It’s a trader’s tale as old as time.

I remember it as clearly as if it just happened.

I dove headfirst into a trade, giddy with excitement…and it went nowhere.

An image crossed my mind. I remembered the last time a trade stalled.

Heeding my advice, I cut the trade quickly…only to watch it explode higher seconds after the mouse click.

This go around, I decide to give it a little more space to do its thing.

Suddenly, it cracks the lows on heavy volume and plunges into the abyss.

It feels like no matter what you do, you get it wrong.

So, let me drop some insight on you from more than 20 years of trading…

There is no right answer!

The issue isn’t black and white with established rules.

Instead, I rely on one principal to make my decisions.

It’s simple enough anyone can use it, and it’s a methodical approach to decision-making.

Because if there is no 100% correct answer, then this gets me as close as possible.

Here’s how it works…

Let Your Setup Be Your Guide

Every trade I take starts with a pattern, with Supernovas as my #1 pick.

With that pattern, I developed my 7-Step PennyStock Trading Framework.

Each phase lends itself to certain setups.

For example, during the ramp and supernova phases, I’m more likely to buy into runners than dips.

On the flip side, I love to dip buy after the cliff dive, especially into morning panics.

These setups provide a clear framework for the trades and tell me EXACTLY what the next step should be.

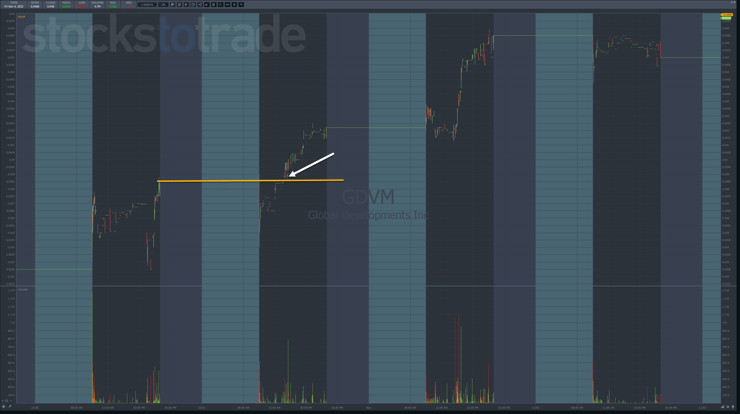

For example, let’s say I’m working a multiday runner like Global Developments Inc. (OTC: GDVM).

I want to buy into a break of the prior day’s highs.

In this scenario, I look for clues as to whether the trade will work.

When a stock breaks a key resistance, it does one of three things:

- Reverse

- Trade sideways

- Keep running

In this case, I want to protect myself against a reversal.

So, either the stock continues its run pronto, or I cut it loose.

If I get a good enough entry, I may let it run sideways, provided I’m very close to where I’d stop out.

But here’s the rub.

I can break even on 50 of these in a row or take tiny losses. All it takes is one runner to keep going for it to pay off.

Let’s take it from another angle.

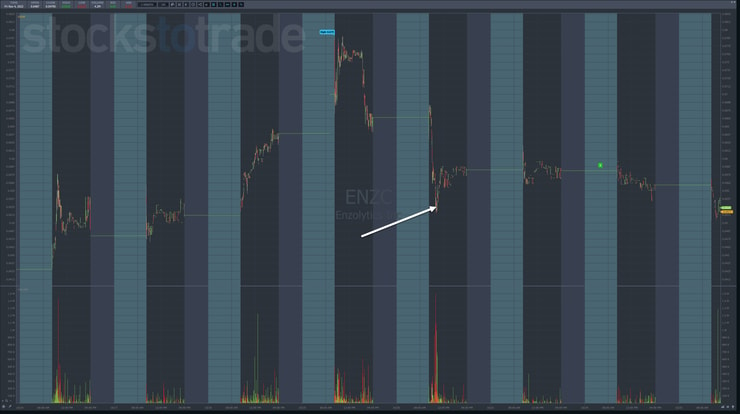

Back on the 20th of October, I did a morning panic dip buy in Enzolytics Inc. (OTC: ENZC).

The first thing you should see right away is that I chose this setup after the stock went supernova and was down almost 30% from its highs.

Morning panic dip buys take practice to nail down the right buy area.

However, I don’t always get the low to the penny.

A simple trick to make it easier on yourself is to wait for the low to form and then buy once you get a small bounce in the other direction.

Nonetheless, I want that stock to bounce once I’m in the trade.

It shouldn’t take more than a few minutes.

If it fails to bounce, I cut it loose.

In nearly every case, I don’t give the trade much time to perform.

I treat it with healthy skepticism and EXPECT it to fail.

This protects me from another leg lower that could leave me with a huge loss.

That said, I expect it to move around a lot more than buying into a runner.

So, I adjust my position size accordingly and give it a bit more wiggle room with the price.

Look Wider

Don’t just limit your analysis to the stock at hand.

Expand your viewpoint. Look at the overall market as well as related penny stocks.

It might be worth giving your trade a little extra time if they’re all catching a bid.

However, I want to be extra cautious in today’s bear market.

It’s more important that I get a good entry that minimizes potential losses and maximizes potential gains.

Do yourself a favor.

Take a look through my trade history here at Profitly.

It’s free and open to everyone.

See how many times I take small wins or losses.

It happens more often than you’d think.

Don’t get me wrong, when stocks are primed, like early 2021, I’ll add more size and ride them harder.

But this isn’t the right market for that.

Remember, you have to survive first before you can hit your profit goals.

—Tim

Leave a reply