Lots of traders are feeling burned by the markets, and who can blame them?

Millions of people bought the market in March 2020, taking a one-way ticket to profit town.

Now, the ones who invested in Bitcoin (BTC) and Ethereum (ETH) are getting pounded into the ground.

Yet, one of my students saw this as an opportunity to take the other side of the trade and hit bank.

Give MAJOR props to @thehonestcroock who now locked in $284,000 in trading profits today on his $BITO $SPY puts, huge congratulations to all his https://t.co/a3dSVG2iCc students too, it pays to learn from transparent millionaire traders, not those too cowardly to show ALL trades! pic.twitter.com/Y3blFky3hw

— Timothy Sykes (@timothysykes) June 13, 2022

And so did many of his subscribers!

In fact, there have been multiple places in the penny stock world to find opportunities.

Here’s where I see them.

Table of Contents

Biotech Breakouts

At any given point, there are literally thousands of biotech companies completing research, working through trials, or seeking approval.

Any one of these announcements can send shares soaring.

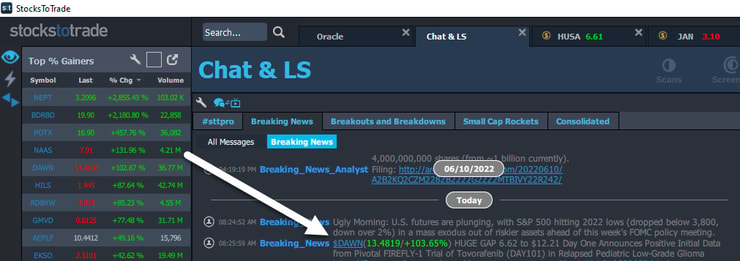

Take Day One Biopharmaceuticals Inc. (NASDAQ: DAWN). Shares soared on Monday after the company reported positive results from a drug trial.

I know some traders who exclusively trade these tiny biotechs.

While it can be tricky, it helps to maintain a list of companies along with expected catalysts and dates.

For example, you might follow Soligenix Inc. (NASDAQ: SNGX) to see when it’s SGX203 for Pediatric Crohn’s Disease could complete its Phase III trial. Mark the tentative completion date on your calendar and be sure to follow up on it.

The 8:30 a.m. Press Release

Maybe you’ve noticed this before, but a lot of small and micro-cap companies love to send out press releases around 8:30 a.m. Eastern.

Most of the time, this is just garbage pushed out by promoters that gets retail excited to pile into the name.

But, it creates plenty of opportunities for trading setups such as morning panic dip buys.

You see, promoters love to push the stock higher so they or whomever they represent can sell shares at a higher price.

They’ll try to scoop up shares whenever the stock faces heavy selling.

I use this to enter the trade alongside them for some fairly quick long trades.

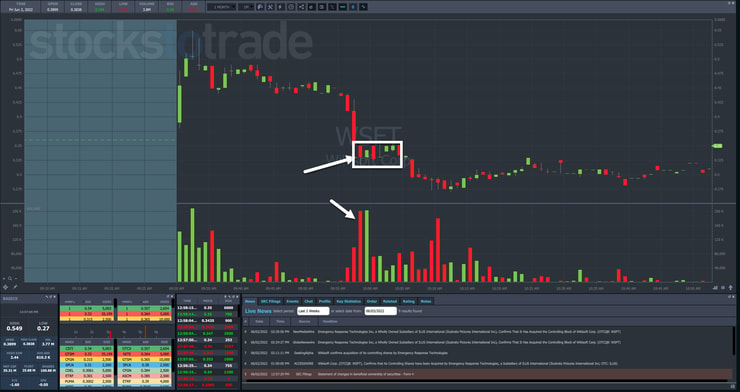

This is what I did with Wikisoft Corp. (OTC: WSFT) a day after the stock made a huge run on some laughable news.

For anyone trading the market, I always recommend studying the price action of stocks like these for several weeks before putting any real money to work.

Look at how they move, see what happens when volume comes in and when it subsides.

Do this for both the premarket and the regular session.

And take notes.

More Breaking News

- BNAI’s Stock Movement Post-Conference: A Surge in Visibility and Enquiries

- Fly-E Group Inc: Deciphering Its Unexpected Market Moves

- FTAI’s Strategic Moves: Ready for a Takeoff or Stalled?

My office used to be littered with trading journals where I put down my thoughts and observations.

Set Up a Morning Process

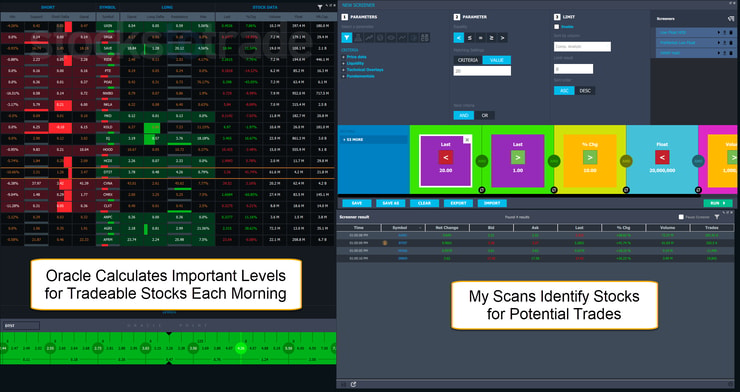

Every morning, I look to the same places for trade ideas.

First, I go to my watchlist. This isn’t anything fancy. Just a list of names that I’ve traded recently or want to keep an eye on.

Second, I look at the Breaking News in StocksToTrade. We hired some of the best analysts around, so I might as well take advantage of it.

These guys not only curate the news down to bite-sized, actionable ideas, but also highlight when large chat rooms are active in a particular name.

Lastly, I run a screener on the StocksToTrade platform.

It’s a simple screener that tells me which stocks are moving in premarket with heavy volume, as well as their float. The great part is I can quickly see if there’s any news related to the results.

Plus, it’s a great place to check out our Oracle tool which automatically calculates support and resistance levels in the premarket on the hottest stocks.

Follow the Trader

When I get a new student, the first thing I do is explain my mantra — keep your losses small and fast.

None of my millionaire students got to where they are overnight. It takes time and practice.

But you can get there.

I know that’s difficult, especially now with markets going haywire.

That’s why I walk students through my trading process, showing them how I look for setups, and letting them see the trades I take.

My goal is for every one of my students to find their own style and become a successful trader.

And I can’t wait for you to join me.

—Tim

Leave a reply