You can’t see me right now, but I’m bouncing up and down in my chair.

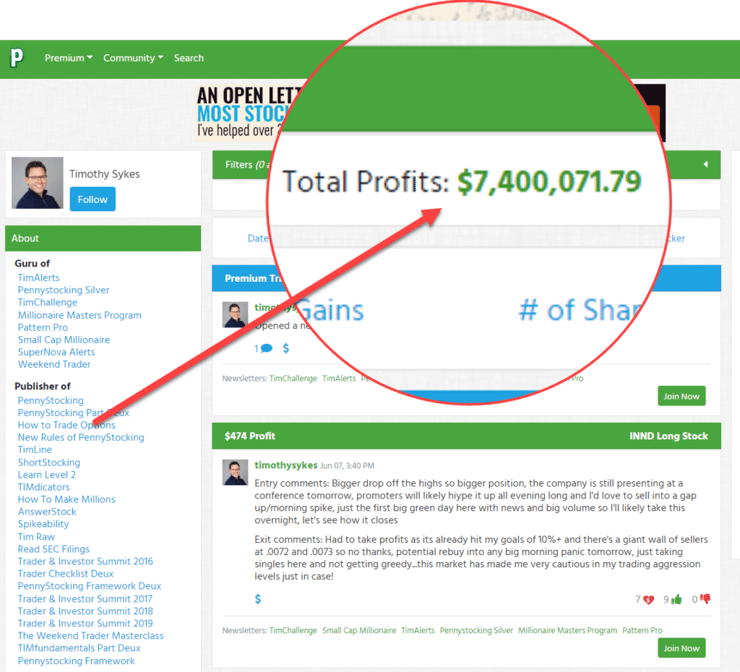

Not because I crossed $7.4 million in total trading profits…

Although it is an incredible milestone…

Although it is an incredible milestone…

You see, I treat the markets like the French justice system — guilty until proven innocent.

I want markets to show me better setups, not once, not twice, but dozens of times before I’m willing to risk more money in my trades.

I’ve harvested almost $75,000 in profits year-to-date, mainly by picking up a couple hundred dollars here and there from small trades.

The ONLY reason I would start risking more on plays is because the market is telling me it’s the right time to.

So what has me believing now is the time to start throwing more chips at the table?

Table of Contents

Bottoming Signals

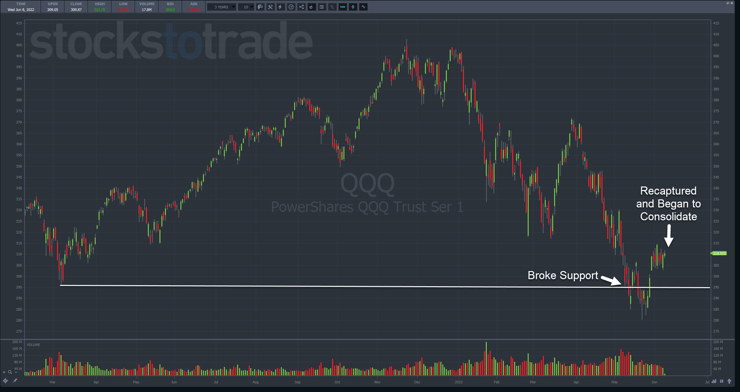

Even though I trade penny stocks, I always keep an eye on the broader market, especially risk indexes like the Invesco QQQ Trust (NASDAQ: QQQ).

Lately, it, along with the other major indexes has begun to put in signs of a bottom, at least temporarily.

In the daily chart of the QQQ below, you can see that price pushed well past the support level initially. However, stocks managed to rally and recapture that support.

Now, they’re trading in a pretty bullish consolidation that exhibits decent strength.

If I had it my way, I’d prefer that markets plunge and drive out a lot more of the waste that’s built up.

But this isn’t Burger King, so I take what I can get.

Penny Stocks Showing Signs of Life

In early 2021, I wouldn’t mind holding a runner overnight. After an initial day one push, promoters would step in overnight and pump up the stock, giving it an overnight bounce that would last into the second day.

For a long while now, that hasn’t happened. The number of true runners has been few and far between.

Lately, I’ve seen that begin to change.

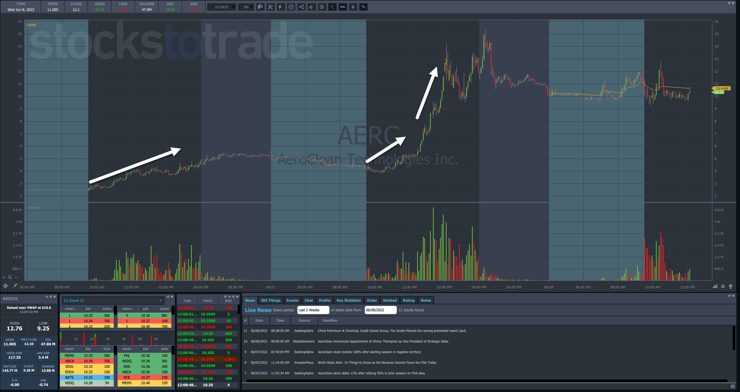

Tim Bohen called out AeroClean Technologies Inc. (NASDAQ: AERC) several times as this stock produced some epic multi-day runs.

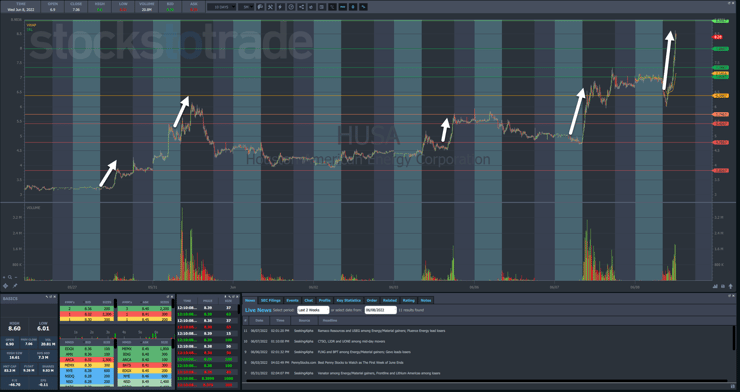

Stocks that I’ve kept on my watchlist like Houston American Energy Corp. (AMEX: HUSA) have seen multiple runs that nearly tripled the price of the stock in a matter of weeks.

This is more indicative of what early 2021 was like.

2022 has been more about one-and-done stocks, those that spike and fail.

So if this is really the turnabout, then I may begin to add size appropriately.

More Breaking News

- Wolfspeed’s Legal Woes: Navigating a Tumultuous Financial Landscape

- BTQQF’s Meteoric Rise: What’s Fueling the Recent Surge?

- Ambev S.A.: Stock Movement Sparks Questions After Q3 Earnings Surprise

But there is one important thing to remember…

Ease Into It

Successful traders build profits over time.

None of my millionaire students, whether it be Roland Wolf, Jack Kellogg, or others, hit that milestone overnight.

Nearly all of them take years to get to that point.

Patience is the key.

That’s why I’m testing the waters with my trades, using small positions to observe the market and see how different sectors operate, which stocks are running, and how the overall market plays into that.

More importantly, I’m keeping my losses small and fast.

Far too many traders get caught in a position where they rationalize away their stops.

Pretty soon, they find themselves holding a day trade overnight.

That’s why no matter how much my risk changes, I will ALWAYS focus on losing small and fast.

It’s the only way I know of that consistently improves my students’ performance quickly and easily.

This becomes especially important when I increase my size. It’s all too easy to hit a handful of wins and suddenly have that one big loss that sets you back.

A Pattern For Explosive Potential

If markets are about to start offering up those juicy opportunities again — multi-day runners — then you need to check out my Supernova pattern.

This pattern has led to some of my greatest trades over my career.

And it’s a fantastic starting place for new and experienced traders.

Click here to learn more about my Supernova Pattern.

—Tim

Leave a reply