A lot of traders love to hunt for stocks that trade on the OTC markets — even though they can be the sketchiest companies.

So what’s the deal with these stocks? Are they inherently sketchy because they’re not listed on a major exchange?

There’s a lot to unpack here…

First, know that I’ve made millions trading penny stocks.* You can find a lot of these low-cost stocks on the OTC markets. These stocks helped me fine-tune my trading and teaching techniques. It didn’t happen overnight, and it’s how I created the rules I trade by to this day.

Now, let’s get into what you need to know about the OTC markets.

(*These results are not typical. Individual results will vary. Most traders lose money. My top students have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

Table of Contents

- 1 What Are OTC Markets?

- 2 What Are the Different Types of OTC Markets?

- 3 What’s the Difference Between OTC Markets and a Stock Exchange?

- 4 What Are the Advantages of Over-The-Counter Markets?

- 5 What Are the Risks of Over-The-Counter Markets?

- 6 Over-the-Counter Market Examples

- 7 List of the Top 3 OTC Stocks to Watch in 2020

- 8 Where Can I Find OTC Stocks?

- 9 Frequently Asked Questions About OTC Markets

- 10 Trading Challenge

- 11 Conclusion: Should I Buy OTC Stocks?

What Are OTC Markets?

OTC means ‘over the counter.’ These stocks aren’t listed on a big exchange.

Basically, you’re on your own when buying OTC stocks. The majority of these stocks are crap. But that doesn’t mean you can’t make money trading them…

What Are the Different Types of OTC Markets?

The OTC Markets Group (OTCMKTS: OTCM) run the following markets. They come in three tiers, broken down by how tough their listing requirements are.

The OTC Bulletin Board (OTCBB) is a rival listing service. It’s operated by FINRA, a government-affiliated financial regulator. It exists to provide quotes under a 1990 SEC regulation. Its listings overlap with the following markets…

OTCQX

This is the top tier of OTC markets — literally called the ‘Best Market.’ And there are some very large companies here. Like stocks that are household names both in the U.S. and abroad. Wal-Mart de México is one example of a company that lists on the OTCQX. That’s not a penny stock.

In fact, the OTCQX won’t list any stocks on its exchange that qualify as penny stocks under SEC rules. If you want to trade penny stocks, look to the next two categories.

OTCQB

Think of OTCQB as the minor leagues of the OTC markets. It’s also known as the ‘Venture Market.’ It’s filled with smaller domestic and international companies that can’t qualify for the OTCQX. But they’re mostly legit. These companies are current in their reporting and sell shares for at least 1 cent.

More Breaking News

- Top Bitcoin Stocks to Watch Under “Crypto Emperor Trump”

- BigBear.ai’s Journey in the Stock Market: Rising Trends and Challenges

Pink Sheets (OTCPK)

The OTC pink sheets are the playground hustler of the OTC markets. A lot of these companies don’t have financial filings. They often have very little cash, small revenues, losses, and mounting debts. If you’re thinking about the worst companies possible, that’s most pink sheets.

There’s no requirement to disclose financial information and no minimum price per share. Some of these companies have no finances to show because they’re still developing their product. But the overwhelming majority won’t succeed.

What’s the Difference Between OTC Markets and a Stock Exchange?

The New York Stock Exchange (NYSE) runs on an auction market system. Traders swap stocks with each other through brokers. There’s competitive bidding, like at an auction.

The Nasdaq has dealers making the trades, called ‘market makers.’ There’s no real difference for traders who have to go through a broker for this too.

OTCs are decentralized and don’t use an exchange. This means your broker will have to reach out to another broker to make your trade.

There’s little transparency and big pricing swings are possible. That’s why it’s smart to use limit orders. And it can take some time to fill an order if your broker can’t find a trading partner. You should always look for stocks trading at a decent volume.

What Are the Advantages of Over-The-Counter Markets?

Just because a company’s in bad financial shape doesn’t mean that it’s a bad stock. The best-performing stocks here are based on price action and a solid trade plan.

My students and I trade these stocks — we don’t invest in them. Like I said earlier, these stocks follow patterns, and these patterns have made me a lot of money.* So let’s check out what these sketchy stocks have going for them…

#1: Volatility

Does saying volatility can be an advantage in trading sound counterintuitive? Welcome to trading.

Stocks on the OTC markets can spike big and crash hard. They’re like stocks driven by hype in any market — except these stocks are usually all hype. You have to study and learn the patterns. Once you do, you can see them play out again and again.

Still don’t get how volatility leads to trading opportunities? Check out my FREE “Volatility Survival Guide” series and get up to speed.

#2: Patterns

Patterns are a big reason I love these crap stocks. You can catch the same spikes again and again. The same patterns repeat again and again.

That’s great if you put in the work to recognize them. Check out my “Pennystocking Framework” DVD. Or get “The Complete Penny Stock Course.” It’s based on my teachings and compiled by my student Jamil. They’re both great ways to learn the rules I follow when I trade.

What Are the Risks of Over-The-Counter Markets?

A lot of people ask why more people aren’t involved in the OTC markets. There’s a good reason…

This is the smallest, strangest, sketchiest niche in all of the stock market.

Why do I focus on it? There’s a lot to like once you understand how these stocks move. These stocks have allowed me and my top students to grow small accounts.* But you have to learn the process. And you need smart rules to follow…

Bad Liquidity

Have you ever tried to sell something you don’t want on eBay? Something you used once but now is just taking up space … and no one’s buying?

That’s most penny stocks. They have a theoretical price, but that doesn’t matter if no one’s willing to buy them.

The penny stocks I look for are liquid. They have to have enough trading volume so I can easily enter or exit a trading position. For a day trader, there’s nothing worse than holding a 10,000-share position, then finding out you’re stuck in it.

Big Pricing Gaps

With more expensive stocks, a 2-cent bid-ask spread seems like a reasonable cost of doing business. But when you’re dealing with penny stocks, a spread that small can make for a losing trade.

It can be worse when a stock is thinly traded. When there are only a few buyers or sellers, they have all the power. Sometimes traders give in to a bad bid-ask spread just to get out of a position.

Over-the-Counter Market Examples

Over the years, OTC markets have helped me make over $5.8 million in winning trades.* They’ve helped some of my top students in the Trading Challenge make even more than that.*

Not proof enough? Read on for some OTC picks to watch right now.

List of the Top 3 OTC Stocks to Watch in 2020

I hope you’re planning on doing your own research. Here’s what I’ve learned in mine. These stocks have helped me make some amazing plays in 2020.

Keep in mind that OTC stocks are fast-moving and very volatile. It’s entirely possible these stocks might be out of play by the time you read this.

Remember, my strategy is about trading, not investing. You can use this list to learn more about my process. Read more in my FREE penny stock guide here.

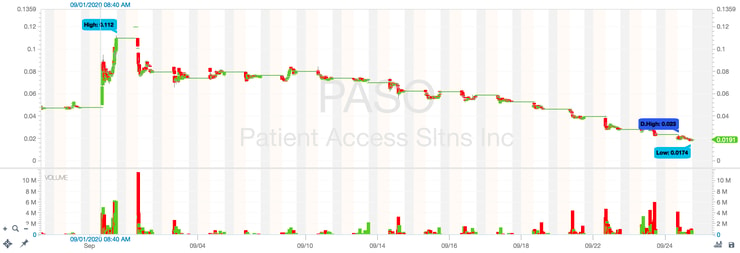

Patient Access Solutions Inc. (OTCPK: PASO)

On September 1, I picked PASO in the $0.05s on news of a reverse merger. It turned out to be the biggest percent gainer on the day. I made a profit but underestimated it.

I made $1,355 on the first play,* an early spiker, which went from $0.056 to $0.07. Then I bought into the morning dip at $0.0775 and got out when it again topped at $0.09 for $2,871.* Then I went in one more time on the afternoon breakout for $4,363,* riding it from $0.0944 to $0.101. I went in a bit bigger on the last play after underestimating it in the morning.

Once again, small gains add up.

Check out PASO’s last month:

This is a hot niche, these low-priced OTC runners. There’s been a lot of momentum in this market.

Toward the end of September, it was trading at a high volume.

Alternet Systems Inc. (OTCPK: ALYI)

I traded ALYI on August 27 when it issued the first of two press releases. It was a huge percent gainer, and now it’s back down. I took a single on it, $0.0105 to $0.0125, for almost $1,000.*

You have to pick the stocks, but you also have to know when to sell them. On August 31, I traded it two more times on dips. I took a small afternoon bounce for $715. Then a bigger panic position later on. I went in again heavier for $2,740.*

And five days later it ran again on news. This time I took a position of $0.023 to $0.0255 for $1,812.*

Here’s the ALYI chart:

Worksport Ltd (OTCQB: WKSP)

WKSP has seen a lot of movement in August and September. It built slowly on news through mid-August before spiking on August 31. This lag is the result of the informational inefficiency seen so often in OTCs.

On August 25, news of a pending deal didn’t move the needle. But I kept watching this stock.

Check out the chart:

A lot of people asked me why I sold it mid-way through the August 31 rally. For me, it was insane for it to go from 15 to 36 cents. But on September 1, it got up to nearly 50 cents.

I wasn’t comfortable holding it overnight. So I took a profit of $1,778.* That’s what felt safe for me.

Take this in. It’s not about how much money you can make. You have to learn the process and find your comfort level.

And remember that small gains add up.

Where Can I Find OTC Stocks?

Still confused on where to find these turbulent little stocks? Read on…

How Can I Buy OTC Stocks?

If you use a major broker, you likely already have access. E-Trade, TD Ameritrade, Charles Schwab, and Fidelity all include access to OTC stocks.

If you’re going through an online-only broker, you’ll want to check first. Interactive Brokers will let you trade OTC stocks, while Robinhood won’t.

Frequently Asked Questions About OTC Markets

Still skeptical about the OTC markets? Good.

A lot of newbie traders hear success stories … Take my student Roland Wolf for example. He recently passed $1 million in trading profits.* Traders see his results and want that kind of success for themselves, overnight.

Doesn’t work like that.

You need to take the time to learn how the penny stock niche works.

Ready to get serious? Apply for my Trading Challenge. This is where I teach the skills I’ve learned over 20+ years of trading.*

Are OTC Stocks Regulated by the SEC?

All stocks listed on the OTCQB market are current in their reporting to the SEC. The OTCQX includes stocks that either report to the SEC or to OTC Link. OTC Link is an SEC-registered system that has alternative reporting standards.

OTC pink sheet stocks don’t require any reporting whatsoever. This is why this market is filled with companies in bankruptcy, shell companies, and other stocks that are all hype.

Can a Stock Go From OTC to NYSE?

This is possible, and it’s even happened before. But it’s not common.

Remember how I said that a lot of these stocks are junk? That’s exactly the reason you won’t see many making the leap to the NYSE. It’s complicated and expensive to list on the NYSE. For companies only looking to raise cash, it’s not an option.

Why Can’t I Buy OTC Stocks?

Are you on Robinhood? If so, you’ve got your answer — but only after ignoring why I think you should avoid this app. Robinhood doesn’t let you buy OTC stocks, only stocks listed on a major exchange.

Some brokers also won’t let you trade OTCs. Penny stocks often trade at low volumes. Sometimes brokers won’t have enough outstanding shares to fill your order.

What Time Do OTC Markets Open?

OTC markets trade from 6 a.m. to 5 p.m. Eastern, Monday to Friday. But most of the volume movement happens during regular trading hours — 9.30 a.m. to 4 p.m. Eastern.

How Many OTC Stocks Are There?

The NYSE has over 2,500 stocks. The Nasdaq has over 3,300 stocks. OTC stocks are more numerous than both of those combined — there are over 11,000.

This is why I tell my students to keep an OTC stock watchlist. You can keep your eye on OTC stock prices and potential picks. When these stocks move, it can be fast and furious. Be prepared.

Need help with your watchlists? Sign up for my FREE weekly stock watchlist here.

What App Can I Use to Buy OTC Stocks?

These days, many major brokers have apps where traders can buy OTC stocks. And some online-only brokers like TradeStation and Interactive Brokers let you trade OTCs. (Again, Robinhood does NOT.)

But if you’re looking for an OTC markets stock screener there’s only one I’ll ever recommend: StocksToTrade. This is the platform I helped to develop. You can use it to scan, track, and keep up on all the OTC markets, news, and stocks.

Is Trading on the OTC Market Safe?

Nothing about trading is ‘safe.’ Focus on your education before you start trading. Never risk more than you can afford to lose. I can’t tell you how many emails I get from traders who blew up their accounts because they don’t wanna listen.

I don’t like that. It’s painful for me to see newbies get excited about trading penny stocks and then go about it all wrong. That’s why I always say you should think like a retired trader. A trade has to be so good, you’d feel guilty not taking it.

And what’s rule #1 for traders? Cut losses quickly.

Trading Challenge

If you like rule #1, you’ll love the rest of my rules. And if you want to trade OTC stocks with any hope of success, you’ll need to learn them all.

That’s why you should apply for my Trading Challenge.* I don’t accept just anyone. I want to make sure that it’s worth my time and yours.

Want to get out there now? I made it easy for you with my 30-Day Bootcamp.* You can learn all my basic trading lessons in one month of studying.

Conclusion: Should I Buy OTC Stocks?

Trading OTC stocks is not about finding one hot stock. They’re almost all crap. Most of these stocks fail in the end.

Remember, you’re looking for good plays. And they can come up a lot on the OTC markets.

But build your knowledge account first. Be smart and prepare for the crazy action that can happen with these stocks.

Still have questions about OTC stocks? Let me know in the comments. I love to hear from you!

Leave a reply