Penny stocks under 10 cents have been HOT this year! Do you know how to trade them?

I’ve been trading penny stocks for 20+ years, so I’ve learned a few things about this niche.

And I’ve seen firsthand how trading penny stocks have the potential to change your life. It sure changed mine. Now I’m paying it forward by teaching everything I know.

So in this post, I’ll share some of my own recent trades of penny stocks under 10 cents. And I’ll give you a list of other penny stocks to watch. Plus, learn the strategy that can help you spot and trade the top penny stocks…

Let’s do this!

Table of Contents

- 1 What Are the Best Online Brokers for Penny Stocks Under 10 Cents

- 2 Should You Trade Penny Stocks Under 10 Cents?

- 3 Watch this video on YouTube

- 4 10 Penny Stocks Under 10 Cents to Watch

- 4.1 World Series of Golf, Inc. (OTCPK: WSGF)

- 4.2 Fiore Cannabis Ltd. (OTCQX: FIORF)

- 4.3 Daniels Corporate Advisory Company, Inc. (OTCPK: DCAC)

- 4.4 BioTech Medics, Inc. (OTCPK: BMCS)

- 4.5 County Line Energy Corp. (OTCPK: CYLC)

- 4.6 Medical Marijuana, Inc. (OTCPK: MJNA)

- 4.7 Resort Savers, Inc. (OTCQB: RSSV)

- 4.8 Optec International, Inc. (OTCPK: OPTI)

- 4.9 GiveMePower Corporation (CVEM: GMPW)

- 4.10 Starstream Entertainment, Inc. (OTCPK: SSET)

- 5 Strategies To Trade Penny Stocks Under 10 Cents

- 6 2 Penny Stocks Under 20 Cents to Watch

- 7 2 Penny Stocks Under 50 Cents to Watch

- 8 What Are Some Top Penny Stocks Under $1 To Watch in 2020?

- 9 Conclusion

What Are the Best Online Brokers for Penny Stocks Under 10 Cents

Students always ask me which brokers I use and which scans I use. I use the brokers that suck the least for my needs. Do your research before picking a broker. You can read more about the brokers I use here.

For scans, I use StocksToTrade. It has broker integration so you can trade right through the platform. It’s designed specifically to find the low-priced stocks I love to trade. That’s because I proudly helped design and develop StocksToTrade and am an investor in it.

Then students ask me, “Yeah, but what else?” Nothing! For me, there are no alternatives! My opinion isn’t going to change. Why people choose to ignore what I say over and over is beyond me…

Should You Trade Penny Stocks Under 10 Cents?

I love cheap stocks. And we’ve seen a lot of penny stocks under 10 cents running this year. I’ll share some of my trades and some penny stocks to watch later in this post, but first…

Trading these stocks is how I’ve made over $6 million in profits.* If it wasn’t for penny stocks and trading I wouldn’t have this life I love — traveling the world, donating so much to charity, and spoiling my parents.

(*Please note that these kinds of trading results are not typical. Most traders lose money. It takes years of dedication, hard work, and discipline to learn how to trade, and individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose.)

I think penny stocks have the most potential for growing small accounts and helping people find financial freedom. Most people are working at jobs they hate. It’s sad…

I became a teacher so I could help people find a different path. You can have freedom from your 9-to-5 job.

You don’t have to be a rocket scientist or even good at math — but you do have to be dedicated to your education.

I’m not that smart. And apologies to my top students, but I don’t think they’re that smart or special either. We’re just ordinary people who are dedicated and disciplined to building a better life.

I think you can do it too. Start with my…

Top Resources for Trading Penny Stocks

I have free resources, like my penny stock guide and my YouTube channel.

Then for a small investment, you can join my 30-Day Bootcamp. It’s a month’s worth of lessons with daily assignments and homework. You can work at your own pace and repeat it as many times as you like.

The Bootcamp also comes with “The Complete Penny Stock Course” book and my “Pennystocking Framework” DVD. It’s an amazing value at under $100!

If you’re truly dedicated to changing your life and finding financial freedom, STUDY HARD!

It’s not easy, but as my top students and I’ve proven, making money with penny stocks is possible.*

10 Penny Stocks Under 10 Cents to Watch

Below is a list of 10 penny stocks under 10 cents to watch. This isn’t a trade list. I don’t trade every stock on my watchlist. Watch them for the right trading opportunity that fits your strategy.

World Series of Golf, Inc. (OTCPK: WSGF)

World Series of Golf, Inc. is a sports entertainment company based in Las Vegas, Nevada. It hosts amateur golf tournaments. But on November 10, it announced a new business direction…

It acquired another company called Vacaychella. Its goal is to provide peer-to-peer lending services to short-term rental owners and investors. It hopes to expand in the future to include other services like discounted supplies, insurance, and maintenance for owners.

I bought 327,000 shares at $0.0092 at the market open when StocksToTrade Breaking News Chat alerted the news. I sold into the morning spike at $0.0125 for a profit of $1,079 or 35.8%.*

The stock ended up being a huge winner. I sold way too soon — as usual.

With the anticipated Airbnb initial public offering (IPO) in the future, this could be a potential sympathy play.

More Breaking News

- Guardant Health: Unraveling the Surprisingly Flourishing Revenue Trajectory

- Walgreens Boots Alliance Faces Probes: Does This Signal Troubling Waters for Investors?

- How Strong Sales and Optimism Drive Urban Outfitters Stock Higher

Fiore Cannabis Ltd. (OTCQX: FIORF)

Fiore Cannabis is a cannabis cultivator. On November 12 it announced it had restructured its debt and convertible shares.

Marijuana stocks have seen renewed interest following the election. This stock is also close to a multi-month breakout above the $0.102 area.

Daniels Corporate Advisory Company, Inc. (OTCPK: DCAC)

I traded this stock on November 4 when the StocksToTrade Breaking News team alerted a press release. The company announced it secured financing to obtain new trucks for its rental fleet.

I bought 98,000 shares right at the market open at $0.012. My profit goal was 10%–20%. There was a beautiful morning spike, and I got out with a 58.3% gain when I sold at $0.019 for a total profit of $686.*

I rebought it in the afternoon with a much bigger size position. It couldn’t make new highs so I played safe and took profits. On that trade, I made 8% for $1,385.*

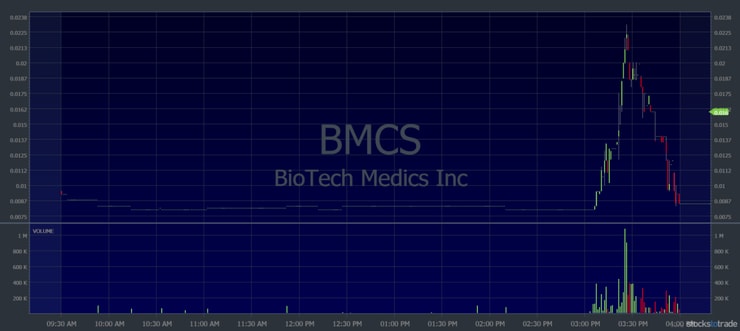

BioTech Medics, Inc. (OTCPK: BMCS)

On November 9 I bought this stock in the afternoon after it was spiking on updated filings. It was another play alerted by STT’s Breaking News Chat. I was planning to hold overnight if it could close strong.

I bought 76,500 shares at $0.0175. It started weakening, so I took profits. I sold at $0.019 for a profit of $115* and moved on to DSG Global Inc. (OTCQB: DSGT), which was closing strong. More on that trade in a bit…

County Line Energy Corp. (OTCPK: CYLC)

Country Line Energy is an oil and gas acquisition and exploration company. There’s no recent news on this company, but it had increased volume and price on November 13.

With crude oil recently increasing in price and increased interest in energy stocks, this is a penny stock to watch.

Medical Marijuana, Inc. (OTCPK: MJNA)

MJNA is a low-priced marijuana stock. I traded it on November 6 when it was spiking onto the close.

It’s a former runner, and it was a breakout play. I held 650,000 shares over the weekend from $0.0235 and sold Monday morning at $0.0272 for a profit of $2,405.*

After the Monday morning gap up, the stock had a morning panic. So I dip bought and made another small profit of $332.*

Resort Savers, Inc. (OTCQB: RSSV)

Resort Savers offers an interesting mix of services … It offers nutritional and fitness consultations and sells supplements. It’s also involved with trading oil, gas, and lubricant products.

This stock’s another former runner. In July, it went from 6 cents to 50 cents in two days. There’s been increased volume in the stock and it’s close to a multi-day breakout level over the $0.075 area.

Optec International, Inc. (OTCPK: OPTI)

On November 5 I bought this stock running on contract news. It was another play alerted by the StocksToTrade Breaking News Chat. (Starting to see why I love this feature so much?)

I bought 187,000 shares at $0.062 at the open and sold into the morning spike at $0.079 for a profit of 27% or $3,179.*

Then I rebought it after a big dip from its highs. It didn’t have a strong bounce, but I got out for a small profit of $386.*

This stock is yet another former runner, and my trades are a good example of how small gains add up. You don’t need to go for home runs — take singles.

GiveMePower Corporation (CVEM: GMPW)

Despite what the name implies, this isn’t an energy company. It’s an investment company, investing in bonds, warrants, options of companies, and real estate.

And it’s a caveat emptor stock. Buyer beware — it’s super sketchy.

It could provide a breakout trading opportunity over the 7 cent level. Trade safely and take profits. Don’t trust these shady companies.

Starstream Entertainment, Inc. (OTCPK: SSET)

Starstream Entertainment is an independent production company focused on event-staffing and brand-building for clients.

In an August 20 press release, the company announced its subsidiary began promoting multiple premium alcohol brands. On November 6, it announced a promotional vehicle program that will go on tour to promote brand awareness.

The stock is trading right at the multi-day breakout level of 6 cents. I’d want to see high volume and strength through the breakout level before this is a penny stock to buy.

Strategies To Trade Penny Stocks Under 10 Cents

As you can see from my recent trades, my advice for strategies to trade penny stocks is…

Use the StocksToTrade Breaking News Chat Feature

You can see from a lot of my trades that the StocksToTrade Breaking News Chat has been a game-changer for my trading this year.

There are so many informational inefficiencies in penny stocks, it’s crazy. When you get the news early, it can help you tremendously.

I owe a huge portion of my trading profits in 2020 to the Breaking News Chat alerts. They helped me act fast.*

Plus, StockToTrade has so many other useful tools, like built-in watchlists and scans, customizable charts and indicators. I use these features every day to find opportunities.

2 Penny Stocks Under 20 Cents to Watch

Penny stocks under 10 cents aren’t the only stocks running lately. Here are a few penny stocks under 20 cents that I traded recently…

DSG Global Inc. (OTCQB: DSGT)

On November 9, DSGT and its automotive division subsidiary announced that it had received $5.7 million in pre-orders for its electric vehicles.

I bought 45,000 shares at $0.215 right before the close for an overnight hold. The next morning there was a small gap up and I sold at 23 cents for a profit of $675.*

J.C. Penney Company, Inc. (OTCPK: JCPNQ)

On November 10, J.C. Penny announced it would emerge from bankruptcy before Thanksgiving after a court-approved sale of the company. Later it announced a new clothing brand for women that mixes style with comfort.

After its run-up on the news it was emerging from bankruptcy, I traded this stock on November 11. It was an afternoon trade that was a variation of my favorite pattern. I bought 29,500 at $0.1055, got a decent bounce, and sold at $0.115 for a profit of $280.*

The overall market was tanking so I took quick profits. Always be ready to adapt your trading plan.

2 Penny Stocks Under 50 Cents to Watch

Marijuana stocks have seen some renewed interest since the election and the promises of legalization. Here are two marijuana penny stocks under 50 cents to watch…

IntelGenx Technologies Corp. (OTCQB: IGXT)

IGXT is a Canadian drug-delivery company. It manufactures oral thin film products for pharmaceuticals and entered the cannabis market with a non-prescription cannabis-infused oral film.

On November 12 it reported its third-quarter earnings and provided company updates. The stock was up two days in a row following the earnings report.

Auxly Cannabis Group Inc. (OTCQX: CBWTF)

This cannabis stock has no recent news releases but has been running. It even released a press release last month saying it doesn’t know why its stock is up (sure thing). And it reported there’s no material change in the business.

That resulted in one big candle back on October 21. But again the stock is running…

Could it be a pump? Maybe. But it’s also in the weed sector that’s heating up, and it’s close to a breakout in the 32-cent to 35-cent range.

What Are Some Top Penny Stocks Under $1 To Watch in 2020?

Here are a few penny stocks under a dollar to watch. Keep watching big percent gainers and stocks in hot sectors with news…

Integrated BioPharma, Inc. (OTCQB: INBP)

INBP and its subsidiaries are in the vitamin and supplement business. It reported third-quarter earnings on November 12.

Learn more about earnings and contract winners with my most comprehensive DVD “How to Make Millions.” It’s 35 hours of education on my patterns and strategies. Bonus: All proceeds are donated to charity.

Global Warming Solutions, Inc. (OTCPK: GWSO)

GWSO is a developmental company looking for solutions to reduce global warming and its effects. It has a few products in development.

On November 10 it announced the launch of a wholly-owned subsidiary to develop electric vehicles and charging solutions. On November 12 it dropped a press release saying it’s working on developing a power generation device that’s 100% renewable and emission-free.

You know what they say … “If it sounds too good to be true, it probably is.” But hey, I’ve been wrong before…

Conclusion

I hope my trades help you realize the potential of trading penny stocks.

I always like big percent gainers, preferably with a catalyst and volume. I get in and out of trades quickly. And I don’t trust these shady companies…

Don’t get burned like I did when I invested in a penny stock and lost half a million of my own money. (Read about it in my book “An American Hedge Fund.”)

If you’re in a trade and it doesn’t do what you want or expect — get out!

Rule #1 is to cut losses quickly. Keeping losses smaller than your gains is how small gains add up over time.

If you’re serious about your education, apply for my Trading Challenge. I don’t accept everyone. I don’t want lazy students!

Be ready to work your butt off if you want to change your life. Apply now to get to work.

What do you think of these penny stocks under 10 cents? Let me know in the comments … I love to hear from my readers!

Leave a reply