Usually, I act like a retired trader. But lately, I’ve fallen off the wagon … So I want to talk about how to avoid overtrading.

The struggle is REAL. Overtrading is dangerous, but it’s so hard to avoid right now.

Overall, the market’s ugly. For the past couple of months, the Dow’s been like a rollercoaster … Large-cap stocks are tanking … General Electric (NYSE: GE) had its lowest lows in over 11 years, sparking all sorts of rumors about its demise…

But if you can adapt to this volatile market like my students and I have, there are SO many amazing opportunities. That’s why I’m up over $40K** so far this month (and donating all of my profits to charities like Direct Relief). It’s also why so many of my top students report killing it, too.

(*Please note: my results, as well as the students mentioned in this post, are not typical. We’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

Big congrats to two hard working/hard studying https://t.co/EcfUM63rtt students: jackss: Passed $20k verified AND viperm → timothysykes: $DFFN, in this morning at 1.2 out at 1.44. This program is awesome, thank you Tim!!!!!

— Timothy Sykes (@timothysykes) May 15, 2020

I’ve gotta be transparent, so I’m telling the truth about how I’m overdoing it. I want you to be smarter and better than me. Consider this post my public service announcement about the dangers of overtrading…

Table of Contents

What’s Overtrading?

Overtrading is exactly what sounds like: trading too much.

It’s like anything else in life: when you spread yourself too thin, it’s hard to stay focused. You start to lose track of the details … That’s when you start to make mistakes.

Think of a circus juggler with too many balls in the air … At a certain point, they’re all gonna drop.

So Many Amazing Plays Right Now

Like I said — I haven’t been sticking to my mantra of “act like a retired trader.”

The combination of not being able to travel during lockdown plus so many amazing setups have made it SO hard to avoid overtrading.

+$7,958 for me today overtrading & selling too soon on $GNUS $NMHLY but playing it safe on $VBIV $RXMD $TOMZ now I've made $154,492 YTD 2020, sooo many damn plays, thank you @StocksToTrade breaking news tool https://t.co/9qqyKg1Phb grab it before prices go up tomorrow! #whataday

— Timothy Sykes (@timothysykes) May 14, 2020

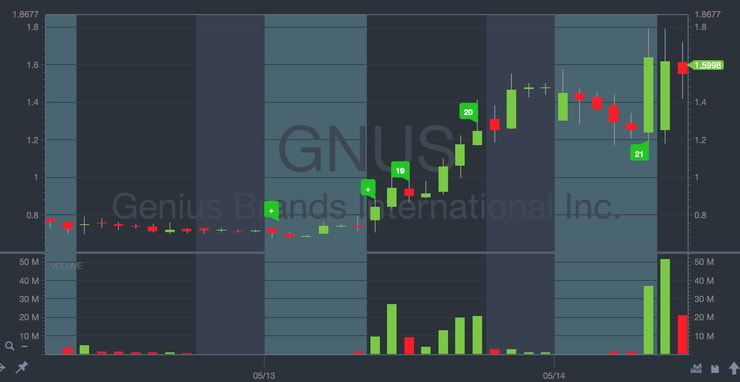

I mean, just look at a play like Genius Brands International Inc. (NASDAQ: GNUS.) This was a stock with an actual catalyst — a shareholder letter. How’d I find that out?

How to Find the Best Penny Stock Breaking News

The brand new Breaking News tool on StocksToTrade. This is my favorite thing right now. You get the best potential news leads cherry-picked for you by two sharp stock market pros. You’ve never been able to filter the news like this.

To be clear, you need to have @StocksToTrade already to use the breaking news tool here https://t.co/6CEb0wxhvn but it literally can pay for a whole year, or even several years, within 1-2 trades, it's the only reason why I nailed $GNUS & helped me avoid $FWP $RTTR $MARK traps

— Timothy Sykes (@timothysykes) May 14, 2020

Once I knew there was an actual catalyst, I bought it in the $0.70s. I sold WAY too soon in the $0.80s before it went up to about $1.40 on the day I traded … All the same, I made nearly $2K.

I missed out on the highs, but the next day I got in on the red to green action with a $3K+ win.

Here’s the chart action:

My Trading Challenge students killed it on GNUS, too.

Profit.ly user Focusdaddy reports a confirmed $855 profit on GNUS …

Profit.ly user TroyMan reports a confirmed $525 profit, noting:

“Made a plan, had patience and waited for the dip, and executed it near perfectly! I had just listened to Tim say in his live Webinar yesterday say, ‘You want fading before a morning panic ideally.’ Those words I had written in my trading journal notes guided me to be patient and wait for the stock to come to me! Beautiful!”

Overtrading: It Happens to the Best Traders

If you think overtrading is just a problem for degenerate gamblers or newbies, you’re wrong.

Yeah, I’ve found it hard to resist crazy plays like Waitr Holdings Inc. (NASDAQ: $WTRH), SPO Global Inc. (OTCMKTS: $SPOM), and more …

Damn $SPOM promoters even more downsides today too? This is getting worse than $FWP it's embarrassing for all the longs who did their "solid DD" but failed to read https://t.co/odGAkS7oEN or https://t.co/QTYT7tytOA making all their DD is worthless…gotta learn how the game works

— Timothy Sykes (@timothysykes) May 15, 2020

I’ve had some wins … But also some losses. The potential to make mistakes increases exponentially the more you trade. NEVER forget that.

No trader is immune…

More Breaking News

- HPE’s Strategic Partnerships and Expansions Set to Boost Market Trajectory

- Sony’s Earnings Surge Drives Stock Momentum

- Strategy Growth: Bitcoin Ambitions Spark Investor Optimism

- HP Inc. Sets Sights on Strong Performance: Fiscal 2026 Outlook Unveiled

Tim Grittani’s Experience With CytoDyn Inc. (OTCMKTS: CYDY)

Yep, even my top student Tim Grittani, who’s up nearly $11 million** in profits, overtrades sometimes. And he knows overtrading is dangerous. Check it out…

Trading Challenge students have the opportunity to learn from incredible traders like Tim in my vast library of webinars and video lessons … You can learn a LOT from successful traders like him.

In his webinar on April 28 on Profit.ly, he addressed his overtrading problems head-on:

“It’s been a craptastic week for me. I have struggled so far. Not so much any one big loss or anything, just overtrading and lots of sloppy losses. Right now I’m trying to trade about $10K risk, and I think I’ve had about 6 or 7 losses this week that are $7K or $8K losses.”

He continued,

“I owe a lot of it to my BFF $CYDY … That’s what happens when you get over-attached to a ticker and get attached to a name too much.”

What happened? In short…

- He thought “sell the news” and took a loss on a short…

- Then he dip bought and thought it was stupid and sold at a loss…

- Then he bought again and it went red on him…

Grittani just couldn’t quit this ticker. He ended up getting angry, emotional, and had some losses. Check out his trades here.

The point is, overtrading is dangerous … the risk is very real. Grittani sums it up well, “There’s no avoiding it, no matter how far along in your journey you are.”

How to Avoid Overtrading in This Hot Market

How can you avoid overtrading during this hot penny stock market — especially if you have extra time on your hands? Here are some key tips…

Wait for the Right Setups

I can’t stress this enough. You MUST wait for the right setups — the ones that fit your criteria.

Even if there are a zillion traders posting insane profits from short selling — if it doesn’t fit your strategy, don’t do it.

For instance, I’m super rusty on Check out my verified trade here. I sold 1,000 shares at .10 and covered at .53. People asked me why I covered so quickly. Frankly, I’m scared of short selling … I’ve dabbled a little. But lately, I’ve mainly been focusing on first green days and morning panics. I know those setups work best for me.

Sure, be open to adapting — every trader’s style evolves over time. For example, one of my top students, Jack Kellogg, has slowly shifted from OTCs to coronavirus plays and Nasdaq stocks. And now he’s on fire … He made over $70K** last month!

But you’ve gotta know the difference between adapting and trying to force yourself into trades.

Be PREPARED

The market is still crazy volatile. It can be tempting to go crazy and start trading everything. Big mistake. Things can go really wrong really fast if you’re not prepared.

Have a trading plan. Study the market. Have a strong watchlist. Be like a sniper waiting to attack when the moment is just right.

Don’t be an idiot! Get smart about how to prepare for these market conditions. If you haven’t checked out “The Volatility Survival Guide,” it’s a MUST-watch resource.

It’s up to you. Check out this NO-COST guide to learn how to stay safe in this crazy market … Or be one of the morons and keep losing…

Sooooo many people whining about their losses in pumps like $FWP $MARK $SPOM $IZEA all down 50% off their highs this week. You guys wanted easy $, you didn't want to study, you ignored my warnings & now you've learned the hard way, so how much do you have to lose to change/study?

— Timothy Sykes (@timothysykes) May 15, 2020

Don’t Believe the Hype

Rumors. Hype. Pumps. This is the stuff that can move penny stocks.

Idiot newbies take hype at face value. They buy penny stocks thinking that they just bought a winning lottery ticket … Then they’re surprised when they blow up their accounts.

Most of these companies will screw up in one way or another. Eventually, most penny stocks will fail.

It’s all about outsmarting the idiots who pump these stocks up and then riding the volatility.

I don’t want them to stop … I just want to trade off of the predictable patterns they create.

Remember: There WILL Be Other Opportunities

Before you start jumping into trade after trade, remember that overtrading is dangerous. Missed the latest hot play in the hottest sector in years? Don’t worry. Spikes can run again. Former runners can come back.

Think about that drunken uncle who always seems to come back to every wedding and family event. Stocks can be like that … They keep coming back, and they never really change that much.

When you keep track of former runners and get to know the personalities of individual tickers, you can be better prepared to take advantage of them when they run again.

Trading Challenge

Who am I? Just a rich guy teaching what I’ve learned over the past 20+ years in the stock market.

What I want to teach you is how to be a smart, discerning trader who knows how to pursue a trade rather than blindly chase. You can learn how to avoid overtrading, find the best setups, and so much more…

I created my Trading Challenge to give traders the educational resources I didn’t have — because they didn’t EXIST — when I was just getting started. I had to do it the hard way and make a ton of mistakes along the way. You can benefit from what I did right … and avoid what I did wrong.

You’ll have access to a TON of resources — video lessons, webinars, and my personal favorite, the chat room. I’ve gotten SO many trade ideas from that chat room, it’s ridiculous.

Ready to get serious and study hard to become a self-sufficient trader? Consider applying.

Have you been overtrading? Be honest. Tell me if you struggle with overtrading and what’s happened as a result!

Leave a reply