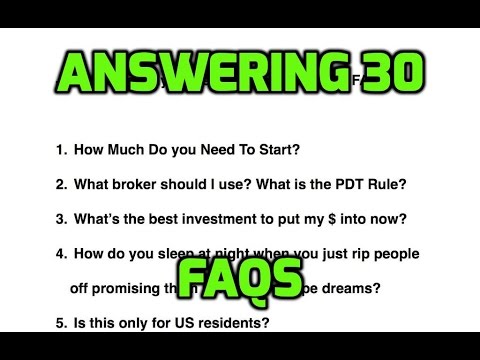

Today’s 80-minute video below I answer 30 FAQs/explain all about what makes my trading challenge so special and what exactly is this tool I use every day and why it’s so useful. Please pay attention, as I’m tired of answering these same questions all the time!

**

I’ll get that video transcribed shortly, since I know how important it is to even my valued deaf students and what I’m about to say next might sound surprising, but stay with me.

The fact is, there’s a good reason why a lot of traders look down on penny stocks. Actually, there are several good reasons. Among them: penny stocks are risky, the market is volatile and there are a lot of shady stock promoters looking to pump and dump. Oh, and let’s not forget: the companies themselves are not always the best.

To tell you the truth, I’m not going to argue any of these points. The thing is, these reasons to avoid the penny stock market are completely valid. The market is volatile. Penny stocks are not for the faint of heart. However, once you begin to learn about penny stocks and how they work, you can devise a system for success. That’s exactly what I did and I’ve now turned $12,415 into $4,500,000+ including plenty of losses along the way.**

So yes, there’s plenty of risk, but there can also be plenty of payoff with penny stocks.

OK, I’ll level with you: there is no way to get it right all of the time with penny stocks. However, by taking certain proactive measures and following these steps, you are far more likely to pick winners when trading penny stocks. Save this guide and refer to it whenever you need a reminder.

1. Learn how penny stocks work. This seems painfully obvious, right? But you’d be amazed by how many people think that just because penny stocks are traded in such small amounts per share, that they don’t need to learn the rules of the stock market before they start trading. This is a common beginner mistake and, for many, it’s the first and fatal mistake that ends their trading career before it begins.

To learn how to pick winning penny stocks, you have to start at the beginning. Learn how penny stocks work. Read my e-guide, which will give you a great primer on the basics of penny stocking. If you’re ready to get serious about trading, consider joining my Millionaire Challenge, where I go into a lot of detail and specifics about the ins and outs of trading penny stocks.

2. Think pre-spike. Traditionally, the format goes like so: stock traders look to buy low and sell high. Makes sense, right? But as my students know, you can maximize profits even further by buying low, selling high and then selling short when prices begin to fall. When you work this way, it’s possible to make profits both as the price rises and falls.

However, there’s a catch: you need to identify stocks before they spike. In this way, thinking “pre-spike” can help you choose the most effective and lucrative penny stocks. It can help double your money making potential.

This post details my secret formula for discerning whether or not a stock has spiked or not, with helpful tips that can be applied immediately in your trading.

3. Learn the patterns. Like I said in the video earlier, there is no way that you can be right all the time about penny stocks. But, over my time as a trader, I have identified a number of patterns that can prime you for penny stock success….patterns like this and this and this.

I go into MUCH greater detail in my Millionaire Challenge program. But, in a nutshell, you can look to the market for specific clues: looking for stocks that have already begun to spike, looking for breakouts that are reaching new heights and taking a long, hard look at the price action.

More Breaking News

- Ford’s Strategic Moves: Navigating Workforce Changes and Union Challenges

- Texas Pacific Land Eyes New Heights: Strategic Movements Signal Change

- Datadog Stock Rises After Price Target Increases: Is This the Moment to Act?

By learning these patterns and understanding what they mean, you can help yourself choose the best penny stocks possible.

4. Do your research. It’s a cold, hard truth: many penny stock traders don’t succeed because they simply don’t do their research. One of the lessons I drum into my students from the beginning of their studies is that doing your research is a vital step that cannot be skipped.

It can be easy to feel like you’re not taking action or “doing” anything while researching stocks. But that couldn’t be further from the truth. If all you’re doing is depending on the word of others, then your profits can automatically be cut, because you’re just being a lemming. Rather than following the trend, seek to be ahead of the curve. This can help you begin to make profits.

Time and time again, a relatively short amount of time spent on research yields profits, both for me and my students.

When a stock seems to hold promise, don’t just depend on the word of promoters, who have their own agendas and have probably “clued in” countless other traders. Do your own digging. Research the stock’s filing and disclosures and see what’s going on in SEC news. See what is going on with the company and what they have in the works; make sure it is legit.

Often, simply doing your research can assist you in making bigger profits and leaving your competitors in the dust. It makes you an influencer, not a follower.

5. Be prepared. Success calls for hard work. It requires determination. You need to do your research and you need to be methodical. But you also need to be prepared.

In chess, the most successful players are thinking several moves ahead: they have a long-term strategy and plan. This is exactly what you need as a trader. Penny stock traders who are just chasing the profits but aren’t prepared are probably going to bankrupt their portfolios.

While doing your research and being methodical might not be sexy, the money that you can make certainly is exciting.

But I’m not selling a get rich quick solution here; that would be insincere and it probably wouldn’t work. While it is possible to make money quickly, the mentality that you need to have is long term. Proper planning isn’t fun but it is necessary.

**

I said it at the beginning of this post and I will say it again. Picking a winner every time is simply not possible, in penny stocks, in horse racing, or in any sector of life. However, there are steps that you can take to help ensure success. Follow the tips in this post and it will help you choose more winners over time.

Do you have any favorite tips for choosing a winning penny stock?

Leave a reply