Choosing a reliable broker is your first stop in penny stock trading — this article analyzes the pros and cons of Chase’s brokerage platform.

J.P. Morgan Chase is one of the biggest banks in the country. It’s also a relative latecomer to the online trading ranks, competing with the likes of Wealthsimple Trade, Charles Schwab, Interactive Brokers, and many more. This can be both a good and bad thing, depending on your trading style.

Is J.P. Morgan Chase a good penny stock broker? Read on to see the penny stock trades you can make with this broker!

Table of Contents

- 1 Trading on Chase.com

- 2 Can I Buy Penny Stocks on Chase?

- 3 The OTC Marketplace on Chase

- 4 How to Find Penny Stocks on Chase.com

- 5 Chase Penny Stock Fees

- 6 10 Penny Stocks to Watch for on Chase.com

- 6.1 1. Amesite Inc (NASDAQ: AMST) — The AI Product Launch Penny Stock

- 6.2 2. Moolec Science SA (NASDAQ: MLEC) — The USDA Approval Fake Meat Penny Stock

- 6.3 3. Edible Garden (NASDAQ: EDBL) — The Reverse Split Agritech Penny Stock With Strong Earnings That’s Still in Delisting Danger

- 6.4 4. Matterport Inc (NASDAQ: MTTR) — The Ex-SPAC Tech Stock That’s Being Acquired for a 207% Premium

- 6.5 5. Indonesia Energy Corp Ltd (AMEX: INDO) — The Oil Stock Benefitting From the Oil Shock

- 6.6 6. Canopy Growth Corp (NASDAQ: CGC) — The Legal Weed Stock With the Huge Catalyst

- 6.7 7. Onfolio Holdings Inc (NASDAQ: ONFO) — The Holding Company With an AI Pump in Its Past

- 6.8 8. SciSparc Ltd. (NASDAQ: SPRC) — The AI Biotech Penny Stock

- 6.9 9. Auddia Inc (NASDAQ: AUUD) — The Reverse Split AI Audio Stock

- 6.10 10. Beamr Imaging Ltd (NASDAQ: BMR) — The NVIDIA Catalyst AI Penny Stock

- 7 Key Takeaways

Trading on Chase.com

Chase.com’s online brokerage platform is called J.P. Morgan Self-Directed Investing. As the name implies, this platform is geared toward investing, not penny stock trading. It gives users access to stocks, options trades, ETFs, mutual funds, and other investment options.

J.P. Morgan Chase doesn’t offer a desktop trading app, just web-based and mobile options. Both versions of the platform let users customize the platform layout and screener tool settings. However, this customization is basic compared to dedicated penny stock trading apps like StocksToTrade.

You can find listed Nasdaq and NYSE stocks on Chase’s app. If you’re looking to trade stocks from major artificial intelligence firms, biotechs, energy companies, and other established corporations, you won’t have a hard time finding them.

You’ll have a harder time finding cheap stocks and low-priced securities that aren’t listed on major exchanges. You can access the over-the-counter (OTC) markets through the app, but sketchier unlisted penny stocks won’t be tradeable. Crypto and NFT trading is also outside Chase’s purview.

At the time of this writing, margin isn’t available to most J.P. Morgan Self-Directed Investing account holders. If you want to trade on margin or use short selling as part of your strategy, you should look at other brokerages. The broker plans to roll out online margin trading more widely by the end of 2023.

Can I Buy Penny Stocks on Chase?

You can buy penny stocks or micro-cap stocks on Chase, but the selection is relatively limited. Any penny stocks listed on major stock exchanges are available to buy, but Chase doesn’t let you buy OTC stocks priced under $5.

On Chase, you’re barred from trading most of the OTC penny stocks that I watch. If you want to see why that’s a problem, subscribe to my NO-COST weekly watchlist here.

The OTC Marketplace on Chase

The Chase brokerage app doesn’t impose additional charges on OTC transactions. But this has a limited upside — like I said above, your selection is limited to OTC stocks priced at $5 or more. If you’re looking for wider access to the OTC market or pink sheet stocks, you should look for another online broker.

How to Find Penny Stocks on Chase.com

Chase.com’s basic stock screener lets you filter by price — to find penny stocks, search for stocks under $5.

You’ll need a more complete stock screener like StocksToTrade to narrow down your search results. I helped design StocksToTrade to match my trading needs, and its stock screener is no exception. It lets you search by:

- Percent gain over the previous trading day

- 52-week highs

- Volume

- Sector

- Float

There’s much more to every aspect of this pro-level trading platform. Sign up for a 14-day trial of StocksToTrade to see how it changes the way you trade — only $7!

Chase Penny Stock Fees

Chase has no penny stock fees or commissions on most trades, excepting regulatory charges and per-contract options fees. This falls in line with most other online trading options — brokers which charge for OTC transactions usually give traders access to all OTC stocks.

10 Penny Stocks to Watch for on Chase.com

My Chase.com penny stock picks are:

- NASDAQ: AMST — Amesite Inc — The AI Product Launch Penny Stock

- NASDAQ: MLEC — Moolec Science SA — The USDA Approval Fake Meat Penny Stock

- NASDAQ: EDBL — Edible Garden — The Reverse Split Agritech Penny Stock With Strong Earnings That’s Still in Delisting Danger

- NASDAQ: MTTR — Matterport Inc — The Ex-SPAC Tech Stock That’s Being Acquired for a 207% Premium

- AMEX: INDO — Indonesia Energy Corp Ltd — The Oil Stock Benefitting From the Oil Shock

- NASDAQ: CGC — Canopy Growth Corp — The Legal Weed Stock With the Huge Catalyst

- NASDAQ: ONFO — Onfolio Holdings Inc — The Holding Company With an AI Pump in Its Past

- NASDAQ: SPRC — SciSparc Ltd — The AI Biotech Penny Stock

- NASDAQ: AUUD — Auddia Inc — The Reverse Split AI Audio Stock

- NASDAQ: BMR — Beamr Imaging Ltd — The NVIDIA Catalyst AI Penny Stock

Before you send in your orders, take note: I have NO plans to trade these stocks unless they fit my preferred setups. This is only a watchlist.

The best traders watch more than they trade. That’s what I’m trying to model here. Pay attention to the work that goes in, not the picks that come out.

1. Amesite Inc (NASDAQ: AMST) — The AI Product Launch Penny Stock

My first Chase penny stock pick is Amesite Inc (NASDAQ: AMST).

This stock has its feet in two hot sectors:

- The biotech industry.

- The AI industry.

These are probably the two hottest sectors in the stock market right now. We’ve seen individual AI and biotech spikes since early 2023.

AMST pulls momentum from both of these sectors, that’s one of the main reasons I’m excited about this stock.

Here’s the news that sent it higher:

On April 24 the company announced it successfully launched an AI app that will reportedly empower 5.2 million nurses. Share prices spiked 110% that day,

I grabbed 15% of the move with a starting stake of $14,742. My trade notes are below:

The reason I was able to trade this stock so early is because Breaking News alerted me to the move.

Now, this stock is still in play … But make sure you’re watching Breaking News for the next stock to start spiking.

AMST’s price action shows sideways consolidation right now … The consolidation is a hint that the price could spike higher!

On the chart below I drew a line that shows the $3 support level on AMST, every candle represents 10 minutes:

Plus, StocksToTrade shows that the float is only 1.7 million shares.

Stocks with a float below 10 million shares are considered to have a low supply. And the low supply of shares will help prices spike higher when demand increases.

AMST is still deciding whether it wants to break out …

But all of the factors point toward an explosive push upward.

2. Moolec Science SA (NASDAQ: MLEC) — The USDA Approval Fake Meat Penny Stock

My second Chase penny stock pick is Moolec Science SA (NASDAQ: MLEC).

On April 22, MLEC announced USDA approval for its plant-grown animal protein.

For a few years now, there’s been a push toward more sustainable animal protein. As it turns out, the meat industry produces quite a bit of pollution. Not to mention the higher prices of grocery store meat amid sticky inflation across the entire economy. Plant grown protein could offer lower costs in the long term.

There are attractive aspects of the fake-meat industry. And for a penny stock, any government approval can act as a HUGE catalyst.

When MLEC announced the USDA news, prices spiked 130% in one day. I snagged a quick 5% before the momentum switched.

These plays can be fast!

My trade notes are below, with a starting stake of $15,405:

The stock dipped after the initial day of spiking. It wasn’t able to hold support like some of these multi-day runners …

But I’m still watching it because past spikers can spike again.

We’ve already seen MLEC react well to bullish news. All it takes is another bullish catalyst to get things moving.

More Breaking News

- J.M. Smucker Sees Subtle Shifts: A Recipe for Revival or Retreat?

- Is Hims & Hers Health Poised to Capitalize on GLP-1 Shortages?

- Vuzix Stock Price Drama: Are the Recent Gains Justified or Temporary?

3. Edible Garden (NASDAQ: EDBL) — The Reverse Split Agritech Penny Stock With Strong Earnings That’s Still in Delisting Danger

My third Chase penny stock pick is Edible Garden (NASDAQ: EDBL).

On April 2, EDBL announced an incoming 1-for-20 reverse split.

For those who are unaware: A reverse split lowers the overall supply of shares. As a result, each individual share becomes more expensive.

Sketchy penny stocks tend to use reverse splits as a tool to inflate their share prices. See, stocks on exchanges like the Nasdaq have to adhere to certain listing requirements. One of them being a minimum share price above $1.

If the stock falls below $1, the company can always reduce the share supply to artificially push up prices. It’s a good sign for traders because we can see which stocks are willing to engage in shady activity that results in bullish volatility.

I don’t believe in the future of these stocks, I’m just riding the short term volatility.

The April 2 announcement and resulting volatility was a hint that this stock could spike again.

And sure enough, on April 17 the company spiked 170% after announcing first-quarter produce-revenue grew year-over-year by 40%. And cut-herb revenue grew by 200% within the same period.

The spike didn’t last long. Prices are on a bearish trajectory right now, back toward $1 …

Which means, it’s only a matter of time until we see EDBL try to spike the price again.

It shouldn’t be too difficult, since StocksToTrade shows the float is only 295k shares.

4. Matterport Inc (NASDAQ: MTTR) — The Ex-SPAC Tech Stock That’s Being Acquired for a 207% Premium

My fourth Chase penny stock pick is Matterport Inc (NASDAQ: MTTR).

On April 22, we learned that CoStar Group Inc. (NASDAQ: CSGP) would acquire MTTR for an equivalent value of $5.50 per share.

At the time of the announcement, MTTR was trading below $2. The price spiked 180% that day but never pushed above $5 …

When there’s an announcement that includes a definitive share valuation, we have to be careful about the spike.

Whereas other catalysts might mention value added, the news from MTTR mentioned a $5.50 per share valuation. We don’t know whether the stock will run that high, but it’s an important level to keep an eye on.

Currently, the stock is consolidating under $5. A break of that level could send it to $5.50 within a single day.

On the chart below, every candle represents fifteen minutes:

Use StocksToTrade to set a price alert on MTTR.

If it trades near the $5 level, we’ll get a notification!

5. Indonesia Energy Corp Ltd (AMEX: INDO) — The Oil Stock Benefitting From the Oil Shock

My fifth Chase penny stock pick is Indonesia Energy Corp Ltd (AMEX: INDO).

We’ve seen oil stocks spike as a result of rising global tensions in Eastern Europe and the Middle East.

- The war between Ukraine and Russia.

- The war between Israel and Hamas.

INDO is a perfect example.

Russia invaded Ukraine in February 2022. INDO share prices spiked 1,800% as a result.

Fast forward to April 12, 2024, we learned of an incoming offensive against Israel from Iran. It signaled an escalation of the war in the Middle East. And INDO share prices spiked 140% in response.

The chart below shows consolidation above $4 after INDO’s most recent spike. Every candle represents 15 minutes:

Unfortunately, the conflicts overseas don’t show any signs of cooling.

As traders, it’s our job to take advantage of volatile price action caused by hot catalysts. Keep an eye on this oil runner as the world continues to navigate dangerous war-time catalysts.

6. Canopy Growth Corp (NASDAQ: CGC) — The Legal Weed Stock With the Huge Catalyst

My sixth Chase penny stock pick is Canopy Growth Corp (NASDAQ: CGC).

The weed sector comes and goes. It’s never been the strongest batch of runners, but we have to respect CGC’s price action. The stock already spiked 231% between March and April.

This price action isn’t random.

There’s been a lot of talk about marijuana legalization recently. Both in the U.S. and worldwide:

- POTUS Biden and VPOTUS Harris both recently expressed an interest in reforming the U.S. approach toward marijuana.

- Germany decriminalized marijuana.

But CGC is also running thanks to a catalyst that was announced on March 14.

- There was news of a potential acquisition. The vote deadline for the acquisition was April 10. On April 15 we learned of a successful shareholder vote to endorse the acquisition.

I snagged a profit on March 22 thanks to the potential acquisition news. The price started running before we even learned of a successful vote.

Take a look at my trade notes below, with a starting stake of $21,420:

And now that the acquisition is successful, there’s a chance the price pushes even higher.

Below, a multi-month chart of the run shows support at $6. Every candle represents one trading day:

This stock is in play as long as it stays above $6!

7. Onfolio Holdings Inc (NASDAQ: ONFO) — The Holding Company With an AI Pump in Its Past

My seventh Chase penny stock pick is Onfolio Holdings Inc (NASDAQ: ONFO).

In June 2023 the company announced its intent to increase an AI business presence through acquisitions and by leveraging certain subsidiaries.

The chart didn’t spike like some of its peers in the same sector.

But I’m still watching the price action.

The company obviously knows what’s hot. They tried to inflate the price with an AI press release in June of 2023. That’s only a few months after the AI craze began.

Also, StocksToTrade shows that the float is only 3.2 million shares.

ONFO is a powder keg that’s waiting for the perfect spark.

8. SciSparc Ltd. (NASDAQ: SPRC) — The AI Biotech Penny Stock

My eighth Chase penny stock pick is SciSparc Ltd. (NASDAQ: SPRC).

This stock combines the two hottest sectors in the market.

- AI

- Biotech

It seems there’s a new batch of biotech stocks spiking every week right now.

The biotech sector has been hot in the past. It’s not a huge surprise to see these stocks spiking.

But it’s very exciting when we find stocks with a foot in two hot sectors instead of one.

Besides the double sector, SPRC has an incredibly low float.

StocksToTrade shows only 259k shares.

The chart also shows a huge history of spiking in 2023. Take a look below, every candle represents one trading day:

Just like ONFO, SPRC is a powder keg.

Get ready for the next spike …

9. Auddia Inc (NASDAQ: AUUD) — The Reverse Split AI Audio Stock

My ninth Chase penny stock pick is Auddia Inc (NASDAQ: AUUD).

Sketchy penny stocks hold reverse splits in an effort to prop up the share price.

The share supply is cut, thereby making every remaining share more valuable.

Penny stocks usually have to inflate their prices to meet exchange listing requirements. One of the requirements a company must follow to remain on the Nasdaq exchange is a share price above $1.

On February 23, AUUD announced a 1-for-25 reverse split set for February 27. This is clear evidence that the company will take action to prop up the price.

And it foreshadowed the spike in April.

On April 4 the company announced a new patent from the U.S. Patent and Trademark Office for its AI technology.

The price spiked 290%* in one day. The subsequent selloff was drastic, but prices are still hovering around support at $2. That’s a hint the price could push higher.

Plus, StocksToTrade shows the float is only 1.9 million shares.

Wait for the next catalyst to spike the price higher.

10. Beamr Imaging Ltd (NASDAQ: BMR) — The NVIDIA Catalyst AI Penny Stock

My tenth Chase penny stock pick is Beamr Imaging Ltd (NASDAQ: BMR).

On February 12, at 7 A.M. Eastern during premarket hours, BMR announced a partnership with NVIDIA Corporation (NASDAQ: NVDA).

NVDA is arguably the most popular company in the world right now. Definitely within the tech sector.

The stock is surging to new heights as businesses scramble for NVDA microchips. The massive tech stock is smashing company value records.

Take a look at the NVDA chart below, every candle represents one trading day:

A hook up with a sector leader like NVDA is huge news for a penny stock.

BMR spiked 1,500%* in less than 24 hours after the announcement. Since then the stock has lost 70% of its value.

But there’s a possible squeeze brewing.

It reminds me of another intense spiker that started running only a few days earlier on February 7. Another stock that we already covered …

MicroCloud Hologram Inc. (NASDAQ: HOLO) managed to spike 2,600%* in a similarly spectacular fashion.

The price slid lower, like BMR, but it consolidated for a few days and broke out to reach $98 per share!

HOLO was trading below $2 less than two weeks before … That’s a 6,400%* move. And BMR was trading below $3 before its recent spike …

This stock could wake up any day!

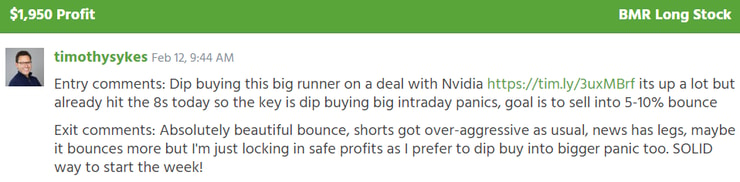

I’ve already traded it 3 times since the spike on February 12.

A starting stake of $16,575:

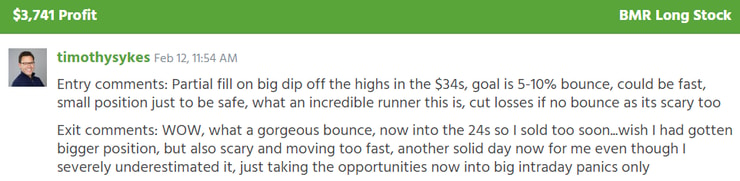

A starting stake of $16,710:

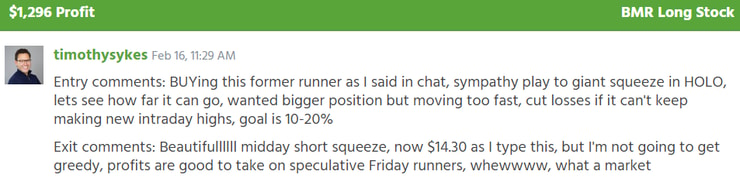

A starting stake of $15,696:

It’s not a 100% guarantee that BMR will push to new highs.

Nothing is guaranteed when it comes to the stock market.

But we know that volatile stocks can follow popular patterns. And we know that past spikers can spike again.

The next time BMR goes on a run, there are patterns that we can use to trade the price action.

Key Takeaways

At its core, the J.P. Morgan Self-Directed Investing platform is geared toward investors and not traders. That’s why it lacks the advanced options and features of other online brokers and platforms.

If you’re looking for a penny stock trading platform, there are better brokers out there. But if Chase’s app fits into your comfort zone, don’t listen to the haters. There is no one-size-fits-all in trading — it’s all about finding the tools that work best for YOU.

Picking a broker doesn’t have to be a lifelong decision. If you’re curious about a platform try it out. That’s a direct deposit to your knowledge account, and will teach you more about what fits you than any amount of advice.

Have you used Chase’s online platform to trade penny stocks? Share your experiences in the comments!

*Past performance does not indicate future results

Leave a reply