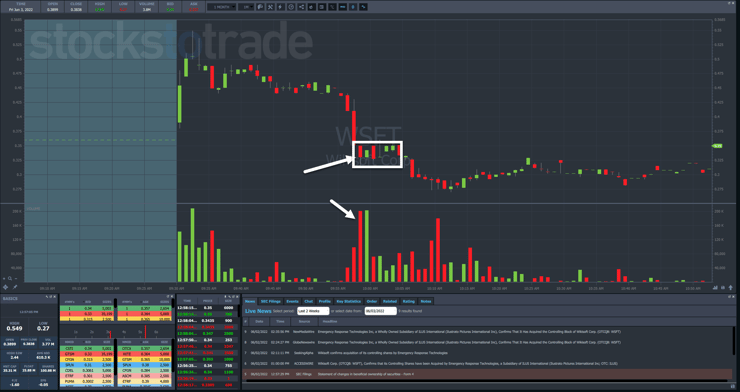

The other day, I showed what this looked like in WikiSoft Corp. (OTC: WSFT).

This may be a one-minute chart on an OTC stock, but it applies to any other chart.

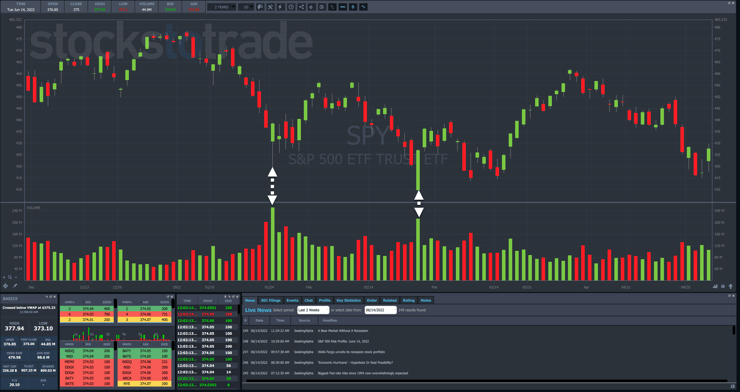

Take a look at the SPDR S&P 500 ETF Trust (ARCX: SPY) daily chart below.

Other than there being no premarket and open, this could be a penny stock chart.

Just like WSFT, the SPY found a low when volume increased and price action reversed the trend.

When I talk about ‘staying safe’ I mean waiting until there’s a clear opportunity.

Yes, I want to sell into strength and buy into weakness. But that’s only half of the equation.

The other half is to have a plan that uses price action to identify a potential bottom.

Keep Risk Small

It’s no secret that I teach my students to lose small and fast.

In fact, I’ve got my trading so dialed in that I often manage to take small winners that might otherwise be losers.

Managing risk comes down to just two things:

- Distance to your stop

- Position size

With every entry, I want to enter a position as close to my stop as possible while giving the trade enough room to play itself out.

That’s why some of my trades go in at $0.067 and out at $0.066 for a loss.

On the flip side, the bounces out of these bottoms should create far more profit potential than I risk.

And with this market’s volatility, I can expect bigger price swings than normal.

Because of that, I want to reduce my position size accordingly.

Especially when I’m testing a bottom, there’s no reason to take a huge position and risk getting the rug pulled out from under me.

More Breaking News

- Navigating the Rising Star: Is Innoviz Technologies the Game-Changer in Autonomous Vehicles?

- XHG’s Unexpected Surge: An Opportunity or Mirage?

- Is Humacyte’s Innovative Breakthrough Signaling a Stock Rebound?

As markets return to normal and more opportunities present themselves, I can increase my risk over time.

Look for Confirmation

In 2020, when the market bottomed, it was only a few stocks at first like Amazon.com Inc. (NASDAQ: AMZN).

It wasn’t until several months later that the rest of the market really began to pick up steam.

And that’s when all the preparation my students did paid off.

The next year and a half was incredible trading for penny stocks and swing traders.

But I learned the hard way that markets like to fake out traders.

So, before I get super bullish on anything, I like to see confirmation that markets have indeed found a bottom.

I’m talking about getting beaten down sectors moving higher along with completely unrelated industries like oil and biotech.

Most folks refer to this as market breadth. The idea is that a bull market moves all stocks, save for maybe a few outliers.

The Bottom Line

Markets can and often do stretch well beyond what most people think.

I’ve never found it useful or profitable to step in front of one in a violent decline.

There are plenty of opportunities out there. You just have to know where to look.

And I plan to take that to the next level with Operation Overseer.

This is going to be HUGE!

— Tim

Leave a reply