How to Spot the Top of a Penny Stock Pump: Key Takeaways

- Revealed: A weird new way to spot the top. (Due to its nature, sharing before the crash is only possible for the Trading Challenge community.)

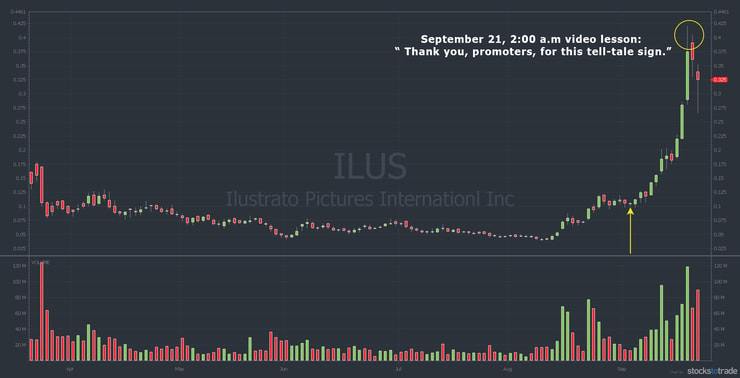

- Check out ILUS … and see how I called it ahead of time.

- Promoters twist the truth to lure in newbies! (See how I use their BS to judge potential dip buys in today’s market.)

If you’ve ever wondered how to spot the top of a penny stock pump, you’re going to love this. Learn how it works and understand the opportunity.

Table of Contents

“This Is the Sign the Pump Is Nearing Exhaustion”

This weird new way of identifying the top didn’t come in a blast of light from above. It came from finally putting two and two together.

What I’m about to explain has happened more than once this year. At first, I laughed it off — even though I was getting attacked by promoters on social media.

But this week promoters confirmed my suspicions. Before I explain, understand that promoters have been around a long time.

Old School: Why Penny Stock Promoters Changed Things Up

In the past, you could make a rough guess about how long promoters would pump. It was pretty clear based on the dollar amount in the disclaimer of their email blasts.

$3 million channeled into a “marketing campaign” meant a longer pump than $300,000.

But now, all the biggest email promoters have shut down. Promoters have gone underground. They changed tactics. It’s not new — I’ve been warning about Twitter pumps and promoter chat rooms for a while.

But what I didn’t know was how obvious it is when they telegraph the top. And I don’t know how long this will last. They might see this post or the video lesson I made for Trading Challenge students. Let’s hope not — I want to see this keep working.

Massive Props to Promoters

Some people ask why I talk about promoters so much. Why don’t I just focus on the chart? We’ll look at a chart, but I have to give props to the promoters first. I’m grateful for what they do. Check it out…

Here’s Why We Should Thank Penny Stock Pumpers

When penny stocks get overextended, they become perfect potential morning panics. That’s what I’m waiting for — opportunities to dip buy.

But, and this is key, the best panics aren’t just the stocks that are up the most. The best panics come with stocks that have promoters. That’s why I like it when promoters get involved. But beware…

More Breaking News

- Supreme Court Greenlights New Gold’s Game-Changing Acquisition by Coeur Mining

- Novo Nordisk’s Shares Surge as FDA Targets Illegal Drug Marketing

- MNTS Stock Surges Amid Strategic Expansion and Financial Insights

- Oracle’s Expansion Plans and Market Response Fuel Stock Momentum

Caveat Emptor

You never really know who the promoters are or how many are involved. All these people talking about penny stocks on WeBull, Reddit, or Twitter could be one or two guys who have hired a click farm to create bot accounts.

And because it’s done on social media, there aren’t any disclaimers. So expect the worst out of everybody in this industry. Especially penny stock promoters. I could give you hundreds of examples of recent promos that went bust. They all collapse.

Here’s a recent example I called in a video lesson for Trading Challenge students. (The video lesson goes into great detail about how to spot the top of the pump. Watch it!)

Ilustrato Pictures International, Inc. (OTCPK: ILUS)

Here’s the ILUS six-month chart…

As you can see, I called the top almost perfectly. Notice the last three candles on the right. I was up filming the video lesson at 2 a.m. Eastern on September 21. In other words, just hours before the market opened and ILUS went red…

Thanks again to all the $ILUS $CYBL promoters for tipping your hand ahead of time to prepare everyone for the inevitable https://t.co/aICa7zzdDq crashes we saw today, my guess is they were behind $MJWL $GGII $DPLS $LTNC $HMBL $CYDY too because the price action is the EXACT same!

— Timothy Sykes (@timothysykes) September 22, 2021

Again, this isn’t the first time this year it happened. It’s just the first time I figured out exactly what they’re doing.

I don’t plan on exposing the promoters. Frankly, I don’t know who they are. And I don’t want to know. But I’m aware of their techniques.

Ready? Check out this tweet from September 2. Keep in mind that it was before ILUS went supernova.

Calling all degenerates obsessed with boring AF plays $ILUS $AITX $NSAV $MJWL step away from the computer, focus on big % gainers $LUSI $ANY

— Timothy Sykes (@timothysykes) September 2, 2021

Believe it or not, that tweet gave me an even clearer look into…

The Corrupt Underbelly of Penny Stocks

Weird, right? But over the past few days, all these bot accounts started reposting that tweet from September 2. And not just one or two. I’m talking about 200, 300, maybe even 400 accounts.

This is key — they tagged me.

Now, before I give you the last piece of the puzzle, understand that on September 2, ILUS was boring. Look at the yellow arrow on the chart above. It points to September 2. ILUS did nothing that day. Nothing!

So when all these accounts started reposting and tagging me, I finally put two and two together…

Seriously it never fails, right when promoters begin attacking me en masse, their promo starts to crash, it's like their last gasp for attention. I didn't realize it on $INVU $HMBL $LTNC $ALPP but now this pattern has been confirmed on $DPLS $GGII $MJWL $ILUS it's actually CRAZY!

— Timothy Sykes (@timothysykes) September 22, 2021

It’s laughable to me because I have nothing against ILUS. I want all pumps to go as high as possible. But they made me an “enemy of ILUS longs.” And now all these ILUS longs are saying things like, “We know you’re secretly short.” That’s ridiculous. I haven’t shorted anything in two years.

How Promoters Pimp the Pump

So now there are all these social media promoters. And when the promoters take my tweets and twist them, they’re looking for attention. They’re desperate to maximize the pump.

It’s usually the beginning of the end. Whoever’s doing it is obviously trying to rile up people and squeeze every last penny out of the pump.

Now that it’s happened a few times I see it. This is the sign that a pump is nearing exhaustion. The promoters try to rope me in and get my community involved. They’re desperate to find any buyers for their trash at, or near, the peak.

That’s usually the sign of a top.

Again, I can’t thank the promoters enough for the opportunity, for this tell-tale sign.

Coming soon…

Don’t miss my follow-up post on common dip-buying mistakes. You won’t believe it. ILUS had the perfect panic and bounce … and I wanted it so bad I screwed it up. Aye, aye, aye.

Trading Challenge

In the meantime, apply for my Trading Challenge. It’s where I share when I get tagged by hundreds of Twitter accounts — signaling the top of the pump. It’s also where all my top students honed their skills. Apply for the Trading Challenge now.

What do you think of this weird new way to spot the top of a penny stock pump? Comment below, I love to hear from all my readers!

Leave a reply