Want to know how to learn stock trading? I’ll let you in on a little secret…

It’s not rocket science. But it’s also not easy. It takes hard work and dedication. Most traders lose. Even with all the resources we offer, most traders still don’t make enough money to break free.

You might be wondering why I’d just say that straight up. It’s because I want to be the mentor to you that I never had. But for that to happen, you have to come with the right mindset.

In this post, I’ll share 21 tips on how to learn stock trading. Keep reading to get your mindset right before you waste time and energy.

First, here’s a little perspective on life…

Table of Contents

- 1 Tragedy in Myanmar

- 2 Trading Mentor

- 3 How to Learn Stock Trading: 21 Tips for Beginners

- 3.1 Tip #1: Your Past Doesn’t Matter

- 3.2 Tip #2: ALL Study Time Adds Up

- 3.3 Tip #3: Get a Well-Rounded Financial Education

- 3.4 Tip #4: Specialize in One Niche

- 3.5 Tip #5: Small Losses Are Fine

- 3.6 Tip #6: There Are Lessons to Learn Every Day

- 3.7 Tip #7: The Market Will Always Be There

- 3.8 Tip #8: Slow Markets Give You Time to Study

- 3.9 Tip #9: Work Hard, But Work Intelligently

- 3.10 Tip #10: Want Freedom? Throw the Idea of a 9-to-5 Out the Window

- 3.11 Tip #11: When the Market Changes, Adapt

- 3.12 Tip #12: Do NOT Follow Trade Alerts

- 3.13 Tip #13: Do NOT Trust Promoters

- 3.14 Tip #14: The Market Doesn’t Care What You Want

- 3.15 Tip #15: Take It One Day, One Trade At a Time

- 3.16 Tip #16: Beware of Burnout and Know When to Back Off

- 3.17 Tip #17: Perspective Matters

- 3.18 Tip #18: Know Yourself

- 3.19 Tip #19: Be Aware of Overtrading

- 3.20 Tip #20: The ‘Process’ Is Many Small Processes

- 3.21 Tip #21: This Is NOT a Soft Industry So Stop Asking Me to Be Nice

- 4 Trade Review

- 5 Bantec, Inc. (OTCPK: BANT)

- 6 Millionaire Mentor Market Wrap

Tragedy in Myanmar

The military coup in Myanmar is making life incredibly difficult for thousands. It has displaced entire families. The military is running a campaign to suppress protests. Meanwhile, children are going hungry as the economy goes into freefall. Working with Partners Relief & Development, the Karmagawa community is trying to help.

This is how too many people/children are living in #Myanmar right now, it's truly devastating & hardly anyone is talking about it! I'm proud to support @PartnersRelief helping locals there with $700,000 in donations, but they need more support…retweet this & donate to them too! pic.twitter.com/sRjyYi1x9Q

— Timothy Sykes (@timothysykes) April 22, 2021

To support Karmagawa with our mission, visit our shop. Profits go to carefully chosen charities doing great work.

To support Partners Relief & Development directly, go to the Myanmar Crisis page.

Let’s talk trading…

Trading Mentor

The recent slower market has a lot of people scratching their heads. People who got rewarded for bad behavior earlier this year are getting punished.

Which means I’m getting a lot of messages from people saying, “Oh, I thought trading was easy. Now it seems hard. What should I do?”

So I want to share some basics. But not specific trading strategies. To learn the basics of my strategies, read “The Complete Penny Stock Course.”

Without further ado…

How to Learn Stock Trading: 21 Tips for Beginners

These tips focus on the mindset you need before you learn how to trade stocks. Heed them well as you continue your journey to freedom.

Tip #1: Your Past Doesn’t Matter

Your background or past doesn’t matter. The stock market doesn’t care where you’re from or who you know. What matters is your dedication to studying. Hard work matters. And your mindset matters.

Too many people start with a belief that they’re not good enough, don’t have enough education, or aren’t smart enough. None of that matters. Focus on what you have right now: a burning desire to learn.

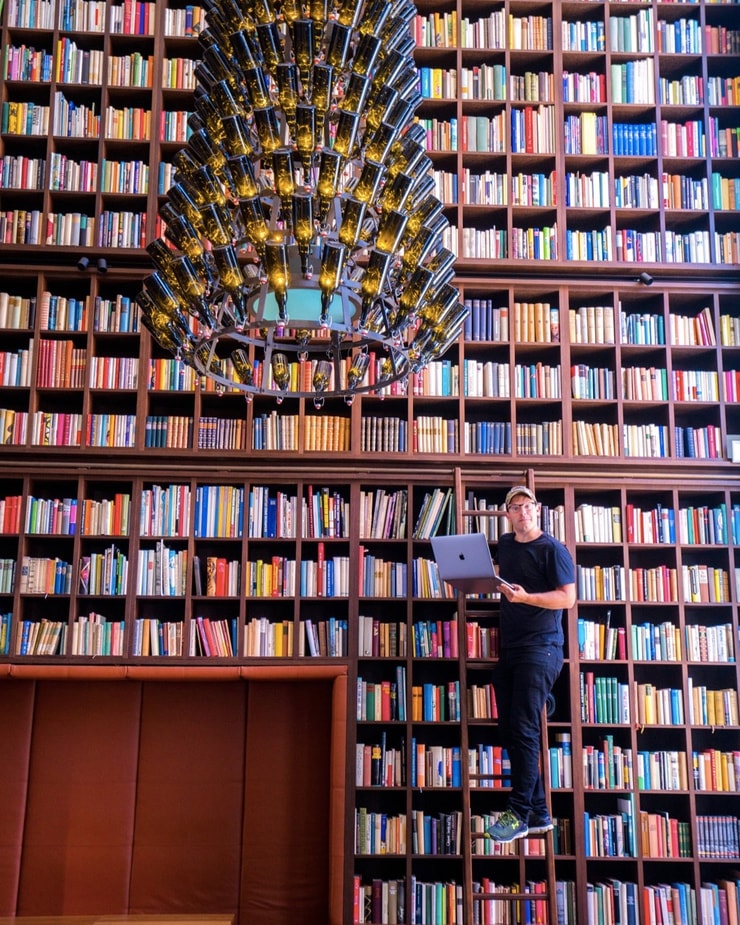

Tip #2: ALL Study Time Adds Up

Every minute you put into studying adds up over time.

That includes weekend study time. While everyone else is being lazy over the weekend, you can gain valuable hours of study. Think about it — if you put in four hours of studying every weekend for an entire year, that’s over 200 hours. Most people aren’t willing to do it.

Most people overestimate what they can do in a year, but underestimate what they can do in five years. If you study four hours every weekend for five years, that’s over 1,000 hours. My top students put in even more time. Roland Wolf studied 17 hours per day when he started.

More Breaking News

- Innodata Inc.: Navigating the Buzz of Praise and Speculation

- Lucid Group’s Bold Moves: Will They Spark a Stock Rebound?

- Vistra’s Ambitious More: How Recent Developments Could Shape Its Market Trajectory

Tip #3: Get a Well-Rounded Financial Education

You don’t need to know everything in finance. But knowing about different markets and ideas helps you to understand catalysts. What’s going on in the overall market? How is news affecting the markets?

Here’s an example…

Last Thursday, news broke that President Biden will propose a hike in capital gains taxes. Check out the SPY S&P 500 ETF Trust chart from that day. Can you tell where the news was released?

It doesn’t take a genius to see how the markets reacted to the news. What does that have to do with penny stocks? Roughly three out of four stocks follow the overall markets. When news hits, it can turn a winning position into a losing position fast.

So it’s good to know what’s happening. If you’re serious about trading, learn about the markets as a whole. Learn about the different stock sectors. Try to gain as much knowledge as possible.

That said, try this…

Tip #4: Specialize in One Niche

Especially in the beginning. Trying to do too many things at once becomes a distraction. Even within your niche, focus on one or two strategies. You will have to try different things to find what works for you. But once you find your pattern, master it. Build from there.

Tip #5: Small Losses Are Fine

Small losses are part of the game. You MUST learn to take small losses to protect bigger wins. Don’t get stubborn. If a trade goes against you, get out. If it eventually does what you wanted, you learned something.

Tip #6: There Are Lessons to Learn Every Day

This is huge right now. I’m getting messages from people saying, “There aren’t any plays right now. Why is it so boring? What should I do?”

There are still plays every day. Learn from them. And use the downtime to study. Make every day count. Slower markets are a time to study and prepare for hot markets. Remember…

Tip #7: The Market Will Always Be There

Seriously. So many newbies are freaking out because they missed the stock market madness last year. Will it be another 20 years before we see that kind of market? Anything is possible. But there’s a big difference…

With trading apps and high-speed internet, it’s MUCH easier to start trading than it was 20 years ago. So I don’t think it will be another 20 years.

Even if it did take another 20 years … you can trade in almost any market. You just need to be more patient and wait for A+ setups.

Tip #8: Slow Markets Give You Time to Study

Almost everyone reading this isn’t prepared for a hot market. Use this time to learn and study. Again, people got rewarded for bad behavior and habits in January and February. In this market, that will destroy you.

Tip #9: Work Hard, But Work Intelligently

I say “study hard” and “no days off” all the time. But keep things in perspective…

If you’re working 18 hours a day of hard labor, you probably won’t break free. So it’s not just about how hard you work, it’s about using your brain to work intelligently. Don’t waste time.

So many people are trying to do things the hard way. They don’t want to invest in tools.

Think about it…

If you wanted to drill a hole, would you do it with an old-school hand crank drill or use an electric drill?

Use the tools created to save you time … like StocksToTrade. We specifically designed it to scan for low-priced stocks. Yes, I’m an investor and I helped design it. My goal is to help you with tools I didn’t have when I started.

I had to use three or four computers in my high school library to have different websites and chat rooms open. You don’t need to do that. So WHY would you? (Read about my trading journey in my no-cost book, “An American Hedge Fund.”)

And for those of you in 9-to-5 jobs… it’s OK. I don’t advise anyone to quit their job and trade full-time until they’re ready. Just understand that…

Tip #10: Want Freedom? Throw the Idea of a 9-to-5 Out the Window

99% of people working a 9-to-5 will NEVER achieve freedom. Some will enjoy a career. And some will build wealth over time through a retirement plan. But very few will break free.

But that doesn’t mean the answer is working less. Most millionaires work LONGER hours before they break free. And many continue working long hours because they love what they do.

The average millionaire (80%) works every day. In fact, many of them work MORE than the average person with a 9-to-5 job. Elon Musk is known for working 80-100 hours a week while Marissa Mayer, ex-CEO of Yahoo, worked upwards of 130 hours per week. How bad do you want it?

— StocksToTrade (@StocksToTrade) April 19, 2021

There’s nothing wrong with only working 40 hours if that’s what you want. But if you want freedom, you’ll need to put in more time at first. And probably for years!

Tip #11: When the Market Changes, Adapt

This is almost like a super tip for how to learn stock trading. Why? Because you have to adapt right from the beginning. The faster you learn to adapt to a changing market, the smoother your learning experience.

And once you start trading, you MUST adapt. Which means knowing the difference between making a mistake and being stubborn. We all make mistakes and have losing trades. Getting stubborn even when the market is changing is lazy. Don’t be lazy. Focus.

Also be willing to walk away. Remember, sometimes the best trade is no trade. In the words of one of the best traders of all time..

“There is time to go long, time to go short, and time to go fishing.” — Jesse Livermore

Tip #12: Do NOT Follow Trade Alerts

I know that’s confusing to some people. But alerts are NOT to follow someone into a trade. I alert in real time so you can learn. Seeing what and how I trade helps new traders begin to recognize patterns. It helps build screen time. Your goal should be to become self-sufficient. Never follow me — or any other trader — into a trade.

Remember to be patient and wait for the absolute best trade, do NOT follow anyone else's alerts, do NOT believe promoters or BS management hype, expect the absolute worst from everyone who says anything publicly & from every single company and you'll never be disappointed 🙂

— Timothy Sykes (@timothysykes) April 21, 2021

Which leads to…

Tip #13: Do NOT Trust Promoters

Stock promoters don’t have your best interest at heart. Their goal is to suck as many newbies in as possible. They’ll say things like, “Buy any dip. Only the weak hands sell. This one’s going to the moon.”

It’s BS. It’s not going to the moon. And it’s the same pattern over, and over, and over again.

If you aren’t sure who the promoters are or what it looks like…

ANYONE who says to hold and not lock in profits along the way is a promoter. Anyone who tells you to hold and hope is a promoter. And anyone who tweets 50 times a day about the same stock is a promoter.

You don’t even need to follow them. StocksToTrade Breaking News chat will tell you when a stock is a chat pump or Twitter promotion.

Again … use the tools.

Tip #14: The Market Doesn’t Care What You Want

So many people hold through crazy swings as if there’s some market force that’s on their side. The market doesn’t care and never will. It’s ruthless. Stop thinking about what you want a stock to do and pay attention to what it’s doing.

Tip #15: Take It One Day, One Trade At a Time

Expecting or looking forward to something happening is a waste of time. Focus on today and one trade at a time. Take care of that trade. When you get more experience, if you want to push it like Jack Kellogg, then maybe you can think about more.*

But understand, Jack pushed it probably more than any other penny stock trader I’ve ever seen. He’s now made over $6.5 million.* But he paid the price for that level of intensity. (Thankfully, Jack is taking care of himself. He’s trading less, hired a chef, and exercising to gain his health back.)

And THAT leads to…

Tip #16: Beware of Burnout and Know When to Back Off

It wasn’t just Jack who pushed it. Kyle and Matt also pushed hard for months. All three are taking a step back. They’re using the slower market to take care of themselves.

Last week on Thursday, I woke up near the market open feeling like absolute crap. Between jet lag and working long hours, I needed more sleep. I thought it would be 30 minutes. Three hours later I woke up. I didn’t even publish my watchlist — that’s very rare.

The point is that you must listen to your body. Be aware of how easy it is to burn out if you push too hard. Respect your body and health.

Tip #17: Perspective Matters

If the trading year ended today, it would be the third-best in my 20+ year career. I’m on track for my best year. But if I don’t reach it, who cares? Yes, I want to make more because I donate 100% of my trading profits to charity. So I want to make more to give back.*

But I’m not worried or stressed if the market doesn’t pick back up.

Here’s another way to look at it…

So far, April is my worst month of 2021. But almost any other year in my career it would be my best month.

So keep perspective. All you can do is your best.

Tip #18: Know Yourself

Also, I know I’m impatient in trades. I rarely hold when a stock isn’t doing exactly what I thought it would do. Other Trading Challenge mentors have their own strategies.

You have to figure out what works best for you and your schedule.

That requires self-reflection. You MUST be willing to look at yourself, your habits, your lifestyle — everything. Review your trades, too.

Tip #19: Be Aware of Overtrading

I can’t emphasize this enough. This industry is full of degenerates. Maybe you’re one of them. I admit that trading is addictive and I’m basically a trading addict. And that’s exactly why I keep myself so busy. It’s why I trade using these rules.

Tip #20: The ‘Process’ Is Many Small Processes

A student brought this up in my Trading Challenge webinar last Wednesday. I often talk about focusing on the process. And I do mean to focus on the process over profit and loss, especially in the beginning.

You have to study the DVDs, watch video lessons, and learn to create daily watchlists. It takes practice trading patterns before you get good. You have to learn to manage risk and read SEC filings. And you’ll need to learn Level 2 to recognize the turn on an OTC morning panic…

Each of those is a process in and of itself. There are many small processes to learn as you build your knowledge account. Be willing to break it down. The market will always be there.

Tip #21: This Is NOT a Soft Industry So Stop Asking Me to Be Nice

I’m blunt for a reason. You need to know the hard truth about how things work ASAP! Otherwise, you’ll lose your butt to promoter hype, BS, and sketchy companies.

Trading is a battlefield and I’m your drill sergeant. My job is to prepare you for battle. I’m not here to be your friend. If you want a friend, get a dog.

That’s enough tips on how to learn stock trading for today. Remember, it’s a marathon, not a sprint. These tips are about the proper mindset for the learning process. Read them again. Write them down and keep them next to your trading setup.

Let’s look at a trade from last week…

Trade Review

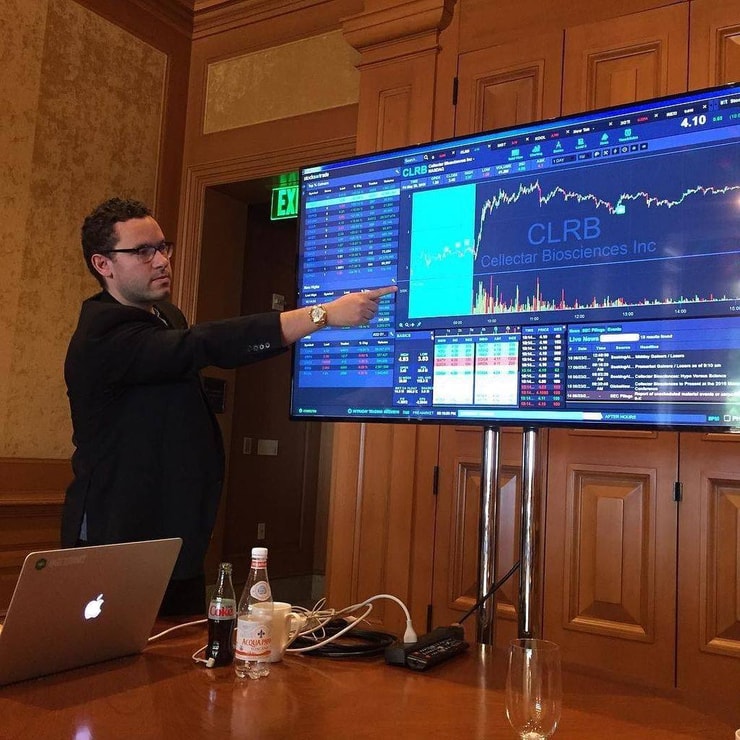

This trade goes along with how to learn stock trading tip #9 — work hard but also work intelligently…

Bantec, Inc. (OTCPK: BANT)

StocksToTrade Breaking News Chat alerted this. Bantec announced it will offer drone sanitizing for schools and stadiums in the fall. That’s a strong catalyst given how much everyone wants life to get back to normal.

BANT is a former runner. As you follow the penny stock niche over time, you’ll start to remember former runners as they can run again. Last week we saw several stocks that had been quiet for a while making moves. It was a noticeable shift in the market from the past few weeks. So when there’s a shift, recognize it and adapt.

Here’s the April 21 BANT chart with my alerts…

As you can see, the stock wasn’t doing much until the news hit. But then it was a super-fast play. It’s not a play to take big size if you’re just beginning. And it’s also not a good idea to chase. My goal on this play was to make 5%–10%. It turned into a much bigger move.

Rather than get greedy or hold and hope, I sold into strength for a $3,358 profit and 28% win.*

The StocksToTrade Breaking News Chat alert was key for me in taking this trade. Otherwise, I probably would’ve missed it. Again, work intelligently. Use the tools.

Millionaire Mentor Market Wrap

Newbies ask me often about how to learn stock trading. I get DMs and tweets from people saying they want to be my next millionaire student.

But I don’t think most people realize how much work and dedication you have to put in. This past year has been crazy with all the new millionaire Challenge traders.* But remember, they’ve all been in the Trading Challenge for three to five years.

How to Learn Stock Trading

It starts with mindset and education. Study as much as you can. You get to choose your level of dedication.

If you’re not sure where to start, try my free YouTube videos. There are 1,458 videos on my channel as I write. I upload more videos all the time.

What’s next? Get the 30-Day Bootcamp created by me and top trader Matt Monaco this time last year.

And if you’re really ready to go deep, apply for the Trading Challenge today. It’s not for everyone, and it’s an investment. It’s also where all my top students hit their stride.*

What do you think of the 21 tips on how to learn stock trading? Comment below, I love to hear from all my readers!

Disclaimers

*Please note that reported trading results are not typical. Most traders lose money. It takes years of dedication, hard work, and discipline to learn how to trade. Individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose. I’ve also hired Jack, Matt, and Kyle to help in my education business.

While Tim Sykes has enjoyed remarkable success trading stocks over the years, earning an aggregate sum of over $7 million in trading profits between 1999 and 2021, his primary income derives from the sale of financial education products and subscription services offered by various businesses and websites in which he has an ownership stake.

This level of successful trading is not typical and does not reflect the experience of the majority of individuals using the services and products offered on this website. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit. This figure is taken from tracking user accounts on Profit.ly, a trading community platform. Timothy Sykes has a minority shareholder interest in the platform. The typical success rate of users was based on the following methodology:

- From January 1, 2020, to December 31, 2020, 849,078 trades were uploaded to Profit.ly. 633,891 trades were “verified” (corroborated with trade account data).

- Instructor trades are ignored.

- Average P&L / trades is obtained by calculating total P&L and dividing by the total number of trades

- Average trades per account is obtained by counting the total number of trades and dividing by the number of accounts (mean function)

Leave a reply