I want to show you the power of the morning panic pattern. This week I called the best morning panic of 2020 so far — in the midst of absolute market insanity.

First, you must understand that studying the past is crucial to learning patterns like the morning panic.

Just when I thought the market was starting to slow down from coronavirus mania, stocks went bonkers on April 23.

Sub-$1 oil stocks started flying in the newest round of sector momentum. With a total collapse of oil demand, the market’s extremely volatile. For the first time in history, crude oil dropped below $0 a share.

The last month has been market madness — and my students report absolutely crushing it every day.

If you're not making at least a few hundred dollars or a few thousand dollars yesterday/today with all these solid plays like $DECN $WLL now $AXAS and $OAS you're either a.) a fucken idiot b.) not properly trained in penny stock trading or c.) a fucken moron…which one are you?

— Timothy Sykes (@timothysykes) April 23, 2020

But while most traders were distracted by oil stocks, the best play of the day was on one of the hottest OTC stocks of 2020. But before I get to that…

I want to show you the power of my favorite pattern…

Table of Contents

The Morning Panic Pattern

I’m primarily a long-biased trader. I don’t like going short. I think it’s an overcrowded niche and the risk/reward is terrible.

Long-biased trading can offer better opportunities … if you know what to look for.

Every morning, newbies fire up their scanners and chase the largest percent gainer of the day. Chasing stocks up 50%–100% isn’t a strategy — that’s gambling. Instead…

Wait for panic. What does panic look like? Here’s a classic example from last year…

After a multi-week run from 30 cents to 75 cents, CBD Unlimited, Inc. (OTCPK: EDXC) gapped down on April 23, 2019, and started tanking. In the first hour of the day, it pulled from the low $0.70s all the way to $0.314 — a drop of over 50%.

That’s panic.

Any long traders who held from the previous day were stuck in their positions and couldn’t sell their shares. As more traders tried to sell, the stock continued lower … and lower.

It’s extremely difficult to sell shares during a drop like this so people start panicking — hence the morning panic pattern. Before I show you the best morning panic this year…

What You Need to Know About the Morning Panic Pattern

Here are a few critical elements of the morning panic pattern:

- First, the stock must be up a lot — at least 50%. The higher the stock runs, the bigger the panic. I don’t want to try to dip buy a stock that’s only up 20% over a few days. There’s not enough meat on the bone. Wait until they’re extended.

- Don’t randomly buy a stock that’s down huge in the morning. Companies have bad news all the time. I want a stock that’s a recent runner, not a company with a negative catalyst.

- Don’t rush into the panic. Stocks can panic much further than you think. I’ve seen stocks drop over 90% in a day. Wait until the stock begins to test support levels and buyers step in on level 2. Here’s a great live example.

- Cut losses quickly — it’s my #1 rule for a reason. It’s difficult to nail the bottom of panic, so sometimes I enter too early. If that happens, cut the loss and try again. Holding the loss further into the panic could result in a huge loss.

Alright, it’s time. Here’s the stock I perfectly called the morning panic on…

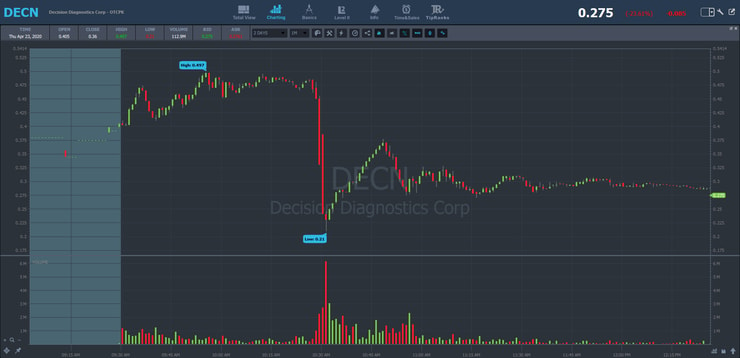

Decision Diagnostics Corp. (OTCPK: DECN)

In my weekly Q&A Trading Challenge webinar, I told my students to watch DECN for a morning panic dip buy.

WOW, what a perfect $DECN panic & bounce, CLASSIC https://t.co/4lKUY5SH24 panic pattern I not only made 19% or $3k+ on, but called it AHEAD OF TIME in my https://t.co/EcfUM63rtt webinar last night, that’s why hundreds of my students banked…were you prepared? LEARN THIS PATTERN! pic.twitter.com/vGIqFfuYzQ

— Timothy Sykes (@timothysykes) April 23, 2020

If you’re serious about trading, you need to join the Challenge. All my top students come from the Challenge. I don’t accept everyone. But if you think you have what it takes … Apply for the Trading Challenge today.

Anyway … I made over $3,000 in less than 10 minutes* and caught it all on video. God bless this pattern. Burn this chart into your memory…

My top students nailed this dip buy. They’ve studied all 546 of my morning panic video lessons and the 850+ dip buy lessons.

Watch every single one of them. The best time to start is now. Who knows when this lockdown will end. Take advantage of it.

(*Please note: my results are not typical. I’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

My DECN Trade Plan

When stocks go supernova, I start watching them for morning panics. After talking with my students during the Challenge webinar, I put DECN on the top of my watchlist.

Here’s my plan on DECN for April 23:

“DECN should be the best potential panic and bounce if it can drop hard and quick enough over the inevitable disappointment of their update regarding test kits.”

How did I know it would happen on April 23?

Take a look at the daily chart:

DECN ran from a penny in February to a high of nearly 50 cents on April 23. The stock was up 50 times in less than two months. That’s overextension.

Since the stock was up 5,000%, it was long overdue for a pullback. But what gave me the conviction on April 23 specifically was its looming test kit update. The company scheduled the update to release midday.

I was slightly disappointed DECN didn’t panic out of the gate, but I kept watching it. I was waiting for the update to hit the news wire because I thought this could be a classic “buy the rumor, sell the news” situation.

How My DECN Morning Panic Trade Played Out

First, here are my comments from this morning panic…

10:26:30 AM: “$DECN news out https://tim.ly/2VUor4L c’mon big panic please”

10:29:26 AM: “$DECN paniccccc time, congrats to shorts”

10:30:32 AM: “Beautiful/merciless $DECN selling”

Within ten minutes of the update, the stock panicked over 50%.

I saw some buyers stepping in at 22 cents. So I tried buying 25,000 shares but ended up filling 75,000 shares at $0.225 because I put in multiple orders. I didn’t want to miss this incredible opportunity. Check out my verified trade here.

I’m usually too conservative with my trades. I alerted to my students that I was only looking for a quick 15%–30% bounce. The bounce came quick and I locked in all my shares at a $0.267 average…

I hugely underestimated DECN, but I don’t care. I took my $3,000* and got the morning panic pattern on video for you. This video lesson will be gold. Stay tuned.

DECN bounced all the way to 36 cents before flattening out for the rest of the day. What an opportunity.

(*Please note: my results are not typical. I’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

How My Students Played DECN

So many of my students report crushing this play. More importantly, a ton learned how predictable the morning panic pattern can be. I’m so proud of these students. Especially…

Two of my newest six-figure students, Jack Kellogg and Kyle Williams, perfectly outlined their plans on DECN in this week’s TWIST episode. Check it out:

More Breaking News

- Discover Financial Services: What’s Driving the Stock?

- SHF Holdings’ Big Deal: What’s Next?

- MicroCloud’s Strategic Moves: Stock Dynamics

April 23

09:54 AM Jackaroo: “$DECN what an OTC!”

10:29 AM RMcInarnay: “and that’s why you don’t hold thru news folks $DECN”

10:31 AM TJinx13: “never seen a fall like this before in real time $DECN”

10:32 AM yasten: “$DECN great lesson for a newbie like me”

10:34 AM OPtrader: “$DECN first dip buy ever and nailed it! thanks TIM”

10:35 AM MoonShot: “$DECN classic dip buy”

10:35 AM jdlizzie: “Thanks for the lesson, buy the rumor and sell before the news”

10:37 AM therealmcdougal: “NICE! In .2301 out .284 on $DECN, literally bought and sold the same time as you, no joke, wasn’t following your alert. Although I am only paper trading today, I’m still super encouraged by this! what a great thing to witness and learn from”

10:38 AM harrycorker: “Nailed $DECN today, first proper dip buy!! Thank you Tim!!!!”

10:40 AM IsaiahV: “Just took the best trade of my trading career with $DECN. Classic Pattern. Studying payed off.”

More Comments From Students

10:42 AM Elktrader66: “$DECN was a gimmie -perfect panic dip buy play”

10:47 AM StickerJon: “$DECN Perfect example of why you should be in cash so you can take advantage of perfect setups when they present themselves”

10:48 AM bao_tran33: “wow I haven’t seen a chart that clean as $DECN for a while.”

10:49 AM TrippinTrades19: “$DECN bounced right off a support zone i have drawn out perfectly. Love seeing that!”

10:57 AM rabbit196568: “Wow that was awesome to watch TS. Panic on $DECN! My funds don’t clear till tomorrow so couldn’t trade it, but that was cool to watch”

11:08 AM MoreCowBell: “Woot!! Thank you Tim Sykes for sharing your knowledge and working so hard to get out the message!! $DECN is my FIRST dip buy! […] WOW!!! Thank you thank you thank you!!”

03:26 PM DeanHiser: “Tim you nailed it on $DECN. Thanks so much for your alerts yesterday and today. You are an excellent mentor. So blessed to be part of your group.”

[*Student results are not typical. Always remember all trading is risky and never risk more than you can afford. These students dedicate time and effort to develop exceptional trading knowledge and skills.]

So many students report killing it! It’s hard to keep up. Use these traders as inspiration. Know what’s possible if you study hard enough.

What’s Next For DECN

This morning I woke up to the news that DECN has been suspended from trading by the SEC.

LOL $DECN suspended from trading, this is why you can't just hold and hope on ANY of these stocks, gotta trade the price action/pattern an expect the worst…then you're never disappointed 🙂

— Timothy Sykes (@timothysykes) April 24, 2020

Remember, most of these stocks are garbage. Never believe the news these companies are pumping out, especially if it’s about the coronavirus pandemic.

Penny stocks are penny stocks for a reason. If DECN really had the testing kits it claimed it did, it wouldn’t be trading on the OTC market. It was a great trading vehicle but never should have been a long-term investment.

I sincerely hope none of you are stuck in this halt. It will open much lower … probably on the grey sheets.

Conclusion

The morning panic pattern is a classic that I’ve used for years.

I think it’s a great place for new traders to start because it can offer huge percent opportunities. DECN bounced 50% in fifteen minutes. You won’t find that anywhere besides penny stocks.

The pattern is simple and predictable. Most importantly, it’s repeatable.

Want to capture the next morning panic? Join my Trading Challenge. My Challenge students are dedicated and were prepared for this play nearly 24 hours ahead of time. Think you have what it takes? Apply today.

Comment below if you understand the morning panic pattern or have questions about it — I love hearing from my dedicated readers!

Leave a reply