Sub-penny stocks are definitely NOT my favorite to trade. There’s a reason they’re sub-penny…

These are some of the sketchiest stocks in the entire market. Many are shell companies. Very few have products or meaningful revenue. Most aren’t up to date with filings.

The SEC is cracking down on OTC “Pink No Information” companies. You shouldn’t worry about something you can’t change. Rules come and go — your job is to adapt.

But I do think you should arm yourself with the most knowledge possible.

Which leads to today’s lessons on sub-penny hype. A lot of “Pink No Information” companies are scrambling to get current because of the new rules. And they’ll go to almost any length to appear legit. Keep reading for a good example from last week.

And, as always, there’s a student Q&A section. But first, I’m proud to announce…

Table of Contents

- 1 Karmagawa Supports Eat Move Grow

- 2 5 Key Lessons From a Sub-Penny Crash

- 3 Trading Mentor: Questions From Students

- 4 Trade Review

- 5 Millionaire Mentor Market Wrap

Karmagawa Supports Eat Move Grow

I’m super excited to announce Karmagawa’s 82nd school project in partnership with Eat Move Grow.

Eat Move Grow supports under-resourced schools in Louisiana. When big grants come through for schools, a lot of the money goes to population centers. These rural schools get overlooked. Eat Move Grow works directly with schools in 23 parishes in rural communities.

We helped with a new basketball court and computer equipment. Check it out…

I made it from Croatia to Louisiana to attend the opening of the 82nd @karmagawa school project with @eatmovegrowLA and I’m just thrilled to be able to help give these kids a new basketball court, new equipment/monitors/computers, inspiring video with all the details coming soon! pic.twitter.com/J15HrBdP3r

— Timothy Sykes (@timothysykes) May 19, 2021

But wait … there’s more…

Trying to keep up updating everyone with all the new @karmagawa schools being built….it's pretty insane, I'm about to post photos/videos from new schools #82, 83, 84 and 85….gradually going up, but it takes time….c'mo the big 100!!! 200…500….1,000 #dreambig #studyhard

— Timothy Sykes (@timothysykes) May 21, 2021

New School Projects Underway in Syria

We’re excited to be working again with Partners Relief & Development. And we’re proud to announce construction has started in these bombed-out schools. Click through the pictures and videos to see more from our Louisiana project, too.

View this post on Instagram

As always, it’s our honor to help. If you want to support Karmagawa’s mission, buy our branded sustainable merch. Tag me on Twitter or Instagram while wearing it. Help spread the word and let’s get to 100 schools and beyond!

Let’s talk trading…

5 Key Lessons From a Sub-Penny Crash

Last Thursday, several students learned an expensive lesson about sub-penny hype and speculation.

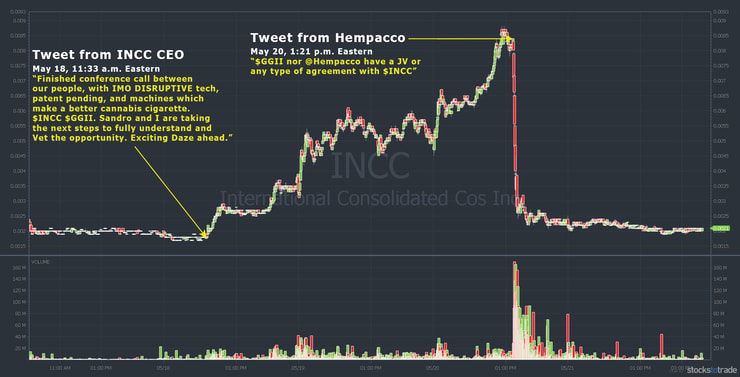

The stock was International Consolidated Companies, Inc. (OTCPK: INCC). INCC was one of many cannabis sector companies to get a February boost on news of a renewed push for legalization.

On May 11, INCC had a small spike after giving a shareholder update. The big spike came on May 18 after this tweet started a speculation-driven frenzy. The company CEO said he’d had a conference call with the CEO of Green Globe International (OTCPK: GGII)…

“Finished conference call between our people, with IMO DISRUPTIVE tech, patent pending, and machines which make a better cannabis cigarette. $INCC $GGII. Sandro and I are taking the next steps to fully understand and Vet the opportunity. Exciting Daze ahead.”

Twitter promoters and pumpers did what they always do — pump junk stocks. And newbies did what they always do — buy, hold, and hope. For two days, INCC trended up.

Then, on May 20, GGII owner Hempacco tweeted this…

“$GGII nor @Hempacco have a JV or any type of agreement with $INCC.”

Here’s the INCC five-day chart illustrating a key lesson on sub-penny hype…

Here are my key lessons from the INCC crash on Thursday…

Sub-Penny Plays Are Different

I don’t like trading sub-penny stocks because you never know what will happen. Again, these are the worst companies in the stock market.

That doesn’t mean I don’t trade them. INCC is still a potential dip buy because it’s up 2,000% YTD. But it would take the right price action. Ideally, another multi-day run with volume and a real news catalyst. Or at least competent promoters to pump it up again.

But I’ll always err on the side of caution because…

More Breaking News

- SES AI Corporation’s Recent Surge: Unraveling the Dynamics Behind Its Rising Stock

- Archer Aviation’s Financial Complexity: Is Opportunity Nestled in Recent Challenges?

- The Tumultuous Ride of Red Cat Holdings: Navigating Earnings and Leadership Changes

The Market Doesn’t Care What You Want

I feel like I’m taking crazy pills sometimes. But I’ll repeat this again…

Many traders learned the wrong lessons in December, January, and February. One of the worst lessons was that being over-aggressive paid off. Let INCC be a strong reminder that…

Hype & Speculation Are Hype & Speculation

Just because a company CEO tweets they had a call with another company CEO doesn’t mean there’s a deal. It only means the CEO is blatantly promoting the stock.

Real deals are announced via SEC filings and press releases, not Twitter. Even if there was a real deal, you have zero idea how the market will react.

When it comes to these kinds of plays…

Don’t EVER Expect Profits

There’s a reason I teach students to…

- Sell into strength.

- Don’t chase. (INCC was a sub-penny on the third green day, up 388% based on a tweet…)

- Lock in profits along the way. Singles add up.

- Don’t get greedy or overaggressive.

- And ALWAYS follow rule #1: cut losses quickly…

The list of rules goes on. Students took losses on this. With few exceptions, they were unnecessary losses.

Final key lesson on sub-penny hype…

Study the Past

Bad news crashes aren’t usually good bounce plays. But no matter the reason, this isn’t the first time a stock crashed and failed to bounce. Studying the past opens a window into seeing the risks we take every day.

Here’s another recent example…

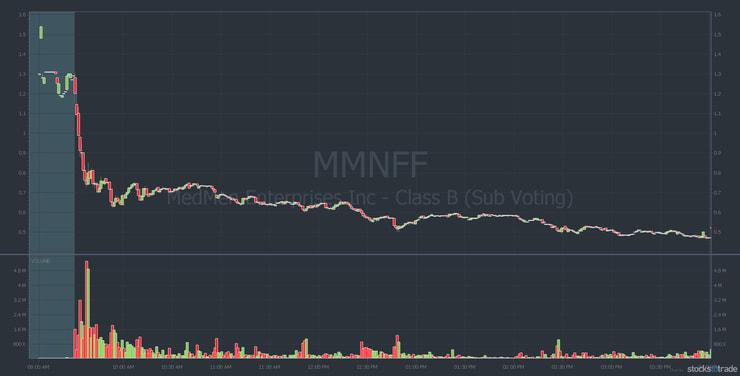

On February 11, MedMen Enterprises, Inc. (OTCQX: MMNFF) crashed hard and didn’t bounce. Several top students, including Jack Kellogg, got caught out by this. Learn from history…

MMNFF wasn’t a sub-penny, but that doesn’t matter. Stocks don’t have to bounce. You have to be ready for anything. Including cutting losses quickly when a trade doesn’t work.

Now it’s time for…

Trading Mentor: Questions From Students

Here are four questions answered during a recent Trading Challenge Q&A webinar. If you want your questions answered live, apply for the Trading Challenge today.

“What do you think about sector focus?”

I couldn’t care less about sector focus. So many people say, “Let’s focus on one sector.” Newbies have misconceptions and assumptions.

Focus on big percent gainers. If you watch my DVDs, webinars, and video lessons, I always focus on big percent gainers. Check out my trade commentary, tweets, and YouTube videos. Everywhere it’s the same — focus on big percent gainers. My watchlists always focus on the biggest percent gainers.

Get my no-cost watchlist delivered to your inbox every week when you register here.

If you focus on big percent gainers you’ll see certain sectors heat up. But sometimes it’s not just one sector, it’s two or three. Focus on… (Did you say big percent gainers? Good. Keep saying it.)

Next question…

“Do you size in and out of trades?”

No. When I’m traveling, sometimes it’s difficult just to get good Wi-Fi. I try to get in and out, one trade at a time. I get a lot of partial positions as some of these stocks move too fast.

And because we’re not seeing the same big moves we saw in January or February, I don’t go for bigger position sizes. Sometimes I could size in. But, given the way I trade, the market environment, and my geography, I’d rather be conservative. Each of those things plays a role.

It’s all included in the “Trader Checklist” and “Trader Checklist Part Deux” guides.

Next question…

“Sometimes your 5%, 10%, or 20% goal is met in the first few minutes of a trade but you hold longer. Why?”

Sometimes I see something that makes me think it can keep going. If a stock can keep going, I don’t need to take 5% or 10% right away. Sometimes I make 20% … or 30%.** It all depends.

Once you have 20+ years of experience, you see the ups and downs and the patterns. You can adapt on the fly. That’s another reason why I think the longer you’re in this game, the better. Experience is useful.

This goes back to me teaching students it’s a marathon and not a sprint. It’s why we created the Trading Challenge Lifetime membership for existing students. I think it helps students create the proper mindset. The market will always be around. It doesn’t matter what you make in year one — or even year three. Stay in the game. Gain experience.

Last question…

“What do you think about hesitation and second-guessing?”

It’s normal and natural, especially in the beginning. Watch this video to see why I think it’s better to be hesitant than over-aggressive…

Not Everyone Should Trade During Hot Markets

I’m more concerned about students who have no hesitation and don’t second guess. Those who say, “I’m just gonna go for it,” are gunslingers. Gunslinging usually makes you broke in the long run.

I can’t stress it enough: ALWAYS take profits into excessive strength. Don’t worry if you miss the top or even the meat of the move, singles add up nicely over time while promoters, newbies and gunslingers always talk the loudest but then go quiet & broke over time. YOU CHOOSE!

— Timothy Sykes (@timothysykes) May 21, 2021

If you’re skeptical and hesitant, good. Welcome to trading. Even though it gets easier over time, you still have to be very careful in this game.

Let’s review a trade…

Trade Review

This trade was my second biggest dollar and biggest percent win from last week.**

Reelcause Inc. (OTCPK: RCIT)

Reelcause is a hydrogen/clean energy play. On May 16, the company announced it had “developed eco-friendly new and renewable energy technology that produces green hydrogen energy using water electrolysis […]”

On May 17, RCIT spiked on the news. Here’s the chart with my entry and exit…

I took a small, speculative position since it wasn’t very liquid. My goal was for it to get back to the 11-cent range. It managed the high of day (HOD) breakout, but not much more. The overall market didn’t look strong at that time, so I took the single.

The result was a 31% win for $1,215 in profit.** My thesis played out well even though it was a small trade.

Millionaire Mentor Market Wrap

Study the INCC debacle very closely. It’s not the first time sub-penny hype has ended in tears for hold-and-hopers. Learn the lessons now. I can almost guarantee you it will happen again.

Focus on your education. Study history and learn the rules. Focus on the process instead of the money. The greatest success comes over time. But you MUST be patient, meticulous, and dedicated. Remember, start small and size up later.

For a solid overview of the basic penny stock strategies I use, start with the 30-Day Bootcamp. Each of the stocks mentioned in this post fit with the strategies covered in the Bootcamp. Get it. Study it. Study hard. NO DAYS OFF. (At least in the beginning.)

What do you think of the lessons from sub-penny hype? Comment below, I love to hear from all my readers!

Disclaimers

*Please note that Jack’s trading results are not typical and do not reflect the experience of the majority of individuals using our products. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit. This figure is taken from tracking user accounts on Profit.ly, a trading community platform. It takes years of dedication, hard work, and discipline to learn how to trade. Individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose. I’ve also hired Jack to help in my education business.

**Please note: My results are far from typical. Individual results will vary. Most traders lose money. I have the benefit of years of hard work, dedication, and experience. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.

Leave a reply