One of the main reasons I’ve been able to succeed at trading for two decades now is that I’m very good at protecting my profits.

If I make money, it’s hard for you to snatch it back from me.

Now, I teach my students several ways to manage risk, the top being lose small and fast.

What I don’t often talk about is what to do when your account has grown substantially.

Take Mark Croock, one of my millionaire trading students.

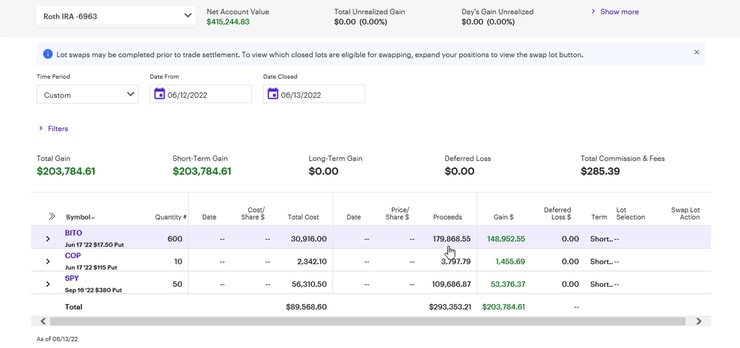

Just the other day, when markets were plunging, Mark’s Evolved Trader strategy smacked a huge win…

Do yourself a favor and check out Mark’s Evolved Trader Summit

I don’t know about you, but that’s a lot of money in one day, even by my standards.

Now, Mark could roll that into his account and up the size of his next trade.

But I’ve got a better way to manage account growth, one that not only protects profits but focuses on long-term wealth generation rather than quick wins.

And once you learn it, you’ll be able to sleep easier at night and break through common mental barriers.

Go Back to Square One

Early on in my trading career, I struggled to get my account over certain dollar thresholds.

First it was $50,000, then $100,000, etc.

It turns out this is a common problem that traders face all the time.

This mental barrier prevents them from breaking through to the next level.

So, I came up with a simple solution…

Reset the account.

If I was comfortable with $30,000 in my account, I would take out profits at the end of the week or when it got to $50,000.

This does two things.

First, it locks in profits by moving them over to my bank account.

Second, it keeps my account at a value that I’m comfortable with trading.

Increase Slowly

Now, this creates a problem when I want to increase the size of my trades.

At some point, if the size of trades gets too large relative to my account, it’ll start taking huge swings and create problems.

A lot of traders want to take their wins and roll them right into the next trade.

Instead, I prefer to do that slowly over time in a more controlled fashion.

One easy way to do that is to size the trade based on a percentage of your account.

Assume I choose to risk 1% of my $30,000 account. I can size the trade as 1% of the total account, which is $300.

Alternatively, I can size the trade based on a calculated loss of $300. To do that, I’d need to know my entry and stop-loss out of the gate, which isn’t always exact in my style of trading.

Now, let’s say that I continue to reset my account back to $30,000.

I could slowly increase the amount from 1% to 1.25% to 1.5% and so on.

The key is to make sure I do it in a methodical way that allows me to mentally adjust.

Similarly, I can slowly increase my account size on each reset or the amount I reset from.

More Breaking News

- CleanSpark’s Financial Moves: Outlook and Market Impacts

- QuantumScape Shares Skyrocket: Is This the Key to Future Success?

- Snap’s Potential Upswing: Analyzing the Market Shifts and Future Possibilities

For example, I may reset my account to $30,500 next time or wait until I hit $50,500.

Be Comfortable With Consistency

One thing new folks fail to realize is that most career traders don’t keep growing their account into infinity for two reasons.

First, depending on the style of trading, they run into practical challenges where their position size would start to influence price.

That’s why I’m particular in the liquidity of the stocks that I trade, not that I trade any huge size.

Second is there simply isn’t a need after a certain point. Most traders find a groove where their gains are significant enough to make them happy.

I know traders that like to make $10,000 a day and others that are fine with $500. And they’ve been doing it for years.

Only you know what level is appropriate for you.

And as I’ve said before, this isn’t something that needs to happen overnight.

Nearly every one of my millionaire students took years to get where they are.

Trading is a business that takes time and investment.

Now, if you’re looking to cut the learning curve, then I recommend you check out Mark’s Evolved Trader.

Not only is he a fantastic trader but an incredible teacher as well.

—Tim

Leave a reply