One of my newsletter subscribers is a mailman and he emails me every time he’s about to deliver mailers on a penny stock pump!

Penny stocks promoted by scumbags like this career criminal and The Female Wolf Of Wall Street here.

I formerly wrote about this mailman HERE and it’s actually very logical to buy a pump if it’s early enough in the promotion (since a penny stock pump’s entire existence is to enhance the wealth of insiders/promoters who prop up a worthless “company” by marketing it to unsuspecting and financially ignorant people all over the world, sadly mostly to midwesterners, the kind of people who believe reality shows are real (newsflash, as I wrote HERE, they’re not)

The vast majority of the world believes trading penny stocks to be unpredictable and dangerous while traders like this young man, my success as documented HERE and videos like these below prove beyond a shadow of doubt that penny stocks actually are VERY predictable if you stick to the right patterns and use rules like these to trade penny stocks.

Not to mention all of these people too!

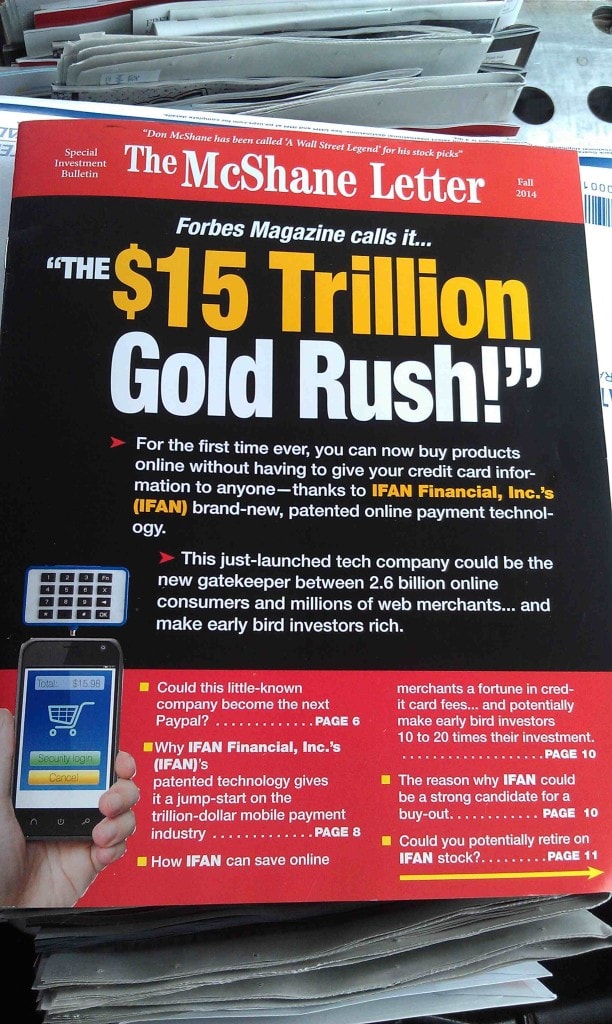

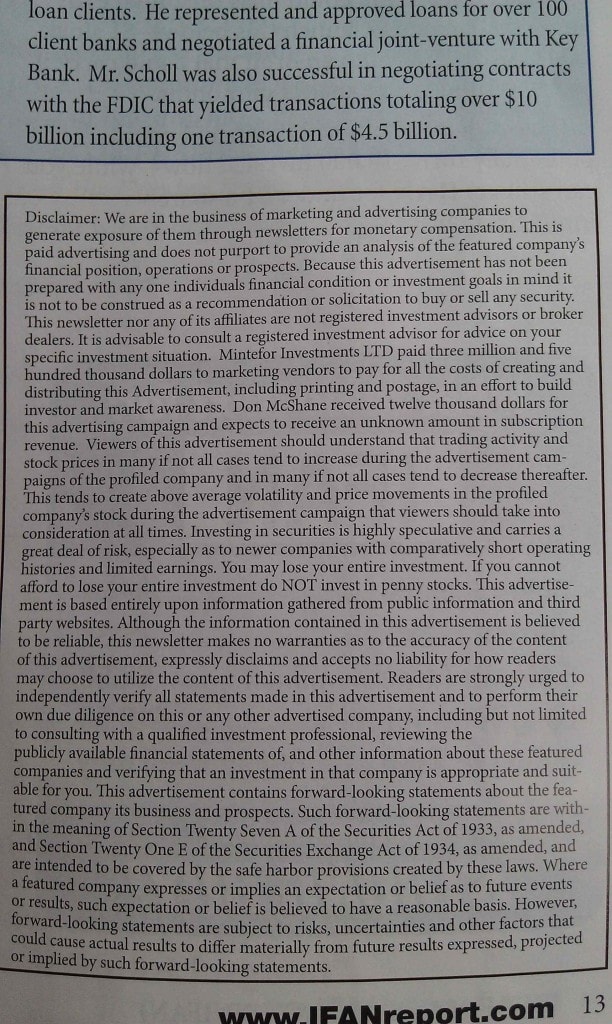

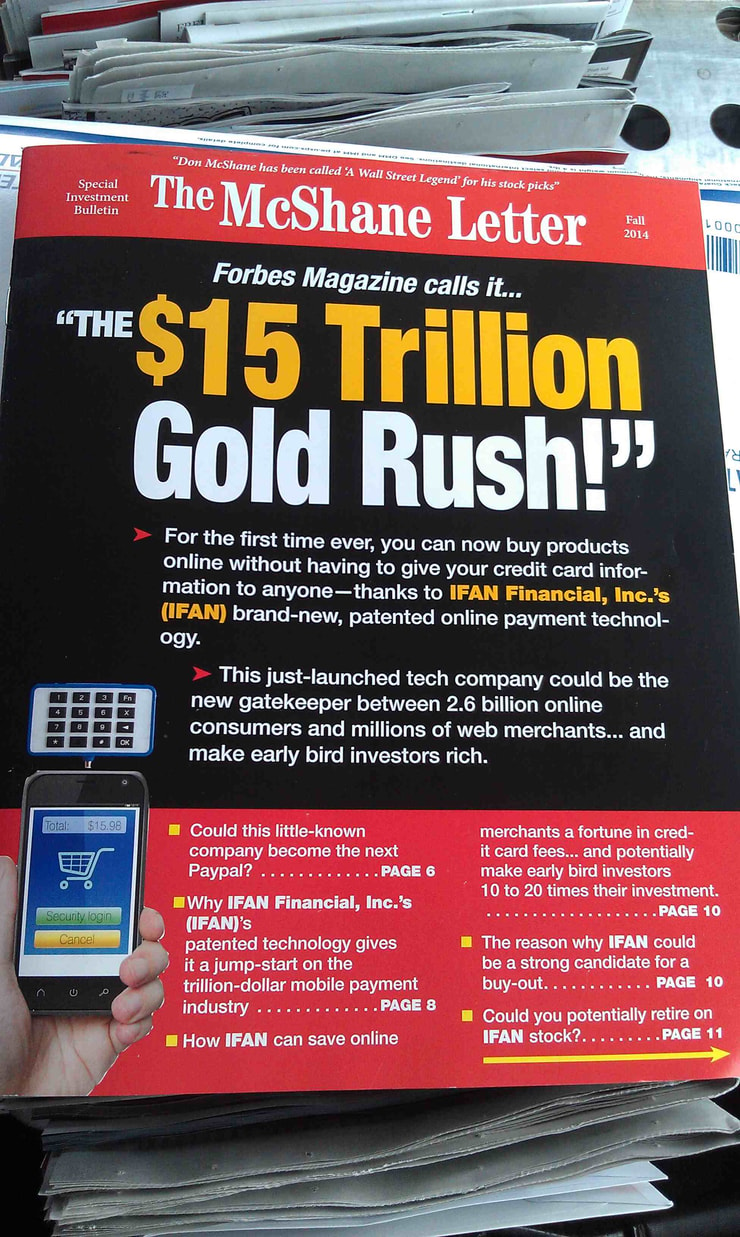

And that’s because with penny stock pumps you don’t have to analyze the company’s industry, competitors, their profit potential, revenue growth etc. because they don’t have any real businesses, their stocks are artificially inflated by sending out mailers like these:

More Breaking News

- Banco Santander Seals Major Acquisition, Enhances Market Position

- McKesson Corporation Clears European Hurdles and Raises FY26 EPS Guidance

- Blue Owl Capital Surges as Q4 Earnings Beat Expectations

- Bill.com Boosts Fiscal Year Outlook with Impressive Q2 Results

Yup, that’s right IFAN is being artificially pumped up by mailman everywhere right now…as my mailman student says “Disclaimer says 3.5 million paid to advertise. Mailing these today!” so I wouldn’t be shorting IFAN right now… truly and blissfully financially people receive these mailers today, tomorrow, over the weekend and I’d love to see insiders/promoters NOT sell into their buying so there may be a massive short squeeze if and when the stock breaks above . 60 and .61…and I might even buy such a breakout despite the fact that I was shorting it the other day at .59.

I don’t think the company is worth more than a penny per share, but with all these mailmen delivering mailers, the vast majority of the world’s idiots will be buying this stock and there’s a lot more of them than there are me or my well informed students…breakout potential, just be careful though as insiders and promoters can and will sell at anytime and if the SEC ever gets off their butts, this stock should be halted soon too so there’s risk buying and holding overnight too.

I look forward to IFAN being a great short eventually, once the promotion runs out as it’ll crack EXACTLY like this and my top trading challenge students and I will be ready to short in anticipation of its inevitable 30-50-70% crash which will happen over 1-2-3 days when insiders/promoters have cashed out all their shares.

Leave a reply