Michael Goode, my first Millionaire Challenge success story, thought I was a typical promoter.

Before meeting me, he dedicated 450 words to castigate me, starting with this lovely headline…

I could have fought Michael tooth and nail – treated him like he did me.

Instead, I listened to what he had to say.

He saw my process, my trades, and other successful students. Ever so slowly, I proved with real-world facts and data why I was the REAL DEAL.

Promoters look flashy on the outside, but they’ve got nothing to back up their game.

They lie, cherry-pick trades, and have no success stories that follow in their wake.

Years later, Michael and I sat down for an interview, a bit tongue & cheek, talking about his journey from hater to millionaire student.

I’m fully aware that I come off as a gregarious, sometimes boastful personality.

But I don’t do it maliciously to hurt people – quite the opposite.

I do it to warn everyone about these promoters framing themselves like do-gooders when they’re the wolves preying on people.

Trashing others online to establish yourself as an authority is a form of gaslighting.

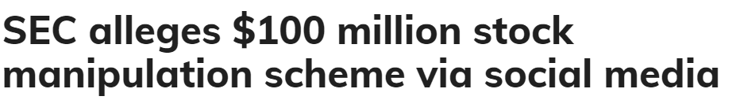

Just look at the recent arrest of Zack Morris, a high-profile Twitter account that fought back when I criticized his work.

He did NOT like me highlighting his shortcomings.

I mean, this guy was brutal.

Check out this video on Twitter if you don’t believe me.

Newbies don’t realize I warned about @mrzackmorris & all of Zack Morris’ friends FOR YEARS, he even put me in a video claiming I was lying…NOPE! It’s literally the same scam EVERY FUCKEN TIME! Study https://t.co/KhqHFIe64c & https://t.co/QTYT7tytOA & https://t.co/A3cHHOaAYJ uhhh pic.twitter.com/wilnceEXxi

— Timothy Sykes (@timothysykes) December 14, 2022

And guess what?

Now he’s in serious trouble with the SEC:

I want everyone, whether you’re my student, a subscriber to this newsletter, or simply a casual observer, to hear an honest truth…

Trust No One. Make Them Prove Themselves!

You should treat every trading mentor, every Twitter pumper, and every stock this way.

I don’t want folks to assume I know what I’m talking about.

I’d rather they review my trades all posted on Profitly that demonstrate I’m the real deal.

Some folks don’t think this is necessary and creates unnecessary busy work.

But I want to share with you the story of Zack Morris (no relation to Mark-Paul Gosselaar) which highlight the dangers promoters present.

So, the next time you see someone on social media boasting or bashing, you view them with a skeptical eye.

Zack Morris Missed the Bell

We’re familiar with well-known scam artists like Bernie Madoff, who operated a Ponzi scheme audaciously in full view of everyone.

SEC regulators had no idea what was going on until the house of cards crashed.

Because as long as investors made generous returns, no one wanted to question how he did it.

And that’s where it all starts.

More Breaking News

- GBTC Stocks: A Closer Look at Recent Trends

- Quantum Computing Inc.’s Stock Soars. Is It Time to Invest?

- Equifax’s Roller Coaster: Buy or Bail Out?

‘Zack Morris’ isn’t the first promoter to be taken down for scamming folks.

In fact, he followed the same pattern I wrote about in this blog post.

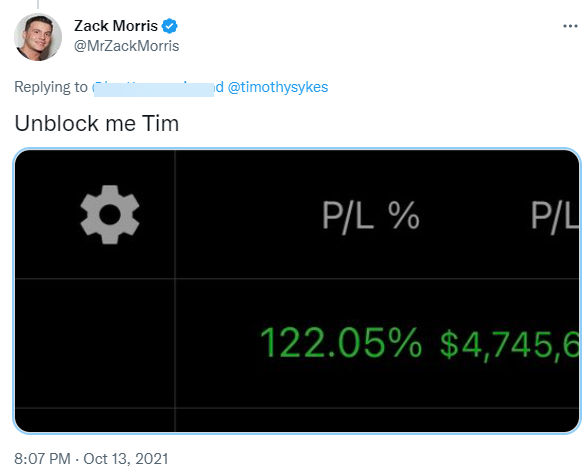

He would rile his followers and call me out because I criticized him.

Then, he’d turn around and put up posts like this…

Promoters don’t like it when I expose them.

They prefer to live in the shadows where no one can see them.

Several years ago, the same story played out years before with the Wolf of WeedStreet.

I pointed out the dangers of his pumps, and he fought back.

And I bet you can guess how it ended.

The story was even highlighted in Men’s Journal.

Penny stock promoters use the same tactics over and over to dupe traders.

And just because I call them out, doesn’t mean I won’t take advantage of their tricks.

As I posted on Twitter yesterday, these guys stuck to the 7-Step Penny Stock Framework like glue.

Lost in the gossip about #zackmorris & friends is the fact that ALL their pumps fit the https://t.co/46W8tDBAGj pattern to a T! Look at the charts of $CLOV $CEI $DATS $FUBO & let's see if you can guess when #AtlasTrading promoted them? Same as $ENZC $HMBL $CYDY $ALPP promos too! pic.twitter.com/QAQeAd1GYv

— Timothy Sykes (@timothysykes) December 14, 2022

Look, this guy and his groupies are just one of many promoters out there. They weren’t the first and won’t be the last.

But I KNOW about them. I track them. I call them out. I use their tricks against them to make a profit for myself.

If promoters weren’t around, I’d have to rethink some of my strategies.

Yet, as long as these guys throw up ‘bro’ pictures and talk about how great they are, people will get sucked into their nonsense.

However, it’s easy to see when these guys are at it. They’ll talk up penny stocks and present a story as if the company is investable.

I can’t think of one time I looked at a penny stock and said to myself, “man, I want to own that company.”

These are trades, not investments.

99% of penny stock companies don’t turn a profit, let alone generate positive cash flow.

They are just vehicles for the hope that a series of fortunate events will take a no-name company into a real business.

That rarely happens.

And it’s why my Penny Stock Framework plays out all the time.

Promoter greed fuels the same behaviors that inevitably lead to the Supernova lifecycle.

But at the end of the day, they can’t pass the sniff test.

They’re all hype and no substance.

All you have to do is look one or two layers below the surface to see what’s really going on.

Don’t assume ANYONE is on the up and up until they prove themselves.

I don’t care if they’re a regular on CNBC or your best friend.

The proof is in the pudding.

–Tim

Leave a reply