Last week I made $11,460** taking one trade at a time.

What. A. Week!

Also, my team and I put the finishing touches on my brand-new Volatility Survival Guide. Read on to get no-cost access right now. I think you’re gonna love it. So far 7,860 people have signed up, and so many people are thanking me.

In this edition of the update:

- Why you should take it one trade at a time and remember what matters most. (So much for the power of one…)

- The most important trading psychology tip I can give you today. (BONUS: it applies to your entire life — pay attention.)

- The three patterns that changed my life. (Literally!)

- My trade of the week. This one might surprise you…

(**My results are not typical. I’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

Now it’s time to…

Table of Contents

Think Outside the Box

In times like these, we have to think outside the box. A lot of people are struggling due to the coronavirus shelter-in-place orders. Others are OK because they can work from home.

But it seems a lot of people are focused on themselves. They’re not thinking about the bigger picture.

It’s easy to get caught up in whatever’s happening to you. That’s understandable and natural. But to beat this thing, we have to consider our actions and how they affect others. Specifically front-line healthcare workers.

Right now, these men and women are putting their lives on the line to serve us. We owe them the respect of staying home to help stop the spread of the coronavirus. Do your part: #StaySafeStayHome.

How Karmagawa Is Taking Action

Mat Abad and I recently announced a $50K donation to Direct Relief for protective gear and masks. Check it out…

You can donate to Direct Relief here: COVID-19 Relief.

Buying Time to Save Lives

I try to lead by example. I don’t post my charity donations on social media to make myself feel good. It’s to inspire others.

For example, we’ve built 19 schools in Bali. But by posting about it on social media, another 16 schools have been built. People got inspired to do something.

The current situation with the coronavirus pandemic is another opportunity to inspire…

Direct Relief is one of the biggest charities in the medical space. Our $50K donation is a drop in the bucket. But if you donate $10 … and your neighbor donates $10 … if everyone in America donates $10 … that’s billions of dollars.

I wrote about the biggest coronavirus risk in this blog post. Let me reiterate…

If this virus keeps spreading exponentially, it will lead to a huge lack of medical supplies. Then the fatality rate might jump to 10%, 20%, or higher. It’s all about medical supplies and buying time until we find a vaccine.

Also, keep in mind…

More Breaking News

- JetBlue Airways Expands Horizons: Is It Set To Soar Or Stall?

- CleanSpark Inc. Stock Shake-Up: Is Crypto Scrutiny To Blame?

- Archer Aviation’s Unexpected Surge: What’s Fueling the Takeoff?

Animals Are Suffering as Well

At Karmagawa we take animal welfare seriously. We support animals around the world. In Thailand, tourism is shut down like the rest of the world. That means there are elephants starving because the money to feed them isn’t coming in.

So we also donated to Trunks Up — an amazing charity focused on saving Asian elephants from captivity.

We hope you’ll think outside the box with us a little and donate: Support Trunks Up.

In this unprecedented time, we must consider both humans and animals. Please think about your actions, and if you’re in a position to help, please do so.

As always, I encourage you to use any extra time to study…

Trading Lessons

This week’s top trading lesson is a life lesson. Apply it to trading or any other part of your life.

It starts with a little…

Tough Love — You Owe Yourself More

Too many people are wasting this opportunity.

You can change your life while you shelter in place. Normally we have lives to live. Families, school, pets … jobs. And, yes, I realize some of you still have commitments. But almost everyone has more time.

Too many people just don’t want it bad enough. Be dedicated during this time. Turn off the TV and study your butt off. Make a commitment.

Someone recently asked me how long they should wait before investing in StocksToTrade. I’ll tell you what I told him. Apply this to your entire life. NOW.

Every Unprepared Day Is an Opportunity Lost

Every single day that goes by where you…

… don’t have the right broker…

… don’t have the right software…

… and aren’t prepared with the right knowledge…

… is a wasted opportunity.

Why? Because today might be the day an opportunity comes … and you aren’t prepared.

Stop. Wasting. Time.

It takes time to learn how to use your broker’s platform. It takes time to learn how to use StocksToTrade. Too many of you are stuck on step one expecting to jump right to step 10 and be rich. Focus on the process first.

With that in mind, please take advantage of my…

Volatility Survival Guide

My team and I just created this no-cost trading guide. It explains the strategies my students and I use to trade this crazy market volatility. With so much volatility around the pandemic, it focuses on coronavirus plays. But the information applies to any volatile market or sector.

Since its release last Friday, over 7,860 people have signed up for the Volatility Survival Guide.

Inside you’ll discover…

- Why penny stocks have the potential for big returns even during a market downturn.

- The “hidden in plain sight” window of opportunity. (And … why I’m grateful Wall Street hotshots ignore my niche.)

- The exact sectors, stocks, and patterns my students and I have been trading the past few months…

- How regular people all over the world are learning my strategies. (And why they have the potential to change your life.)

- PLUS: Tim Bohen guides you through the power of StocksToTrade scans. (BONUS: We’re offering a special on StocksToTrade. Don’t miss this opportunity. Watch the guide and use the link there to get the deal.)

Get Access to the Volatility Survival Guide Here

What Students Are Saying About the Volatility Survival Guide.

1:12 AM TrentUglow → timothysykes: “Thank you for your 2 hour video guide Tim. I just finished it. Rewatching the video lessons was good and the STT info was really helpful. 5 hours to sleep then preparation for the market!”

09:20 AM SurfinWaves → timothysykes: “Good morning. Loved the Corona volatility special video this weekend. I did nothing but study this weekend!”

10:42 AM EddieE → timothysykes: “happy with the day eaven was a micro win but knlage wise very good. it makes the difference pick one get in and out with a plan. thanks for the volatility survival guide.”

2:06 PM cody995: “What a ride, thanks Tim. Took lessons directly from your COVID video for that $AKER trade.”

2:41 PM CrazyWillows → therealmcdougal: “I was doing the same thing 100%…. If its an uptrending chart you have better odds and trying to just buy random. That Volatility guide had some really key pointers in it. Made soooooo many notes…”

Again, this is a NO-COST resource. I’d call it free, but my lawyer says I can’t since you have to submit your email. Look, if you want to learn about the potential for freedom from trading penny stocks … it’s a no brainer.

Get Access to the Volatility Survival Guide Here

Now, let’s focus a little on…

Trading Psychology

What I teach is relatively simple. None of the patterns or strategies are new. I’ve been trading and teaching the same patterns for years. Once you put in the time, it’s a matter of refining your own personal process. It’s not layer after layer of new information.

So what do I teach? Three things:

- Patterns — including all the nuances I learned from two decades of trading. (And over a decade of teaching.)

- Rules I learned from thousands of trades. (I trade with these rules.)

- And … trading psychology I learned from my own experience. (And from watching other traders either blow up or become successful.)

So my trading psychology tip of the week is this…

Take It One Trade at a Time

And focus on patterns you know well.

There are three main patterns I focus on. That’s it. Three main patterns to go from $12K to over $5.1 million.** But not every trade will be a big winner. Some days are no trades.

You can’t expect big profits every single day, just take what the markets give you, today I’ve made less than $100 even though last week I made over $11,000+. Yes, it’s early, but so far big % spikers are weak so I’ll be patient and conservative waiting for solid setups ONLY!

— Timothy Sykes (@timothysykes) April 6, 2020

(**Again, my results are NOT typical. Over 90% of traders lose. Always remember that trading is risky. Never risk more than you can afford.)

With that in mind, here are…

Three Patterns That Changed My Life

I often say three patterns have changed my life — it’s 100% true. Check ‘em out…

Morning Dip Buys Into Panics

When penny stocks are overextended, I look for this pattern. Again, the pattern doesn’t play out exactly the same every time. This isn’t an exact science. Take it one trade at a time.

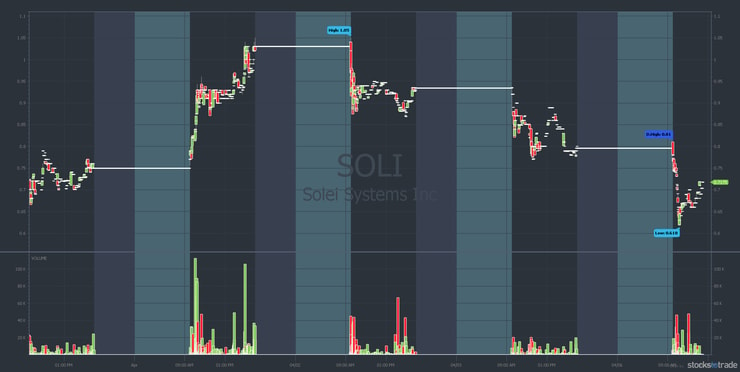

Check out the Solei Systems, Inc. (OTCPK: SOLI) three-month chart below. It’s a clear example of a multi-day, multi-week runner:

I don’t like to chase stocks when they’re up too much. Instead, I wait for my favorite pattern, the morning panic dip buy…

Here’s the SOLI chart showing the top of the run on April 1 and the morning panic on April 2:

Start looking for morning panics. These trades are FAST. I took the trade but got out for a small profit when it didn’t bounce much. Plus, there was a better opportunity elsewhere…

Morning Spikes on Former Runners

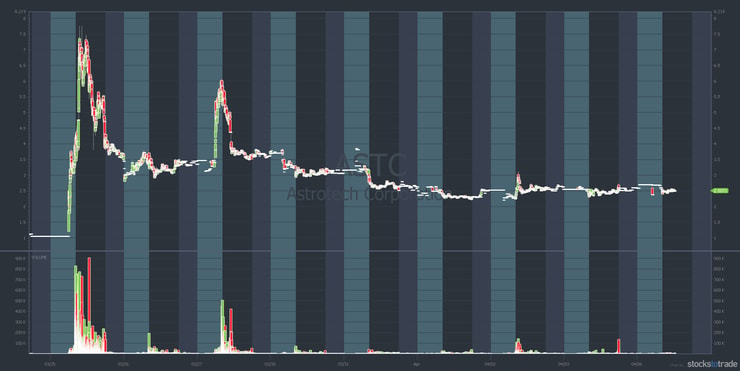

Look at the Astrotech Corporation (NASDAQ: ASTC) chart below. It’s like a bouncing ball, getting smaller with each bounce. Remember that former runners can spike again.

Recent runners with news or a press release can run again. The spike on April 2 is a perfect example. It doesn’t look like much compared to the big spikes. But if you understand the nuances, it’s a solid trade opportunity.

In this case, the stock didn’t have a new big news catalyst. Instead, a few big traders were tweeting about it. It was almost like a Twitter pump. All the more reason to use StocksToTrade’s social media scanner.

(Again, watch Tim Bohen’s section of the Volatility Survival Guide. He shows exactly how to filter out noise with the social media search tool.)

Here’s the last of my three favorite patterns…

First Green Day OTCs

The first green day is my primary overnight hold pattern. I used to hold them overnight most of the time. Which is what I did on GeneThera Inc. (OTCPK: GTHR).

Check out the GTHR chart from April 1–2:

Recently the first green day has been a little different. It pays to sell into strength near the close. When I traded this, I sold a little over half my position into the close. I held the rest hoping for an overnight gap up. It didn’t really gap up, so I sold at the open.

To learn the nuances of these patterns, apply for my Trading Challenge today. These patterns changed my life.

Now on to the…

Trade of the Week

Sometimes I talk about my trade of the week because it has good lessons. But the reality is every single trade has lessons. You have to improve — or try to improve — with every trade.

CRAZY I made $6,000+ today but missed SO much on $CYDY i.e. a $15k+ profit day, @Jackaroo_Trades made $5k but was also upset with his $ATHX trades & @sublimetrades made $3k+ but messed up on $APT & $ATHX & despite our mistakes, the 3 of us made $14,000+ TODAY #notanexexactscience

— Timothy Sykes (@timothysykes) April 3, 2020

It’s not an exact science. Put this next to your computer monitor…

No One Trade Matters

Put it on a brightly colored post-it note. Or print it in bold letters: No. One. Trade. Matters.

This is a process. I’ve made millions taking singles.** Don’t go for home runs — singles win the game.

Very rarely will any of us trade completely perfectly so we must just focus on the best plays, try our best, take the meat of the move, accept our gains (or losses) & learn from what we did right/wrong & come back strong/wiser/better the next day! #itsaprocess #optimizingovertime

— Timothy Sykes (@timothysykes) April 3, 2020

Even my top student Tim Grittani started small. He took so many small losses while he was learning. He blew up his first $1,500 account and didn’t make anything for his first 9 months. Then slowly, over time, he gained experience and grew his account. He learned to size up.

NEVER underestimate small gains & the lessons from them…Grittani has made nearly $11 million but his average profit is just $3,759, I’ve made $5+ million & my average profit is just $1,761. Also, in the beginning both our averages were even lower…SMALL GAINS ADD UP OVER TIME!

— Timothy Sykes (@timothysykes) April 6, 2020

Now — 10 years later — he’s having big days and big months. But he’s worked his butt off for it. And he’s still humble. For those of you enrolled in the Trading Challenge — watch Grittani’s webinars. It blows my mind more students don’t watch all of his webinars.

But it all starts with the process. You don’t build a career and wealth on one trade. And if you follow rule #1, one bad trade shouldn’t destroy you. Take it one trade at a time and focus on the process.

Let’s end with…

Questions From Students

Just one this week from a student who understands how great this niche is…

“Tim, March was your best month in years during one of the worst months for the stock market. Do you feel vindicated by your (and your students’) successes?”

Every new successful trader or student shows how great this niche is. Especially at a time where 99.99% of people are losing in the stock market.

+$6k for me & SO many students to congratulate today: LegalPimp: made $5500 on $ATHX ArtOfWar: ATHX +2800 royhdevries: made 1200 on $APT 1400 on $CYDY hot20: $5k profit on ATHX, $7k on CYDY. Jackaroo: $5k on the day StockPiln: Im +$5500 today papajohn: $3,245 profit on the day!

— Timothy Sykes (@timothysykes) April 2, 2020

But there will be slower times for penny stocks. And I’ll still be proud because penny stocks are so much easier than every other niche. All year round. In any market.

But you have to work and study. Maybe harder than you’ve ever studied in your life.

Once you gain knowledge and experience, nobody can take that away from you. And you won’t be up against machines or even the smartest traders on the planet. You’ll be up against yourself.

Millionaire Mentor Market Wrap

That’s another update in the books.

Remember to take it one trade at a time. No one trade matters. Focus on patterns you know well. If you don’t know any patterns well, study my new Volatility Survival Guide.

Then get a copy of “The Complete Penny Stock Course.” Read it until it’s dog-eared and you’ve memorized the entire course.

Remember: You owe yourself more. Tough love. Now go get it.

After you sign up for the Volatility Survival Guide, comment below with “I will take it one trade at a time.” I love to hear from all my readers, so comment below!

Leave a reply