If I could instill just one lesson into every student, it would be to cut losses quickly. Sadly, too many newbies get fed a load of BS by promoters posing as teachers. Or so-called teachers who front-run their students.

So newbies hear, “This one is going to the moon.” Or “Only the weak sell.” And sometimes they get lucky, hold through a big dip, and win. The problem is, they learn the wrong lesson.

So in this edition of the update, my goal is to burn rule #1 into your brain.

First, a reminder…

Table of Contents

Stock Market Closed Today

The stock market is closed today for Martin Luther King Jr. Day.

Enjoy your day off, but don’t waste it. Use it to study. Prepare for the week ahead. If you want to be a self-sufficient trader, NOW is the time to grow your knowledge account.

Like Matthew Monaco said in his excellent Trading Challenge webinar last week…

“If you want to be a successful trader, stop being lazy.” I couldn’t have said it better myself.

Before we talk trading…

I donate 100% of my trading profits to charity. It changed my life and gave me a passion beyond trading and teaching. Which is why I want to share this…

Karmagawa’s Mission

Mat Abad and I started Karmagawa to inspire and challenge people. Many people go through life feeling as if they don’t have enough. Not enough money, enough energy, or enough education…

And that holds people back. Our experience is that if you’re willing to push yourself to your limits…

If you’re willing to challenge yourself…

You have far more inside than you could ever dream.

Karmagawa means to make your own destiny through giving back. The more you give, the more you receive. When you live your life with purpose, take positive action, and give to make the world a better place…

It comes back to you. THAT is what Karmagawa is about.

So I’m proud of our recent…

$50,000 Donation to World Central Kitchen

As you know, the pandemic has affected many people on many levels. Some people are struggling just to put food on the table. At the same time, many restaurants are at risk of going under.

The incredible team at World Central Kitchen stepped up in a big way. They’ve partnered with over 2,000 local restaurants to prepare fresh meals for people in need. So far they’ve delivered over 12 million meals.

I'm proud to announce a $50,000 donation from my charity @karmagawa to @WCKitchen as their incredible team helps feed children/families, frontline workers & natural disaster victims worldwide! This money is from my December trading profits as I made nearly $190,000 for the month! pic.twitter.com/fWU2SIDFq3

— Timothy Sykes (@timothysykes) January 14, 2021

I hope that if you become a self-sufficient trader, you’ll find it in your heart to give back. Together we CAN make the world a better place.

Let’s talk trading…

Trading Mentor

This is an insane market. It’s the craziest market I’ve experienced in 20+ years of trading. Stocks like VDRM (keep reading for a review of my VDRM trades) can run 1,400% in a day.

But with all this craziness comes a warning…

Words of Caution in a Bubble Market

There are plays every day. If you miss one, it’s no big deal because there’s another play the next day. If you sell too soon or only get a partial execution … don’t worry. More plays will come.

My top students and I are capitalizing on the hottest market in years. You have HUGE numbers to inspire you. Ridiculous numbers.

But…

I’m not trying to sugar coat. Don’t think that everyone is winning. Never forget (and always remember) that statistically, 90% of traders lose.

If you’re not prepared (and most traders aren’t) then don’t think you’re going to do the same. If you’re just beginning … do NOT size up too early. Do NOT think you’re going to have big wins right now. Everything is moving too fast.

And that’s why it’s so important for you to learn…

More Breaking News

- Reddit Inc.’s Stock Surge: Understanding the Rise

- Growth or Bubble? Guardant Health Stock Mysteries Unveiled

- Tesla’s Big Moves: Is the Future Bright?

The 3 Most Important Words EVERY Trader Should Know

LOL, my newest video lesson at https://t.co/0HhPp6CC1v is really connecting with people, here's a graphic someone made me, I hope it helps you too as it's my rule #1 from my https://t.co/ZB6EtR1OtK rules so learn it, live it, love it! pic.twitter.com/97Bg3re5iR

— Timothy Sykes (@timothysykes) January 15, 2021

Watch this video. If you’ve already watched it, watch it again. One of my goals is to teach you the lessons I’ve had to learn the hard way over 20 years…

Trading isn’t an exact science, but rule #1 is top of the list for a reason. Ask Jack Kellogg what happened the first year he became profitable.* His answer will be, “I learned to cut losses quickly.”

Ask Matt Monaco and Roland Wolf what’s the most important thing to learn as a beginner. They’ll say, “Learn to cut losses quickly.”

(*These traders’ results aren’t typical. These traders put in the time and dedication and have exceptional skills and knowledge. Most traders lose money. Always remember trading is risky … never risk more than you can afford.)

It’s not rocket science, but all my top students do it. So burn into your brain: CUT LOSSES QUICKLY!

And this brings up something super important for small account holders. I know what it’s like to try to get an account over the PDT. It’s not easy — especially if you’ve never done it before.

That’s why, every January for the past several years, I’ve started the year with…

The Small Account Challenge

Things have been so crazy it took a while to get the paperwork done to open a new small account. But it’s done.

Why do I trade with a small account? Because I know most of my students — and most readers — start with a small account. And you have to trade differently with a small account.

Hardfought +$2.6k for me so far today on $ALYI $AABB $OZSC $GWSO $FTRCQ trading scared as these panics are INTENSE, but very excited to get my https://t.co/COXnm3k20a small account challenge restarted, retweet/favorite this if you want a video lesson on how I trade under the PDT!

— Timothy Sykes (@timothysykes) January 12, 2021

That’s not to say I won’t trade with my big account. This year I’m trading both. Again the market is so crazy I have to maximize — both for charity and for students. So many students grew their accounts in the last year that I have a responsibility to them, too.

So, as a teacher, I’m trading both big and small accounts. And it’s better for charity, too, since I’m donating all trading profits.

Small Account vs. Speculative Trades

Just because a trade is small doesn’t mean it’s a Small Account Challenge trade. As you’ll see in my trade review below, there are certain trades I won’t take in my small account. Even if they’re small dollar amounts.

My commentary will say ‘Small Account Challenge’ when I trade that account. Pay attention to those trades and setups if you’re still under the PDT.

And now, this is for anyone who hates on penny stocks…

Trade Review

2025 Millionaire Media, LLCWhat happens when a stock runs 1,400% in one day? How about when it spikes 3,750% in two days before reality sets in? Check it out…

ViaDerma, Inc. (OTCPK: VDRM)

ViaDerma is a specialty pharmaceutical manufacturer. The stock has a history of big spikes but it’s also ultra-low priced. Not my favorite to trade…

On January 13, the company issued a press release reviewing 2020 and looking forward to 2021. It was actually good news rather than just a bunch of hype. It kept uptrending throughout the day so it was on my radar. I tried to wait on this one. But it was just going too fast…

Forced Out of Retirement

I like to think of myself as a retired trader — only coming out of retirement for the best setups. I was hoping to wait to buy near the market close on January 13. But once it started to break out, it forced me out of retirement.

VDRM was one of the best stocks in the past couple of weeks. There were opportunities to trade breakouts and panic dip buys. I took advantage of both.

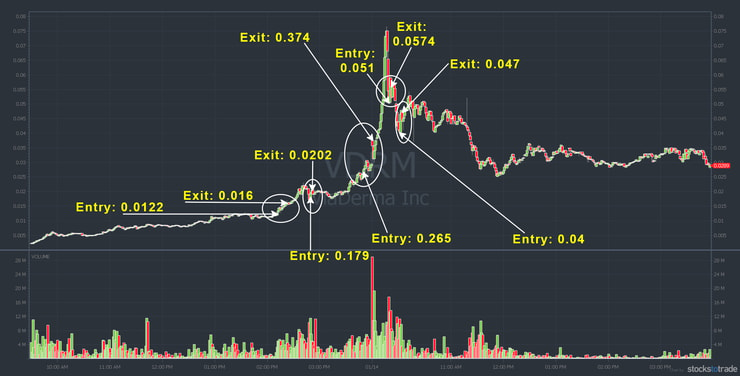

Here’s the two-day VDRM chart from January 13–14, with my entries and exits:

As you can see from the chart, I traded VDRM five times over two days. Not seen on this chart is one more VDRM trade from January 15. All told, I made $14,521 in profits on this stock over three days.*

(*Please note: my results are not typical. I’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

I won’t break down every trade. But here’s the general gist of things…

With the first trade, I was buying the late-day breakout. I wasn’t sure about holding overnight. When it hit my goals in a matter of minutes, I got out.

The second trade, realizing I’d underestimated the big spike, I bought the dip. It was a decent bounce but not as much as I expected. Since it was already up 960% on the day, I decided to play it safe.

The third trade was a classic example of my OTC first green day pattern. But it was VERY speculative as the stock was up over 1,000% on the day. I don’t like chasing, but the setup was near perfect: big percent gainer, with news, with volume, closing strong…

Why VDRM Overnight Wasn’t a Small Account Challenge Trade

I like to use OTC first green day trades to build my small account each year. Why? Because when you hold overnight it doesn’t use a day trade.

But VDRM didn’t fit my criteria for the Small Account Challenge. It was too speculative. I would never encourage taking this trade with a small account. VDRM closed up 1,400% on the day. It had come too far to risk holding it overnight with a small account.

So even though I held a small position overnight, it was using my big account. Know the difference between a solid risk/reward in relation to your account size. As it turned out, VDRM had a beautiful gap up, and I sold at the open.

Then after a brief dip, it went full supernova in the first 15 minutes on day two. When it came back down, I bought the dips twice. What a bouncer!

If you’re familiar with my Pennystocking Framework, this chart should look familiar. If not… learn the framework. Study this chart. Look for this sequence of patterns. It keeps happening. I have no idea when it will happen again … but I would be shocked if it didn’t.

HUGE caveat: the Pennystocking Framework came from watching penny stock promotions play out. I was short-biased at the time. I would NEVER short sell a stock this low priced. Plus, I really hate trading sub-penny stocks. VDRM was a sub-penny stock at the start of the day on January 13. So for me, long was the only option for this stock.

What would I have done if it didn’t gap up? Easy. I’d follow…

Trading Rule #1: Cut Losses Quickly

I don’t think it’s good to have to rely on luck or a hot market for your strategy to work. What happens when you don’t have luck or a hot market? You get annihilated like most traders.

People ask me if rule #1 about cutting losses quickly still applies in this bubble market & the answer is definitely YES! I know it can be tough/frustrating, but it's good to be overly-safe in ALL markets as too many traders are gunslingers who can do well, but blow up in the end

— Timothy Sykes (@timothysykes) January 14, 2021

If you want to succeed, you’re going to have to learn to keep your losses small. And that means you MUST cut losses quickly.

Those small losses are not bad things. They’re part of the process. I’m not scared of losses. And I’m not scared of students taking losses if they’re following rule #1.

Small losses, especially in the beginning, are a good thing. Over time they help you build confidence. You get to a point where a small loss isn’t emotional.

But if you don’t follow rule #1 — if you don’t cut losses quickly — it can lead to disaster. Not just for your account, but for your confidence.

Be Proud to Cut Losses Quickly

When promoters rag on my students for their small wins and small losses on social media … I laugh. And I want YOU to laugh as well. Because if you can really learn to cut losses quickly and focus on the process … you’ll have the last laugh.

The reason promoters twist small losses and tell newbies they’re bad, is because they don’t want you to sell. When too many people sell their blatant pump, it’s ineffective.

So if you’re just starting, be proud of your small losses. Be proud of the ability to cut losses quickly. Use EVERY trade as a way to learn and refine.

It can be confusing at first. Welcome to the penny stock world. Everything is backward.

Millionaire Mentor Market Wrap

What are you doing today to prepare for tomorrow? Are you studying? Do yourself a favor … carve out a few hours today and study.

As you make your watchlist and prepare, make a commitment to cut losses quickly EVERY time. Sure, you’ll get caught out sometimes. It happens. But make it a habit to get out when in doubt.

In the long run, following rule #1 will give you time to refine. And you need time…

Trading Challenge

Learning to trade consistently takes time. This market is amazing. But without rules, small mistakes can turn into disasters. This is why having a mentor to guide you through the ups and downs of the market is so important.

Trading Challenge students get to learn from me and several of my top students. We mentor you through ups and downs. We mentor you through bull and bear markets. Most importantly, we mentor you through the grind at the beginning.

Make no mistake: it’s a difficult path. There’s a lot to learn. But if you’re serious about trading, it’s the most comprehensive program we offer.

Do you have what it takes? Apply for the Trading Challenge today.

If you understand the importance of rule #1, comment below with “I will cut losses quickly!” If you don’t… Give me 100 burpees and repeat it after each one.

Leave a reply