Twitter traders want you to believe they have the magic indicator that will make you immediately profitable.

After decades in the market, I can tell you no such thing exists.

Even my #1 chart pattern can’t be used in a vacuum.

As I explained in my interview with Jordan Belfort recently, markets change, and traders need to adapt or perish.

That’s why I highlight my losses just as much as my wins because they keep me honest.

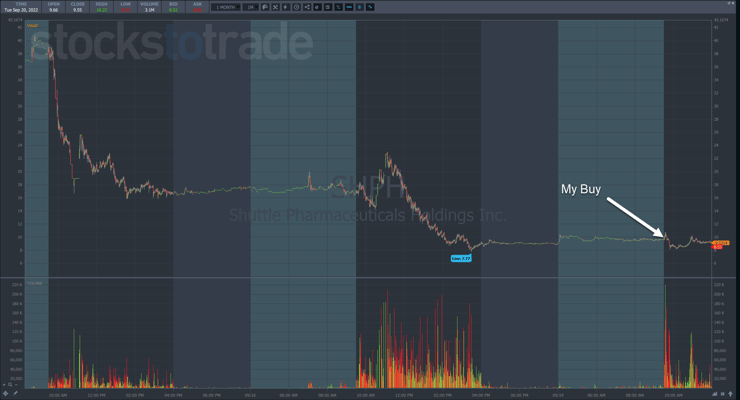

How's your trading going today, are you staying disciplined? I made a terrrrrribly undisciplined trade this morning on $SHPH so I've put myself in timeout. Not too bad of a loss since I had small size, but seriously boneheaded AF and I still can't believe I did it. Burpees for me

— Timothy Sykes (@timothysykes) September 19, 2022

Even an experienced trader like me makes dumb mistakes from time to time.

And this loss, in particular, provides a valuable teaching moment.

I want everyone to understand mistakes can and do happen.

Great traders use them to improve their performance and become more profitable.

Here’s how they do it.

Table of Contents

Acknowledge Your Mistake

No one likes to admit when they’re wrong.

Frankly, it’s one of the hardest things for any trader to do. It goes against our nature.

Yet, it’s the first and by far the most important step to improving your performance.

Don’t make it self-defeating.

Embrace the mistake and even add in a little humor.

It’s not about making yourself feel bad but rather using the mistake as a catalyst to do better.

There are three categories of mistakes a trader can make:

- Opportunity, identification, and signal

- The trade setup

- Execution

I’ll get to the causes in a minute. Categorizing mistakes helps to narrow down the solutions to fix those problems.

Let’s dive into my example and see where it falls.

Shuttle Pharmaceuticals Holdings Inc. (NASDAQ: SHPH)

Every weekend, I provide my students with educational videos from either myself or one of my top students.

Over this past weekend, I talked specifically about SHPH, and I wasn’t bullish.

In fact, I pointed out that the price action fell into step six of my 7-step penny stock framework.

Leave a reply