Shame…anger…disappointment

…rage…humiliation…shock

These are all emotions you can feel after suffering a big trading loss.

As much as you would like to think it’s on to the next trade…

There’s some mental baggage you’re carrying over.

How you respond will determine whether you dig yourself into a deeper hole or bounce back.

With more than $7.4 million in trading profits to my name, I can tell you straight up I’ve suffered some big losses throughout my trading career.

But I’ve always been able to bounce back from them.

Now, that’s not an accident.

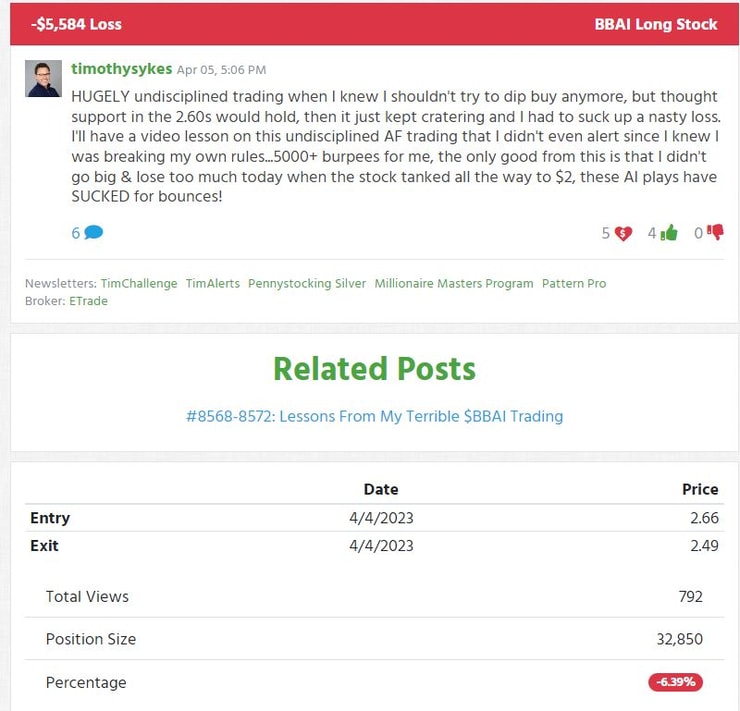

I’ll show you what I’m doing to get back on track after taking my biggest hit in 2023 in the ticker symbol BBAI.

Be Honest and Take Ownership

I missed the breakout in BBAI. I tried to dip buy too aggressively, and then when the real dip buy opportunity came…I was already out of bullets.

What can I say…an absolute disaster.

And you know whose fault it was?

Mine.

I was the one who wanted to make money from the play. I forced the action and started averaging down out of pure desperation.

I have to be aware that my actions led to this trading loss. I also want to pick apart my decision-making and see where I acted wrongly and what I can do better in the future.

We must all remember that trading is addictive…and trading is dangerous.

I probably have more millionaire students than any other online trading mentor…

I’m not saying that to brag…but I’ve been around many successful traders over the last two decades.

And if there’s one thing most will agree with, it’s: You’ve got to respect the market, or it will humble you quickly.

Developing The Right Mindset Again

Sometimes after a big loss, you will wear it.

Most people can see it on your face, tone, and body expressions.

Naturally, you want to shake it off and get back on track.

But you can’t think about revenge trading or anything else that will get you emotionally charged.

You’ve got to go about it one trade at a time.

It may take a few days, several weeks, or just a couple of trades to get the losses back…or it may never happen…there are no guarantees in trading.

That’s why I tell my students to focus on their best setups and take it one trade at a time.

Review your past trades to familiarize yourself with your best setups and results. Or study recent winners in the market and try to reverse engineer why they worked.

More Breaking News

- Palladyne AI Corp: Can Recent Drones Market Expansion Propel Growth?

- Color Star Tech’s Unexpected Surge: What’s Fueling ADD’s Growth?

- Ecolab’s Strategic Moves: A Look at New Financial Upgrades

The best way to stage a comeback is by focusing on A+ setups.

Don’t Set Monetary Goals

I tell my students to think like they’re retired traders. Only jump back into the market if you find a trade so compelling…you’ll regret not being involved.

This allows me to be more selective.

You see, I was forcing the action. Trying to get past $7.5 million in trading profits and pushing to get my monthly gains up.

But the market doesn’t care about my profit goals.

And that’s the funny thing about trading.

The more you desperately want to make money, the less likely you will.

That’s why if you’re considering giving trading a real shot, you need money set aside or a job to fall back on.

Many of my top students didn’t make profits in year one.

That means your trading profits aren’t likely to pay your bills anytime soon.

But if you don’t have the pressure of money, you’ll likely be better focused on the opportunities.

It’s counterintuitive.

But the less you focus on the money…I believe your chances of success are greater if you instead make process-related goals.

That’s why I like to consistently remind myself of my best patterns and the best ones that work for me.

Don’t pressure yourself to make your losses up quickly—stay focused.

If you’d like to learn more about my mentoring program…click here to get started.

Leave a reply