Traders use market maker signals as another indicator to inform their trades. We can view these signals on instruments like Level 2.

Essentially, we’re able to view the shares trading hands in real-time.

We can see how many shares and for how much money.

This data helps us paint a better picture of the market. When the picture is clear, it’s easier for us to see trade opportunities.

Most people throw money at the market and don’t look at the market maker’s signals. They ignore a key piece of data.

That means that if we can understand the language, we’ve got an advantage.

I’ve been in the market for over 20 years. I know the tricks of the trade. I’ve seen the man behind the curtain.

Understanding market maker signals separates the real traders from the gamblers.

And I’m not here to gamble.

I’m here to make money. Let’s get down to business.

Table of Contents

What Are Market Maker Signals?

Market maker signals are numerical cues that market makers (firms and brokers who buy and sell stocks) use to communicate their intentions.

Whether it’s a buy signal, sell signal, or anything in between, these signals offer glimpses into the market maker’s next move. Think of it as reading their hand.

While some see this as manipulation, for many traders, it’s just another layer of data, another aspect of the market’s complex dynamics.

Diving Deeper into the Concept of a Market Maker

Market makers play a vital role in the trading ecosystem. They are the dealers that bridge the gap between buyers and sellers, providing liquidity and maintaining a seamless flow in the market.

These companies hold vast amounts of stocks, including penny stocks, and constantly provide bid and ask quotes.

The aim? To profit from the spread between buying and selling.

The concept goes beyond just numbers. Market makers operate at the core of market functionality, offering value by smoothing out price volatility. They’re like the grease in the engine, ensuring all parts move smoothly without resistance.

The risk they take on by holding positions helps increase trading volumes, and they’re an essential part of the Nasdaq and other exchanges.

But most people don’t know anything about them.

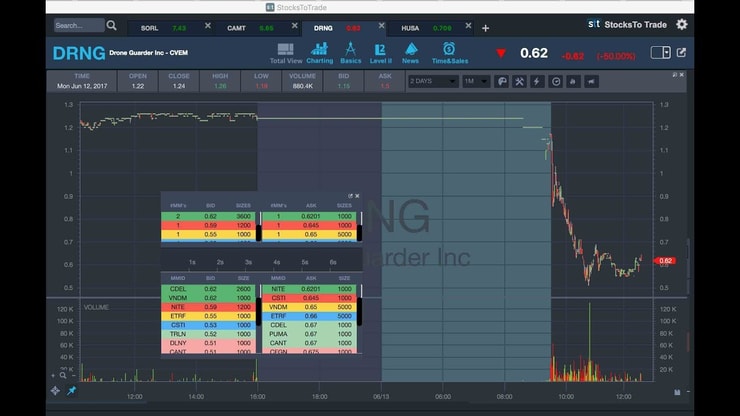

One of the only places you can access market makers is in Level 2 software.

Free trading software doesn’t show Level 2. That’s why I use StocksToTrade. I helped develop it for small account traders like you and me.

To get a full view of the market …

Try a 14-day trial of StocksToTrade for just $7.

What Is a Market Maker?

A market maker is like the dealer in the world of trading.

It’s a firm or individual trader who facilitates the buying and selling of shares, keeping the stock market’s wheels turning.

They ensure liquidity by offering to buy or sell at any time, bridging the gap between buyers and sellers. The role of market makers is vital in keeping the market process smooth and efficient.

How Do Market Makers Work?

How market makers operate is a blend of art and strategy.

By setting bid and ask prices and trading with either side, they make money through spreads and commissions. They react to changes in the market, offers from other market participants, and information such as news releases.

These activities are essential in maintaining liquidity, offering buyers and sellers a platform to trade easily.

You can see them in the video below …

Understanding Market Maker Signals in Action

Understanding market maker signals can be likened to decoding a unique language.

These signals, including buy signals, hold signals, up signals, down signals, over signals, and under signals, provide clues to the market maker’s intentions. I know there’s a lot. Don’t worry, it comes with time.

Traders who can read these signals have an edge, tapping into insights that many others overlook. And vice versa, traders that ignore the signals are missing out.

For example, a hold signal might reveal a dealer’s intent to keep a position static for the time being.

Meanwhile, up signals and down signals might show trends in price direction.

These clues can be invaluable to investors and traders alike, but they require attention, analysis, and the right resources to decode. It’s not about quick tips or shortcuts; it’s about diligence, understanding the theory, and putting in the work.

While understanding market maker signals is crucial, it’s equally important to have a comprehensive understanding of other day trading indicators.

These indicators can provide additional insights into market trends and potential trading opportunities. For a more in-depth look at day trading indicators, consider exploring this comprehensive guide. It provides valuable insights that can enhance your trading strategy and decision-making process.

More Breaking News

- PDD Holdings’ in Turbulent Waters: Navigating Challenges and Opportunities

- HCW Biologics’ Stock Soars: What’s Fueling This Phenomenon?

- XPeng Stock on the Rise: Will It Keep Climbing or Lose Steam?

Real Market Maker “Signals” To Pay Attention To

Pay attention, traders. Understanding real market maker signals can be a game-changer.

These signals reveal intentions to buy, sell, hold, or even manipulate the stock price. They come in different forms, including numbers and changes in order volume.

This is something I show all my students in the Challenge. I hold live webinars to display Level 2. Then I explain the market maker signals in real-time.

That’s why all my millionaire students come from the Challenge, it’s the one-stop shop for everything a trader needs …

Click here for the head start I wish I had!

Reading them correctly can guide you in making informed trades.

5 Common Market Maker Signals and Their Meanings

There’s a world within numbers. Here’s a breakdown of 5 common market maker signals:

- 100 – I need shares.

- 200 – I need to unload shares.

- 300 – Take the stock down to get shares.

- 400 – Keep trading it sideways.

- 500 – Gap the stock up or down.

Understanding these signals and their meanings can enhance your trading strategy.

Less Frequently Used Market Maker Signals

While some market maker signals are common, others are used less frequently.

These can include specific numeric codes or changes in order flow that indicate less conventional market strategies. While they may not appear every day, keeping an eye on these signals can provide insights into specific market conditions and opportunities.

The Impact of Market Maker Signals on Various Markets

Market maker signals aren’t confined to one trading arena. They can be found across stocks, penny stocks, and even forex.

The impact of these signals can be far-reaching, affecting everything from price levels and ranges to liquidity and competition.

In the stock market, these signals can influence the support and resistance points, shaping how prices move.

For investors, recognizing these signals can be the difference between success and failure. It’s about looking at the evidence, understanding the reasons behind the signals, and making informed decisions.

No two markets are the same, but the presence of market makers and their signals weaves a common thread through them all.

It’s a case of connection and interplay between thousands of entities.

How Do Market Makers Move Prices?

Market makers can move prices up, down, over, or under. By placing orders and managing the bid and ask spread, they create fluctuations in stock prices.

This is not necessarily manipulation; it’s part of their role in maintaining liquidity and matching buyers and sellers. Understanding this aspect can enhance your ability to read the market.

What Is Market Maker Strategy?

Market maker strategy is about leveraging the data, research, and content to make buying and selling decisions.

It’s not just about reading signals; it’s about using them to create opportunities. A market maker will analyze trading volume, trends, and market news to make their moves.

Market Makers in Various Types of Trading

From stocks to forex, market makers are a constant.

Their presence ensures that trades happen, even when buyers and sellers are scarce. In every type of trading, these entities hold sway, providing stability and keeping costs in check.

In the world of penny stocks, market makers might be seen as the linchpin, enabling small trades that can lead to big profits. The same principles apply to other types of trading, with market makers adapting their strategies and signals to suit the environment.

Understanding these various roles requires more than just superficial knowledge; it requires diving deep into the subject, understanding each other’s roles, and recognizing the interplay between all the various parts.

Market Makers in Forex Trading

In forex trading, market makers play a significant role in providing liquidity.

By offering buy and sell signals and controlling spreads, they facilitate trading between different currencies. Understanding their signals in this arena can lead to better decision-making.

Forex trading is a fast-paced environment where scalping is often used as a strategy.

Scalping involves making numerous trades within a day to profit from small price changes. To effectively implement this strategy, it’s crucial to understand the best indicators for scalping.

For a detailed discussion on this topic, check out this resource. It provides a comprehensive overview of the best indicators for scalping, which can be a valuable addition to your forex trading toolkit.

Market Makers in Stocks Trading

Stock trading is where market makers truly shine. They provide the liquidity needed for buyers and sellers to trade efficiently.

By monitoring their signals, you can glean insights into the direction of stock prices and make informed trades.

In stock trading, momentum is a key factor that traders often monitor. Momentum indicators can provide insights into the speed of price changes, helping traders identify potential trading opportunities.

For a deeper understanding of how to use momentum indicators in stock trading, this article is a must-read. It offers a detailed explanation of momentum indicators, enhancing your ability to make informed trading decisions.

Market Makers in Crypto Trading

Market makers are a crucial part of the crypto world.

They facilitate trading in a relatively new and volatile market, using their signals to bridge gaps between buyers and sellers. Understanding these signals can provide an edge in this rapidly evolving landscape.

If you’re interested in crypto at all, make sure to watch my video below …

Market Makers in CFD Trading

In CFD (Contract for Difference) trading, market makers provide the ability to trade without owning the underlying asset.

They signal their intentions through their actions, providing insights into market trends and opportunities.

Key Takeaways

Understanding market maker signals is about peeling back another layer of the trading world.

It’s not about getting rich quick; it’s about deepening your understanding, enhancing your strategy, and making informed decisions.

From stocks to forex, these signals are a valuable resource for traders who are willing to put in the work.

Trading isn’t rocket science. It’s a skill you build and work on like any other. Trading has changed my life, and I think this way of life should be open to more people…

I’ve built my Trading Challenge to pass on the things I had to learn for myself. It’s the kind of community that I wish I had when I was starting out.

We don’t accept everyone. If you’re up for the challenge — I want to hear from you.

Apply to the Trading Challenge here.

Trading is a battlefield. The more knowledge you have, the better prepared you’ll be.

Do you use diamond pattern trading in your trading strategy? Let me know in the comments — I love hearing from my readers!

Frequently Asked Questions (FAQs)

Do Market Makers Manipulate Price?

Market makers don’t necessarily manipulate prices.

They facilitate trading by providing liquidity. While their actions might move prices, it’s part of their role, not a devious scheme.

Do Market Makers Own Stock?

Yes, market makers do own stock.

They hold inventory to facilitate trades between buyers and sellers. It’s part of their essential role in keeping the market moving.

What Are the 3 Major Markets Where Market Maker Signals Are Used?

The three major markets where market maker signals are prevalent include the stock market, the Forex market, and the crypto market.

Each one of these markets has its dynamics, but the presence of market makers ensures liquidity and facilitates the smooth trading of assets.

By understanding market maker signals in each of these contexts, traders can make more informed decisions.

Leave a reply