Definitely watch these 20 video lesson on how to spot and buy breakouts and read this great guest blog post from a new trading challenge student below:

Price breakouts are great for people who happened to be in the stock early and think it is due for a breakout. However, for a more active trader the breakout is the sign to buy the stock. The gains might be less overall, but it requires less upfront risk. A stock already moving presents a great opportunity. Obviously, you need to be a trader that knows what to do, but it can avoid the risk of a false signal if you buy before the breakout.

RSI Extremes

The Relative Strength Index (RSI) has a chart with a top and a bottom range that is labeled overbought and oversold, respectively. The top range starts at 70 and the bottom range is 30 and below. The oversold and overbought labels are a bit misleading, because going from the “normal” middle band to one of the extremes means that the price could break out in that direction. It could be a false break over the range lines, but it could also signal rapid movement of the price in the direction of the RSI.

This is where the common explanations of the RSI indicators fail. Overbought and oversold are not accurate descriptions for the ranges. If the RSI continues posting higher numbers as it crosses the 70 or lower crossing the 30, then the existing trend could move rapidly for one last move. The trend can even be sustainable if the RSI cools off while the price stays flat.

On the other hand false signals can telegraph a reversal in the trend. If the RSI goes above 70 then goes lower and even breaks below the 70 line, then it is a strong sign that the uptrend is over and larger downtrend is in the works. This could just be the stock cooling off and consolidating its gains or it could be an overall change in the long-term direction of the stock.

MACD Crosses

The MACD chart has two lines, a slow and fast one, and a histogram. When the fast line crosses the slow line it can be a sign of a change in the prevailing trend. It depends on the general force of the trend whether you would call it a breakout. Fast and steep price action is usually what it takes for it to count as a breakout.

The MACD is a good indicator, but should usually be coupled with others like the RSI in order to give the clearest signals. False signals are very common and not all MACD crosses are breakouts. The MACD is a good measure of momentum, not primarily the trend, so using more directional indicators can create a powerful combination.

More Breaking News

- Is IREN’s Recent Momentum A Clear Signal for Investors?

- Blueprint Medicines: Is It Riding A New Wave of Success?

- How Richtech Robotics’ Financial Woes Are Shaping Stock Performance: Buy Now or Hold Off?

One of the things to look out for is for an MACD divergence, which is what occurs when the price moves one way but the MACD moves another such as a price high but the MACD makes a lower high. That indicates that the trend may be near its end. You can use divergences to spot false signals even if the histogram makes a cross. It is not impossible to have it peak across the center line only to head back. That indicates fidelity to the larger trend that is at play with the recent movement in the opposite direction a small correction as opposed to a full reversal.

Highs and Lows

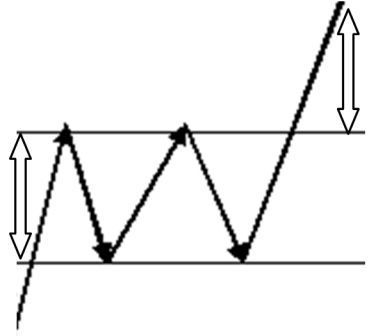

Breakouts also occur when a stock enters completely new territory or at least a price range that it has not been in a while. This is not on a scale of weeks but years. Three years, five years, and maybe even ten years are valid chart ranges. A horizontal line is drawn from either the highest close or the highest point on the chart. You can use either the absolute high or the highest close, or open.

On a candlestick chart you can be sure that a close or open for a bar will be firmer than the tip of the wick. The reason is that the wicks can just be outliers that do not have a ton of volume behind them. Since the candles on this scale would be daily candles you do need to account for outliers.

The horizontal line that is drawn is the line that the price needs to break to see a breakout. There would not really be any meaningful resistance beyond that line. As long as there is momentum the stock could keep rising. There would be no brick wall of investors who want to sell their shares.

Obviously there will always be people locking their gains in, but these will be at specific price levels not chart levels. The psychological resistances of 10s or 100s become more important. There is no line on the chart that could reasonably be looked at by investors or traders. Everything at that point is subjective. This situation also arises for all-time highs, because stocks generally start low, though there are times when a stock has never gone below a certain level since its gone public.

It is acceptable to only focus on the last few years and not the largest timescale. The principles still stand, though for stocks that tend to be popular as current or former long-term holds can have investors ready to exit at various price levels as the stock retreads price levels it has not seen in a long time.

Conclusion

Breakouts are fantastic to trade before they occur, but there are many false breakouts. Trading a breakout as soon as it happens cuts your returns, but gives a quicker trade. The problem with aiming for a breakout is that you can get bogged down in a stock if it is choppy for a bit longer than you expected. You might be right eventually, but it could take a while.

Leave a reply