I’m not going to lie to you.

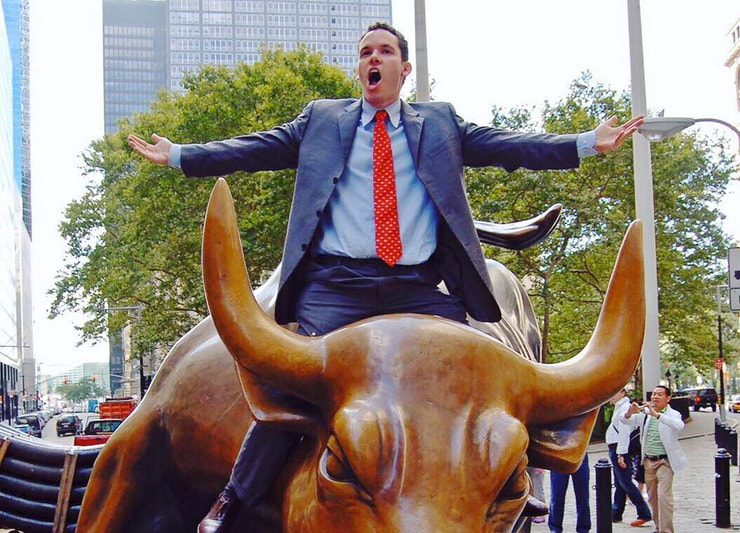

I was feeling myself after two back-to-back-to-back winning trades on Thursday.

I was sticking to my rules, staying patient, and waiting for the right setup.

And the results started to follow after a slow start to the month of March.

Source: Profit.ly

I just had three straight winning trades in the ticker symbol SIVBQ.

I own that stock…or so I thought.

Having one of my best trading days in weeks…I could easily have packed it up and shut down my platform.

But instead, I got cocky and decided to go to the well again.

The result?

An absolute disaster—giving up about ⅓ of my gains on a dumb trade.

And while it sucks it happened, it’s not uncommon for most traders.

In fact, overconfidence is one of the biggest mistakes traders can make, leading to irrational decision-making and increased risk-taking.

But before I tell you how you can avoid falling prey to the dangers of overconfidence…

I want to invite you to an all-day LIVE trading event I’m hosting TODAY

Ring in Q2 with me and watch how I analyze opportunities and trade in real-time. If you’ve wondered how a consistently profitable millionaire trader approaches the market, you’ll want to join this special live event.

Now that we’ve cleared that…let’s talk about overconfidence and how it can destroy your trading account.

I’ll share with you some of my best practices you can use to stay grounded and focused on your trading goals.

Here are three ways overconfidence can kill your trading…

#1 It Can Lead To Overtrading

When you think you’ve figured out the markets, guess what happens?

You believe you can trade any pattern at any time and succeed.

With that kind of belief, naturally, you want to be in on as many trades as possible, right?

WRONG.

If you are having success, it’s probably because you’re doing the right things.

For example, in my two earlier trades in SIVBQ, I exercised patience, waited for the right levels, and executed perfectly.

I waited for the panic to dip buy…

And I was being rewarded for making the right decisions.

That’s how it should be.

However, I got excited because I was on a hot streak after a slow start to the month. So instead of packing it in…I was looking for more opportunities.

And I stopped following my rules.

Just because the stock was making new lows…doesn’t mean it’s a dip buy opportunity…Moreover, I was not considering the time of day we were in. In the early afternoon, volumes decline…and pick up again right before the close.

My overconfidence led to overtrading.

How can you fix this?

Have a trading plan. A well-defined trading plan with clear entry and exit points can help you avoid impulsive trades based on overconfidence. Stick to your plan and avoid making trades outside it.

#2 Avoiding Risk Management

I tell my students to study, learn, and trade small until they build enough confidence to scale up.

And for some traders, the trading small part is difficult. They invest hours studying but only trade a few shares and make or lose a few bucks. They want to scale up, and join the ranks of my other millionaire students.

So naturally, when they start getting a few good trades under their belt, maybe a profitable week or month, they think it’s time to step it up and trade bigger.

Their overconfidence can lead them to take on more risk than they should, thinking they can handle it. But if the market moves against them, they may lose more than they can afford…wiping them out completely or robbing them of months worth of gains.

How do you avoid this?

I tell my students to approach the market as I do. Imagine you’re a retired trader who doesn’t need to trade anymore. You come out of retirement only if you find an opportunity so compelling that you would kick yourself for missing it.

This will help you develop the right mindset. But if you want to avoid taking an unnecessary risk, you should constantly review your trading.

I journal, write down my trades and make video recaps of my trading. I try to explain to my students the reasons behind my actions, the patterns I was playing, my thoughts on risk management, and my mistakes.

More Breaking News

- Coherus Oncology’s Stock Offering: Strategic Moves Unveiled

- Algorhythm Holdings Skyrockets with New Freight platform

- Kyndryl Holdings’ Strategic Moves Signal Growth Potential

- CleanSpark Broadens Horizons: Expansion and Financial Updates

This keeps me honest. And helps me stay grounded and learn from my experiences.

#3: Refusing To Admit Mistakes

Cocky traders find it difficult to admit when they’ve made a mistake.

This is extremely dangerous for newbie traders.

Why?

Because this can lead them to hold onto losing positions too long…instead of admitting they were wrong and taking a small loss…they refuse to cut losses…turning a small loser into a terrible loss.

But it gets worse…

Some newbie traders will double down on their positions because they refuse to believe they’re wrong, which can only lead to bigger losses.

My number one rule is to cut losses quickly, something I tell my students daily.

I rarely take big hits these days…

But if I do…I’ve found practicing humility helps.

Usually, when I make a boneheaded mistake, I will shoot a video and share it with my students. It’s a confessional that helps both of us. They learn from my mistake, and I’m reminded to stay grounded.

Even with +20 years under my belt, I don’t claim to know everything. But that’s okay because that keeps me open-minded to new information, trends, and strategies.

I started out as mainly a short-seller. If I had been stubborn and stuck with that route, I’d unlikely still be here. But I adapted, and that’s why I’ve been able to stay consistently profitable.

If you’re reading this early on Monday morning, you may still have a chance to catch my all-day live trading event today. Click here to join the event.

If you’re reading this later in the day, and would like to learn more about my coaching program, click this link to learn more.

Leave a reply