Table of Contents

The World is an Amazing Place

What’s up? Before I answer the question of the week, tell you about my best trade, and tell you what my students are doing, here’s what I was up to last week …

I spent the majority of the week in Hawaii hanging out on the beach. We ate at Mama’s Fish House on Maui’s North Shore. I highly recommend it. Excellent food and excellent service.

One of the reasons I want you to apply for the Trading Challenge is to give you a shot at going out to see the world, visit nice places, and explore (but of course you have to put in the time, hard work, studying, etc.) …

… just like the owners of Mama’s Fish House did back in the ‘60s. Their story is pretty inspiring …

Use Inspiration to Change Your Perspective

After a visit to Hawaii and Tahiti, Floyd and Doris Christenson decided to live on an island in the South Pacific. With one toddler in tow and another born along the way, they spent several years sailing around Polynesia on their 38 ft. sailboat, the Marinaro.

They fell in love with traditional Tahitian food at Café Vaima in Papeete and dreamed of one day opening their own restaurant. Through both calm and rough seas — and even a hurricane with 120 mph winds — they kept that vision clear in their mind.

In 1973 they opened Mama’s Fish House on Maui’s North Shore. There they serve fresh fish in the traditional Old Polynesian manner. They also have lovely beachfront cottages to rent.

The Christensons and Mama’s Fish House are a great example of an idea I keep trying to get across in my travel videos: there’s soooo much to do in the world. There’s so much potential. Get out and explore. This is why I want you to learn and to study. The world is an amazing place.

When you go out there and see more things and meet more people you become more open-minded. There’s this whole isolationist thing going on in the U.S. — I think that’s ridiculous. When you close yourself off you hurt your education, you don’t learn as much. So get out there — meet different people and see different cultures. It’s beautiful.

Trading from Hawaii

Trading from Hawaii is difficult. I had 4 a.m. wake-up calls — so right now I’m trying not to get sick. But I do love Hawaii and the good news is that when you wake up so early you have the whole afternoon available. We did some hikes, I went fishing, hung out with friends, and we met with a few different charities about saving sea turtles and the coral reef.

More Breaking News

- Is It Too Late to Buy H&E Equipment Services Stock After a Surge?

- Palladyne AI Corp: Can Recent Drones Market Expansion Propel Growth?

- Will Nvidia’s Stock Recover Amidst New Export Restrictions?

Karmagawa Is a Big Priority

I’m working hard this year to keep up with the charity stuff — a fair amount of time in Hawaii has been trying to get all my work done with Karmagawa. We had several photos and videos go viral. So, lots of stuff going on.

My Best Trade of the Week

My best trade last week was American Premium Water Corp. (OTCPK: HIPH). I dip bought this strong first green day move on a former runner. There was a strong news catalyst — new, non-dilutive financing at 10x the current valuation!

Here’s the chart from that day:

After you read this post you can check out the HIPH article over on Yahoo Finance. When I say pay attention to news catalysts — that’s the kind of thing you’re looking for.

This was a great trade and I made roughly 10% gains.** I played it safe. I had planned to hold overnight but decided to lock in profits on my small $12K E*Trade account because it had a nice strong finish at the end of the day.

The trade got most of my goals but not all. My entry was at $.0713. I hoped to sell in the $.08s or $.09s and sold at $.0794. But I didn’t have to risk holding overnight. When you’re trading with a small account, if you can make a few hundred bucks on a trade, you do it. Profit on this trade: $972.**

The best news for me: because I didn’t have to hold it overnight I didn’t have to wake up at 4 a.m. the next day!

What My Students Are Reporting on Twitter

Study and trade. The markets are back — there are a lot of speculative stocks, a lot of biotechs running. Some of my students are playing hot stocks like SAExploration Holdings, Inc (NasdaqCM: SAEX), which went from the $2s to the $6s and back to the $3s. It’s traded all the way up into the $5s since.

Here’s a chart for SAEX so you see what I mean.

KTOV is another one, this went from the $1s close to $3 and has since gone back down to the $1s.

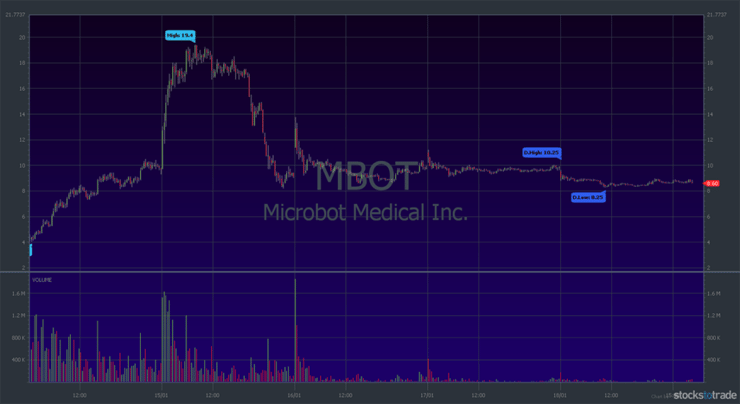

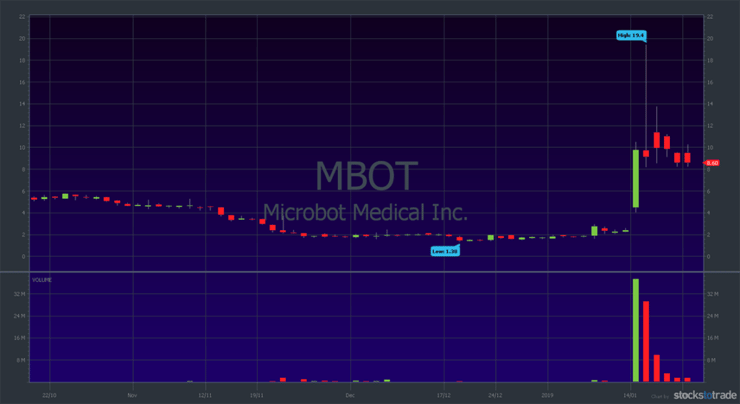

Another play some of my students made: Microbot Medical, Inc. (Nasdaq: MBOT) went all the way from the $2s to the $19s and dropped back to the $8-$9 range. So lots of big movers lately, which some students are focusing on. Personally, you know, I’m better at simple first green day plays on former OTC runners — like the HIPH trade I showed you above.

Question of the Week

Speaking of MBOT …

… the question of the week had to do with a tweet I made when this stock had a huge breakout on the 14th of January. Here’s a link to the tweet.

Why Is It Risky to Short a First Green Day?

Let’s take a look a the chart and then I’ll answer the question. Actually, I’ll put up two charts. The first is a 5-day, 5-minute candlestick chart starting on the 14th — the day the big breakout happened.

The question came from a Twitter follower who noticed I mentioned short-biased traders getting crushed and the lesson to be learned — the hard way — from trying to short first green day stocks. Make sure you follow me on Twitter — you can learn a lot from questions like this. Here’s the tweet again.

With MBOT the stock did eventually come back down, as you can see. I know a lot of people in other chat rooms were shorting in the $6-$10 range (a huge range, right?). There were newbie short sellers and wanna-be short sellers saying, “Oh, this is up from $2. This is ridiculous. It has to come down.”

Guess what? They underestimated it and that’s how you blow up an account! If you say, “This is definitely the top,” then you’re asking for it.

First green days on low float plays like this …

… you do not want to short.

Here’s the second chart, a 3-month chart with daily candlesticks to give you an idea of the big picture:

You don’t know where the top is — nobody does. Even though the top eventually came, almost anybody who shorted on the first green day is still down! Because the stock did come down 50% off its highs, but it’s still in the $8’s or $9s. It’s settled into sideways action around the price it ended the first green day.

If you shorted anywhere below about $8.25, you’re still down on your position. So it’s very difficult to short a first green day. You simply don’t know when the top will come. My Trading Challenge students learn this as part of the course.

Also, there weren’t that many shares to short. There were some sketchy offshore brokers with shares to short. But I wouldn’t have an account with them and I recommend you don’t either. You have to be careful which broker you use in the U.S. — let alone offshore brokers.

So this is the kind of play to go long on — a first green day on a low float stock. I’m proud of a lot of students who made $1 a share. Some made $2, $3, or even $4 a share upside in a day. That’s the way to play those stocks.

The second part of the question was …

Why Is It So Important to Learn Trading Patterns and Study the Past?

I hope the answer to that question is clear in my explanation of the first green day play. My tweet came from experience, from studying patterns, and studying the past. That’s how I know a first green day is not a good short play.

I said the short-biased traders were learning the hard way. And they did. You either learn the hard way or by studying patterns and studying the past. Sometimes you need both. But my hope for you is that you don’t have to learn the hard way. I’d much rather see you join the Trading Challenge and learn the patterns. Thanks for the question!

That’s another wrap of the Millionaire Mentor Weekly Update. I hope you’re enjoying these updates as much as I enjoy writing them. Hit me up with questions — maybe yours will be answered in an upcoming post.

Are you a trader? How will you apply the lessons in this post? Comment below — I love to hear from you!

Leave a reply