So you want to add some Level 2 trading skills to your toolkit. That’s great!

Level 2 data is the nerdy part of trading I usually hate on. It’s the type of stuff that makes me feel like a computer programmer from the 80s. Like I’m in some bunker trying to decode a Soviet plot. All those flashing colors and numbers and acronyms that you ‘probably should know’…

Today, I want to dispel any antipathy around trading with Level 2 AND show you how to use Level 2 for day trading. It’s not rocket science. It’s not a cheat code for trading, either.

It’s simply one more tool that you can learn.

If you’re here, I hope you’ve already picked up some trading basics — like my FREE guide to penny stocks. Be sure to check out my YouTube channel. It’s full of trading lessons and guides, like my “30 Trading Videos in 30 Days” playlist.

Maybe you’re even on your way to applying for my Trading Challenge, where many top traders have started.

Level 2 is one more piece of the puzzle. Understanding Level 2 won’t give you some brand new ‘trading system.’ You do that yourself, by continuing to learn and grow as a trader.

Table of Contents

What Is Level 2 Trading?

2025 Millionaire Media, LLCWhen someone tries to buy or sell a stock with a limit order, it gets listed with all the other orders.

This is what’s called the order book. Buyers are listed in the left column — the ‘bid.’ Sellers are in the right column — the ‘ask.’ The prices closest to the last price the stock traded are at the top, and are the first to come off.

This is the part you should pay attention to.

When bids come off the board, the price will usually go down.

When asks come off the board, the price is probably heading up.

Why is that? Offers to buy and sell at higher or lower prices than the current price can help give you an idea of the mood around the stock.

If you have a stock that’s been selling for $1.04 per share, the only reason to take $1.03 is so you don’t get stuck taking $1.02. Or less.

You know that moment in school when you realized that something wasn’t cool anymore? That’s when you just knew you needed the new ‘it’ thing to impress your friends…

The same principle is in play when a stock runs. It isn’t just a trading principle — it’s a LIFE principle.

Level 2 and Price Action

2025 Millionaire Media, LLCIf you want to understand how Level 2 quotes affect price action, there’s a book I think is worth reading.

“Extraordinary Popular Delusions and the Madness of Crowds” by Charles Mackay is one of my favorite books. It explains why prices move based on crowd sentiment. It was published in the 1800s, but its lessons are timeless.

(As an Amazon Associate, we earn from qualifying purchases.)

Or just watch that last scene in “Trading Places” again. When the old rich guys are buying orange juice futures, everyone wants in.

But like I say, this is only one piece of the puzzle. When the news signals a drop in OJ futures in the scene, people trade on the news and not peer pressure. The price goes down. Check out my video lesson from 2016. It may be a few years old, but the lessons still apply today…

Level 2 Trading Platforms

Most of the best trading platforms out there have Level 2 functionality. Fidelity, E-Trade, Interactive Brokers, and many others have Level 2 stock trading and Level 2 options trading.

Even the brokers I called out in the tweet above have caught on. Robinhood and Webull have since come out with Level 2 add-ons.

Many of these brokers will even give you Level 2 data on their trading apps.

And yeah, I know your next question … because it’s one I always get. “What about free Level 2 trading platforms, Tim?”

Well, in the days of no minimum deposits, a lot of Level 2-equipped trading software is free. Just watch out for fees and commissions.

StocksToTrade

The Level 2 trading platform I use is StocksToTrade. It isn’t free, but I think its robust Level 2 quotes more than make up for that.

This is especially true for OTC stocks. Some platforms have incomplete Level 2 quotes for OTC stocks. Heck, Robinhood and Webull won’t even let you trade OTCs.

But to me, OTC stocks can be great for helping to build a small account. And Level 2 is even more important for OTCs than listed stocks. More on this later.

StocksToTrade has many other features that make it my go-to:

- A killer news scanner that picks up on press releases, earnings reports, tweets, and other things that move a stock

- A flexible stock screener, built with penny stock traders in mind

- Awesome charting capabilities, which help me to identify my favorite setups

Try STT now for 14 days — it’s only $7.

(Quick disclaimer: I helped design and develop StocksToTrade. I’m also an investor in it.)

What Is the Difference Between Level 1 and Level 2 Trading?

2025 Millionaire Media, LLCLevel 1 quotes are also known as real-time quotes. They show you the current bid-ask spread on a stock, as well as the volume being offered. And they also show you the last price the stock traded at and the volume. But you only see a single bid and ask — you can’t see how deep they go.

Level 2 shows you real-time quotes for each market maker. This is the order book — limit orders that are waiting for a fill. It can give you a better picture of supply and demand. Seeing Level 2 is like a glimpse into what everyone’s thinking.

How to Read Level 2 Market Data

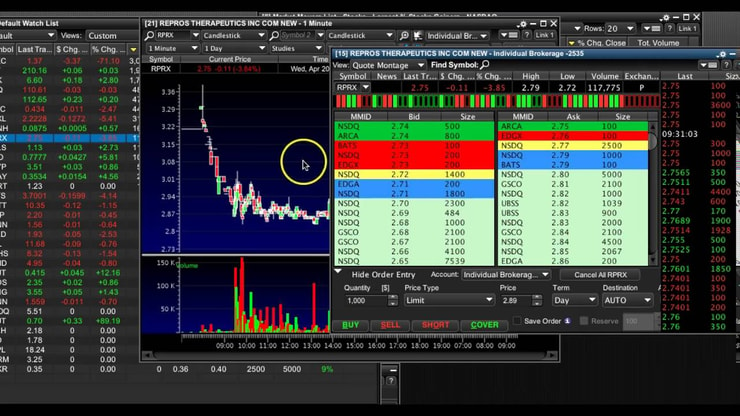

2025 Millionaire Media, LLCOK, get your decoder rings on. We’re about to go under the hood.

First, let’s talk about the three- and four-letter names alongside those numbers. Those are called market maker IDs (MMIDs), and some traders use them to guide their trading.

Market makers literally ‘make the market.’ Many are large institutional brokers or exchanges. They provide liquidity by buying when no one else is buying and selling when no one else is selling.

But they’re also traders trying to make money. And they try all kinds of tactics to make that happen.

They know we’re watching.

Here’s what it looks like…

2025 Millionaire Media, LLC — courtesy of StocksToTrade.comOn the left, you see the bidders. There are a lot of bids at $34.95, and each market maker is displayed under the ‘MMID’ heading. Sellers are under ‘ASK’ on the right. You can see the number of shares for each bid or ask under ‘SIZE.’

How’s that useful? Imagine we’re trading a breakout. The stock’s about to break over a multi-year high of $2. We’ll take the most fundamental approach, and buy over $2. But what if there’s a HUGE number of sellers? The only way to tell is with Level 2.

Level 2 data can warn you of a failed breakout. You can see if there are massive numbers of shares on the ask and follow my #1 rule: cut losses quickly.

More Breaking News

- THRD’s Ambitious Moves: From Trials to Strategies?

- Microbot’s Liberty Boosts Stock: What’s Next?

- Is Roblox Stock Surging Towards Another Boom?

The Inside Game of Level 2 Trading

One of the games that market makers play is flashing big orders in one of the columns and then taking it off the board. This can make traders second-guess themselves. Is it a real order or market manipulation?

Orders will show up in small volume and restock as soon as the order gets filled. Often, market makers stage their orders in this way to avoid spooking the market. This is called ‘soaking up size.’

Market makers can also disguise their orders through alternate market makers. These are known as electronic communications networks (ECNs).

A third market participant is the wholesaler. Some brokers sell their order flows to these wholesalers. They usually represent retail traders.

Some traders keep cheat sheets on market makers. They watch for the ones known for dilution — flooding the market with shares and killing the price.

They also watch for the ax, which is the most important market maker. The ax usually drives the price action in any given stock. If you become familiar with a stock’s Level 2, you can figure out who the ax is and keep an eye on its moves.

Of course, the ax knows you’re watching. They’ll dig into their bag of tricks whenever it suits them.

And those 8-bit colors? They’re just there to help you visually group the prices.

See How I Use Level 2

2025 Millionaire Media, LLCLevel 2 can be incredibly useful for the niche I trade, penny stocks. Check out this video…

OTC stocks tend to have much clearer Level 2 quotes than listed stocks. So when you see a wall of buyers like I did in the video, you can be a little more confident that you’ve found the bottom.

That’s because OTC stocks usually have lighter volume than listed stocks. When the order book isn’t as deep, it’s harder for market makers to hide orders.

It’s much harder to use this strategy on listed stocks.

On the main exchanges, market makers create noise … They try to disguise or manufacture supply and demand.

The market moves on simple supply and demand. If you see 100,000 shares on the sell side and only 5,000 on the buy side, the price will probably go down.

But market makers are smart. They know traders are looking. And they put on extra weight to tip the scales or prop it up so you don’t see what’s really happening.

So they sell through 5,000, then another 5,000, and so on. If they’re careful, they can sneak the whole 100,000 through without moving the market.

But remember — it all comes down to price. If the price doesn’t budge after a buyer or seller imbalance, that’s all you need to know.

Level 2 Trading: “Learn Level 2” DVD Webinar

If you’re looking for a Level 2 trading tutorial, check out the “Learn Level 2” DVD recorded in 2008…

It may seem dated, but the principles are the same.

And I think this DVD is one of the best resources available for understanding Level 2. This DVD isn’t just a classic, though. It’s also one of the few resources you’ll find that spotlights OTC Level 2 quotes and shows you how to trade with them.

Apply for My Trading Challenge

2025 Millionaire Media, LLCIf you see education as a never-ending battle, check out my Trading Challenge. But know that I only accept the most dedicated students. If you’re accepted, you get access to all my DVDs, including “Learn Level 2.”

Plus, I share all my trades and the plans behind them, every day in the Challenge chat room. I’m proud to be a transparent trader in an industry full of fakes. It gives my students more opportunity to learn from my every move, even my mistakes.

Everything I’ve learned in my 20+ trading career goes into this challenge. Come learn from me, other top traders, and a group of peers.

It’s your time to level up. Apply for the Challenge today and start your journey!

The Level 2 Trading Conclusion

2025 Millionaire Media, LLCLevel 2 knowledge can help you in your trading. But you need to keep it in perspective.

For me, Level 2 is just another indicator for a trade.

Like my Trading Challenge students, you’ve gotta realize that your learning is never done. There’s no magic knowledge pill that makes you a successful trader.

There’s only getting a little bit better every day. So stick with it. And always remember that small gains add up and to cut losses quickly.

Have you figured out Level 2 trading? Let me know your Level 2 strategies in the comments — I love hearing from my readers!

Leave a reply