Between promoter bots and sketchy companies, I’ve had it. No OTC fairy tale comes to a good end.

I won’t stop trading OTCs. But I also won’t stop teaching. My job as a teacher is to expose the risks. As a trader, I’m being very safe and suggest you do the same. Remember, trading is a battlefield.

Will you get sucked into the story? Or will you accept it’s a fairy tale and slay the beast? Keep reading for lessons learned from an OTC fairy tale.

First…

Table of Contents

Karmagawa Proudly Announces the Jack Kellogg Learning Center

I’m so proud to announce our 74th school/library and the 25th with the Bali Children’s Project. In honor of student-turned-master Jack Kellogg, we hope it inspires a lifetime of learning.

I'm proud to announce the opening my charity's 74th school/library, The Jack Kellogg Learning Center, in honor of my https://t.co/occ8wKmlgm student @Jackaroo_Trades his $5.7+ million in profits (see all trades https://t.co/EzikHbwiaz) now these children can study hard like Jack! pic.twitter.com/9UuMUPORve

— Timothy Sykes (@timothysykes) February 26, 2021

Our partnership with Bali Children’s Project includes another six learning centers underway. If you’d like to support one of our projects, visit Karmagawa and click on Donate Now.

Congratulations Are in Order

Massive congratulations to Mariana — the first female Trading Challenge student to hit the $1 million* milestone.* Mariana was featured in this recent post about upcoming female traders.

(*Please note that these kinds of trading results are not typical. Most traders lose money. It takes years of dedication, hard work, and discipline to learn how to trade. Individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose.)

Check out Mariana’s tweet that highlights her incredible February results.*

Never forget February 2021!

+$626,200 🌷

Will it always be this way? probably not, but did I try my best? Absolutely, and that’s what matters most.

So incredible thankful to be at the right place at the right time. 🤯 pic.twitter.com/emRvd6Uzvy

— Mariana Hincapie (@mari_trades) February 27, 2021

Again, Mariana’s results are NOT typical. She’s exceptional — so get inspired!

Now, let me tell you a story…

Trading Mentor: To The Moon!

You don’t have to look far to see that promoters are alive and well. Back in the day, they ran on emails and cold calls. The SEC cracked down, but now all you have to do is check social media, Twitter, and free chat rooms to spot them…

OTC Fables and Other BS Stories

Do you remember, as a child, your parents reading you fairy tales?

That’s what all these companies are — OTC fairy tales. Except there’s rarely a happy ending. The sooner you get that through your head the better.

I get soooooo many messages about very new potential technology, I wonder if people actually believe all this hype & BS or if there's just 1-2 Jordan Belfort-like promoters with hundreds of screen names? Either way, we'll look back in a few years & laugh at all these schemes LOL

— Timothy Sykes (@timothysykes) February 26, 2021

In my top penny stocks weekly update, I do a brief write-up of five companies. I often write “Company X is in the clean-energy sector” or “Company Y is in the EV space.”

Please understand, I mean Company X claims to be in the clean-energy sector. Half the time the ‘About’ page on the company website says something different.

What’s that? It doesn’t make sense?

Welcome to OTC fairy tales. Remember…

All These Companies Are Fiction

That’s how cynical I am. I mean all OTCs. Every single one.

These companies merge or change sectors every couple of years. They move from cannabis to real estate. They shift from mobile app development to crypto mining. One day a subsidiary is in the floor-tile business, the next it’s a digital payment gateway. (You can’t make this stuff up.)

If a promoter does their job well, they spike the stock. Then insiders and promoters sell shares and make a killing. All this without ever selling a real product. Or anything else, for that matter.

Some of these companies have been through so many tickers it’s like alphabet soup trying to figure out what’s what. I expect every OTC stock to get halted or go to zero. But it doesn’t matter in the long run, because they’ll just find another way to defraud investors.

Before I get bombarded with DMs and emails…

I’m not shorting these companies. I just understand they’re fake. They’re fiction. Most of them have ZERO revenue, ZERO products, and ZERO hope of ever becoming a real company.

Be more cynical. Disbelieve everything.

If you see this…

More Breaking News

- Cleveland-Cliffs’ Unexpected Surge: What’s Driving the Steel Giant’s Performance?

- Can ChargePoint Holdings Inc. Rebound After Recent Downturn?

- Vital Farms’ Stock Surge: Is It Sustained Growth or a Temporary High?

REVOLUTIONARY BATTERY!

Or…

Hot New Clean Energy Company!

Or…

World Changing Tech!

Take a deep breath and remember…

It’s BS. It’s a promoted piece of crap. They’re all promoted pieces of crap.

And if you see people posting on Twitter about due diligence and conversations with the CEO…

It’s all a joke.

You don’t have to believe these fictional stories. If you want to sit down and read their little fairy tale, that’s fine. Give them a round of applause.

But stop believing their stories. Don’t believe the press releases. Don’t believe it when these companies say they’re doing good for the world. They’re not. It’s storytelling. It’s like Hollywood.

Just because I quote a press release doesn’t mean I believe it. I’m trying to educate you … to help you understand which catalysts move penny stocks.

All OTCs Are Risky

If I was the SEC commissioner, I’d probably halt ALL these companies. But it would crush the hopes and dreams of millions of degenerate gamblers.

As I've warned for years, OTC plays are trash, don't listen to a word any promoter or management says, expect the worst & you'll never be disappointed. Watch https://t.co/KhqHFIvHsM & read https://t.co/QTYT7tQ5da & stay safe/cynical, I'll wait for https://t.co/4lKUY5B6aw setups!

— Timothy Sykes (@timothysykes) February 26, 2021

Trading is inherently risky. But if you hold any OTC overnight … there’s a risk of it getting halted. Right now the SEC is cracking down.

Want proof?

Check this list of OTCs halted by the SEC on February 25. 15 stocks in one go. Read the entire order. People think I’m over the top when I call OTCs junk. But the order says it all…

- “[…] questions have arisen as to their operating status, if any […]”

- “[…] certain social media accounts may be engaged in a coordinated attempt to artificially influence their share prices. […]

NEVER believe the hype. EVER. And while the SEC is reeling in the worst of the worst, beware…

The Fable of the OTC Overnight Play

It’s rare for me to hold OTCs overnight recently. And only with a very small dollar position. The potential gap-ups have been weak lately. It’s just not worth the bigger risk. Now, with the halts, I’m not holding OTCs overnight at all…

Let me be VERY clear: I would NOT hold ANY OTC play overnight now, the SEC has now halted trading in 2 dozen plays based on social media promotion & literally EVERY single OTC big % winner has that same promo/hype so huge risk of halt on EVERY OTC play, welcome to reality/justice

— Timothy Sykes (@timothysykes) February 26, 2021

Why do stocks get halted by the SEC? It can be for a variety of reasons. Corporate Universe, Inc. (CVEM: COUV) got halted due to “questions regarding the accuracy of information in the marketplace.”

Check out the COUV one-month chart to see why it’s so risky to hold…

Imagine being stuck in COUV when it got halted. Or watching it open two weeks later down over 90%. That’s the risk. That said, the smart move, if you were stuck in COUV, was to cut losses when it opened. Good luck to the bagholders. COUV got the dreaded skull and crossbones. It’s all part of the OTC fairy tale…

Slay the Dragon But NEVER Believe the OTC Fairy Tale

OTCs aren’t long-term investments. Don’t let any promoter tell you differently.

Remember, bots spread most of the hype you see on social media. I’ve been saying it for weeks … promoter bots are everywhere.

So it was no surprise when cybersecurity analysts said bots were hyping meme stocks like GameStop. (NYSE: GME) Sadly, too many newbies fell for the BS.

In the penny stock gutter, which most of Wall Street looks down on, the promoters get away with a lot more. The cybersecurity analysts don’t give a crap about a sub-penny that spiked 4,000% in a few months. It’s off their radar.

But uneducated newbies LOVE these plays.

Me … I’m cynical. But I’ve been dealing with bots for a while. (When I get spammed with the same message by 50 different Twitter accounts, it’s obvious to me what’s going on.) And I’ve been dealing with promoters for years.

Promoters: Purveyors of Fine Fiction

Promoters will have you believe a stock is the next Amazon. It NEVER is. Amazon and Microsoft were never promoted penny stocks like these. They might have been low-priced at one point, but they never did promos.

That’s the difference!

Companies that do promos fail. This is the secret. How do I know? I look at history. I’m a glorified history teacher.

So you can ignore my warnings and learn the hard way, or pay attention. It’s up to you. Here’s an example…

Since we’re on the subject of OTC risks and trading as safely as possible, let’s look at a trade from last week. It worked out, but keep reading to find out why it could’ve been a disaster. Remember, hold and hope is not a strategy.

Trade Review: OTC Fairy Tales Have Bad Endings

If you expect the worst, you won’t be disappointed. Check it out…

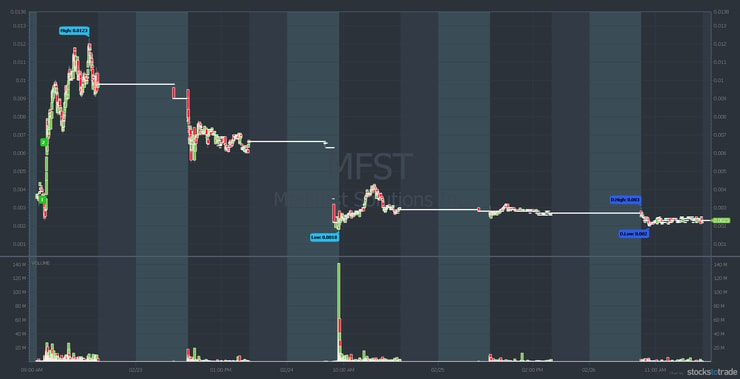

Medifirst Solutions, Inc. (OTCPK: MFST)

StocksToTrade Breaking News alerted this one…

(Quick disclaimer: I proudly helped design and develop StocksToTrade and am an investor in it.)

On February 22, the company announced it was sponsoring a clinical study for a breast cancer diagnostic device.

Here’s the February 22 intraday chart for MFST with my alerts…

As you can see, it was spiking fast. I got a partial position on a dip off the highs. My goal was 10%–20%. It looked like it was struggling to keep going, so I got out. At $878 in profits*, it wasn’t a huge win.* But it hit my goals.

(*Please note: My results are far from typical. Individual results will vary. Most traders lose money. I have the benefit of years of hard work, dedication, and experience. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

When it kept going, I considered going long overnight. Since it failed to close strong, I didn’t want to risk it. And … I’m wary of holding OTCs overnight right now.

As it turns out, my cynicism was spot on. Check out the MFST five-day chart…

Why the tank? The day after I traded MFST, the CEO was arrested for securities fraud. He “allegedly received kickbacks from a corrupt broker and concealed the role of paid promoters from investors.”

Millionaire Mentor Market Wrap

I’m trying to get you to think the right way. Many of you want it to be an exact game. You need to think like an experimental scientist. A very cynical and skeptical scientist.

All these companies are fictional. This niche is basically a joke. The supposed market cap doesn’t matter. These companies are worthless. Pretend all their stocks are going to zero.

Here’s the caveat…

In a bubble market, OTC fairy tales can go up. With enough promotion, an OTC fairy tale can go up in any market.

Your job is NOT to find the next Microsoft. It’s to take advantage of volatility. When the setup is right, trade like a sniper.

How do you know if the setup is right? Study. Get experience trading small. Study more. Practice. Adapt. It’s not an exact science. But I assure you the fairy tale isn’t real.

What should you study?

Trading Education Resources

If you’re new to penny stocks, start with my free penny stock guide.

To get a solid foundation in the basics read “The Complete Penny Stock Course.”

For a more immersive experience, try the 30-Day Bootcamp. (“The Complete Penny Stock Course” and my “Pennystocking Framework” guide are bonuses.)

And if you’re ready for the ultimate challenge, apply for the Trading Challenge today.

What do you think of the OTC fairy tale? Comment below, I love to hear from all my readers!

Leave a reply